MPLX LP Announces $1 Billion Private Placement of 6.5% Series A Convertible Preferred Units

28 April 2016 - 6:18AM

FINDLAY, Ohio, April 27, 2016 - MPLX LP (NYSE:

MPLX) today announced that it has entered into an agreement for the

private placement of $1 billion of newly authorized 6.5% Series A

Convertible Preferred Units (the "Preferred Units") at a price of

$32.50 per unit with approximately 30.8 million Preferred Units to

be outstanding at the closing of the private placement. The

Preferred Units are generally convertible into MPLX common units on

a one for one basis after three years, at the purchasers' option,

and after four years at MPLX's option, subject to certain

conditions. The transaction is expected to close in May

2016.

The net proceeds, after deducting offering and transaction

expenses, are expected to be approximately $984 million. MPLX

expects to use the proceeds for capital expenditures, repayment of

debt, and general partnership purposes. Primary investors include

funds managed by Stonepeak Infrastructure Partners, Magnetar

Capital, Kayne Anderson Capital Advisors and The Energy &

Minerals Group.

"The partnership elected to take advantage of very strong investor

interest in convertible preferred securities by agreeing to the

private placement of $1 billion of those securities with a select

group of investors," MPLX Chairman and Chief Executive Officer Gary

R. Heminger said. "This private placement provides an attractive

funding source for the partnership and combined with some

opportunistic at-the-market issuances in the first quarter,

provides for the partnership's anticipated funding needs for the

remainder of 2016 and into 2017, enabling MPLX to continue its

execution of attractive organic growth projects that will

contribute to distributable cash flow and long-term value for our

unitholders."

On April 28, MPLX will provide an update on its 2016 first-quarter

results through an earnings release, to be followed by a conference

call scheduled for 11 a.m. EDT that day. Interested parties may

listen to the conference call by dialing 1-800-446-1671

(confirmation #42124992) or by visiting MPLX's website at

http://www.mplx.com and clicking on the "2016 First-Quarter

Financial Results" link in the "News & Headlines"

section.

The securities offered in the private placement have not been

registered under the Securities Act of 1933, as amended (the

"Securities Act"), or any state securities laws and may not be

offered or sold in the United States absent registration or an

applicable exemption from registration requirements of the

Securities Act and applicable state laws.

This press release is neither an offer to sell nor a solicitation

of an offer to purchase the securities described herein.

###

About MPLX LP

MPLX is a diversified, growth-oriented master

limited partnership formed in 2012 by Marathon Petroleum

Corporation to own, operate, develop and acquire midstream energy

infrastructure assets. We are engaged in the gathering, processing

and transportation of natural gas; the gathering, transportation,

fractionation, storage and marketing of NGLs; and the

transportation and storage of crude oil and refined petroleum

products. Headquartered in Findlay, Ohio, MPLX's assets consist of

a network of common carrier crude oil and products pipeline assets

located in the Midwest and Gulf Coast regions of the United States,

an inland marine business, a butane storage cavern located in West

Virginia with approximately 1 million barrels of storage capacity,

crude oil and product storage facilities (tank farms) with

approximately 4.5 million barrels of available storage capacity, a

barge dock facility with approximately 78,000 barrels per day of

crude oil and product throughput capacity and gathering and

processing assets that include more than 5,000 miles of gas

gathering and NGL pipelines, 53 gas processing plants, 13 NGL

fractionation facilities and one condensate stabilization

facility.

Investor Relations Contacts:

Lisa D. Wilson (419) 421-2071

Kevin Hawkins (866) 858-0482

Media Contact:

Chuck Rice

(419) 421-2521

Forward-looking statements

This press release contains

forward-looking statements within the meaning of federal securities

laws regarding MPLX LP ("MPLX") and Marathon Petroleum Corporation

("MPC").These forward-looking statements relate to, among other

things, expectations, estimates and projections concerning the

business and operations of MPLX and MPC. You can identify

forward-looking statements by words such as "anticipate,"

"believe," "design," "estimate," "expect," "forecast," "goal,"

"guidance," "imply," "intend," "objective," "opportunity,"

"outlook," "plan," "position," "pursue," "prospective," "predict,"

"project," "potential," "seek," "strategy," "target," "could,"

"may," "should," "would," "will" or other similar expressions that

convey the uncertainty of future events or outcomes. Such

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of

which are beyond the companies' control and are difficult to

predict. Factors that could cause MPLX's actual results to differ

materially from those implied in the forward-looking statements

include: negative capital market conditions, including a

persistence or increase of the current yield on common units, which

is higher than historical yields, adversely affecting MPLX's

ability to meet its distribution growth guidance; risk that the

synergies from the acquisition of MarkWest Energy Partners, L.P.

