38.932.7000092014812/312024Q3falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:Rateiso4217:EURlh:contracts00009201482024-01-012024-09-3000009201482024-10-2800009201482024-09-3000009201482023-12-3100009201482024-07-012024-09-3000009201482023-07-012023-09-3000009201482023-01-012023-09-300000920148us-gaap:CommonStockMember2022-12-310000920148us-gaap:AdditionalPaidInCapitalMember2022-12-310000920148us-gaap:RetainedEarningsMember2022-12-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100009201482022-12-310000920148us-gaap:CommonStockMember2023-01-012023-03-310000920148us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000920148us-gaap:RetainedEarningsMember2023-01-012023-03-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-3100009201482023-01-012023-03-310000920148us-gaap:CommonStockMember2023-03-310000920148us-gaap:AdditionalPaidInCapitalMember2023-03-310000920148us-gaap:RetainedEarningsMember2023-03-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100009201482023-03-310000920148us-gaap:CommonStockMember2023-04-012023-06-300000920148us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000920148us-gaap:RetainedEarningsMember2023-04-012023-06-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-3000009201482023-04-012023-06-300000920148us-gaap:CommonStockMember2023-06-300000920148us-gaap:AdditionalPaidInCapitalMember2023-06-300000920148us-gaap:RetainedEarningsMember2023-06-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000009201482023-06-300000920148us-gaap:CommonStockMember2023-07-012023-09-300000920148us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000920148us-gaap:RetainedEarningsMember2023-07-012023-09-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000920148us-gaap:CommonStockMember2023-09-300000920148us-gaap:AdditionalPaidInCapitalMember2023-09-300000920148us-gaap:RetainedEarningsMember2023-09-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-3000009201482023-09-300000920148us-gaap:CommonStockMember2023-12-310000920148us-gaap:AdditionalPaidInCapitalMember2023-12-310000920148us-gaap:RetainedEarningsMember2023-12-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000920148us-gaap:CommonStockMember2024-01-012024-03-310000920148us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000920148us-gaap:RetainedEarningsMember2024-01-012024-03-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-3100009201482024-01-012024-03-310000920148us-gaap:CommonStockMember2024-03-310000920148us-gaap:AdditionalPaidInCapitalMember2024-03-310000920148us-gaap:RetainedEarningsMember2024-03-310000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100009201482024-03-310000920148us-gaap:CommonStockMember2024-04-012024-06-300000920148us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000920148us-gaap:RetainedEarningsMember2024-04-012024-06-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-3000009201482024-04-012024-06-300000920148us-gaap:CommonStockMember2024-06-300000920148us-gaap:AdditionalPaidInCapitalMember2024-06-300000920148us-gaap:RetainedEarningsMember2024-06-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-3000009201482024-06-300000920148us-gaap:CommonStockMember2024-07-012024-09-300000920148us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000920148us-gaap:RetainedEarningsMember2024-07-012024-09-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000920148us-gaap:CommonStockMember2024-09-300000920148us-gaap:AdditionalPaidInCapitalMember2024-09-300000920148us-gaap:RetainedEarningsMember2024-09-300000920148us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000920148us-gaap:SegmentContinuingOperationsMember2024-01-012024-09-300000920148us-gaap:SegmentContinuingOperationsMember2023-01-012023-09-300000920148us-gaap:SegmentDiscontinuedOperationsMember2024-01-012024-09-300000920148us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-09-300000920148lh:DiagnosticsMember2024-07-012024-09-300000920148lh:DrugDevelopmentMember2024-07-012024-09-300000920148lh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-01-012024-09-300000920148lh:FortreaRevolverDue2028Member2023-12-310000920148lh:FortreaTermLoanAMaturing2028Member2023-12-310000920148lh:FortreaTermLoanBMaturing2028Member2023-12-310000920148srt:NorthAmericaMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:EuropeMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:OthercountriesMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:ClientMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:NorthAmericaMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:EuropeMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:OthercountriesMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:ClientMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:NorthAmericaMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:EuropeMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:OthercountriesMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148us-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:NorthAmericaMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:EuropeMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:OthercountriesMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148us-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:NorthAmericaMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:EuropeMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:OthercountriesMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:MedicareandMedicaidMember2024-07-012024-09-300000920148srt:NorthAmericaMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:EuropeMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:OthercountriesMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:MedicareandMedicaidMember2023-07-012023-09-300000920148srt:NorthAmericaMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:EuropeMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:OthercountriesMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:NorthAmericaMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:EuropeMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:OthercountriesMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:NorthAmericaMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:EuropeMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:OthercountriesMemberlh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148lh:LabCorpDiagnosticsMember2024-07-012024-09-300000920148srt:NorthAmericaMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:EuropeMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:OthercountriesMemberlh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148lh:LabCorpDiagnosticsMember2023-07-012023-09-300000920148srt:NorthAmericaMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-07-012024-09-300000920148srt:EuropeMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-07-012024-09-300000920148lh:OthercountriesMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-07-012024-09-300000920148lh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-07-012024-09-300000920148srt:NorthAmericaMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:CovanceDrugDevelopmentMember2023-07-012023-09-300000920148srt:EuropeMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:CovanceDrugDevelopmentMember2023-07-012023-09-300000920148lh:OthercountriesMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:CovanceDrugDevelopmentMember2023-07-012023-09-300000920148lh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:CovanceDrugDevelopmentMember2023-07-012023-09-300000920148srt:NorthAmericaMember2024-07-012024-09-300000920148srt:EuropeMember2024-07-012024-09-300000920148lh:OthercountriesMember2024-07-012024-09-300000920148srt:NorthAmericaMember2023-07-012023-09-300000920148srt:EuropeMember2023-07-012023-09-300000920148lh:OthercountriesMember2023-07-012023-09-300000920148srt:NorthAmericaMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:EuropeMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:OthercountriesMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:ClientMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:NorthAmericaMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:EuropeMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:OthercountriesMemberlh:ClientMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:ClientMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:NorthAmericaMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:EuropeMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:OthercountriesMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148us-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:NorthAmericaMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:EuropeMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:OthercountriesMemberus-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148us-gaap:SelfPayMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:NorthAmericaMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:EuropeMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:OthercountriesMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