FALSE000073326900007332692025-03-062025-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2025

| | | | | | | | |

| | |

| LiveRamp Holdings, Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | |

| Delaware | 001-38669 | 83-1269307 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

225 Bush Street, San Francisco, CA (Address of Principal Executive Offices) | | 94104 (Zip Code) |

(888) 987-6764 (Registrant's Telephone Number, Including Area Code) |

| (Former name or former address, if changed since last report) |

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $.10 Par Value | | RAMP | | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the |

| Exchange Act. | ☐ | |

Section 2—Financial Information

Item 2.05 Costs Associated with Exit or Disposal Activities

On March 6, 2025, LiveRamp Holdings, Inc. (the “Company”) announced a workforce restructuring involving approximately 65 full-time employees, representing approximately 5% of the Company’s full-time employees. The restructuring is part of a broader strategic reprioritization to build a stronger, more profitable company by tightening our focus and simplifying and driving efficiency into our business processes.

We estimate that we will incur approximately $6.5 million of restructuring and related charges primarily related to employee severance and benefits, substantially all of which we expect to incur in the fourth quarter of our fiscal year ending March 31, 2025.

If we subsequently determine that we will incur additional material restructuring costs or charges or there are material differences from the amounts provided above, we will file an amendment to this Current Report on Form 8-K to disclose any such material costs, charges, or differences.

Section 7—Regulation FD

Item 7.01 Regulation FD Disclosure

As a result of the actions disclosed in Item 2.05 above, on March 7, 2025, the Company is updating its GAAP operating income (loss) financial guidance to ($13.0) million and $5.0 million for the fourth quarter and fiscal year ending March 31, 2025, respectively. The change reflects the $6.5 million restructuring and related charges, net of a $1.5 million decrease in stock-based compensation expense.

The Company reaffirms its revenue and Non-GAAP operating income financial guidance for the fourth quarter and fiscal year ending March 31, 2025, as previously reported in the Company’s press release dated February 5, 2025, announcing the results of the Company’s financial performance for its third quarter ended December 31, 2024.

A reconciliation of GAAP to Non-GAAP operating income (loss) guidance is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information set forth under this “Item 7.01. Regulation FD Disclosure,” including the exhibit attached hereto, is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of Section 18 of the Exchange Act, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in any such filing.

Section 9—Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data file (formatted as Inline XBRL) |

| *Furnished herewith |

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended (the “PSLRA”). These statements, which are not statements of historical fact, contain estimates, assumptions, projections and/or expectations regarding the Company’s financial position, results of operations for the fourth quarter and fiscal year ending March 31, 2025, and expenses associated with the announced workforce restructuring. Forward-looking statements are often identified by words or phrases such as “anticipate,” “estimate,” “plan,” “expect,” “believe,” “intend,” “foresee,” or the negative of these terms or other similar variations thereof.

These forward-looking statements are not guarantees of future performance and are subject to a number of factors and uncertainties that could cause the Company’s actual results and experiences to differ materially from the anticipated results and expectations expressed in the forward-looking statements.

Among the factors that may cause actual results and expectations to differ from anticipated results and expectations expressed in forward-looking statements are uncertainties related to high interest rates, cost increases, the possibility of a recession, general inflationary pressure, geo-political circumstances that could result in increased economic uncertainties and the associated impacts of these potential events on our suppliers, customers and partners; the Company’s dependence upon customer renewals, new customer additions and upsell within our subscription business; our reliance upon partners, including data suppliers; competition; rapidly changing technology’s impact on our products and services; the risk that we fail to realize the potential benefits of or have difficulty integrating acquired businesses (including Habu); and attracting, motivating and retaining talent. Additional risks include maintaining our culture and our ability to innovate and evolve while operating in a hybrid work environment, with some employees working remotely at least some of the time within a rapidly changing industry, while also avoiding disruption from the workforce restructuring, further reductions in our current workforce as well as disruptions resulting from acquisition, divestiture and other activities affecting our workforce. Our global workforce strategy and workforce restructuring could possibly encounter difficulty and not be as beneficial as planned. Our international operations are also subject to risks, including the performance of third parties as well as impacts from war and civil unrest, that may harm the Company’s business. The risk of a significant breach of the confidentiality of the information or the security of our or our customers’, suppliers’, or other partners’ data and/or computer systems, or the risk that our current insurance coverage may not be adequate for such a breach, that an insurer might deny coverage for a claim or that such insurance will continue to be available to us on commercially reasonable terms, or at all, could be detrimental to our business, reputation and results of operations. Other business risks include unfavorable publicity and negative public perception about our industry; interruptions or delays in service from data center or cloud hosting vendors we rely upon; and our dependence on the continued availability of third-party data hosting and transmission services. Our clients’ ability to use data on our platform could be restricted if the industry’s use of third-party cookies and tracking technology declines due to technology

