0001556593false00015565932024-02-072024-02-070001556593us-gaap:CommonStockMember2024-02-072024-02-070001556593ritm:SevenPointFivePercentSeriesAFixedToFloatingRateCumulativeRedeemablePreferredStockMember2024-02-072024-02-070001556593ritm:SevenPointOneTwoFivePercentSeriesBFixedToFloatingRateCumulativeRedeemablePreferredStockMember2024-02-072024-02-070001556593ritm:SixPointThreeSevenFivePercentSeriesCFixedRateResetCumulativeRedeemablePreferredStockMember2024-02-072024-02-070001556593ritm:SevenPercentFixedRateResetSeriesDCumulativeRedeemablePreferredMember2024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2024

Rithm Capital Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | | | | | | | |

| | | | |

| 001-35777 | | 45-3449660 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 799 Broadway | New York | New York | | 10003 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (212) 850-7770

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading Symbols: | Name of each exchange on which registered: |

| Common Stock, $0.01 par value per share | RITM | New York Stock Exchange |

| 7.50% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | RITM PR A | New York Stock Exchange |

| 7.125% Series B Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | RITM PR B | New York Stock Exchange |

| 6.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock | RITM PR C | New York Stock Exchange |

| 7.00% Fixed-Rate Reset Series D Cumulative Redeemable Preferred Stock | RITM PR D | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2024, Rithm Capital Corp. (the “Company”) issued a press release announcing the Company’s results for its fiscal quarter and year ended December 31, 2023. A copy of the Company’s press release is attached to this Current Report on Form 8-K (the “Current Report”) as Exhibit 99.1 and is incorporated herein solely for purposes of this Item 2.02 disclosure.

This Current Report, including the exhibit attached hereto, is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, unless expressly set forth as being incorporated by reference into such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | Press release, dated February 7, 2024, issued by Rithm Capital Corp. |

| 104 | | Cover Page Interactive Data File — the cover page XBRL tags are embedded within the Inline XBRL document. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| RITHM CAPITAL CORP. |

| (Registrant) |

|

| /s/ Nicola Santoro, Jr. |

| Nicola Santoro, Jr. |

| Chief Financial Officer and Chief Accounting Officer |

|

| Date: February 7, 2024 |

Rithm Capital Corp. Announces Fourth Quarter and Full Year 2023 Results

NEW YORK - (BUSINESS WIRE) — Rithm Capital Corp. (NYSE: RITM; “Rithm Capital” or the “Company”) today reported the following information for the fourth quarter ended and full year ended December 31, 2023:

Fourth Quarter 2023 Financial Highlights:

•GAAP net loss of ($87.5) million, or ($0.18) per diluted common share(1)

•Earnings available for distribution of $247.4 million, or $0.51 per diluted common share(1)(2)

•Common dividend of $120.8 million, or $0.25 per common share

•Book value per common share of $11.90(1)

Full Year 2023 Financial Highlights:

•GAAP net income of $532.7 million, or $1.10 per diluted common share(1)

•Earnings available for distribution of $997.2 million, or $2.06 per diluted common share(1)(2)

•Common dividend of $483.2 million, or $1.00 per common share

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q3 2023 | | FY 2023 | | FY 2022 | | | | | |

| Summary Operating Results: | | | | | | | | | | | | |

GAAP Net (Loss) Income per Diluted Common Share(1) | $ | (0.18) | | | $ | 0.40 | | | $ | 1.10 | | | $ | 1.80 | | | | | | |

| GAAP Net (Loss) Income | $ | (87.5) | | million | $ | 193.9 | | million | $ | 532.7 | | million | $ | 864.8 | | million | | | | |

| | | | | | | | | | | | |

| Non-GAAP Results: | | | | | | | | | | | | |

Earnings Available for Distribution per Diluted Common Share(1)(2) | $ | 0.51 | | | $ | 0.58 | | | $ | 2.06 | | | $ | 1.31 | | | | | | |