:MedicareandMedicaidMember2024-01-012024-09-300000920148srt:NorthAmericaMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:EuropeMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:OthercountriesMemberlh:MedicareandMedicaidMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:MedicareandMedicaidMember2023-01-012023-09-300000920148srt:NorthAmericaMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:EuropeMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:OthercountriesMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:NorthAmericaMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:EuropeMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:OthercountriesMemberlh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:ThirdpartyMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:NorthAmericaMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:EuropeMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148lh:OthercountriesMemberlh:LabCorpDiagnosticsMember2024-01-012024-09-300000920148srt:NorthAmericaMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:EuropeMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:OthercountriesMemberlh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148lh:LabCorpDiagnosticsMember2023-01-012023-09-300000920148srt:NorthAmericaMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-01-012024-09-300000920148srt:EuropeMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-01-012024-09-300000920148lh:OthercountriesMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2024-01-012024-09-300000920148srt:NorthAmericaMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2023-01-012023-09-300000920148srt:EuropeMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2023-01-012023-09-300000920148lh:OthercountriesMemberlh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2023-01-012023-09-300000920148lh:BiopharmaceuticalandmedicaldevicecompaniesMemberlh:DrugDevelopmentMember2023-01-012023-09-300000920148srt:NorthAmericaMember2024-01-012024-09-300000920148srt:EuropeMember2024-01-012024-09-300000920148lh:OthercountriesMember2024-01-012024-09-300000920148srt:NorthAmericaMember2023-01-012023-09-300000920148srt:EuropeMember2023-01-012023-09-300000920148lh:OthercountriesMember2023-01-012023-09-300000920148country:US2024-07-012024-09-300000920148country:US2023-07-012023-09-300000920148country:US2024-01-012024-09-300000920148country:US2023-01-012023-09-300000920148lh:DiagnosticsMember2024-09-300000920148lh:DiagnosticsMember2023-12-310000920148lh:DrugDevelopmentMember2024-09-300000920148lh:DrugDevelopmentMember2023-12-310000920148us-gaap:AccountsReceivableMember2024-01-012024-09-300000920148lh:UnbilledContractsReceivableMember2024-01-012024-09-300000920148us-gaap:NotesReceivableMember2024-01-012024-09-300000920148lh:BaystateMedicalCenterMember2024-09-300000920148lh:ProvidenceMedicalFoundationMember2024-09-300000920148lh:WestpacLabsInc.Member2024-09-300000920148lh:InvitaeCorporationMember2024-09-300000920148lh:BioReferenceHealthMember2024-09-300000920148us-gaap:CustomerListsMembersrt:MinimumMember2024-01-012024-09-300000920148us-gaap:CustomerListsMembersrt:MaximumMember2024-01-012024-09-300000920148lh:BaystateMedicalCenterMember2024-01-012024-09-300000920148lh:ProvidenceMedicalFoundationMember2024-01-012024-09-300000920148lh:WestpacLabsInc.Member2024-01-012024-09-300000920148lh:InvitaeCorporationMember2024-01-012024-09-300000920148lh:BioReferenceHealthMember2024-01-012024-09-300000920148lh:TuftsMember2024-01-012024-09-300000920148lh:A2024MeasurementPeriodAdjustmentsMember2024-09-300000920148lh:TuftsMember2024-07-012024-09-300000920148lh:OtherAcquisitionsMember2024-09-300000920148lh:SYNLABMember2024-09-300000920148lh:SYNLABMembercurrency:USD2024-01-012024-09-300000920148lh:SYNLABMembercurrency:EUR2024-01-012024-09-300000920148lh:JeffersonHealthMember2023-09-300000920148lh:EnzoBioChemMember2023-09-300000920148lh:ProvidenceHealthAndServicesOregonMember2023-09-300000920148lh:TuftsMember2023-09-300000920148lh:OtherAcquisitionsMember2023-09-300000920148lh:OtheracquireesMember2023-01-012023-09-300000920148us-gaap:CustomerListsMembersrt:MinimumMember2023-01-012023-09-300000920148us-gaap:CustomerListsMembersrt:MaximumMember2023-01-012023-09-300000920148lh:TotalBusinessAcquisitionsAndAdjustmentsMember2023-09-300000920148us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-01-012023-09-300000920148us-gaap:GoodwillMember2023-01-012023-09-300000920148lh:TotalBusinessAcquisitionsAndAdjustmentsMember2023-01-012023-09-300000920148us-gaap:OtherNoncurrentAssetsMember2023-01-012023-09-300000920148us-gaap:AccruedLiabilitiesMember2023-01-012023-09-300000920148us-gaap:OtherNoncurrentLiabilitiesMember2023-01-012023-09-300000920148lh:LabCorpDiagnosticsMember2023-12-310000920148lh:CovanceDrugDevelopmentMember2023-12-310000920148lh:CovanceDrugDevelopmentMember2024-01-012024-09-300000920148lh:LabCorpDiagnosticsMember2024-09-300000920148lh:CovanceDrugDevelopmentMember2024-09-300000920148us-gaap:CustomerRelationshipsMember2024-09-300000920148us-gaap:CustomerRelationshipsMember2023-12-310000920148lh:PatentsLicensesAndTechnologyMember2024-09-300000920148lh:PatentsLicensesAndTechnologyMember2023-12-310000920148us-gaap:NoncompeteAgreementsMember2024-09-300000920148us-gaap:NoncompeteAgreementsMember2023-12-310000920148us-gaap:LicensingAgreementsMember2024-09-300000920148us-gaap:LicensingAgreementsMember2023-12-310000920148lh:InProcessRAAndMediaMember2024-09-300000920148lh:InProcessRAAndMediaMember2023-12-310000920148us-gaap:OtherCurrentLiabilitiesMember2024-09-300000920148us-gaap:OtherCurrentLiabilitiesMember2023-12-310000920148lh:AccountsReceivableSecuritizaitonMember2024-09-300000920148lh:AccountsReceivableSecuritizaitonMember2023-12-310000920148us-gaap:RevolvingCreditFacilityMember2024-09-300000920148lh:SeniorNotesDue2030Member2024-09-300000920148lh:SeniorNotesDue2032Member2024-09-300000920148lh:SeniorNotesDue2034Member2024-09-300000920148lh:A2.30SeniorNotesDue2024Member2024-09-300000920148lh:A3.60SeniorNotesDue2025Member2024-09-300000920148us-gaap:SeniorNotesMember2024-01-012024-09-300000920148us-gaap:CommonStockMember2023-12-310000920148us-gaap:CommonStockMember2024-01-012024-09-300000920148us-gaap:CommonStockMember2024-09-3000009201482024-07-240000920148us-gaap:SubsequentEventMemberlh:DividendPayableDateDeclaredMember2024-10-102024-10-100000920148us-gaap:SubsequentEventMember2024-10-100000920148us-gaap:SubsequentEventMember2024-10-102024-10-100000920148us-gaap:SubsequentEventMemberlh:DividendPayableDateToBePaidMember2024-12-132024-12-130000920148us-gaap:SubsequentEventMemberlh:DividendPayableDateOfRecordMember2024-11-262024-11-260000920148lh:InitialDamagesMember2024-07-012024-09-300000920148lh:EnhancedDamagesMember2024-07-012024-09-300000920148us-gaap:FairValueInputsLevel1Member2024-09-300000920148us-gaap:FairValueInputsLevel2Member2024-09-300000920148us-gaap:FairValueInputsLevel3Member2024-09-300000920148us-gaap:FairValueInputsLevel1Member2023-12-310000920148us-gaap:FairValueInputsLevel2Member2023-12-310000920148us-gaap:FairValueInputsLevel3Member2023-12-310000920148lh:Seniornotesdue2027Member2024-09-300000920148lh:A2018SwapAgreementsMember2024-09-300000920148lh:A2022SwapAgreementsMember2024-09-300000920148us-gaap:SwapMember2024-04-012024-06-300000920148lh:A2031And2034SwapAgreementsMember2024-09-300000920148us-gaap:SwapMember2024-07-012024-09-300000920148lh:SeniorNotesDue2029And2034Member2024-09-300000920148lh:A2029SwapAgreementsMember2024-09-300000920148lh:A2034SwapAgreementsMember2024-09-300000920148us-gaap:OperatingSegmentsMemberlh:DiagnosticsMember2024-07-012024-09-300000920148us-gaap:OperatingSegmentsMemberlh:DiagnosticsMember2023-07-012023-09-300000920148us-gaap:OperatingSegmentsMemberlh:DiagnosticsMember2024-01-012024-09-300000920148us-gaap:OperatingSegmentsMemberlh:DiagnosticsMember2023-01-012023-09-300000920148us-gaap:OperatingSegmentsMemberlh:DrugDevelopmentMember2024-07-012024-09-300000920148us-gaap:OperatingSegmentsMemberlh:DrugDevelopmentMember2023-07-012023-09-300000920148us-gaap:OperatingSegmentsMemberlh:DrugDevelopmentMember2024-01-012024-09-300000920148us-gaap:OperatingSegmentsMemberlh:DrugDevelopmentMember2023-01-012023-09-300000920148us-gaap:IntersegmentEliminationMember2024-07-012024-09-300000920148us-gaap:IntersegmentEliminationMember2023-07-012023-09-300000920148us-gaap:IntersegmentEliminationMember2024-01-012024-09-300000920148us-gaap:IntersegmentEliminationMember2023-01-012023-09-300000920148us-gaap:OperatingSegmentsMember2024-07-012024-09-300000920148us-gaap:OperatingSegmentsMember2023-07-012023-09-300000920148us-gaap:OperatingSegmentsMember2024-01-012024-09-300000920148us-gaap:OperatingSegmentsMember2023-01-012023-09-300000920148us-gaap:CorporateMember2024-07-012024-09-300000920148us-gaap:CorporateMember2023-07-012023-09-300000920148us-gaap:CorporateMember2024-01-012024-09-300000920148us-gaap:CorporateMember2023-01-012023-09-300000920148lh:AdamSchechterMember2024-07-012024-09-300000920148lh:AdamSchechterMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 1-11353

