McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to provide new assay results from its Grey Fox deposit,

part of the Fox Complex located in the Timmins region of Ontario,

Canada. Grey Fox is located in the southern part of the Black Fox

property and comprises six zones, known as Gibson, Whiskey Jack,

Contact, 147, 147NE and Grey Fox South (see

Figure

1).

Highlights:

- High-grade drill

hole results include: 10.2 grams per tonne (g/t)

Au over 11.1 m at Whiskey Jack.

- Geological

investigations demonstrate similarities between the Grey Fox

Deposit and the Hishikari Gold Mine.

- Potential for

stacked epithermal gold-bearing veins over & adjacent to an

orogenic gold system.

- An example of

the potential for additional orogenic gold mineralization similar

to the Black Fox Mine can be seen in Figures 5 and

6.

- An updated

Mineral Resource estimate for the entire Fox Complex will be

released in Q1 of 2025, including Grey Fox (current resource of

1.4 million Indicated and Inferred gold ounces)

and Stock (current resource of 0.46 million

Indicated and Inferred gold ounces) (see Table

2).

- The Black Fox

Mine was a 1-million-ounce orogenic gold producer. The Black Fox

Exploration Horizon extends from the Black Fox Mine for 3

kilometers to the Grey Fox Deposit (see Figure

1).

Rob McEwen, Chairman and Chief Owner said,

“Our investment in exploration at Grey

Fox, in the southern portion of the Black Fox property, is

generating an exciting future for two specific

reasons. Firstly, our team is focused on drilling to add gold

ounces into our production pipeline. Secondly, we are impressed

by the depth potential. There are two styles of

gold mineralization, epithermal veining and orogenic lenses, both

gold-rich at the top of the systems. Based on our past and recent

drilling, it appears that the Fox Complex has

the opportunity to expand its production profile, and the depth

potential is still wide open.”

Current geological modeling of Grey Fox

indicates the presence of over 50 distinct mineralized lenses in an

area of only about 1.3 square kilometers in size, with many of the

lenses extending to the bedrock surface.

In addition, over 90% of the current Grey Fox

resource, of about 1.4 million ounces of gold, lies within the top

300 meters from the surface in epithermal-style quartz breccia

veins. Drill core from the epithermal vein systems suggests that

the bulk of the deposit that has been tested to date is still above

the ‘boiling zone’, typical of an epithermal system, yet has high

gold grades with potential mineralization continuing deeper.

Surface expressions of the modelled mineralized

zones are generally parallel and strike northeast to southwest

suggesting a strong, long-lived mineralizing system. Geological

investigations suggest two distinct gold mineralizing systems of

stacked epithermal veins and orogenic zones within close proximity.

This observation opens the potential for a ‘Hishikari-type'

epithermal vein system beside orogenic gold zones.

The Hishikari gold mine in Japan is one of the

richest gold mines in the world, in production since 1985. To date,

the mine produced 8.6 million ounces of gold, with an average

grade of 30-40 g/t gold. It has a cluster of 125 low-sulphidation

epithermal veins, within an area measuring 500 to 1,000 meters wide

by 3,000 meters long. The veins are 1 to 3 meters wide to a maximum

of 8 meters, and are ’blind’, as they don’t come to the

surface, starting at 100 metres below the surface, with the top of

the boiling zone at approximately 200 meters below the surface. In

the boiling zone at Hishikari, the quartz veins are noted for

having crustiform banding, while at Grey Fox only thin

intersections of similar textures have generally been intersected

to date, which suggests that most of the current drilling is still

above the boiling zone.

Table 1 below shows recent

assay results and some previously released key assay intercepts

received for the Grey Fox Deposit.