Earnings Available for Distribution(2) | $ | 247.4 | | million | $ | 280.8 | | million | $ | 997.2 | | million | $ | 633.1 | | million | | | | |

| | | | | | | | | | | | |

| Common Dividend: | | | | | | | | | | | | |

| Common Dividend per Share | $ | 0.25 | | | $ | 0.25 | | | $ | 1.00 | | | $ | 1.00 | | | | | | |

| Common Dividend | $ | 120.8 | | million | $ | 120.8 | | million | $ | 483.2 | | million | $ | 470.4 | | million | | | | |

“Over the course of 2023, we executed on our growth strategy to accelerate Rithm’s transformation and position the business for long-term success,” said Michael Nierenberg, Chairman, Chief Executive Officer and President of Rithm Capital. “We are proud to have closed our acquisition of Sculptor Capital in the fourth quarter, a significant milestone for our firm and a critical next step in Rithm’s evolution into a global asset manager focused on real estate, credit and financial services. Our diversified platform positions Rithm to continue to capitalize on dislocation across financial markets. I look forward to working with our growing team to take advantage of the opportunities ahead.”

Fourth Quarter 2023 Company Highlights:

•Newrez

•Combined Origination & Servicing segment pre-tax loss of ($120.9) million(3)

•Generated a full year 19% pre-tax ROE on $3.5 billion of equity(4)

•Origination funded production volume of $8.9 billion

•Total Rithm MSR Portfolio Summary

•MSR portfolio totaled $590 billion in unpaid principal balance (“UPB”) at December 31, 2023 compared to $595 billion UPB at September 30, 2023(5)

◦Portfolio average constant prepayment rate of approximately 5%

•Sculptor

•Successfully completed our previously announced acquisition of Sculptor Capital Management, Inc. (“Sculptor”) on November 17, 2023, Sculptor has ~$33 billion of assets under management (“AUM”) at December 31, 2023(6)

•Specialized Loan Servicing(7)

•As previously announced, in October 2023, the Company entered into a definitive agreement with Computershare Limited (ASX:CPU) to acquire Computershare Mortgage Services Inc. and certain affiliated companies, including Specialized Loan Servicing LLC (“SLS”), for a purchase price of approximately $720 million.

•The acquisition includes approximately $136 billion in UPB of MSRs, of which $85 billion is third-party servicing, along with SLS’s origination services business

•Continue to target closing for Q1’24, subject to customary closing conditions and approvals

Renewal of Stock Repurchase Program:

The Company announced today that its Board of Directors authorized new stock repurchase programs of up to $200 million of shares of the Company's common stock (the "common stock repurchase program”), and up to $100 million of shares of the Company’s preferred stock (the “preferred stock repurchase program”, and together with the common stock repurchase program, the “repurchase programs”), through December 31, 2024. The new repurchase programs replace the Company’s previous $200 million common stock repurchase program and $100 million preferred stock repurchase program, which expired on December 31, 2023.

(1)Per common share calculations for both GAAP Net Income and Earnings Available for Distribution are based on 483,214,458 and 484,350,288 weighted average diluted shares for the quarters ended December 31, 2023 and September 30, 2023, respectively. Per share calculations of Book Value are based on 483,226,239 common shares outstanding as of December 31, 2023. Per common share calculations for both GAAP Net Income and Earnings Available for Distribution are based on 483,716,715 and 481,636,125 weighted average diluted shares for the years ended December 31, 2023 and 2022, respectively.

(2)Earnings Available for Distribution is a non-GAAP financial measure. For a reconciliation of Earnings Available for Distribution to GAAP Net Income, as well as an explanation of this measure, please refer to the section entitled Non-GAAP Financial Measures and Reconciliation to GAAP Net Income below.

(3)Includes noncontrolling interests.

(4)Excludes full MSR mark-to-market of $98.8 million.

(5)Includes excess and full MSRs.

(6)“Assets Under Management” (AUM) refers to the assets for which Sculptor provides investment management, advisory or certain other investment-related services. This is generally equal to the sum of (i) net asset value of the funds, (ii) uncalled capital commitments, (iii) total capital commitments for certain real estate funds and (iv) par value of collateralized loan obligations. AUM includes amounts that are not subject to management fees, incentive income or other amounts earned on AUM. Our calculation of AUM may differ from the calculations of other asset managers, and as a result, may not be comparable to similar measures presented by other asset managers. Our calculations of AUM

are not based on any definition set forth in the governing documents of the investment funds and are not calculated pursuant to any regulatory definitions.