LABCORP HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 99-2588107 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 358 South Main Street | | |

| Burlington, | North Carolina | | 27215 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant's telephone number, including area code) 336-229-1127

Securities registered pursuant to Section 12(b) of the Exchange Act.

Title of Each Class Trading Symbol Name of exchange on which registered

Common Stock, $0.10 par value LH New York Stock Exchange

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

| | | | | | | | | | | | | | |

| Class | | Shares Outstanding | | Date |

| Common Stock $0.10 par value | | 83,639,261 | | October 28, 2024 |

INDEX

PART I. FINANCIAL INFORMATION

| | | | | | | | |

| Item 1. | | |

| | | |

| | | |

| | September 30, 2024 and December 31, 2023 | |

| | | |

| | | |

| | Three and Nine Months Ended September 30, 2024 and 2023 | |

| | | |

| | |

| Three and Nine Months Ended September 30, 2024 and 2023 | |

| | |

| | | |

| | Three and Nine Months Ended September 30, 2024 and 2023 | |

| | | |

| | | |

| | Nine Months Ended September 30, 2024 and 2023 | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

PART II. OTHER INFORMATION

| | | | | | | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | |

| Item 5. | | |

| | | |

| Item 6. | | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

LABCORP HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,517.3 | | | $ | 536.8 | |

| Accounts receivable, net | 2,058.5 | | | 1,913.3 | |

| Unbilled services | 166.3 | | | 185.4 | |

| Supplies inventory | 483.1 | | | 474.6 | |

| Prepaid expenses and other | 684.7 | | | 655.3 | |

| | | |

| Total current assets | 4,909.9 | | | 3,765.4 | |

| Property, plant and equipment, net | 3,050.0 | | | 2,911.8 | |

| Goodwill, net | 6,482.4 | | | 6,142.5 | |

| Intangible assets, net | 3,540.7 | | | 3,342.0 | |

| Joint venture partnerships and equity method investments | 16.9 | | | 26.9 | |

| | | |

| Other assets, net | 612.6 | | | 536.5 | |

| | | |

| Total assets | $ | 18,612.5 | | | $ | 16,725.1 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 660.9 | | | $ | 827.5 | |

| Accrued expenses and other | 757.5 | | | 804.0 | |

| Unearned revenue | 403.1 | | | 421.7 | |

| Short-term operating lease liabilities | 184.3 | | | 165.8 | |

| Short-term finance lease liabilities | 6.3 | | | 6.4 | |

| Short-term borrowings and current portion of long-term debt | 1,399.9 | | | 999.8 | |

| | | |

| Total current liabilities | 3,412.0 | | | 3,225.2 | |

| Long-term debt, less current portion | 5,352.1 | | | 4,054.7 | |

| Operating lease liabilities | 701.3 | | | 648.9 | |

| Financing lease liabilities | 75.2 | | | 78.6 | |

| Deferred income taxes and other tax liabilities | 358.3 | | | 417.9 | |

| Other liabilities | 528.2 | | | 409.3 | |

| | | |

| Total liabilities | 10,427.1 | | | 8,834.6 | |

| Commitments and contingent liabilities | | | |

| Noncontrolling interest | 15.2 | | | 15.5 | |

| Shareholders’ equity: | | | |

Common stock, $0.10 par value, 83.7 and 83.9 shares outstanding at September 30, 2024, and December 31, 2023, respectively | 7.6 | | | 7.7 | |

| Additional paid-in capital | — | | | 38.4 | |

| Retained earnings | 8,275.8 | | | 7,888.2 | |

| | | |

| Accumulated other comprehensive loss | (113.2) | | | (59.3) | |

| Total shareholders’ equity | 8,170.2 | | | 7,875.0 | |

| Total liabilities and shareholders’ equity | $ | 18,612.5 | | | $ | 16,725.1 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 3,282.0 | | | $ | 3,056.8 | | | $ | 9,679.5 | | | $ | 9,128.3 | |

| Cost of revenues | 2,377.6 | | | 2,205.6 | | | 6,951.4 | | | 6,584.8 | |

| | | | | | | |

| Gross profit | 904.4 | | | 851.2 | | | 2,728.1 | | | 2,543.5 | |

| Selling, general and administrative expenses | 568.6 | | | 525.5 | | | 1,634.8 | | | 1,488.5 | |

| Amortization of intangibles and other assets | 63.7 | | | 55.7 | | | 186.0 | | | 160.6 | |

| Goodwill and other asset impairments | — | | | 10.2 | | | 2.5 | | | 15.2 | |

| Restructuring and other charges | 18.0 | | | 7.5 | | | 34.6 | | | 30.8 | |

| Operating income | 254.1 | | | 252.3 | | | 870.2 | | | 848.4 | |

| Other income (expense): | | | | | | | |

| Interest expense | (50.4) | | | (50.3) | | | (144.9) | | | (150.8) | |

| Investment income | 3.1 | | | 15.9 | | | 7.3 | | | 22.6 | |

| Equity method income (expense), net | (0.5) | | | (0.3) | | | (0.7) | | | (1.5) | |

| | | | | | | |

| Other, net | 4.3 | | | 21.1 | | | 43.8 | | | (2.7) | |

| Earnings from continuing operations before income taxes | 210.6 | | | 238.7 | | | 775.7 | | | 716.0 | |

| Provision for income taxes | 41.0 | | | 55.1 | | | 172.2 | | | 168.8 | |

| Earnings from continuing operations | 169.6 | | | 183.6 | | | 603.5 | | | 547.2 | |

| Earnings from discontinued operations, net of tax | — | | | — | | | — | | | 38.8 | |

| Net earnings | 169.6 | | | 183.6 | | | 603.5 | | | 586.0 | |

| Less: Net earnings attributable to the noncontrolling interest | (0.3) | | | (0.3) | | | (0.9) | | | (0.9) | |

| Net earnings attributable to Labcorp Holdings Inc. | $ | 169.3 | | | $ | 183.3 | | | $ | 602.6 | | | $ | 585.1 | |

| | | | | | | |

| Basic earnings per share: | | | | | | | |

| Basic earnings per share continuing operations | $ | 2.02 | | | $ | 2.12 | | | $ | 7.17 | | | $ | 6.22 | |

| Basic earnings per share discontinued operations | $ | — | | | $ | — | | | $ | — | | | $ | 0.44 | |

| Basic earnings per share | $ | 2.02 | | | $ | 2.12 | | | $ | 7.17 | | | $ | 6.66 | |

| | | | | | | |

| Diluted earnings per share: | | | | | | | |

| Diluted earnings per share continuing operations | $ | 2.00 | | | $ | 2.11 | | | $ | 7.13 | | | $ | 6.19 | |

| Diluted earnings per share discontinued operations | $ | — | | | $ | — | | | $ | — | | | $ | 0.44 | |

| Diluted earnings per share | $ | 2.00 | | | $ | 2.11 | | | $ | 7.13 | | | $ | 6.63 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net earnings | $ | 169.6 | | | $ | 183.6 | | | $ | 603.5 | | | $ | 586.0 | |

| Foreign currency translation adjustments | 78.3 | | | (56.0) | | | (53.2) | | | 43.8 | |

| Net benefit plan adjustments | 1.6 | | | 1.1 | | | (0.1) | | | 3.4 | |

| | | | | | | |

| Other comprehensive earnings (loss) before tax | 79.9 | | | (54.9) | | | (53.3) | | | 47.2 | |

| Provision for income tax related to items of comprehensive earnings | (1.1) | | | (0.2) | | | (0.6) | | | (0.8) | |

| Other comprehensive earnings (loss), net of tax | 78.8 | | | (55.1) | | | (53.9) | | | 46.4 | |

| Comprehensive earnings | 248.4 | | | 128.5 | | | 549.6 | | | 632.4 | |

| Less: Net earnings attributable to the noncontrolling interest | (0.3) | | | (0.3) | | | (0.9) | | | (0.9) | |

| Comprehensive earnings attributable to Labcorp Holdings Inc. | $ | 248.1 | | | $ | 128.2 | | | $ | 548.7 | | | $ | 631.5 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS’ EQUITY

