Perfect Corp. (NYSE: PERF) (“Perfect” or the “Company”), a

global leader in providing artificial intelligence (“AI”) and

augmented reality (“AR”) Software-as-a-Service (“SaaS”) solutions

to beauty and fashion industries, today announced its unaudited

financial results for the three months ended September 30, 2024 and

the nine months ended September 30, 2024.

Highlights for the Three Months Ended

September 30, 2024

- Total revenue was $16.1 million for the three months

ended September 30, 2024, compared to $14.5 million in the same

period of 2023, an increase of 10.8%. The increase was primarily

due to growth momentum in the revenue of AI- and AR- cloud

solutions and mobile app subscriptions.

- Gross profit was $13.0 million for the three months

ended September 30, 2024, compared with $11.8 million in the same

period of 2023, an increase of 9.6%.

- Net income was $2.5 million for the three months ended

September 30, 2024, compared to a net income of $3.5 million during

the same period of 2023.

- Adjusted net income (non-IFRS)1 was $3.2 million for the

three months ended September 30, 2024, compared to adjusted net

income (non-IFRS) of $2.7 million in the same period of 2023, an

increase of 20.6%.

- Operating cash flow was $4.2 million in the third

quarter of 2024, compared to $4.0 million in the same period of

2023, an increase of 6.3%.

- The Company’s YouCam mobile beauty app active subscribers grew

by 17.0% year-over-year, reaching a record high of over 977,000

active subscribers as of end of the third quarter of 2024.

- The Company had 151 Key Customers2 as of September 30, 2024,

compared to 151 Key Customers as of June 30, 2024. The number of

key customers remained the same due to the stability of our

enterprise business.

- As of September 30, 2024, the Company’s cumulative customer

base included 708 brand clients, with over 806,000 digital stock

keeping units (“SKUs”) for makeup, haircare, skincare, eyewear,

watches and jewelry products, compared to 686 brand clients and

over 774,000 digital SKUs as of June 30, 2024.

Highlights for the Nine Months Ended

September 30, 2024

- Total revenue was $44.3 million for the nine months

ended September 30, 2024, compared to $39.4 million in the same

period of 2023, an increase of 12.5%.

- Gross profit was $35.2 million for the nine months ended

September 30, 2024, compared with $31.6 million in the same period

of 2023, an increase of 11.2%.

- Net income was $3.9 million for the nine months ended

September 30, 2024, compared to a net income of $4.0 million during

the same period of 2023, a decrease of 2.2%.

- Adjusted net income (non-IFRS) was $6.0 million for the

nine months ended September 30, 2024, compared to adjusted net

income (non-IFRS) of $4.9 million in the same period of 2023, an

increase of 23.2%.

- Operating cash flow was $9.8 million in the first nine

months of 2024, compared to $10.4 million in the same period of

2023, a decrease of 6.5%.

Ms. Alice H. Chang, the Founder, Chairwoman, and Chief Executive

Officer of Perfect, commented, “The Company has managed to maintain

a positive trajectory, demonstrating resilience in the face of

market challenges. This is bolstered by the strong performance of

our consumer suite of apps, and improved operating efficiencies,

which positioned the Company for sustainable success. As a result,

we are confident in both the Company's ability to navigate the

current landscape and the long-term industry outlook. The

combination of steady growth and operational improvements suggests

a promising future, underscoring Perfect Corp.'s commitment to

long-term value creation and innovation. Our advanced Generative AI

technologies will continue to deliver value to customers and

shareholders.”

Financial Results for the Three Months

Ended September 30, 2024

Revenue

Total revenue was $16.1 million for the three months ended

September 30, 2024, compared to $14.5 million in the same period of

2023, an increase of 10.8%.