(7)Based on management’s current views and estimates. Actual results may vary materially.

ADDITIONAL INFORMATION

For additional information that management believes to be useful for investors, please refer to the latest presentation posted on the Investors section of the Company’s website, www.rithmcap.com. For consolidated investment portfolio information, please refer to the Company’s most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K, which are available on the Company’s website, www.rithmcap.com. Information on, or accessible through, our website is not a part of, and is not incorporated into, this press release.

EARNINGS CONFERENCE CALL

Rithm Capital’s management will host a conference call on Wednesday, February 7, 2024 at 8:00 A.M. Eastern Time. A copy of the earnings release will be posted to the Investors section of Rithm Capital’s website, www.rithmcap.com.

All interested parties are welcome to participate on the live call. The conference call may be accessed by dialing 1-833-974-2382 (from within the U.S.) or 1-412-317-5787 (from outside of the U.S.) ten minutes prior to the scheduled start of the call; please reference “Rithm Capital Fourth Quarter and Full Year 2023 Earnings Call.” In addition, participants are encouraged to pre-register for the conference call at https://dpregister.com/sreg/10186157/fb82d49eed.

A simultaneous webcast of the conference call will be available to the public on a listen-only basis at www.rithmcap.com. Please allow extra time prior to the call to visit the website and download any necessary software required to listen to the internet broadcast.

A telephonic replay of the conference call will also be available two hours following the call’s completion through 11:59 P.M. Eastern Time on Wednesday, February 14, 2024 by dialing 1-877-344-7529 (from within the U.S.) or 1-412-317-0088 (from outside of the U.S.); please reference access code “1244166 .”

Consolidated Statements of Operations (Unaudited)

($ in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, | | |

| December 31,

2023 | | September 30,

2023 | | 2023 | | 2022 | | | | |

| Revenues | | | | | | | | | | | |

| Origination and Servicing, Investment Portfolio, Mortgage Loans Receivable and Corporate | | | | | | | | | | | |

| Servicing fee revenue, net and interest income from MSRs and MSR financing receivables | $ | 482,210 | | | $ | 442,644 | | | $ | 1,860,255 | | | $ | 1,831,964 | | | | | |

| Change in fair value of MSRs and MSR financing receivables (includes realization of cash flows of $(134,884), $(138,993), $(518,978) and $(631,120), respectively) | (466,346) | | | 20,934 | | | (565,684) | | | 727,334 | | | | | |

| Servicing revenue, net | 15,864 | | | 463,578 | | | 1,294,571 | | | 2,559,298 | | | | | |

| Interest income | 454,317 | | | 476,607 | | | 1,676,324 | | | 1,075,981 | | | | | |

| Gain on originated residential mortgage loans, held-for-sale, net | 98,114 | | | 149,230 | | | 508,434 | | | 1,086,232 | | | | | |

| Other revenues | 58,495 | | | 60,319 | | | 236,167 | | | 230,905 | | | | | |

| 626,790 | | | 1,149,734 | | | 3,715,496 | | | 4,952,416 | | | | | |

| Asset Management | | | | | | | | | | | |

| Asset management revenues | 82,681 | | | — | | | 82,681 | | | — | | | | | |

| 709,471 | | | 1,149,734 | | | 3,798,177 | | | 4,952,416 | | | | | |

| Expenses | | | | | | | | | | | |

| Interest expense and warehouse line fees | 400,474 | | | 382,554 | | | 1,421,254 | | | 791,001 | | | | | |

| General and administrative | 191,614 | | | 190,475 | | | 730,752 | | | 875,428 | | | | | |

| Compensation and benefits | 222,457 | | | 186,149 | | | 787,092 | | | 1,231,446 | | | | | |