(in millions)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock | | Additional

Paid-in

Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Earnings (Loss) | | Total

Shareholders’

Equity | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| BALANCE AT DECEMBER 31, 2022 | $ | 8.1 | | | $ | — | | | $ | 10,581.7 | | | $ | (493.2) | | | $ | 10,096.6 | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 212.9 | | | — | | | 212.9 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | 49.0 | | | 49.0 | | | |

| Dividends declared | — | | | — | | | (64.7) | | | — | | | (64.7) | | | |

| Issuance of common stock under employee stock plans | — | | | 27.6 | | | — | | | — | | | 27.6 | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (20.5) | | | — | | | — | | | (20.5) | | | |

| Stock compensation | — | | | 40.6 | | | — | | | — | | | 40.6 | | | |

| | | | | | | | | | | |

| BALANCE AT MARCH 31, 2023 | $ | 8.1 | | | $ | 47.7 | | | $ | 10,729.9 | | | $ | (444.2) | | | $ | 10,341.5 | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 188.9 | | | — | | | 188.9 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | 52.5 | | | 52.5 | | | |

| Fortrea Holdings Inc. spin-off | — | | | — | | | (2,018.1) | | | 238.0 | | | (1,780.1) | | | |

| Dividends declared | — | | | — | | | (64.5) | | | — | | | (64.5) | | | |

| Issuance of common stock under employee stock plans | — | | | 26.8 | | | — | | | — | | | 26.8 | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (18.2) | | | — | | | — | | | (18.2) | | | |

| Stock compensation | — | | | 38.1 | | | — | | | — | | | 38.1 | | | |

| | | | | | | | | | | |

| BALANCE AT JUNE 30, 2023 | $ | 8.1 | | | $ | 94.4 | | | $ | 8,836.2 | | | $ | (153.7) | | | $ | 8,785.0 | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 183.3 | | | — | | | 183.3 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | (55.1) | | | (55.1) | | | |

| Dividends declared | — | | | — | | | (64.6) | | | — | | | (64.6) | | | |

| | | | | | | | | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (0.9) | | | — | | | — | | | (0.9) | | | |

| Stock compensation | — | | | 34.4 | | | — | | | — | | | 34.4 | | | |

| Purchase of common stock | (0.4) | | | (123.2) | | | (885.4) | | | — | | | (1,009.0) | | | |

| BALANCE AT SEPTEMBER 30, 2023 | $ | 7.7 | | | $ | 4.7 | | | $ | 8,069.5 | | | $ | (208.8) | | | $ | 7,873.1 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| BALANCE AT DECEMBER 31, 2023 | $ | 7.7 | | | $ | 38.4 | | | $ | 7,888.2 | | | $ | (59.3) | | | $ | 7,875.0 | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 228.0 | | | — | | | 228.0 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | (126.1) | | | (126.1) | | | |

| Dividends declared | — | | | — | | | (60.9) | | | — | | | (60.9) | | | |

| Issuance of common stock under employee stock plans | — | | | 26.7 | | | — | | | — | | | 26.7 | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (14.7) | | | — | | | — | | | (14.7) | | | |

| Stock compensation | — | | | 31.6 | | | — | | | — | | | 31.6 | | | |

| | | | | | | | | | | |

| BALANCE AT MARCH 31, 2024 | $ | 7.7 | | | $ | 82.0 | | | $ | 8,055.3 | | | $ | (185.4) | | | $ | 7,959.6 | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 205.3 | | | — | | | 205.3 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | (6.6) | | | (6.6) | | | |

| Dividends declared | — | | | — | | | (60.2) | | | — | | | (60.2) | | | |

| | | | | | | | | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (23.1) | | | — | | | — | | | (23.1) | | | |

| Stock compensation | — | | | 30.8 | | | — | | | — | | | 30.8 | | | |

| Purchase of common stock | — | | | (77.2) | | | (22.8) | | | — | | | (100.0) | | | |

| BALANCE AT JUNE 30, 2024 | $ | 7.7 | | | $ | 12.5 | | | $ | 8,177.6 | | | $ | (192.0) | | | $ | 8,005.8 | | | |

| | | | | | | | | | | |

| Net earnings attributable to Labcorp Holdings Inc. | — | | | — | | | 169.3 | | | — | | | 169.3 | | | |

| Other comprehensive earnings (loss), net of tax | — | | | — | | | — | | | 78.8 | | | 78.8 | | | |

| | | | | | | | | | | |

| Dividends declared | — | | | — | | | (61.1) | | | — | | | (61.1) | | | |

| Issuance of common stock under employee stock plans | — | | | 26.3 | | | — | | | — | | | 26.3 | | | |

| Net share settlement tax payments from issuance of stock to employees | — | | | (0.9) | | | — | | | — | | | (0.9) | | | |

| Stock compensation | — | | | 27.0 | | | — | | | — | | | 27.0 | | | |

| Purchase of common stock | (0.1) | | | (64.9) | | | (10.0) | | | — | | | (75.0) | | | |

| BALANCE AT SEPTEMBER 30, 2024 | $ | 7.6 | | | $ | — | | | $ | 8,275.8 | | | $ | (113.2) | | | $ | 8,170.2 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net earnings | $ | 603.5 | | | $ | 586.0 | |

| Earnings from discontinued operations, net of tax | — | | | (38.8) | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 472.9 | | | 430.9 | |

| Stock compensation | 89.4 | | | 101.7 | |

| Operating lease right-of-use asset expense | 136.7 | | | 128.5 | |

| Goodwill and other asset impairments | 2.5 | | | 15.2 | |

| Deferred income taxes | (58.6) | | | (18.2) | |

| Other | 46.0 | | | 3.9 | |

| Change in assets and liabilities (net of effects of acquisitions and divestitures): | | | |

| Increase in accounts receivable | (143.2) | | | (173.6) | |

| Decrease in unbilled services | 22.8 | | | 103.4 | |

| Decrease in supplies inventory | 2.0 | | | 9.7 | |

| Increase in prepaid expenses and other | (39.8) | | | (74.9) | |

| Decrease in accounts payable | (138.2) | | | (188.6) | |

| (Decrease) increase in unearned revenue | (27.9) | | | 50.7 | |

| Decrease in accrued expenses and other | (159.5) | | | (313.2) | |

| Net cash provided by continuing operating activities | 808.6 | | | 622.7 | |

| Net cash provided by discontinued operating activities | — | | | 125.4 | |

| Net cash provided by operating activities | 808.6 | | | 748.1 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Capital expenditures | (377.8) | | | (286.4) | |

| Proceeds from sale of assets | 0.6 | | | 0.3 | |

| Proceeds from sale of business | 13.5 | | | — | |

| Proceeds from sale or distribution of investments | — | | | 6.7 | |

| | | |

| Investments in equity affiliates | (42.3) | | | (20.1) | |

| Acquisition of businesses, net of cash acquired | (751.2) | | | (516.7) | |

| Net cash used for continuing investing activities | (1,157.2) | | | (816.2) | |

| Net cash used for discontinued investing activities | — | | | (24.7) | |

| Net cash used for investing activities | (1,157.2) | | | (840.9) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from senior note offerings | 2,000.0 | | | — | |

| Payments on senior notes | (600.0) | | | — | |

| | | |

| | | |

| Proceeds from revolving credit facilities | 2,463.7 | | | 1,968.5 | |

| Payments on revolving credit facilities | (2,463.7) | | | (1,878.9) | |

| Proceeds from accounts receivable securitization | 300.0 | | | — | |

| | | |

| | | |

| | | |

| Net share settlement tax payments from issuance of stock to employees | (38.7) | | | (39.6) | |

| Net proceeds from issuance of stock to employees | 53.0 | | | 54.4 | |

| Dividends paid | (183.0) | | | (192.9) | |

| Purchase of common stock | (175.0) | | | (1,009.0) | |

| Other | (29.7) | | | (15.0) | |

| Net cash provided by (used for) continuing financing activities | 1,326.6 | | | (1,112.5) | |

| Net cash provided by discontinued financing activities | — | | | 1,499.7 | |

| Net cash provided by financing activities | 1,326.6 | | | 387.2 | |

| Effect of exchange rate changes on cash and cash equivalents | 2.5 | | | 3.5 | |

| Net increase in cash and cash equivalents | 980.5 | | | 297.9 | |

| Cash and cash equivalents at beginning of period | 536.8 | | | 430.0 | |

| | | |

| | | |

| Cash and cash equivalents at end of period | $ | 1,517.3 | | | $ | 727.9 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

1. BASIS OF FINANCIAL STATEMENT PRESENTATION

Labcorp® Holdings Inc. (Labcorp® or the Company) is a global leader of innovative and comprehensive laboratory services that provides vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions. By leveraging its unparalleled diagnostics and drug development capabilities, the Company provides insights and accelerates innovations to improve health and improve lives.