Table 1. Drill Results From the

Grey Fox Deposit

|

Hole ID |

From(m) |

To(m) |

CoreLength(m) |

TrueWidth(m) |

TrueWidth(ft) |

AuGrade(g/t) |

Grade xTrue Width(GxM) |

|

24GF-1517 |

558.5 |

561.5 |

3.0 |

2.4 |

7.8 |

7.5 |

17.9 |

|

Including |

560.5 |

561.5 |

1.0 |

0.8 |

2.6 |

16.0 |

12.7 |

|

24GF-1516 |

105.2 |

107.6 |

2.4 |

1.9 |

6.1 |

10.7 |

20.0 |

|

Including |

106.9 |

107.6 |

0.7 |

0.5 |

1.7 |

16.1 |

8.2 |

|

24GF-1513 |

114.0 |

118.0 |

4.0 |

2.8 |

9.2 |

5.1 |

14.3 |

|

Including |

115.1 |

118.0 |

2.9 |

2.1 |

6.7 |

6.0 |

12.4 |

|

&Including |

115.1 |

116.0 |

0.9 |

0.7 |

2.2 |

15.5 |

10.3 |

|

And |

139.0 |

145.0 |

6.0 |

4.3 |

14.0 |

6.3 |

27.0 |

|

Including |

139.0 |

141.0 |

2.0 |

1.4 |

4.7 |

17.8 |

25.3 |

|

And |

442.0 |

450.0 |

8.0 |

5.8 |

18.9 |

11.2 |

64.8 |

|

Including |

444.9 |

450.0 |

5.1 |

3.7 |

12.0 |

17.2 |

63.0 |

|

&Including |

446.0 |

447.0 |

1.0 |

0.7 |

2.4 |

72.7 |

52.5 |

|

24GF-1512 |

107.4 |

111.5 |

4.1 |

3.7 |

12.2 |

7.5 |

27.8 |

|

Including |

107.4 |

108.2 |

0.8 |

0.7 |

2.4 |

37.1 |

26.9 |

|

And |

156.6 |

164.0 |

7.5 |

6.6 |

21.7 |

4.6 |

30.4 |

|

Including |

160.4 |

161.2 |

0.8 |

0.7 |

2.3 |

39.6 |

28.1 |

|

24GF-1511 |

241.0 |

243.0 |

2.0 |

1.3 |

4.2 |

46.3 |

59.2 |

|

Including |

241.0 |

242.0 |

1.0 |

0.7 |

2.2 |

88.3 |

58.7 |

|

And |

334.0 |

336.2 |

2.2 |

1.5 |

5.0 |

9.6 |

14.6 |

|

Including |

334.0 |

335.0 |

0.9 |

0.7 |

2.2 |

16.1 |

10.8 |

|

24GF-1510 |

106.0 |

108.0 |

2.0 |

1.8 |

5.8 |

8.4 |

14.9 |

|

Including |

107.0 |

108.0 |

1.0 |

0.9 |

2.9 |

12.3 |

10.9 |

|

And |

118.0 |

121.0 |

3.0 |

2.7 |

8.7 |

5.3 |

14.1 |

|

Including |

119.1 |

120.0 |

0.9 |

0.8 |

2.7 |

15.5 |

12.6 |

|

24GF-1508 |

149.4 |

163.9 |

14.5 |

11.1 |

36.5 |

10.2 |

113.3 |

|

Including |

149.4 |

154.3 |

5.0 |

3.8 |

12.5 |

27.7 |

105.4 |

|

24GF-1500 |

116.5 |

117.6 |

1.1 |

0.9 |

3.0 |

54.4 |

49.5 |

|

And |

176.0 |

178.0 |

2.0 |

1.7 |

5.5 |

13.2 |

22.0 |

|

Including |

176.0 |

177.0 |

1.0 |

0.8 |

2.7 |

24.5 |

20.4 |

|

24GF-1498 |

120.0 |

124.9 |

4.9 |

4.3 |

14.3 |

4.1 |

17.8 |

|

And |

132.0 |

139.1 |

7.1 |

6.3 |

20.8 |

4.7 |

29.7 |

|

Including |

135.0 |

136.5 |

1.5 |

1.3 |

4.4 |

19.0 |

25.4 |

|

24GF-1495 |

73.0 |

75.0 |

2.0 |

1.6 |

5.2 |

8.4 |

13.5 |

|

24GF-1484 |

153.0 |

159.0 |

6.0 |

4.4 |

14.3 |

3.1 |

13.6 |

|

Including |

153.0 |

154.0 |

1.0 |

0.7 |

2.4 |

16.1 |

11.7 |

|

24GF-1473 |

170.0 |

175.0 |

5.0 |

3.9 |

12.7 |

4.2 |

16.1 |

|

Including |

173.0 |

174.0 |

1.0 |

0.8 |

2.5 |

17.5 |

13.5 |

|

24GF-1466 |

287.3 |

290.0 |

2.8 |

2.2 |

7.2 |

5.3 |

11.8 |

|

Including |

289.0 |

290.0 |

1.0 |

0.8 |

2.6 |

14.0 |

11.2 |

|

24GF-1459 |

100.0 |