| Management fee to affiliate | — | | | — | | | — | | | 46,174 | | | | | |

| Termination fee to affiliate | — | | | — | | | — | | | 400,000 | | | | | |

| 814,545 | | | 759,178 | | | 2,939,098 | | | 3,344,049 | | | | | |

| Other income (loss) | | | | | | | | | | | |

| Realized and unrealized gains (losses), net | 70,607 | | | (123,668) | | | (37,236) | | | (200,181) | | | | | |

| Other income (loss), net | (2,834) | | | 6,888 | | | (69,010) | | | (145,385) | | | | | |

| 67,773 | | | (116,780) | | | (106,246) | | | (345,566) | | | | | |

| Income (loss) before income taxes | (37,301) | | | 273,776 | | | 752,833 | | | 1,262,801 | | | | | |

| Income tax expense | 29,850 | | | 52,585 | | | 122,159 | | | 279,516 | | | | | |

| Net income (loss) | $ | (67,151) | | | $ | 221,191 | | | $ | 630,674 | | | $ | 983,285 | | | | | |

| Noncontrolling interests in income of consolidated subsidiaries | (2,020) | | | 4,848 | | | 8,417 | | | 28,766 | | | | | |

| Dividends on preferred stock | 22,395 | | | 22,394 | | | 89,579 | | | 89,726 | | | | | |

| Net income (loss) attributable to common stockholders | $ | (87,526) | | | $ | 193,949 | | | $ | 532,678 | | | $ | 864,793 | | | | | |

| | | | | | | | | | | |

| Net income (loss) per share of common stock | | | | | | | | | | | |

| Basic | $ | (0.18) | | | $ | 0.40 | | | $ | 1.11 | | | $ | 1.84 | | | | | |

| Diluted | $ | (0.18) | | | $ | 0.40 | | | $ | 1.10 | | | $ | 1.80 | | | | | |

| Weighted average number of shares of common stock outstanding | | | | | | | | | | | |

| Basic | 483,214,458 | | | 483,214,061 | | | 481,934,951 | | | 468,836,718 | | | | | |

| Diluted | 483,214,458 | | | 484,350,288 | | | 483,716,715 | | | 481,636,125 | | | | | |

| | | | | | | | | | | |

| Dividends declared per share of common stock | $ | 0.25 | | | $ | 0.25 | | | $ | 1.00 | | | $ | 1.00 | | | | | |

Consolidated Balance Sheets

($ in thousands, except share data)

| | | | | | | | | | | |

| December 31,

2023

(Unaudited) | | December 31, 2022 |

| Assets | | | |

| Mortgage servicing rights and mortgage servicing rights financing receivables, at fair value | $ | 8,405,938 | | | $ | 8,889,403 | |

| Real estate and other securities ($9,757,664 and $8,289,277 at fair value, respectively) | 9,782,217 | | | 8,289,277 | |

| Residential loans held-for-investment, at fair value | 379,044 | | | 452,519 | |

| Residential mortgage loans, held-for-sale ($2,461,865 and $3,297,271 at fair value, respectively) | 2,540,742 | | | 3,398,298 | |

| Consumer loans held-for-investment, at fair value | 1,274,005 | | | 363,756 | |

| Single-family rental properties | 1,001,928 | | | 971,313 | |

| Mortgage loans receivable, at fair value | 2,232,913 | | | 2,064,028 | |

| Residential mortgage loans subject to repurchase | 1,782,998 | | | 1,219,890 | |

| Cash and cash equivalents | 1,287,199 | | | 1,336,508 | |

| Restricted cash | 385,620 | | | 281,126 | |

| Servicer advances receivable | 2,760,250 | | | 2,825,485 | |

| Receivable for investments sold | — | | | 473,126 | |

| Other assets ($1,489,419 and $921,373 at fair value, respectively) | 3,478,931 | | | 1,914,607 | |

| $ | 35,311,785 | | | $ | 32,479,336 | |

| Liabilities and Equity | | | |

| | | |

| Liabilities | | | |

| Secured financing agreements | $ | 12,561,283 | | | $ | 11,257,736 | |

| Secured notes and bonds payable ($554,800 and $632,404 at fair value, respectively) | 10,679,186 | | | 10,098,943 | |

