Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the

“Company”), a leading global lithium-ion battery resource recovery

company, today announced the closing of its previously announced

underwritten public offering in the United States (the “Offering”).

Gross proceeds to the Company were approximately $15 million before

deducting for offering expenses payable by the Company, including

underwriting fees and expenses.

The Offering consisted of 5,000,000 units (the “Units”) and

10,000,000 pre-funded units (“Pre-Funded Units”). Each Unit

consists of: (i) one common share, without par value, of the

Company (“Common Share”), (ii) one Series A Warrant to purchase one

Common Share (“Series A Warrant”), and (iii) one Series B Warrant

to purchase one Common Share (“Series B Warrant”). Each Pre-Funded

Unit consists of: (i) one pre-funded warrant to purchase one Common

Share (the “Pre-Funded Warrant” and together with the Series A

Warrant and the Series B Warrant, the “Warrants”), (ii) one Series

A Warrant, and (iii) one Series B Warrant.

The public offering price per Unit was $1.00 and the public

offering price per Pre-Funded Unit was $0.99999, which is equal to

the public offering price per Unit minus an exercise price of

$0.00001 per Pre-Funded Warrant. The initial exercise price of each

Series A Warrant is $1.00 per Common Share. The Series A Warrants

will be immediately exercisable and will expire on the eight-month

anniversary of the initial date of issuance. The initial exercise

price of each Series B Warrant is $1.00 per Common Share. The

Series B Warrants will be immediately exercisable and will expire

on the five-year anniversary of the initial date of issuance.

In connection with the Offering, the Company has granted Aegis

Capital Corp. a 45-day option to purchase additional Common Shares

and/or Series A Warrants and/or Series B Warrants representing up

to 15% of the total Common Shares and up to 15% of the total Series

A Warrants and Series B Warrants sold in the Offering solely to

cover over-allotments, if any, at a price of $0.99998 per Common

Share, $0.00001 per Series A Warrant, and $0.00001 per Series B

Warrant. On January 16, 2025, Aegis Capital Corp. exercised its

over-allotment option with respect to 2,250,000 Series A Warrants

and 2,250,000 Series B Warrants.

The Offering closed on January 16, 2025. Li-Cycle intends to use

the net proceeds from this Offering for working capital and general

corporate purposes.

Aegis Capital Corp. acted as the sole book-running manager for

the Offering on a firm commitment basis. Freshfields US LLP acted

as counsel to the Company. Sichenzia Ross Ference Carmel LLP acted

as counsel to Aegis Capital Corp.

The Offering was made pursuant to an effective shelf

registration statement on Form S-3 (File No. 333-278010) previously

filed with the U.S. Securities and Exchange Commission (“SEC”) and

declared effective by the SEC on March 29, 2024. A final prospectus

supplement and accompanying prospectus describing the terms of the

Offering were filed with the SEC on January 16, 2025 and is

available on the SEC’s website at www.sec.gov. Electronic copies of

the final prospectus supplement and the accompanying prospectus

relating to the Offering may be obtained, when available, by

contacting Aegis Capital Corp., Attention: Syndicate Department,

1345 Avenue of the Americas, 27th floor, New York, NY 10105, by

email at syndicate@aegiscap.com, or by telephone at +1 (212)

813-1010.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

Consent and Waiver Agreement with Glencore Canada

Corporation

In connection with the Offering, on January 14, 2025, the

Company entered into a consent and waiver agreement with Glencore

Canada Corporation (“Glencore”), a related party of the Company and

the holder of the senior secured convertible note dated as of March

25, 2024 issued by the Company (the “Glencore Senior Secured

Convertible Note”), pursuant to which Glencore has, among other

things, granted its consent to the issuance by the Company of the

Warrants and agreed to waive any default or event of default under

the Glencore Senior Secured Convertible Note which may occur as a

result of the issuance of the Warrants and the Company’s compliance

with certain terms of the Warrants (the “Consent and Waiver

Agreement”). In addition, under the agreement, the Company has

agreed to amend the Glencore Senior Secured Convertible Note, the

First A&R Note and the Second A&R Note (in each case as

defined in the Glencore Senior Secured Glencore Note) and the form

of warrants attached thereto (collectively, the “Glencore Notes”),

to reflect any terms contained in the Warrants that are more

favorable to the holders of the Warrants than those contained in

the Glencore Notes, to the extent requested by Glencore, within ten

business days following the closing of the Offering. Additional

information regarding the Consent and Waiver Agreement may be found

in a Form 8-K that will be filed with the U.S. Securities and

Exchange Commission and in a material change report that will be

filed with the Ontario Securities Commission.

Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions

The entering into of the Consent and Waiver Agreement and the

matters contemplated thereby (the “Transactions”) are considered

“related party transactions” within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (“MI 61-101”) of the Canadian Securities

Administrators. In its consideration and approval of the

Transactions, the independent members of the Board of Directors of

Li-Cycle determined that the Transactions will be exempt from the

formal valuation and minority approval requirements of MI 61-101 on

the basis of the “financial hardship” exemptions in Sections 5.5(g)

and 5.7(e) of MI 61-101. The Company meets the requirements set out

in Sections 5.5(g) and 5.7(e) of MI 61-101 based on the independent

members of the Board of Directors of Li-Cycle, acting in good

faith, having unanimously determined that Li-Cycle is in serious

financial difficulty, that the Transactions are designed to improve

Li-Cycle’s financial position, and that the terms of the

Transactions are reasonable in the circumstances of Li-Cycle.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Forward-Looking Statements

Certain statements contained in this press release may be

considered “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995, Section 27A

of the U.S. Securities Act of 1933, as amended, Section 21 of the

U.S. Securities Exchange Act of 1934, as amended, and applicable

Canadian securities laws. Forward-looking statements may generally

be identified by the use of words such as “believe”, “may”, “will”,

“continue”, “expect”, “should”, “plan”, “potential”, “future”, or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters, although

not all forward-looking statements contain such identifying words.

Forward-looking statements in this press release include, but are

not limited to, statements about the Company’s intended use of

proceeds, and the Company’s agreement to amend the Glencore Notes,

to reflect any terms contained in the Warrants that are more

favorable to the holders of the Warrants than those contained in

the Glencore Notes, to the extent requested by Glencore.

These statements are based on various assumptions, whether or

not identified in this press release, including but not limited to

assumptions regarding Li-Cycle’s ability to satisfy the drawdown

conditions and access funding under a loan facility with the U.S.

Department of Energy (the “DOE Loan Facility”); the timing, scope

and cost of Li-Cycle’s projects, including paused projects; the

processing capacity and production of Li-Cycle’s facilities;

Li-Cycle’s ability to source feedstock and manage supply chain

risk; Li-Cycle’s ability to increase recycling capacity and

efficiency; Li-Cycle’s ability to obtain financing on acceptable

terms or at all; the success of Li-Cycle’s cash preservation plan;

the outcome of the go-forward strategy of Li-Cycle’s Rochester Hub;

Li-Cycle’s ability to retain and hire key personnel and maintain

relationships with customers, suppliers and other business

partners. There can be no assurance that such estimates or

assumptions will prove to be correct and, as a result, actual

results or events may differ materially from expectations expressed

in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to fund the anticipated costs of, and realize

the anticipated benefits from, its Spoke optimization plan;

Li-Cycle’s inability to satisfy the drawdown conditions and access

funding under the DOE Loan Facility; Li-Cycle’s inability to

develop the Rochester Hub as anticipated or at all, and other

future projects including its Spoke network expansion projects in a

timely manner or on budget or that those projects will not meet

expectations with respect to their productivity or the

specifications of their end products; risk and uncertainties

related to Li-Cycle’s ability to continue as a going concern;

Li-Cycle’s insurance may not cover all liabilities and damages;

Li-Cycle’s reliance on a limited number of commercial partners to

generate revenue; Li-Cycle’s failure to effectively remediate the

material weaknesses in its internal control over financial

reporting that it has identified or its failure to develop and

maintain a proper and effective internal control over financial

reporting; and risks of litigation or regulatory proceedings that

could materially and adversely impact Li-Cycle’s financial results.

These and other risks and uncertainties related to Li-Cycle’s

business are described in greater detail in the sections titled

“Item 1A. Risk Factors” and “Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operation—Key

Factors Affecting Li-Cycle’s Performance” in its Annual Report on

Form 10-K and the sections titled “Part II. Other Information—Item

1A. Risk Factors” and “Part I. Financial Information—Item 2.

Management’s Discussion and Analysis of Financial Condition and

Results of Operation—Key Factors Affecting Li-Cycle’s Performance”

in its Quarterly Reports on Form 10-Q, in each case filed with the

SEC and the Ontario Securities Commission in Canada. Because of

these risks, uncertainties and assumptions, readers should not

place undue reliance on these forward-looking statements. Actual

results could differ materially from those contained in any

forward-looking statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116633461/en/

Investor Relations & Media

Louie Diaz Sheldon D'souza

Investor Relations: investors@li-cycle.com Media:

media@li-cycle.com

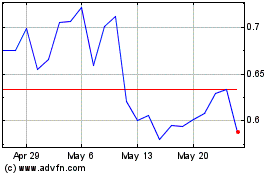

Li Cycle (NYSE:LICY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Li Cycle (NYSE:LICY)

Historical Stock Chart

From Jan 2024 to Jan 2025