platform changes, regulation or increased user controls. Continued changes in the judicial, legislative, regulatory, accounting, cultural and consumer environments affecting our business, including but not limited to litigation, investigations, legislation, regulations and customs at the state, federal and international levels relating to information collection and use represents a risk, as well as changes in tax laws and regulations that are applied to our customers which could cause enterprise software budget tightening. In addition, third parties may claim that we are infringing their intellectual property or may infringe our intellectual property which could result in competitive injury and / or the incurrence of significant costs and draining of our resources.

For a discussion of these and other risks and uncertainties that could affect the Company’s business, reputation, results of operation, financial condition and stock price, please refer to the Company’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings.

The financial information set forth in this Current Report on Form 8-K reflects estimates based on information available at this time. The Company assumes no obligation and does not currently intend to update these forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 6, 2025

| | | | | |

| LiveRamp Holdings, Inc. |

| |

| By: | /s/ Jerry C. Jones |

| Name: | Jerry C. Jones |

| Title: | EVP, Chief Ethics and Legal Officer and Secretary |

| | | | | | | | | | | | | | | |

| LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES |

| RECONCILIATION OF GAAP TO NON-GAAP OPERATING INCOME GUIDANCE (1) |

| (Unaudited) |

| (Dollars in thousands) |

| | For the | | For the |

| | quarter ending | | year ending |

| | March 31, 2025 | | March 31, 2025 |

| | | | | |

| | | | | |

| | | | | |

| GAAP income (loss) from operations | | $ | (13,000) | | | $ | 5,000 | | |

| | | | | |

| Excluded items: | | | | | |

| Purchased intangible asset amortization | | 3,000 | | | 14,000 | | |

| Non-cash stock compensation | | 24,500 | | | 108,500 | | |

| Restructuring costs | | 7,500 | | | 7,500 | | |

| | | | | |

| Total excluded items | | 35,000 | | | 130,000 | | |

| | | | | |

| Non-GAAP income from operations | | $ | 22,000 | | | $ | 135,000 | | |

| | | | | |

| (1) This presentation includes non-GAAP measures. Our non-GAAP measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures, and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same captions and may differ from non-GAAP financial measures with the same or similar captions that are used by other companies. The use of certain non-GAAP financial measures requires management to make estimates and assumptions regarding amounts of assets and liabilities and the amounts of revenue and expense during the reporting periods. The Company bases its estimates on historical experience and assumptions that it believes are reasonable. Actual results could differ from those estimates. | |

v3.25.0.1

Cover

|

Mar. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Tax Identification Number |

83-1269307

|

| Entity Registrant Name |

LiveRamp Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38669

|

| Entity Address, Postal Zip Code |

94104

|

| Entity Address, State or Province |

CA

|

| Entity Address, Address Line One |

225 Bush Street,

|

| Entity Address, City or Town |

San Francisco

|

| Local Phone Number |

987-6764

|

| City Area Code |

888

|

| Entity Emerging Growth Company |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Document Period End Date |

Mar. 06, 2025

|

| Title of 12(b) Security |

Common Stock, $.10 Par Value

|

| Trading Symbol |

RAMP

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000733269

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

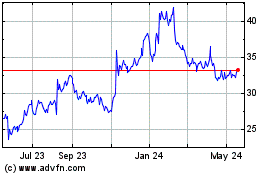

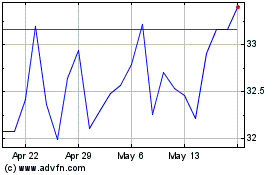

LiveRamp (NYSE:RAMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

LiveRamp (NYSE:RAMP)

Historical Stock Chart

From Mar 2024 to Mar 2025