- AI- and AR- cloud solutions and subscription revenue was $13.4

million for the three months ended September 30, 2024, compared to

$11.4 million in the same period of 2023, an increase of 17.9%. The

double digit growth was driven by robust demand for the Company’s

online virtual product try-on solutions from brand customers, the

healthy momentum in the growth of YouCam mobile beauty app

subscriptions, and the consumer preference for Generative AI

technologies and AI editing features for photos and videos. The

Company’s YouCam mobile beauty app active subscribers grew by 17.0%

year-over-year, once again reaching a record high of over 977,000

active subscribers as of the end of the third quarter of 2024. This

increase reflected the sustained demand in the Company’s YouCam

mobile beauty app services from subscribers and users.

- Licensing revenue was $2.4 million for the three months ended

September 30, 2024, compared to $2.8 million in the same period of

2023, a decrease of 14.5%. The Company anticipates that this legacy

non-recurring revenue will diminish in significance as it continues

to prioritize enhancing its market leadership in offering AI- and

AR-based SaaS subscription solutions for brands and customers.

Gross Profit

Gross profit was $13.0 million for the three months ended

September 30, 2024, compared with $11.8 million in the same period

of 2023, an increase of 9.6%. Despite the increase in gross profit,

our gross margin slightly decreased to 80.3% for the three months

ended September 30, 2024, from 81.2% in the same period of 2023,

primarily due to the increase in third-party payment processing

fees paid to digital distribution partners such as Google and Apple

related to the growth in our mobile app subscription revenue.

Total Operating Expenses

Total operating expenses were $13.0 million for the three months

ended September 30, 2024, compared with $12.7 million in the same

period of 2023, an increase of 3.0%. The increase was primarily due

to higher sales and marketing expenses and research and development

("R&D") expenses, while mainly offset by declines in general

and administrative expenses in the third quarter of 2024.

- Sales and marketing expenses were $7.1 million for the

three months ended September 30, 2024, compared to $6.4 million

during the same period of 2023, an increase of 10.0%. This increase

was largely due to an increase in marketing events and advertising

costs related to our mobile apps and cloud computing.

- Research and development expenses were $3.2 million for

the three months ended September 30, 2024, compared to $3.0 million

during the same period of 2023, an increase of 5.9%. The increase

primarily resulted from the increase in R&D headcount as we

further lean into the development of Generative AI

technologies.

- General and administrative expenses were $2.1 million

for the three months ended September 30, 2024, compared to $3.2

million during the same period of 2023, a decrease of 32.9%. The

decrease was primarily due to enhanced operational efficiencies in

the third quarter of 2024.

Net Income

Net income was $2.5 million for the three months ended September

30, 2024, compared to a $3.5 million during the same period of

2023. The positive net income in the third quarter of 2024 was

supported by continued revenue growth and effective cost

control.

Adjusted Net Income (Non-IFRS)

Adjusted net income was $3.2 million for the three months ended

September 30, 2024, compared to $2.7 million in the same period of

2023, an increase of 20.6%.

Liquidity

As of September 30, 2024, the Company held $127.2 million in

cash and cash equivalents (or $163.2 million when including 6-month

time deposits of $36.0 million, which are classified as current

financial assets at amortized cost under IFRS), compared to $120.8

million as of June 30, 2024 (or $158.8 million when including time

deposits). The total increase in cash, cash equivalents and 6-month

time deposits, resulted from the positive operating cash flow and

the interest income received from the Company’s bank deposits.

The Company had a positive operating cash flow of $4.2 million

in the third quarter of 2024, compared to positive $4.0 million in

the same period of 2023. The Company continues to invest in growth

while maintaining healthy cash reserve to support business

operations signifying the Company's operational health and

sustainability.

Business Outlook for 2024

Based on the growth momentum in both enterprise SaaS solution

demands and YouCam mobile apps subscriptions, the Company

anticipates a year-over-year total revenue growth rate of 12% to

14% for 2024, compared to 2023.

Note that this forecast is based on the Company’s current

assessment of the market and operational conditions, and that these

factors are subject to change.