On April 25, 2024, the Company announced plans to implement a new public holding company structure, with Labcorp Holdings Inc. as the new holding company. On May 17, 2024, the Company completed the holding company reorganization (Reorganization) and Labcorp Holdings Inc. became the successor issuer to Laboratory Corporation of America Holdings (LCAH). The new holding company has no independent assets or operations and its sole ownership interest is in LCAH.

The Company reports its business in two segments, Diagnostics Laboratories (Dx) and Biopharma Laboratory Services (BLS), formerly Drug Development. For further financial information about these segments, see Note 12 (Business Segment Information) to the Condensed Consolidated Financial Statements. During the three months ended September 30, 2024, Dx and BLS contributed approximately 78% and 22%, respectively, of revenues to the Company. During the nine months ended September 30, 2024, Dx and BLS contributed approximately 78% and 22%, respectively, of revenues to the Company.

The accompanying condensed consolidated financial statements of the Company are unaudited. In the opinion of management, all adjustments necessary for a fair statement of results of operations, cash flows, and financial position have been made. Except as otherwise disclosed, all such adjustments are of a normal recurring nature. Interim results are not necessarily indicative of results for a full year. The year-end condensed consolidated balance sheet data was derived from audited financial statements but does not include all disclosures required by generally accepted accounting principles.

The condensed consolidated financial statements and notes are presented in accordance with the rules and regulations of the Securities and Exchange Commission (SEC) and do not contain certain information included in the Company’s fiscal year 2023 Annual Report on Form 10-K (Annual Report). Therefore, these interim statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report.

The condensed consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries for which it exercises control. Long-term investments in affiliated companies in which the Company exercises significant influence, but which it does not control, are accounted for using the equity method. Investments in which the Company does not exercise significant influence (generally, when the Company has an investment of less than 20.0% and no representation on the investee's board of directors) are accounted for at fair value, or at cost minus impairment adjusted for observable price changes in orderly transactions for an identical or similar investment of the same issuer for those investments that do not have readily determinable fair values. All significant inter-company transactions and accounts have been eliminated. The Company does not have any significant variable interest entities or special purpose entities whose financial results are not included in the condensed consolidated financial statements.

The financial statements of the Company's operating foreign subsidiaries are measured using the local currency as the functional currency. Assets and liabilities are translated at exchange rates as of the balance sheet date. Revenues and expenses are translated at average monthly exchange rates prevailing during the period. Resulting translation adjustments are included in “Accumulated other comprehensive income (loss).”

2. DISCONTINUED OPERATIONS

On June 30, 2023 (the Distribution Date), Labcorp completed the previously announced separation (the Separation or spin-off) from the Company of Fortrea Holdings Inc. (Fortrea), formerly the Company's Clinical Development and Commercialization Services (CDCS) business, into a separate, publicly-traded company. All historical operating results of Fortrea are presented as Discontinued Operations, net of tax, in the Condensed Consolidated Statements of Operations. The spin-off is expected to be treated as tax-free for the Company and its shareholders for U.S. federal income tax purposes.

The spin-off of Fortrea from Labcorp was achieved through the Company’s pro-rata distribution of 100% of the outstanding shares of Fortrea common stock to holders of record of Labcorp common stock. Each holder of record of Labcorp common stock received one share of Fortrea common stock for every share of Labcorp common stock held at 5:00 p.m., Burlington, North Carolina, time on June 20, 2023, the record date for the distribution.

In June 2023, Fortrea, prior to the Separation and while a subsidiary of the Company, issued $570.0 of 7.500% senior secured notes due 2030 (the Fortrea Notes). The proceeds from the Fortrea Notes were used to fund cash payments of

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

approximately $1,600.0 to the Company in connection with the Separation. The Company does not guarantee the Fortrea Notes following the Separation. Also in June 2023, Fortrea entered into three floating secured overnight financing rate (SOFR) credit facilities totaling $1,520.0. These are comprised of a $450.0 Revolver maturing June 30, 2028; a $500.0 Term Loan A maturing June 30, 2028; and a $570.0 Term Loan B maturing June 30, 2030.

In connection with the spin-off, the Company entered into several agreements with Fortrea on or prior to the Distribution Date that, among other things, provide a framework for the Company’s relationship with Fortrea after the spin-off, including a separation and distribution agreement, a tax matters agreement, an employee matters agreement, and a transition services agreement. These agreements contain the key provisions relating to the spin-off, including provisions relating to the principal intercompany transactions required to effect the spin-off, the conditions to the spin-off and provisions governing the relationship between Fortrea and the Company after the spin-off. The costs to provide these services are included in operating income but the service fees are included in other income.

Financial Information of Discontinued Operations

Earnings from discontinued operations, net of tax in the Consolidated Statements of Operations reflect the after-tax results of Fortrea's business and Separation-related fees, and do not include any allocation of general corporate overhead expense or interest expense of the Company.

The following table summarizes the significant line items included in Earnings from Discontinued Operations, Net of Tax in the Condensed Consolidated Statements of Operations for the nine months ended September 30, 2023:

| | | | | | | | | | | |

| | | | | Nine Months Ended September 30, 2023 | | |

| Revenues | | | | | $ | 1,506.6 | | | |

| Cost of revenues | | | | | 1,244.5 | | | |

| Gross profit | | | | | 262.1 | | | |

| Selling, general and administrative expenses | | | | | 184.1 | | | |

| Amortization of intangibles and other assets | | | | | 31.9 | | | |

| | | | | | | |

| Restructuring and other charges | | | | | 3.0 | | | |

| Operating income | | | | | 43.1 | | | |

| Other income (expense): | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other, net | | | | | 2.5 | | | |

| Earnings before income taxes | | | | | 45.6 | | | |

| Provision for income taxes | | | | | 6.8 | | | |

| | | | | | | |

| | | | | | | |

| Net earnings attributable to Labcorp Holdings Inc. | | | | | $ | 38.8 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

3. REVENUES

The Company's revenues by segment and by payers/customer groups for the three and nine months ended September 30, 2024, and 2023, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, 2024 | | For the Three Months Ended September 30, 2023 |

| North America | | Europe | | Other | | Total | | North America | | Europe | | Other | | Total |

| Payer/Customer | | | | | | | | | | | | | | | |

| Dx | | | | | | | | | | | | | | | |

| Clients | 24 | % | | — | % | | — | % | | 24 | % | | 24 | % | | — | % | | — | % | | 24 | % |

| Patients | 10 | % | | — | % | | — | % | | 10 | % | | 9 | % | | — | % | | — | % | | 9 | % |

| Medicare and Medicaid | 8 | % | | — | % | | — | % | | 8 | % | | 8 | % | | — | % | | — | % | | 8 | % |

| Third party | 36 | % | | — | % | | — | % | | 36 | % | | 36 | % | | — | % | | — | % | | 36 | % |

| Total Dx revenues by payer | 78 | % | | — | % | | — | % | | 78 | % | | 77 | % | | — | % | | — | % | | 77 | % |

| BLS | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Pharmaceutical, biotechnology, and medical device companies | 9 | % | | 9 | % | | 4 | % | | 22 | % | | 10 | % | | 9 | % | | 4 | % | | 23 | % |

| Total revenues | 87 | % | | 9 | % | | 4 | % | | 100 | % | | 87 | % | | 9 | % | | 4 | % | | 100 | % |