| Residential mortgage loan repurchase liability | 1,782,998 | | | 1,219,890 | |

| Unsecured notes, net of issuance costs | 719,004 | | | 545,056 | |

| Payable for investments purchased | — | | | 731,216 | |

| Dividends payable | 135,897 | | | 129,760 | |

| Accrued expenses and other liabilities ($333,688 and $18,064 at fair value, respectively) | 2,332,379 | | | 1,486,667 | |

| 28,210,747 | | | 25,469,268 | |

| Commitments and Contingencies | | | |

| | | |

| Equity | | | |

| Preferred stock, $0.01 par value, 100,000,000 shares authorized, 51,964,122 and 51,964,122 issued and outstanding, $1,299,104 and $1,299,104 aggregate liquidation preference, respectively | 1,257,254 | | | 1,257,254 | |

| Common stock, $0.01 par value, 2,000,000,000 shares authorized, 483,226,239 and 473,715,100 issued and outstanding, respectively | 4,833 | | | 4,739 | |

| Additional paid-in capital | 6,074,322 | | | 6,062,019 | |

| Retained earnings (accumulated deficit) | (373,141) | | | (418,662) | |

| Accumulated other comprehensive income | 43,674 | | | 37,651 | |

| Total Rithm Capital stockholders’ equity | 7,006,942 | | | 6,943,001 | |

| Noncontrolling interests in equity of consolidated subsidiaries | 94,096 | | | 67,067 | |

| Total equity | 7,101,038 | | | 7,010,068 | |

| $ | 35,311,785 | | | $ | 32,479,336 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP NET INCOME

The Company has four primary variables that impact its performance: (i) Net interest margin on assets held within the investment portfolio, (ii) realized and unrealized gains or losses on assets held within the investment portfolio and operating companies, including any impairment or reserve for expected credit losses, (iii) income from the Company’s operating company investments; and (iv) the Company’s operating expenses and taxes.

“Earnings available for distribution” is a non-GAAP financial measure of the Company’s operating performance, which is used by management to evaluate the Company’s performance without taking into account: (i) realized and unrealized gains and losses on assets held within its investment portfolio and net unrealized gains on MSRs held by its operating companies; (ii) non-cash deferred compensation and non-cash interest expense; (iii) non-capitalized transaction-related expenses; and (iv) deferred taxes.

The Company’s definition of earnings available for distribution excludes certain realized and unrealized losses, which although they represent a part of the Company’s recurring operations, are subject to significant variability and are generally limited to a potential indicator of future economic performance. Management also excludes deferred taxes because the Company believes deferred taxes are not representative of current operations. With regard to non-capitalized transaction-related expenses, management does not view these costs as part of the Company’s core operations, as they are considered by management to be similar to realized losses incurred at acquisition. The Company also excluded amortization of acquisition premium on Mortgage loans Receivable Non-capitalized transaction-related expenses are generally legal and valuation service costs, as well as other professional service fees, incurred when the Company acquires certain investments, as well as costs associated with the acquisition and integration of acquired businesses.

Management believes that the adjustments to compute “earnings available for distribution” specified above allow investors and analysts to readily identify and track the operating performance of the assets that form the core of the Company’s activity, assist in comparing the core operating results between periods, and enable investors to evaluate the Company’s current core performance using the same financial measure that management uses to operate the business. Management also utilizes earnings available for distribution as a financial measure in its decision-making process relating to improvements to the underlying fundamental operations of the Company’s investments, as well as the allocation of resources between those investments, and management also relies on earnings available for distribution as an indicator of the results of such decisions. Earnings available for distribution excludes certain recurring items, such as gains and losses (including impairment and reserves as well as derivative activities) and non-capitalized transaction-related expenses, because they are not considered by management to be part of the Company’s core operations for the reasons described herein. As such earnings available for distribution is not intended to reflect all of the Company’s activity and should be considered as only one of the factors used by management in assessing the Company’s performance, along with GAAP net income which is inclusive of all of the Company’s activities.