Conference Call

Information

The Company’s management will hold an earnings conference call

at 8:00 p.m. Eastern Time on October 29, 2024 (8:00 a.m. Taipei

Time on October 30, 2024) to discuss the financial results. For

participants who wish to join the call, please complete online

registration using the link provided below in advance of the

conference call. Upon registering, each participant will receive a

participant dial-in number and a unique access PIN, which can be

used to join the conference call.

Registration Link:

https://registrations.events/direct/Q4I516305131

A live and archived webcast of the conference call will also be

available at the Company's investor relations website at

https://ir.perfectcorp.com.

About Perfect Corp.

Founded in 2015, Perfect Corp. is a beautiful AI Company and

global leader in enterprise SaaS solutions. As an innovative

powerhouse in using artificial intelligence (AI) to transform the

beauty and fashion industries, Perfect empowers major beauty,

skincare, fashion, jewelry brands and retailers by providing

consumers with omnichannel shopping experiences through augmented

reality (AR) product try-ons and AI-powered skin diagnostics. With

cutting-edge technologies such as Generative AI, real-time facial

and hand 3D AR rendering and cloud solutions, Perfect enables

personalized, enjoyable, and engaging shopping journey. In

addition, Perfect also operates a family of YouCam consumer apps

for photo, video and camera users, centered on unleashing

creativity with AI-driven features for creation, beautification and

enhancement. With the help of technologies, Perfect helps brands

elevate customer engagement, increase conversion rates, and propel

sales growth. Throughout this journey, Perfect maintains its

unwavering commitment to environmental sustainability and

fulfilling social responsibilities. For more information, visit

https://ir.perfectcorp.com/.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended, or the Exchange Act,

that are based on beliefs and assumptions and on information

currently available to Perfect. In some cases, you can identify

forward-looking statements by the following words: “may,” “will,”

“could,” “would,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing,” “target,” “seek” or the

negative or plural of these words, or other similar expressions

that are predictions or indicate future events or prospects,

although not all forward-looking statements contain these words.

Any statements that refer to expectations, projections or other

characterizations of future events or circumstances, including

strategies or plans, are also forward-looking statements. These

statements involve risks, uncertainties and other factors that may

cause actual results, levels of activity, performance or

achievements to be materially different from those expressed or

implied by these forward-looking statements. These statements are

based on Perfect’s reasonable expectations and beliefs concerning

future events and involve risks and uncertainties that may cause

actual results to differ materially from current expectations.

These factors are difficult to predict accurately and may be beyond

Perfect’s control. Forward-looking statements in this communication

or elsewhere speak only as of the date made. New uncertainties and

risks arise from time to time, and it is impossible for Perfect to

predict these events or how they may affect Perfect. In addition,

risks and uncertainties are described in Perfect’s filings with the

Securities and Exchange Commission. These filings may identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Perfect cannot assure you that

the forward-looking statements in this communication will prove to

be accurate. There may be additional risks that Perfect presently

does not know or that Perfect currently does not believe are

immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In light of the

significant uncertainties in these forward-looking statements, you

should not regard these statements as a representation or warranty

by Perfect, its directors, officers or employees or any other

person that Perfect will achieve its objectives and plans in any

specified time frame, or at all. Except as required by applicable

law, Perfect does not have any duty to, and does not intend to,

update or revise the forward-looking statements in this

communication or elsewhere after the date of this communication.

You should, therefore, not rely on these forward-looking statements

as representing the views of Perfect as of any date subsequent to

the date of this communication.

Use of Non-IFRS Financial Measures

This press release and accompanying tables contain certain

non-IFRS financial measures, including adjusted net income, as

supplemental metrics in reviewing and assessing Perfect’s operating

performance and formulating its business plan. Perfect defined

these non-IFRS financial measures as follows:

Adjusted net income (loss) is

defined as net income (loss) excluding one-off transaction costs3,

non-cash equity-based compensation, and non-cash valuation

(gain)/loss of financial liabilities. Starting from the first

quarter of 2024, we no longer exclude foreign exchange gain (loss)

from adjusted net income (loss). As we transitioned to using the

U.S. dollar as the functional currency for certain subsidiaries in

2023, our foreign exchange gains (losses), which historically have

predominantly been unrealized, have not been material since 2023.