105.0 |

5.0 |

4.2 |

13.8 |

4.7 |

19.9 |

|

Including |

102.0 |

103.0 |

1.0 |

0.8 |

2.8 |

18.0 |

15.1 |

|

And |

139.0 |

143.0 |

4.0 |

3.4 |

11.0 |

3.3 |

11.2 |

|

Including |

139.0 |

140.0 |

1.0 |

0.8 |

2.8 |

10.3 |

8.7 |

|

24GF-1457 |

276.0 |

279.0 |

3.0 |

2.6 |

8.6 |

6.7 |

17.6 |

|

Including |

276.0 |

277.0 |

1.0 |

0.9 |

2.9 |

13.0 |

11.4 |

|

24GF-1455 |

195.0 |

198.7 |

3.7 |

3.3 |

10.7 |

5.7 |

18.5 |

|

24GF-1449 |

73.0 |

80.0 |

7.0 |

5.9 |

19.2 |

4.2 |

24.7 |

|

Including |

74.0 |

75.0 |

1.0 |

0.8 |

2.7 |

21.1 |

17.7 |

|

21GF-1333* |

378.4 |

403.6 |

25.2 |

19.0 |

62.2 |

4.8 |

90.4 |

|

21GF-1353* |

231.9 |

236.9 |

5.0 |

4.1 |

13.5 |

17.8 |

73.3 |

|

21GF-1359* |

246.0 |

259.1 |

13.1 |

10.0 |

32.7 |

18.3 |

182.1 |

|

22GF-1363* |

442.4 |

447.4 |

5.0 |

4.4 |

14.4 |

15.5 |

68.3 |

|

22GF-1365* |

144.9 |

157.1 |

12.2 |

9.3 |

30.6 |

13.1 |

122.3 |

|

24GF-1397* |

154.0 |

156.0 |

2.0 |

1.3 |

4.3 |

50.7 |

66.2 |

|

24GF-1424* |

93.0 |

102.5 |

9.5 |

8.4 |

27.4 |

10.0 |

83.6 |

|

24GF-1426* |

200.3 |

200.9 |

0.7 |

0.5 |

1.8 |

586.7 |

315.2 |

|

Gold grades in the table are uncapped. * indicates previously

reported drill results. GxM over 50 are highlighted in bold. |

Figure 1 is a plan view map

showing the multiple zones at Grey Fox in relation to the rest of

the Fox Complex, also demonstrating that the Fox Complex can be

divided into the Grey Fox Exploration Horizon and the Black Fox

Exploration Horizon, based on geological similarities to the

current Grey Fox resource and the Black Fox Mine, respectively.

Minimal drilling has been completed between the Black Fox mine and

the current Grey Fox resource. When looking at Figure

1 it can also be seen that between the Black Fox Mine and

the current Grey Fox resource area there are similarities in terms

of structure (faults) and rock types.

Much of the drilling since 2021 was concentrated

at the Gibson and Whiskey Jack zones. Many of the new results

reported in this news release from recent drilling confirm

promising grades of mineralization for both zones e.g., 24GF-1508:

10.2 g/t Au over 11.1 m at

Whiskey Jack (see Figure 2) and 24GF-1513:

11.2 g/t Au over 5.8 m at Gibson

(see Figure 2).

Figure 1. Plan View Map for the Fox Complex

Figure 2. Plan View Surface Geology Map

with New and Previously Released Results for Its Various Zones. *

Denotes Previously Released Intercepts. Note: TW = True Width; COG

= Cut Off Grade.

Of the 50 lenses identified at Grey Fox,

multiple new lenses have been identified for the Gibson zone since

the last resource update at Grey Fox, released in 2021. The

mineralization within the Gibson zone is characterized by narrow,

steeply dipping, continuous, epithermal vein sets and is still open

to the northwest and down-dip (see Figure 2).

