UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

| For the month of |

October |

|

2024 |

| Commission File Number |

001-41722 |

|

|

| METALS ACQUISITION LIMITED |

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

METALS ACQUISITION LIMITED |

| |

|

|

(Registrant) |

| |

|

|

|

|

|

| Date: |

October 9, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

9 October 2024

Metals Acquisition Limited

Raises ~A$150 Million (~US$103 Million) Through Successful Placement

ST. HELIER, Jersey - (BUSINESS WIRE) - Metals

Acquisition Limited (NYSE: MTAL; ASX:MAC)

Highlights

| · | MAC

has received firm commitments to raise approximately A$150 million (approximately US$103

million)1 (before costs) at an issue price

of A$18.00 per New CDI |

| · | Placement

was well supported with support from new and existing institutional and sophisticated investors

both in Australia and offshore, which is testament to the high-quality nature of the CSA

Copper Mine and the significant work that has been undertaken by management to deliver on

a range of operational improvements over the past year |

| · | Placement

proceeds will be used to optimise MAC’s balance sheet and de-lever (by retiring its

existing Mezzanine Debt Facility at the earliest practicable date) while also providing additional

flexibility to pursue strategic inorganic growth opportunities |

Commentary

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC)

(MAC or the Company) is pleased to advise that the Company has received firm commitments via an oversubscribed placement

of 8,333,334 new CHESS Depositary Interests (New CDIs) at an issue price of A$18.00 per New CDI to raise A$150,000,012 (approximately

US$103 million)1 (before costs) (the Placement). The final Placement size was set at approximately A$150 million (US$103

million).1

The Placement was strongly supported with high

levels of institutional participation that included leading global investor groups both in Australia and offshore.

Proceeds of the Placement, together with existing

cash, will enable MAC to optimise its balance sheet and de-lever following the acquisition of the CSA Copper Mine from Glencore plc in

mid-2023, while also providing additional flexibility to pursue strategic inorganic growth opportunities.

Provided that necessary consents are obtained,

the proceeds of the Placement and MAC’s existing cash will allow MAC to retire the Mezzanine Debt Facility at the earliest possible

date.

The Placement issue price represents a 13.0%

discount to both the closing price of CDIs on ASX of A$20.70 on Tuesday, 8 October 2024 and the 5-day VWAP of A$20.70 on Tuesday,

8 October 2024.

1 Placement proceeds converted into

US$ based on an A$:US$ exchange rate of 0.6869, which represents the average exchange rate for the week from 30 September 2024 to 4 October

2024 (inclusive).

Placement Details

The Placement comprises

the issue of 8,333,334 New CDIs at an issue price of A$18.00 per CDI to raise total proceeds of A$150,000,012 (approximately US$103

million)1 (before costs).

MAC will resume trading on the ASX from market

open on Thursday,10 October 2023. The New CDIs under the Placement are expected to settle on Monday, 14 October 2024 and be

issued and commence trading on the ASX on a normal basis on Tuesday, 15 October 2024. New CDIs issued under the Placement will rank

equally with the Company’s existing CDIs on issue.

Barrenjoey Markets Pty Limited is acting as the

sole Lead Manager and Bookrunner to the Placement to the Placement and Sternship Advisers Pty Ltd is acting as Co-Manager to the Placement.

Gilbert + Tobin is acting as Legal Adviser to MAC.

Indicative Timetable*

| Event | |

Date |

| Announcement of completion of Placement | |

Wednesday, 9 October 2024 |

| Trading halt lifted | |

Thursday, 10 October 2024 |

| Settlement of New CDIs under the Placement | |

Monday, 14 October 2024 |

| Allotment, quotation and trading of New CDIs under the Placement | |

Tuesday, 15 October 2024 |

*The above timetable is indicative only and

subject to change. MAC reserves the right to amend these dates at its absolute discretion, subject to the Corporations Act (2001) (Cth),

the ASX Listing Rules and other applicable laws. The quotation of New CDIs is subject to confirmation from the ASX.

Additional Information

Additional information in relation to the Placement

and the Company can be found in the ASX announcements and Investor Presentation released to the ASX on Wednesday, 9 October 2024,

which contain important information, including a breakdown of the sources and uses of funds, the key risks and foreign selling restrictions

with respect to the Placement.

An updated Appendix 3B for the proposed issue

of New CDIs will follow this announcement.

Nothing contained in this announcement constitutes

investment, legal, tax or other advice. Investors should seek appropriate professional advice before making any investment decision.

-ENDS-

This announcement has been authorised for release

by Mick McMullen, CEO and Director.

Contacts

Mick

McMullen

Chief Executive Officer

Metals Acquisition Limited

investors@metalsacqcorp.com |

Morne

Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX: MAC)

is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in

the electrification and decarbonization of the global economy.

Not an offer in the United States

This announcement does not constitute an offer

to sell, or the solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer

would be unlawful. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act

of 1933, as amended (“U.S. Securities Act”), or the securities laws of any state or other jurisdiction of the United States.

No securities described in this announcement may be offered or sold in the United States or to, or for the account or benefit of, any

U.S. Person (as defined in Regulation S under the U.S. Securities Act) unless they have been registered under the U.S. Securities Act

or are offered and sold in a transaction exempt from, or not subject to, the registration requirements of the U.S. Securities Act and

any other applicable U.S. state securities laws.

Forward Looking Statements

This release includes “forward-looking statements.”

The forward-looking information is based on the Company’s expectations, estimates, projections and opinions of management made in

light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management

of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove

to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of copper, continuing commercial production

at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating

cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors

and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove

to be accurate.

MAC’s actual results may differ from expectations,

estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words

or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation,

MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production,

costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated

reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties indicated from

time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive.

MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not

undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could

affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with

the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that

MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date

of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC

may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so,

except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any

date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

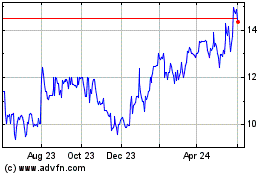

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

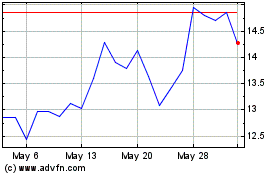

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Dec 2023 to Dec 2024