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Nine Months Ended September 30, 2024 | | For the Nine Months Ended September 30, 2023 |

| North America | | Europe | | Other | | Total | | North America | | Europe | | Other | | Total |

| Payer/Customer | | | | | | | | | | | | | | | |

| Dx | | | | | | | | | | | | | | | |

| Clients | 24 | % | | — | % | | — | % | | 24 | % | | 24 | % | | — | % | | — | % | | 24 | % |

| Patients | 10 | % | | — | % | | — | % | | 10 | % | | 9 | % | | — | % | | — | % | | 9 | % |

| Medicare and Medicaid | 8 | % | | — | % | | — | % | | 8 | % | | 8 | % | | — | % | | — | % | | 8 | % |

| Third party | 36 | % | | — | % | | — | % | | 36 | % | | 36 | % | | — | % | | — | % | | 36 | % |

| Total Dx revenues by payer | 78 | % | | — | % | | — | % | | 78 | % | | 77 | % | | — | % | | — | % | | 77 | % |

| BLS | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Pharmaceutical, biotechnology, and medical device companies | 9 | % | | 9 | % | | 4 | % | | 22 | % | | 10 | % | | 9 | % | | 4 | % | | 23 | % |

| Total revenues | 87 | % | | 9 | % | | 4 | % | | 100 | % | | 87 | % | | 9 | % | | 4 | % | | 100 | % |

Revenues in the United States were $2,738.4 (83.4%) and $2,550.6 (83.4%) for the three months ended September 30, 2024 and 2023, respectively, and were $8,091.8 (83.6%) and $7,645.0 (83.8%) for the nine months ended September 30, 2024 and 2023, respectively.

Accounts Receivable, Unbilled Services and Unearned Revenue

The following table provides information about accounts receivable, unbilled services, and unearned revenue from contracts with customers as of September 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Dx accounts receivable | $ | 1,323.7 | | | $ | 1,135.2 | |

| BLS accounts receivable | 773.7 | | | 810.8 | |

| Less BLS allowance for doubtful accounts | (38.9) | | | (32.7) | |

| Accounts receivable | $ | 2,058.5 | | | $ | 1,913.3 | |

| | | |

| Gross unbilled services | $ | 167.9 | | | $ | 192.9 | |

| Less reserve for unbilled services | (1.6) | | | (7.5) | |

| Unbilled services | $ | 166.3 | | | $ | 185.4 | |

| | | |

| Unearned revenue | $ | 403.1 | | | $ | 421.7 | |

Revenues recognized during the period that were included in the unearned revenue balance at the beginning of the period were $20.2 and $6.3 for the three months ended September 30, 2024 and 2023, respectively, and $98.0 and $79.1 for the nine months ended September 30, 2024 and 2023, respectively.

Credit Loss Rollforward

The Company estimates future expected losses on accounts receivable, unbilled services and notes receivable over the remaining collection period of the instrument. The rollforward for the allowance for credit losses for the nine months ended September 30, 2024, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Accounts Receivable | | Unbilled Services | | Note and Other Receivables | | Total |

| Balance as of December 31, 2023 | $ | 32.7 | | | $ | 7.5 | | | $ | 0.7 | | | $ | 40.9 | |

| Plus, credit loss expense | 7.7 | | | — | | | — | | | 7.7 | |

| | | | | | | |

| Less, write offs | 1.5 | | | 5.9 | | | — | | | 7.4 | |

| Balance as of September 30, 2024 | $ | 38.9 | | | $ | 1.6 | | | $ | 0.7 | | | $ | 41.2 | |

The credit loss expense in the first nine months was primarily related to the collection risk from several biotech receivable balances.

4. BUSINESS ACQUISITIONS AND DISPOSITIONS

During the nine months ended September 30, 2024, the Company acquired several businesses and related assets for cash of approximately $751.2. These acquisitions consisted of the clinical and outreach businesses of Baystate Medical Center ($120.2), Providence Medical Foundation ($54.9), and Westpac Labs, Inc. ($97.7), and selected assets of the Invitae

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

Corporation ($240.8) and BioReference Health (237.6). The preliminary purchase considerations for these acquisitions were allocated under the acquisition method of accounting to the estimated fair market value of the net assets acquired, including approximately $393.6 in identifiable intangible assets. A residual amount of tax deductible goodwill of approximately $349.5 was recorded as of September 30, 2024. The amortization period for non-compete agreements and customer list assets acquired from these businesses are 5 and 15 years, respectively. The purchase price allocations for the Invitae and BioReference Health acquisitions have not been finalized as of September 30, 2024. The preliminary valuation of acquired assets and assumed liabilities, include the following:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Baystate Medical Center | Providence Medical Foundation | Westpac Labs, Inc. | Invitae Corporation | BioReference Health | Measurement Period Adjustments During the Nine Months Ended September 30, 2024 | Amounts Acquired During the Nine Months Ended September 30, 2024 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Inventories | — | | — | | 1.8 | | 12.1 | | — | | — | | 13.9 | | | |

| | | | | | | | | |

| Property, plant and equipment | 7.2 | | 0.9 | | — | | 76.7 | | 9.1 | | (3.9) | | 90.0 | | | |

| | | | | | | | | |

| Goodwill | 70.7 | | 25.9 | | 45.1 | | 100.4 | | 107.4 | | (7.4) | | 342.1 | | | |

| Intangible assets | 79.5 | | 29.0 | | 50.8 | | 113.2 | | 121.1 | | 7.4 | | 401.0 | | | |

| | | | | | | | | |

| Total assets acquired | $ | 157.4 | | $ | 55.8 | | $ | 97.7 | | $ | 302.4 | | $ | 237.6 | | $ | (3.9) | | $ | 847.0 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Unearned revenue | — | | — | | — | | 3.3 | | — | | — | | 3.3 | | | |

| | | | | | | | | |

| Lease liabilities | 7.2 | | 0.9 | | — | | 58.3 | | — | | (3.9) | | 62.5 | | | |

| Other liabilities | | — | | — | | — | | — | | — | | — | | | |

| Total liabilities acquired | 7.2 | | 0.9 | | — | | 61.6 | | — | | (3.9) | | 65.8 | | | |

| Net assets acquired | $ | 150.2 | | $ | 54.9 | | $ | 97.7 | | $ | 240.8 | | $ | 237.6 | | $ | — | | $ | 781.2 | | | |

| Less escrow payment made in 2023 | 30.0 | | — | | — | | — | | — | | — | | 30.0 | | | |

| Cash paid for acquisitions | $ | 120.2 | | $ | 54.9 | | $ | 97.7 | | $ | 240.8 | | $ | 237.6 | | $ | — | | $ | 751.2 | | | |

On September 17, 2024, the Company announced that it entered into an agreement with Cinven, Inc. to acquire a 15% minority interest in SYNLAB, a leader in medical diagnostic services and specialty testing in Europe, for approximately $155.9 (€140.0). The transaction is anticipated to close in early 2025, subject to customary closing conditions for a transaction of this type, including applicable regulatory approvals. The Company will acquire the minority interest through an intermediate holding company that will be established to hold the investment with SYNLAB and will be represented on the holding company board with Cinven, Inc. and other investors.