Many of these new mineralized lenses are in close proximity to the

historical Gibson Ramp and could be accessed via underground or

open pit mining methods.

Figure 3. Zoomed in Plan View Map for

the Gibson & Whiskey Jack Zones at Grey Fox, Showing New (Red)

and Existing (Grey) Lenses.

The entrance to the Gibson Ramp is about 350

meters from the central portion of the Whiskey Jack zone.

There are multiple newly defined epithermal vein sets between the

ramp entrance and the Whiskey Jack zone.

Figure 2 demonstrates that drillhole

intercepts like 22GF-1365 (13.1 g/t Au over

9.3 m) and 21GF-1333

(4.8 g/t Au over 19.0

m) lie on some of these newly defined epithermal vein sets

between the Gibson Ramp and the Whiskey Jack zone. The Gibson ramp

is well located and a suitable platform for additional exploration

and future production.

Figure 4 is a cross section

through the Gibson zone at Grey Fox. Many of the mineralized lenses

are close to the Gibson Ramp. These lenses could offer the

flexibility of multiple production areas.

Figure 4. Grey Fox-Gibson Zone

Cross Section (Looking NE). The Mineralized Lenses Are Open

at Depth. Note their Close Proximity to the Gibson Ramp

(Shown in Blue).

Figure 5. Plan View Map for the Areas

Under and Adjacent to the Grey Fox Deposit. A-A' Denotes a Cross

Section Represented in Figure 6, Showing the Locations of Some of

the Historic Orogenic Intercepts Adjacent to and Under the Grey Fox

Deposit.

Referring to Figures 5 & 6, it can be seen

that there are orogenic-style intercepts located in the Black Fox

Horizon adjacent to the current Grey Fox deposit. These intercepts

represent a good exploration target to expand the current Grey Fox

resource especially at depth, as these orogenic systems are known

to often extend for many kilometers below the surface.

Figure 6. Cross Section Looking NW for the Black Fox

Exploration Horizon Adjacent to the Grey Fox Deposit.

Resource Updates

The drill results from 2021 to October 21st,

2024 will be incorporated into the latest Grey Fox resource update,

which will be released in Q1 2025, as part of an updated total

Mineral Resources Estimate for the Fox Complex, portions of which

have been disclosed in 2024.

Table 2. Current Gold Resources at the

Fox Complex

|

|

MEASURED |

INDICATED |

MEASURED + INDICATED |

INFERRED |

|

|

Tonnes(000s) |

AuGrade(g/t) |

ContainedAu (oz) |

Tonnes(000s) |

AuGrade(g/t) |

ContainedAu (oz) |

Tonnes(000s) |

AuGrade(g/t) |

ContainedAu (oz) |

Tonnes(000s) |

AuGrade(g/t) |

ContainedAu (oz) |

|

Froome |

378 |

3.88 |

47,000 |

265 |

3.93 |

34,000 |

643 |

3.90 |

81,000 |

143 |

3.44 |

16,000 |

|

Grey Fox |

|

|

|

7,566 |

4.80 |

1,168,000 |

7,566 |

4.80 |

1,168,000 |

1,685 |

4.35 |

236,000 |

|

Stock West & Main |

|

|

|

1,938 |

3.31 |

206,000 |

1,938 |

3.31 |

206,000 |

1,386 |

2.96 |

132,000 |

|

Fuller |

|

|

|

1,149 |

4.25 |

157,000 |

1,149 |

4.25 |

157,000 |

693 |

3.41 |

76,000 |

|

Stock East |

|

|

|

866 |

2.70 |

75,000 |

866 |

2.70 |

75,000 |

579 |

2.66 |

50,000 |

|

Others |

504 |

6.42 |

104,000 |

1,221 |

2.19 |

86,000 |

1,725 |

3.43 |

190,000 |

254 |

5.02 |

41,000 |

|

Total Fox Complex |

882 |

5.32 |

151,000 |

13,005 |

4.13 |

1,726,000 |

13,887 |

4.20 |

1,877,000 |

4,740 |

3.62 |

551,000 |

Outline of the 2025 Drill Campaign

The 2025 exploration campaign at Grey Fox will

begin on January 6th with a budget of $9.7 million for

69,500 meters of drilling, and its goals are two-fold: One,

continue to identify potential near-term production gold ounces

that could be accessed using the Gibson Ramp at the Gibson and

Whiskey Jack zones. Two, test for mineralization based on

geophysical anomalies from existing and upcoming geophysical

surveys.