The Company views earnings available for distribution as a consistent financial measure of its portfolio’s ability to generate income for distribution to common stockholders. Earnings available for distribution does not represent and should not be considered as a substitute for, or superior to, net income or as a substitute for, or superior to, cash flows from operating activities, each as determined in accordance with GAAP, and the Company’s calculation of this financial measure may not be comparable to similarly entitled financial measures reported by other companies. Furthermore, to maintain qualification as a REIT, U.S. federal income tax law generally requires that the Company distribute at least 90% of its REIT taxable income annually, determined without regard to the deduction for dividends paid and excluding net capital gains. Because the Company views earnings available for distribution as a consistent financial measure of its ability to generate income for distribution to common stockholders, earnings available for distribution is one metric, but not the exclusive metric, that the Company’s board of directors uses to determine the amount, if any, and the payment date of dividends on common stock. However, earnings available for distribution should not be considered as an indication of the Company’s taxable income, a guaranty of its ability to pay dividends or as a proxy for the amount of dividends it may pay, as earnings available for distribution excludes certain items that impact its cash needs.

The table below provides a reconciliation of earnings available for distribution to the most directly comparable GAAP financial measure (dollars in thousands, except share and per share data):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, | | | |

| December 31,

2023 | | September 30,

2023 | | 2023 | | 2022 | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (87,526) | | | $ | 193,949 | | | $ | 532,678 | | | $ | 864,793 | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | |

| Realized and unrealized (gains) losses, net | 285,807 | | | 49,873 | | | 294,499 | | | (1,067,082) | | | | | | | | |

| Other (income) loss, net | (2,470) | | | (26,308) | | | 5,974 | | | 128,007 | | | | | | | | |

| Non-capitalized transaction-related expenses | 22,229 | | | 15,936 | | | 47,755 | | | 24,404 | | | | | | | | |

| Termination fee to affiliate | — | | | — | | | — | | | 400,000 | | | | | | | | |

| Preferred stock management fee to affiliate | — | | | — | | | — | | | 8,661 | | | | | | | | |

| Deferred taxes | 29,364 | | | 47,386 | | | 116,336 | | | 271,167 | | | | | | | | |

| Interest income held on residential mortgage loans, held for sale | — | | | — | | | — | | | 3,125 | | | | | | | | |

| Earnings available for distribution | $ | 247,404 | | | $ | 280,836 | | | $ | 997,242 | | | $ | 633,075 | | | | | | | | |

| | | | | | | | | | | | | | |

| Net (loss) income per diluted share | $ | (0.18) | | | $ | 0.40 | | | $ | 1.10 | | | $ | 1.80 | | | | | | | | |

| Earnings available for distribution per diluted share | $ | 0.51 | | | $ | 0.58 | | | $ | 2.06 | | | $ | 1.31 | | | | | | | | |

| | | | | | | | | | | | | | |

| Weighted average number of shares of common stock outstanding, diluted | 483,214,458 | | | 484,350,288 | | | 483,716,715 | | | 481,636,125 | | | | | | | | |

SEGMENT INFORMATION

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Quarter Ended December 31, 2023 | | Origination and Servicing | | Investment Portfolio | | Mortgage Loans Receivable | | Asset Management | | Corporate | | Total |

| Servicing fee revenue, net and interest income from MSRs and MSR financing receivables | | $ | 406,654 | | | $ | 75,556 | | | $ | — | | | $ | — | | | $ | — | | | $ | 482,210 | |

| Change in fair value of MSRs and MSR financing receivables (includes realization of cash flows of $(134,884)) | | (414,192) | | | (52,154) | | | — | | | — | | | — | | | (466,346) | |

| Servicing revenue, net | | (7,538) | | | 23,402 | | | — | | | — | | | — | | | 15,864 | |

| Interest income | | 138,332 | | | 246,873 | | | 65,324 | | | 3,788 | | | — | | | 454,317 | |

| Gain on originated residential mortgage loans, held-for-sale, net | | 98,015 | | | 99 | | | — | | | — | | | — | | | 98,114 | |

