The Board of Trustees of Barings Participation Investors (NYSE:

MPV) (the "Trust") met on February 27, 2025, and would like to

report its preliminary financial results for the fourth quarter of

2024.

Financial

Highlights(1)

Three Months Ended

December 31, 2024

Three Months Ended

September 30, 2023

Total Amount

Per

Share(5)

Total Amount

Per Share(4)

Net investment income(2)

$

5,077,391

$

0.48

$

3,553,378

$

0.33

Net realized gains / (losses)(3)

$

327,989

$

0.03

$

(1,505,789

)

$

(0.14

)

Net unrealized appreciation /

(depreciation)

$

(295,452

)

$

(0.03

)

$

1,604,338

$

0.15

Net increase in net assets resulting from

operations

$

5,390,925

$

0.50

$

3,658,567

$

0.34

Total net assets (equity)

$

165,121,426

$

15.46

$

168,387,245

$

15.80

(1)

All figures for 2024 are unaudited

(2)

December 31, 2024 figures net of

approximately $0.04 per share of excise tax

(3)

December 31, 2024 figures net of

approximately $0.02 per share of capital gains tax

(4)

Based on shares outstanding at the end of

the period of 10,660,746.61

(5)

Based on shares outstanding at the end of

the period of 10,680,266.61

Key Highlights:

Commenting on the year, Christina Emery, President, stated, "We

are pleased to have grown net investment income, net of taxes,

during 2024 to $1.55 per share compared to $1.50 per share in 2023.

The increase is a function of both the sound credit quality and

diversity of the portfolio coupled with rising base rates. Both

credit quality and capital structure of portfolio companies are key

factors in our analysis, along with the quality of the ownership

and management groups. As fundamental long-term investors, we

believe it is imperative to remain disciplined and underwrite

capital structures which will remain sound through economic cycles

(and varying interest rate environments). We also seek to maintain

a high level of portfolio diversification overall, looking at both

industry and individual credit concentration. This approach has

historically generated stable returns and relative stability during

economic stress.”

In 2024, the Trust’s dividend increased by $0.01 per share in

the first quarter to $0.37 per share and remained at $0.37 per

share for the second, third and fourth quarter. In addition to the

regular dividend, the Trust paid a special dividend in the fourth

quarter of $0.10 per share made possible by non-recurring dividend

income received from one of the equity investments. This results in

a total annual dividend of $1.57 per share, representing a 7.3%

increase to the 2023 total annual dividend of $1.29 per share.

Based on the Trust’s December 31, 2024, share price of $17.09 per

share, the most recent regular quarterly distribution of $0.37 per

share represents an annualized yield of 8.7%.

During the three months ended December 31, 2024, the Trust

reported total investment income of $6.6 million, net investment

income of $5.1 million, or $0.48 per share, and a net increase in

net assets resulting from operations of $5.4 million, or $0.50 per

share.

Net asset value ("NAV") per share as of December 31, 2024, was

$15.46, as compared to $15.80 as of September 30, 2024. The

decrease in NAV per share was primarily attributable to the payment

of a $0.37 per share dividend on November 15, 2024, and the

declaration of a $0.37 per share regular dividend and a $0.10 per

share special dividend which were both paid on January 17, 2025,

net unrealized depreciation of $0.03 per share, net realized gains

of $0.03 per share, partially offset by net investment income of

$0.48 per share.

Recent Portfolio

Activity

During the three months ended December 31, 2024, the Trust made

nine new private investments totaling $7.9 million, six new public

investments totaling $7.6 million and 30 add-on investments in

existing private portfolio companies totaling $3.7 million. During

the three months ended December 31, 2024, the Trust had six loans

repaid at par totaling $7.9 million and realized three equity

investments totaling $1.3 million for a realized gain of $0.8

million, or approximately $0.08 per share.

Liquidity and

Capitalization

As of December 31, 2024, the Trust had cash of $7.0 million and

$23.5 million of borrowings outstanding. The Trust had unfunded

commitments of $15.6 million as of December 31, 2024.

Net Capital Gains

The Trust realized net capital gains of $327,989 or $0.03 per

share during the quarter ended December 31, 2024, which resulted in

realized net capital losses for the year ended December 31, 2024,

of $860,920 or $0.06 per share. By comparison, for the year ended

December 31, 2023, the Trust realized net capital losses of

$1,447,280 or $0.07 per share. During the quarter ended September

30, 2023, the Trust realized net capital losses of $1,970,622 or

$0.10 per share.

Annual Meeting

The Trust’s annual shareholders' meeting will be held on

Thursday, May 15, 2025. Shareholders of record at the close of

business on March 17, 2025, will be entitled to vote at the

meeting.

About Barings Participation

Investors

Barings Participation Investors is a closed-end management

investment company advised by Barings LLC. Its shares are traded on

the New York Stock Exchange under the trading symbol ("MPV").

About Barings LLC

Barings is a $421+ billion* global investment manager sourcing

differentiated opportunities and building long-term portfolios

across public and private fixed income, real estate, and specialist

equity markets. With investment professionals based in North

America, Europe and Asia Pacific, the firm, a subsidiary of

MassMutual, aims to serve its clients, communities and employees,

and is committed to sustainable practices and responsible

investment. Learn more at www.barings.com.

*Assets under management as of December 31, 2024

Per share amounts are rounded to the nearest cent.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE

RESULTS

Cautionary Notice: Certain statements contained in this press

release may be "forward-looking" statements. Investors are

cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date on which they are made

and which reflect management’s current estimates, projections,

expectations or beliefs, and which are subject to risks and

uncertainties that may cause actual results to differ materially.

These statements are subject to change at any time based upon

economic, market or other conditions and may not be relied upon as

investment advice or an indication of the fund's trading intent.

References to specific securities are not recommendations of such

securities, and may not be representative of the fund's current or

future investments. We undertake no obligation to publicly update

forward-looking statements, whether as a result of new information,

future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227291156/en/

Media Contact: MediaRelations@barings.com

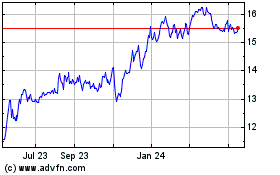

Barings Participation In... (NYSE:MPV)

Historical Stock Chart

From Feb 2025 to Mar 2025

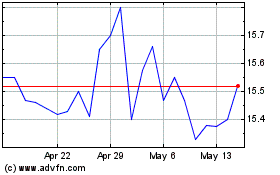

Barings Participation In... (NYSE:MPV)

Historical Stock Chart

From Mar 2024 to Mar 2025