For a reconciliation of adjusted net income (loss) to net income

(loss), see the reconciliation table included elsewhere in this

press release.

Non-IFRS financial measures are not defined under IFRS and are

not presented in accordance with IFRS. Non-IFRS financial measures

have limitations as analytical tools, which possibly do not reflect

all items of expense that affect our operations. Share-based

compensation expenses have been and may continue to be incurred in

our business and are not reflected in the presentation of the

non-IFRS financial measures. In addition, the non-IFRS financial

measures Perfect uses may differ from the non-IFRS measures used by

other companies, including peer companies, and therefore their

comparability may be limited. The presentation of these non-IFRS

financial measures is not intended to be considered in isolation

from or as a substitute for the financial information prepared and

presented in accordance with IFRS. The items excluded from our

adjusted net income are not driven by core results of operations

and render comparison of IFRS financial measures with prior periods

less meaningful. We believe adjusted net income provides useful

information to investors and others in understanding and evaluating

our results of operations, as well as providing a useful measure

for period-to-period comparisons of our business performance.

Moreover, such non-IFRS measures are used by our management

internally to make operating decisions, including those related to

operating expenses, evaluate performance, and perform strategic

planning and annual budgeting.

_________________ 1 Adjusted net income (loss) is a non-IFRS

financial measure. See the “Use of Non-IFRS Financial Measures”

section of this communication for the definition of such non-IFRS

measure. 2 “Key Customers” refers to the Company’s brand customers

who contributed revenue of more than $50,000 in the trailing 12

months ended on the measurement date. 3 The one-off transaction

cost in the first quarter of 2023 included professional services

expenditures that the Company incurred in connection with the

de-SPAC transaction. No such cost incurred in the same period of

2024.

PERFECT CORP. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE

SHEETS

DECEMBER 31, 2023 AND

SEPTEMBER 30, 2024

(Expressed in thousands of

United States dollars)

December 31,

2023

September 30,

2024

Assets

Amount

Amount

Current assets

Cash and cash equivalents

$

123,871

$

127,177

Current financial assets at amortized

cost

30,300

36,000

Current contract assets

2,770

2,022

Accounts receivable

6,992

8,036

Other receivables

343

786

Current income tax assets

311

281

Inventories

33

21

Other current assets

4,042

2,311

Total current assets

168,662

176,634

Non-current assets

Property, plant and equipment

380

617

Right-of-use assets

847

626

Intangible assets

77

44

Deferred income tax assets

257

1,563

Guarantee deposits paid

140

148

Total non-current assets

1,701

2,998

Total assets

$

170,363

$

179,632

PERFECT CORP. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE

SHEETS (continued)

DECEMBER 31, 2023 AND

SEPTEMBER 30, 2024

(Expressed in thousands of

United States dollars)

December 31,

2023

September 30,

2024

Liabilities and Equity

Amount

Amount

Current liabilities

Current contract liabilities

$

15,346

$

17,923

Other payables

10,331

11,393

Other payables – related parties

50

55

Current tax liabilities

21

390

Current provisions

2,394

1,822

Current lease liabilities

481

484

Other current liabilities

277

310

Total current liabilities

28,900

32,377

Non-current liabilities

Non-current financial liabilities at fair

value through profit or loss

1,566

1,459

Non-current lease liabilities

387

171

Net defined benefit liability,

non-current

79

81

Guarantee deposits received

25

25

Total non-current liabilities

2,057

1,736

Total liabilities

30,957

34,113

Equity

Capital stock

Perfect Class A Ordinary Shares, $0.1 (in

dollars) par value

8,513

8,506

Perfect Class B Ordinary Shares, $0.1 (in

dollars) par value

1,679

1,679

Capital surplus

Capital surplus

510,399

512,397

Retained earnings

Accumulated deficit

(380,472

)