| Other investment portfolio revenues | | — | | | 58,495 | | | — | | | — | | | — | | | 58,495 | |

| Asset management revenues | | — | | | — | | | — | | | 82,681 | | | — | | | 82,681 | |

| Total revenues | | 228,809 | | | 328,869 | | | 65,324 | | | 86,469 | | | — | | | 709,471 | |

| Interest expense | | 124,922 | | | 229,607 | | | 34,111 | | | 2,727 | | | 9,107 | | | 400,474 | |

| G&A and other | | 224,069 | | | 73,247 | | | 15,808 | | | 63,870 | | | 37,077 | | | 414,071 | |

| Total operating expenses | | 348,991 | | | 302,854 | | | 49,919 | | | 66,597 | | | 46,184 | | | 814,545 | |

| Realized and unrealized gains (losses), net | | — | | | 87,240 | | | (24,693) | | | 8,060 | | | — | | | 70,607 | |

| Other income (loss), net | | (718) | | | (1,253) | | | (51) | | | 557 | | | (1,369) | | | (2,834) | |

| Total other income (loss) | | (718) | | | 85,987 | | | (24,744) | | | 8,617 | | | (1,369) | | | 67,773 | |

| | | | | | | | | | | | |

| Income (loss) before income taxes | | (120,900) | | | 112,002 | | | (9,339) | | | 28,489 | | | (47,553) | | | (37,301) | |

| Income tax expense (benefit) | | 5,733 | | | (2,073) | | | (931) | | | 27,121 | | | — | | | 29,850 | |

| Net income (loss) | | (126,633) | | | 114,075 | | | (8,408) | | | 1,368 | | | (47,553) | | | (67,151) | |

| Noncontrolling interests in income (loss) of consolidated subsidiaries | | (32) | | | (2,353) | | | — | | | 365 | | | — | | | (2,020) | |

| Dividends on preferred stock | | — | | | — | | | — | | | — | | | 22,395 | | | 22,395 | |

| Net income (loss) attributable to common stockholders | | $ | (126,601) | | | $ | 116,428 | | | $ | (8,408) | | | $ | 1,003 | | | $ | (69,948) | | | $ | (87,526) | |

| | | | | | | | | | | | |

| Total Assets | | $ | 13,671,626 | | | $ | 17,418,708 | | | $ | 2,498,132 | | | $ | 1,694,954 | | | $ | 28,365 | | | $ | 35,311,785 | |

| Total Rithm Capital Stockholders' Equity | | $ | 3,518,107 | | | $ | 2,969,710 | | | $ | 618,147 | | | $ | 632,552 | | | $ | (731,574) | | | $ | 7,006,942 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended September 30, 2023 | | Origination and Servicing | | Investment Portfolio | | Mortgage Loans Receivable | | Asset Management | | Corporate | | Total |

| Servicing fee revenue, net and interest income from MSRs and MSR financing receivables | | $ | 372,979 | | | $ | 69,665 | | | $ | — | | | $ | — | | | $ | — | | | $ | 442,644 | |

| Change in fair value of MSRs and MSR financing receivables (includes realization of cash flows of $(138,993)) | | 95,507 | | | (74,573) | | | — | | | — | | | — | | | 20,934 | |

| Servicing revenue, net | | 468,486 | | | (4,908) | | | — | | | — | | | — | | | 463,578 | |

| Interest income | | 156,607 | | | 260,539 | | | 59,461 | | | — | | | — | | | 476,607 | |

| Gain on originated residential mortgage loans, held-for-sale, net | | 144,139 | | | 5,091 | | | — | | | — | | | — | | | 149,230 | |

| Other investment portfolio revenues | | — | | | 60,319 | | | — | | | — | | | — | | | 60,319 | |

| Asset management revenues | | — | | | — | | | — | | | — | | | — | | | — | |

| Total revenues | | 769,232 | | | 321,041 | | | 59,461 | | | — | | | — | | | 1,149,734 | |

| Interest expense | | 114,570 | | | 227,125 | | | 31,751 | | | — | | | 9,108 | | | 382,554 | |

| G&A and other | | 241,559 | | | 85,364 | | | 15,524 | | | — | | | 34,177 | | | 376,624 | |

| Total operating expenses | | 356,129 | | | 312,489 | | | 47,275 | | | — | | | 43,285 | | | 759,178 | |

| Realized and unrealized gains (losses), net | | 22 | | | (125,141) | | | 1,451 | | | — | | | — | | | (123,668) | |

| Other income (loss), net | | (626) | | | 8,269 | | | 5,369 | | | — | | | (6,124) | | | 6,888 | |

| Total other income (loss) | | (604) | | | (116,872) | | | 6,820 | | | — | | | (6,124) | | | (116,780) | |

| | | | | | | | | | | | |

| Income (loss) before income taxes | | 412,499 | | | (108,320) | | | 19,006 | | | — | | | (49,409) | | | 273,776 | |

| Income tax expense (benefit) | | 56,349 | | | (2,648) | | | (1,116) | | | — | | | — | | | 52,585 | |

| Net income (loss) | | 356,150 | | | (105,672) | | | 20,122 | | | — | | | (49,409) | | | 221,191 | |

| Noncontrolling interests in income (loss) of consolidated subsidiaries | | 269 | | | 4,579 | | | — | | | — | | | — | | | 4,848 | |

| Dividends on preferred stock | | — | | | — | | | — | | | — | | | 22,394 | | | 22,394 | |

| Net income (loss) attributable to common stockholders | | $ | 355,881 | | | $ | (110,251) | | | $ | 20,122 | | | $ | — | | | $ | (71,803) | | | $ | 193,949 | |

| | | | | | | | | | | | |

| Total Assets | | $ | 13,037,996 | | | $ | 19,327,078 | | | $ | 2,355,415 | | | $ | — | | | $ | 25,039 | | | $ | 34,745,528 | |

| Total Rithm Capital Stockholders' Equity | | $ | 4,517,431 | | | $ | 2,794,982 | | | $ | 610,499 | | | $ | — | | | $ | (714,856) | | | $ | 7,208,056 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information in this press release constitutes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts. They represent management’s current expectations regarding future events and are subject to a number of trends and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those described in the forward-looking statements. Accordingly, you should not place undue reliance on any forward-looking statements contained herein. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see the sections entitled “Cautionary Statement Regarding Forward Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent annual and quarterly reports and other filings filed with the U.S. Securities and Exchange Commission, which are available on the Company’s website (www.rithmcap.com). New risks and uncertainties emerge from time to time, and it is not possible for Rithm Capital to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Forward-looking statements contained herein speak only as of the date of this press release, and Rithm Capital expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Rithm Capital's expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

ABOUT RITHM CAPITAL

Rithm Capital is a global asset manager focused on real estate, credit, and financial services. Rithm makes direct investments and operates several wholly-owned operating businesses. Rithm’s businesses include Sculptor Capital Management, Inc., an alternative asset manager, as well as Newrez LLC and Genesis Capital LLC, leading mortgage origination and servicing platforms. Rithm Capital seeks to generate attractive risk-adjusted returns across market cycles and interest rate environments. Since inception in 2013, Rithm has delivered approximately $5 billion in dividends to shareholders. Rithm is organized and conducts its operations to qualify as a real estate investment trust (REIT) for federal income tax purposes and is headquartered in New York City.

Investor Relations

212-850-7770

IR@RithmCap.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ritm_SevenPointFivePercentSeriesAFixedToFloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ritm_SevenPointOneTwoFivePercentSeriesBFixedToFloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ritm_SixPointThreeSevenFivePercentSeriesCFixedRateResetCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ritm_SevenPercentFixedRateResetSeriesDCumulativeRedeemablePreferredMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

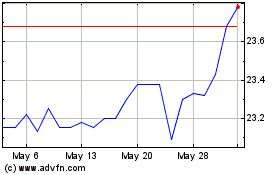

Rithm Capital (NYSE:RITM-C)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rithm Capital (NYSE:RITM-C)

Historical Stock Chart

From Nov 2023 to Nov 2024