The upcoming surveys are designed to extend the

geophysical data into areas that had previously not been covered.

This will allow for the creation of a much more robust model that

integrates our better understanding of the geology and geophysics

at the Grey Fox deposit. These surveys will aid in identifying

Black Fox-style mineralization, which lies stratigraphically below

Grey Fox, both towards the northwest and also back to the southeast

towards Grey Fox (described in the press release dated September

11th, 2024).

Technical Information

Technical information pertaining to the Fox

Complex exploration contained in this news release has been

prepared under the supervision of Sean Farrell, P.Geo., Chief

Exploration Geologist, who is a Qualified Person as defined by

Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

The technical information related to resource

and reserve estimates in this news release has been reviewed and

approved by Luke Willis, P.Geo., McEwen Mining’s Director of

Resource Modelling and is a Qualified Person as defined by SEC S-K

1300 and Canadian Securities Administrators National Instrument

43-101 "Standards of Disclosure for Mineral Projects."

New analyses reported herein were submitted as ½

core samples and assayed by the photon assay method at the

accredited laboratory MSA Labs (ISO 9001 & ISO 17025) in

Timmins, Ontario, Canada.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, fluctuations in the market price of precious metals,

mining industry risks, political, economic, social and security

risks associated with foreign operations, the ability of the

Company to receive or receive in a timely manner permits or other

approvals required in connection with operations, risks associated

with the construction of mining operations and commencement of

production and the projected costs thereof, risks related to

litigation, the state of the capital markets, environmental risks

and hazards, uncertainty as to calculation of mineral resources and

reserves, foreign exchange volatility, foreign exchange controls,

foreign currency risk, and other risks. Readers should not place

undue reliance on forward-looking statements or information

included herein, which speak only as of the date hereof. The

Company undertakes no obligation to reissue or update

forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, Quarterly Report on Form

10-Q for the three months ended March 31, 2024, June 30, 2024, and

September 30, 2024, and other filings with the Securities and

Exchange Commission, under the caption "Risk Factors", for

additional information on risks, uncertainties and other factors

relating to the forward-looking statements and information

regarding the Company. All forward-looking statements and

information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by the management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. is a gold and silver producer

with operations in Nevada (USA), Canada, Mexico, and Argentina. The

company also owns 46.4% of McEwen Copper, which develops the large,

advanced-stage Los Azules copper project. Los Azules aims to become

Argentina's first regenerative copper mine and is committed to

achieving carbon neutrality by 2038.

Focused on enhancing productivity and extending

the life of its assets, the Company's goal is to increase its share

price and provide investor yield. Rob McEwen, Chairman and Chief

Owner, has a personal investment in the companies of US$225

million. His annual salary is US$1.

McEwen Mining's shares are publicly traded on

the New York Stock Exchange (NYSE) and the Toronto Stock Exchange

(TSX) under the symbol "MUX".

Want News Fast?

Subscribe to our email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/

mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

Figures accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8e0db487-7576-4efa-afc1-6d348c34c32d

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb92f8f1-d2b5-4d93-878b-afa07cfcdc3a

https://www.globenewswire.com/NewsRoom/AttachmentNg/152b4c28-e194-4c33-9ae2-cf08ccfad27b

https://www.globenewswire.com/NewsRoom/AttachmentNg/136ade32-7863-4dd4-9f66-67d7f8b4e1bc

https://www.globenewswire.com/NewsRoom/AttachmentNg/35cdd797-bf2d-4cb4-94f8-420daab5e8b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/adef3ae0-4c2f-4e43-b3f2-7a8b07c9e1c4

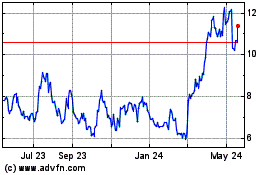

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

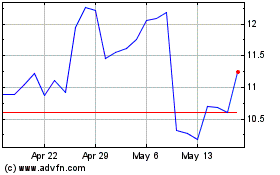

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024