(376,546

)

Other equity interest

Other equity interest

(523

)

(517

)

Treasury shares

(190

)

—

Total equity

139,406

145,519

Total liabilities and equity

$

170,363

$

179,632

PERFECT CORP. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME

FOR THE THREE MONTHS AND NINE

MONTHS ENDED SEPTEMBER 30, 2023 AND 2024

(Expressed in thousands of

United States dollars)

Three months ended September

30

Nine months ended September

30

2023

2024

2023

2024

Items

Amount

Amount

Amount

Amount

Revenue

$

14,549

$

16,127

$

39,381

$

44,321

Cost of sales and services

(2,729

)

(3,171

)

(7,753

)

(9,142

)

Gross profit

11,820

12,956

31,628

35,179

Operating expenses

Sales and marketing expenses

(6,444

)

(7,090

)

(19,029

)

(21,274

)

General and administrative expenses

(3,172

)

(2,128

)

(8,599

)

(6,742

)

Research and development expenses

(3,035

)

(3,213

)

(8,431

)

(9,223

)

Expected credit losses

—

(602

)

—

(602

)

Total operating expenses

(12,651

)

(13,033

)

(36,059

)

(37,841

)

Operating loss

(831

)

(77

)

(4,431

)

(2,662

)

Non-operating income and expenses

Interest income

2,335

1,923

6,944

5,875

Other income

11

5

18

19

Other gains and losses

2,034

422

1,575

131

Finance costs

(5

)

(4

)

(10

)

(14

)

Total non-operating income and

expenses

4,375

2,346

8,527

6,011

Income before income tax

3,544

2,269

4,096

3,349

Income tax benefit (expense)

(17

)

263

(80

)

577

Net income

$

3,527

$

2,532

$

4,016

$

3,926

Other comprehensive income

(loss)

Components of other comprehensive

income (loss) that will be reclassified to profit or loss

Exchange differences arising on

translation of foreign operations

$

(56

)

$

257

$

(224

)

$

6

Other comprehensive income (loss),

net

$

(56

)

$

257

$

(224

)

$

6

Total comprehensive income

$

3,471

$

2,789

$

3,792

$

3,932

Net income, attributable to:

Shareholders of the parent

$

3,527

$

2,532

$

4,016

$

3,926

Total comprehensive income attributable

to:

Shareholders of the parent

$

3,471

$

2,789

$

3,792

$

3,932

Earnings per share (in dollars)

Basic earnings per share of Class A and

Class B Ordinary Shares

$

0.030

$

0.025

$

0.034

$

0.039

Diluted earnings per share of Class A and

Class B Ordinary Shares

$

0.030

$

0.025

$

0.034

$

0.039

PERFECT CORP. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS AND NINE

MONTHS ENDED SEPTEMBER 30, 2023 AND 2024

(Expressed in thousands of

United States dollars)

Three months ended September

30

Nine months ended September

30

2023

2024

2023

2024

Items

Amount

Amount

Amount

Amount

CASH FLOWS FROM

OPERATING ACTIVITIES

Profit before tax

$

3,544

$

2,269

$

4,096

$

3,349

Adjustments to reconcile profit (loss)

Depreciation expense

156

197

482

541

Amortization expense

19

13

56

39

Expected credit losses

—

602

—

602

Interest income

(2,335

)

(1,923

)

(6,944

)

(5,875

)

Interest expense

5

4

10

14

Net (gains) losses on financial

liabilities at fair value through profit or loss

(2,096

)

(61

)

(1,852

)

(107

)

Share-based payment transactions

1,234

744

2,675

2,181

Changes in operating assets and

liabilities

Accounts receivable

974

(1,501

)

1,061

(1,635

)

Current contract assets

(1,603

)

(462

)