During the nine months ended September 30, 2023, the Company acquired several businesses and the related assets for approximately $516.7 in cash. These acquisitions consisted of the clinical and outreach business of Jefferson Health ($108.0), Enzo BioChem ($112.8), Providence Health & Services - Oregon ($110.0), Tuffts Medicine ($157.0), and other small acquisitions for $28.9. The preliminary purchase considerations for these acquisitions were allocated under the acquisition method of accounting to the estimated fair market value of the net assets acquired, including approximately $284.6 in identifiable intangible assets. A residual amount of non-tax deductible goodwill of approximately $230.5 was recorded as of September 30, 2023. The amortization period for non-compete agreements and customer list assets acquired from these businesses are 5 and 15 years, respectively.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

During the nine months ended September 30, 2023, the Company recorded several measurement period adjustments for 2022 acquisitions, relating to final valuations and deferred tax true-ups. The adjustments include the following:

| | | | | | | | | | | |

| Business Acquisitions | Measurement Period Adjustments During Nine Months Ended September 30, 2023 | Amounts Acquired During the Nine Months Ended September 30, 2023 |

| Cash and cash equivalents | $ | — | | $ | 0.2 | | $ | 0.2 | |

| Accounts receivable | (3.0) | | — | | (3.0) | |

| | | |

| Inventories | 1.3 | | — | | 1.3 | |

| Prepaid expenses and other | 0.4 | | 0.6 | | 1.0 | |

| Property, plant and equipment | 4.7 | | (1.5) | | 3.2 | |

| | | |

| Goodwill | 230.5 | | (29.4) | | 201.1 | |

| Intangible assets | 284.6 | | 19.5 | | 304.1 | |

| Other assets | 2.1 | | — | | 2.1 | |

| Total assets acquired | $ | 520.6 | | $ | (10.6) | | $ | 510.0 | |

| | | |

| Accrued expenses and other | 3.9 | | (8.3) | | (4.4) | |

| | | |

| Deferred income taxes | — | | (2.3) | | (2.3) | |

| | | |

| | | |

| Total liabilities acquired | 3.9 | | (10.6) | | (6.7) | |

| Net assets acquired | $ | 516.7 | | $ | — | | $ | 516.7 | |

| | | |

Pro Forma Information

Had the Company's total 2024 and 2023 acquisitions been completed as of January 1, the Company's pro forma results would have been as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Nine Months Ended September 30, |

| | 2024 | | | | 2023 | | 2024 | 2023 |

| Revenues | | $ | 3,333.8 | | | | | $ | 3,152.7 | | | 9,999.9 | | $ | 9,354.4 | |

| Net earnings from continuing operations attributable to Labcorp Holdings Inc. | | $ | 172.2 | | | | | $ | 174.8 | | | 613.1 | | $ | 582.7 | |

| | | | | | | | | |

Dispositions

During the nine months ended September 30, 2024, the Company sold the assets of its Beacon Laboratory Benefit Solutions, Inc. for $13.5 and recorded a gain of $4.9.

5. EARNINGS PER SHARE

Basic earnings per share is computed by dividing net earnings attributable to the Company by the weighted average number of shares of the Company's common stock outstanding. Diluted earnings per share is computed by dividing net earnings including the impact of dilutive adjustments by the weighted average number of common shares outstanding plus potentially dilutive shares, as if they had been issued at the earlier of the date of issuance or the beginning of the period presented. Potentially dilutive common shares result primarily from the Company’s outstanding stock options, restricted stock awards, restricted stock units, and performance share awards.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

The following represents a reconciliation of basic earnings per share to diluted earnings per share for the three and nine months ended September 30:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Earnings | | Shares | | Per Share Amount | | Earnings | | Shares | | Per Share Amount | | Earnings | | Shares | | Per Share Amount | | Earnings | | Shares | | Per Share Amount |

| Basic earnings per share: | | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings | $ | 169.3 | | | 84.0 | | | $ | 2.02 | | | $ | 183.3 | | | 86.6 | | | $ | 2.12 | | | $ | 602.6 | | | 84.0 | | | $ | 7.17 | | | $ | 546.3 | | | 87.9 | | | $ | 6.22 | |

| Dilutive effect of employee stock options and awards | — | | | 0.4 | | | | | — | | | 0.4 | | | | | — | | | 0.5 | | | | | — | | | 0.4 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings including impact of dilutive adjustments | $ | 169.3 | | | 84.4 | | | $ | 2.00 | | | $ | 183.3 | | | 87.0 | | | $ | 2.11 | | | $ | 602.6 | | | 84.5 | | | $ | 7.13 | | | $ | 546.3 | | | 88.3 | | | $ | 6.19 | |

Diluted earnings per share represent the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock. These potential shares include dilutive stock options and unissued restricted stock awards.

The following table summarizes the potential common shares not included in the computation of diluted earnings per share because their impact would have been antidilutive:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Employee stock options and awards | 0.2 | | | 0.2 | | | 0.2 | | | 0.4 | |

6. GOODWILL AND INTANGIBLE ASSETS

The changes in the carrying amount of goodwill for the nine months ended September 30, 2024, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Dx | | | | BLS | | | | Total | | |

| | | | | | | | | | | |

| Balance as of December 31, 2023 | $ | 4,813.9 | | | | | $ | 1,328.6 | | | | | $ | 6,142.5 | | | |

| Goodwill acquired during the period | 349.5 | | | | | — | | | | | 349.5 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Foreign currency impact and other adjustments to goodwill | (9.5) | | | | | (0.1) | | | | | (9.6) | | | |

| Balance as of September 30, 2024 | $ | 5,153.9 | | | | | $ | 1,328.5 | | | | | $ | 6,482.4 | | | |

The Company assesses goodwill and indefinite-lived intangibles for impairment at least annually or whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. The Company recognizes an impairment charge for the amount by which the reporting unit's carrying amount exceeds its fair value.

Although the Company believes that the current assumptions and estimates used in its goodwill analysis are reasonable, supportable, and appropriate, the Company's business could be impacted by unfavorable changes, including those that impact the existing assumptions used in the impairment analysis. Various factors could reasonably be expected to unfavorably impact existing assumptions: primarily, a worsening economic environment and protracted economic downturn and related impacts, including delays in revenue from new customers; increases in customer termination activity; or increases in operating costs. Accordingly, there can be no assurance that the estimates and assumptions made for the purposes of the goodwill impairment analysis will prove to be accurate predictions of future performance.

The Company will continue to monitor the financial performance of, and assumptions for, its reporting units. A significant increase in the discount rate, decrease in the revenue and terminal growth rates, decreased operating margin, or substantial reductions in end markets and volume assumptions, could have a negative impact on the estimated fair value of the reporting units. A future impairment charge for goodwill or intangible assets could have a material effect on the Company's consolidated financial position and results of operations.

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

The components of identifiable intangible assets were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 | | | |

| Gross Carrying Amount | | Accumulated Amortization | | Net | | Gross Carrying Amount | | Accumulated Amortization | | Net | | | |

| Customer relationships | $ | 4,208.6 | | | $ | (1,512.5) | | | $ | 2,696.1 | | | $ | 3,868.6 | | | $ | (1,367.2) | | | $ | 2,501.4 | | | | |

| Patents, licenses, and technology | 523.8 | | | (292.1) | | | 231.7 | | | 526.6 | | | (273.3) | | | 253.3 | | | | |

| Non-compete agreements | 192.2 | | | (78.9) | | | 113.3 | | | 130.3 | | | (60.4) | | | 69.9 | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Canadian licenses | 484.6 | | | — | | | 484.6 | | | 498.8 | | | — | | | 498.8 | | | | |

| Other | 34.3 | | | (19.3) | | | 15.0 | | | 34.1 | | | (15.5) | | | 18.6 | | | | |

| | 5,443.5 | | | (1,902.8) | | | 3,540.7 | | | 5,058.4 | | | (1,716.4) | | | 3,342.0 | | | | |

Amortization of intangible assets for the three and nine months ended September 30, 2024, and 2023, was $63.7 and $55.7 and $186.0 and $160.6, respectively. The amortization expense for the net carrying amount of intangible assets is estimated to be $71.0 for the remainder of fiscal 2024, $260.4 in fiscal 2025, $251.4 in fiscal 2026, $240.1 in fiscal 2027, $232.2 in fiscal 2028, and $1,915.4 thereafter.