("MarkWest") by MPLX may not be fully realized or may take longer

to realize than expected; disruption from the MPLX/MarkWest

transaction making it more difficult to maintain relationships with

customers, employees or suppliers; risks relating to any unforeseen

liabilities of MarkWest; the adequacy of MPLX's capital resources

and liquidity, including, but not limited to, availability of

sufficient cash flow to pay distributions, and the ability to

successfully execute its business plans and growth strategy; the

timing and extent of changes in commodity prices and demand for

crude oil, refined products, feedstocks or other hydrocarbon-based

products; continued/further volatility in and/or degradation of

market and industry conditions; completion of midstream

infrastructure by competitors; disruptions due to equipment

interruption or failure, including electrical shortages and power

grid failures; the suspension, reduction or termination of MPC's

obligations under MPLX's commercial agreements; modifications to

earnings and distribution growth objectives; the level of support

from MPC, including drop-downs, alternative financing arrangements,

taking equity units, and other methods of sponsor support, as a

result of the capital allocation needs of the enterprise as a whole

and its ability to provide support on commercially reasonable

terms; federal and state environmental, economic, health and

safety, energy and other policies and regulations; changes to

MPLX's capital budget; other risk factors inherent to MPLX's

industry; and the factors set forth under the heading "Risk

Factors" in MPLX's Annual Report on Form 10-K for the year ended

Dec. 31, 2015, filed with the Securities and Exchange Commission

(SEC). Factors that could cause MPC's actual results to differ

materially from those implied in the forward-looking statements

include: risks described above relating to MPLX and the

MPLX/MarkWest transaction; changes to the expected construction

costs and timing of pipeline projects; continued/further volatility

in and/or degradation of market and industry conditions; the

availability and pricing of crude oil and other feedstocks; slower

growth in domestic and Canadian crude supply; the effects of the

lifting of the U.S. crude oil export ban; completion of pipeline

capacity to areas outside the U.S. Midwest; consumer demand for

refined products; transportation logistics; the reliability of

processing units and other equipment; MPC's ability to successfully

implement growth opportunities; modifications to MPLX earnings and

distribution growth objectives; federal and state environmental,

economic, health and safety, energy and other policies and

regulations, including the cost of compliance with the Renewable

Fuel Standard; changes to MPC's capital budget; other risk factors

inherent to MPC's industry; and the factors set forth under the

heading "Risk Factors" in MPC's Annual Report on Form 10-K for the

year ended Dec. 31, 2015, filed with the SEC. In addition, the

forward-looking statements included herein could be affected by

general domestic and international economic and political

conditions. Unpredictable or unknown factors not discussed here, in

MPLX's Form 10-K or in MPC's Form 10-K could also have material

adverse effects on forward-looking statements. Copies of MPLX's

Form 10-K are available on the SEC website, MPLX's website at

http://ir.mplx.com or by contacting MPLX's Investor Relations

office. Copies of MPC's Form 10-K are available on the SEC website,

MPC's website at http://ir.marathonpetroleum.com or by contacting

MPC's Investor Relations office.

MPLX Convertible

Preferred

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MPLX LP via Globenewswire

HUG#2007638

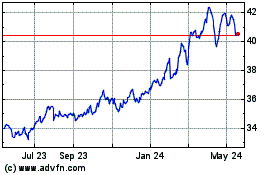

MPLX (NYSE:MPLX)

Historical Stock Chart

From Jun 2024 to Jul 2024

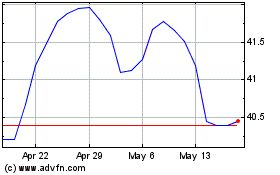

MPLX (NYSE:MPLX)

Historical Stock Chart

From Jul 2023 to Jul 2024