527

752

Other receivables

—

—

3

—

Inventories

1

—

12

12

Other current assets

791

523

838

1,733

Current contract liabilities

(1

)

919

3,034

2,541

Other payables

1,625

1,106

442

1,055

Other payables – related parties

1

2

(11

)

5

Current provisions

181

(15

)

501

(578

)

Other current liabilities

(15

)

101

(122

)

34

Net defined benefit liability,

non-current

1

1

2

2

Cash inflow generated from operations

2,482

2,519

4,810

4,665

Interest received

1,648

1,875

5,979

5,433

Interest paid

(5

)

(4

)

(10

)

(14

)

Income tax paid

(142

)

(158

)

(347

)

(334

)

Net cash flows from operating

activities

3,983

4,232

10,432

9,750

CASH FLOWS FROM

INVESTING ACTIVITIES

Acquisition of financial assets at

amortized cost

(11,000

)

(11,104

)

(171,800

)

(55,574

)

Proceeds from disposal of financial assets

at amortized cost

85,500

13,074

115,500

49,874

Acquisition of property, plant and

equipment

(13

)

(130

)

(183

)

(389

)

Acquisition of intangible assets

—

—

(33

)

(6

)

Increase in guarantee deposits paid

(15

)

—

(15

)

(8

)

Net cash flows from (used in) investing

activities

74,472

1,840

(56,531

)

(6,103

)

CASH FLOWS FROM

FINANCING ACTIVITIES

Repayment of principal portion of lease

liabilities

(107

)

(142

)

(310

)

(381

)

Payments to acquire treasury shares

(446

)

—

(875

)

—

Net cash flows used in financing

activities

(553

)

(142

)

(1,185

)

(381

)

Effects of exchange rates changes on cash

and cash equivalents

(101

)

451

(363

)

40

Net increase (decrease) in cash and

cash equivalents

77,801

6,381

(47,647

)

3,306

Cash and cash equivalents at beginning

of period

37,168

120,796

162,616

123,871

Cash and cash equivalents at end of

period

$

114,969

$

127,177

$

114,969

$

127,177

PERFECT CORP. AND

SUBSIDIARIES

UNAUDITED RECONCILIATION OF

NON-IFRS FINANCIAL MEASURES – ADJUSTED NET INCOME

CALCULATION

FOR THE THREE MONTHS AND NINE

MONTHS ENDED SEPTEMBER 30, 2023 AND 2024

(Expressed in thousands of

United States dollars)

Three months ended September

30

Nine months ended September

30

2023

2024

2023

2024

Items

Amount

Amount

Amount

Amount

Net Income (Loss)

$

3,527

$

2,532

$

4,016

$

3,926

One-off Transaction Costs

—

—

33

—

Non-Cash Equity-Based Compensation

1,234

744

2,675

2,181

Non-Cash Valuation Gain of financial

liabilities

(2,096

)

(61

)

(1,852

)

(107

)

Adjusted Net Income (Loss)1

$

2,665

$

3,215

$

4,872

$

6,000

Note (1): In accordance with the changed definition of “adjusted

net income (loss)” that is detailed in the “Use of Non-IFRS

Financial Measures” section above, we have made a retrospective

adjustment to our adjusted net income for the nine months ended

September 30, 2023 not adjusting for “foreign exchange gain (loss)”

(which amounted to a loss of $277 thousand for the period, as

previously disclosed in our Form 6-K furnished to the SEC on

October 24, 2023).

Category: Investor Relations

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029854226/en/

Investor Relations Contact Investor Relations, Perfect

Corp. Email: Investor_Relations@PerfectCorp.com

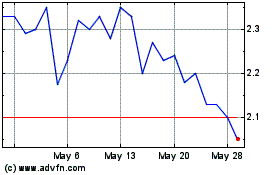

Perfect (NYSE:PERF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perfect (NYSE:PERF)

Historical Stock Chart

From Dec 2023 to Dec 2024