7. DEBT

Short-term borrowings and the current portion of long-term debt at September 30, 2024, and December 31, 2023, consisted of the following:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| 2.30% senior notes due 2024 | 400.0 | | | 400.0 | |

| 3.25% senior notes due 2024 | — | | | 600.0 | |

| 3.60% senior notes due 2025 | 1,000.0 | | | — | |

| Debt issuance costs | (0.5) | | | (1.3) | |

| Current portion of note payable | 0.4 | | | 1.1 | |

| Total short-term borrowings and current portion of long-term debt | $ | 1,399.9 | | | $ | 999.8 | |

| | | |

| | | |

Long-term debt at September 30, 2024, and December 31, 2023, consisted of the following:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 3.60% senior notes due 2025 | — | | | 1,000.0 | |

| 1.55% senior notes due 2026 | 500.0 | | | 500.0 | |

| 3.60% senior notes due 2027 | 600.0 | | | 600.0 | |

| 2.95% senior notes due 2029 | 650.0 | | | 650.0 | |

| 4.35% senior notes due 2030 | 650.0 | | | — | |

| 2.70% senior notes due 2031 | 442.9 | | | 430.4 | |

| 4.55% senior notes due 2032 | 500.0 | | | — | |

| 4.80% senior notes due 2034 | 850.0 | | | — | |

| 4.70% senior notes due 2045 | 900.0 | | | 900.0 | |

| Debt issuance costs | (41.1) | | | (26.3) | |

| AR facility | 300.0 | | | — | |

| Note payable | 0.3 | | | 0.6 | |

| Total long-term debt | $ | 5,352.1 | | | $ | 4,054.7 | |

| | | |

Credit Facilities

The Company maintains a senior revolving credit facility, which was amended and restated on January 13, 2023. It consists of a five-year facility in the principal amount of up to $1,000.0, with the option of increasing the facility by up to an additional $500.0, subject to the agreement of one or more new or existing lenders to provide such additional amounts and certain other customary conditions. The revolving credit facility also provides for a subfacility of up to $100.0 for swing line borrowings and a subfacility of up to $150.0 for issuances of letters of credit. The Company is required to pay a facility fee on the aggregate commitments under the revolving credit facility, at a per annum rate ranging from 0.10% to 0.225%, depending on the Company's debt ratings. The revolving credit facility is permitted to be used for general corporate purposes, including working capital, capital expenditures, funding of share repurchases and certain other payments, acquisitions, and other investments. The revolving credit facility also provides for the issuance of letters of credit without a reduction of the availability of borrowings

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

under the facility. There was $0.0 outstanding on the Company's current revolving credit facility and $91.9 in outstanding letters of credit on the Company's subfacility as of September 30, 2024. As of September 30, 2024, the effective interest rate on the revolving credit facility was 6.26%. The credit facility expires on April 30, 2026.

Under the revolving credit facility, the Company is subject to negative covenants limiting subsidiary indebtedness and certain other covenants typical for investment grade-rated borrowers, and the Company is required to maintain certain leverage ratios. The Company was in compliance with all covenants in the revolving credit facility at September 30, 2024, and expects that it will remain in compliance with its existing debt covenants for the next twelve months.

On August 23, 2024, the Company and a bankruptcy-remote special purpose vehicle (SPV) entered into an accounts receivable securitization facility (AR Facility) with PNC Bank, National Association (PNC) with a three-year term. The AR Facility allows the Company to borrow from PNC an amount of up to $300.0 through August of 2027 and may increase up to $700.0, subject to the satisfaction of certain conditions.

The SPV is a variable interest entity (VIE) for which the Company is the primary beneficiary. The SPV's sole business consists of the continuous purchase of receivables from the Company which is used as collateral for the loan with PNC. Although the SPV is included in the Company's consolidated financial statements, it is a separate legal entity with separate creditors.

Upon the transfer of ownership and control of the receivables to the SPV, the Company has no retained interests in the receivables sold and they become unavailable to the Company's creditors should the relevant seller become insolvent. The Company has collection and administrative responsibilities for the receivables sold to the SPV.

During the three months ended September 30, 2024, the Company received loan proceeds of $300.0 under the AR Facility, which is included in cash from financing activities in the Condensed Consolidated Statement of Cash Flows.

Senior Notes

On September 23, 2024, LCAH entered into an indenture with U.S. Bank Trust Company, National Association, as trustee (the Trustee) (the Indenture). Also, on September 23, 2024, the Company, LCAH, and the Trustee entered into certain first, second, and third supplemental indentures to the Indenture under each of which LCAH issued, and the Company guaranteed, $650.0 aggregate principal amount of 4.35% Senior Notes due 2030 (the 2030 Notes), $500.0 aggregate principal amount of 4.55% Senior Notes due 2032 (the 2032 Notes) and $850.0 aggregate principal amount of 4.80% Senior Notes due 2034, respectively (the 2034 Notes and, together with the 2030 Notes and the 2032 Notes, the Notes), totaling $2,000.0. Interest on the Notes is payable semi-annually on April 1 and October 1 of each year, commencing April 1, 2025. Net proceeds from the offering of the Notes were approximately $1,982.1 after deducting underwriting discounts and other estimated expenses of the offering. The net proceeds will be used to redeem or repay indebtedness and, to the extent not used for such purpose, for other general corporate purposes. Indebtedness to be redeemed or repaid at or prior to maturity were the Company's 2.30% senior notes due 2024, its 3.60% senior notes due 2025 and $350.0 of borrowings under its revolving credit facility.

8. PREFERRED STOCK AND COMMON SHAREHOLDERS’ EQUITY

The Company is authorized to issue up to 265.0 shares of common stock, par value $0.10 per share. The Company is authorized to issue up to 30.0 shares of preferred stock, par value $0.10 per share. There were no preferred shares outstanding as of September 30, 2024, and December 31, 2023.

The changes in common shares issued during the nine months ended September 30, 2024 are summarized below:

| | | | | | | | | |

| Issued and Outstanding | | | | |

| Common shares at December 31, 2023 | 83.9 | | | | | |

| Shares issued under employee stock plans | 0.6 | | | | | |

| | | | | |

| | | | | |

| Shares repurchased | (0.8) | | | | | |

| | | | | |

| Common shares at September 30, 2024 | 83.7 | | | | | |

Share Repurchase Program

When the Company repurchases shares of Common Stock, the amount paid to repurchase the shares in excess of the par or stated value is allocated to additional paid-in-capital unless subject to limitation or the balance in additional paid-in-capital is exhausted. Remaining amounts are recognized as a reduction in retained earnings.

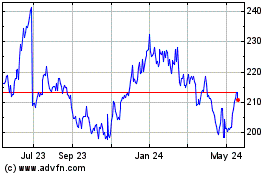

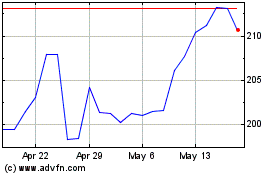

During the nine months ended September 30, 2024, the Company purchased 0.8 shares of its common stock at an average price of $211.63 for a total cost of $175.0. On July 24, 2024, the Board adopted a new share repurchase plan authorizing up to

LABCORP HOLDINGS INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(dollars and shares in millions, except per share data)

$1,000.0 of the Company's shares in addition to the remaining amount outstanding under the previous plan. As of September 30, 2024, the Company had outstanding authorization from the board of directors to purchase up to $1,355.4 of the Company's common stock.

Dividends

For the nine months ended September 30, 2024, the Company paid $183.0 in common stock dividends. On October 10, 2024, the Company announced a cash dividend of $0.72 per share of common stock for the third quarter, or approximately $61.0 in the aggregate. The dividend will be payable on December 13, 2024, to stockholders of record of all issued and outstanding shares of common stock as of the close of business on November 26, 2024. The declaration and payment of any future dividends will be at the discretion of the Company's board of directors.

Accumulated Other Comprehensive Earnings (Loss)

The components of accumulated other comprehensive earnings (loss) during the nine months ended September 30, 2024 were as follows: