Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 December 2024 - 12:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL

Publicly-held Company

Corporate Taxpayer’s ID: 33.042.730/0001-04

NIRE 35-3.0039609.0

MATERIAL FACT

COMPANHIA SIDERÚRGICA NACIONAL

(“CSN” or “Company”) (B3: CSNA3; NYSE: SID), in compliance with article 157, §4, of Law No. 6,404/1976 and

CVM Resolution No. 44/2021, hereby informs its shareholders and the market in general that it entered into a binding proposal (“Binding

Proposal”) on December 10, 2024, for the acquisition of shares representing 70% (seventy percent) of the share capital of Estrela

Comércio e Participações S.A. (“Estrela”), for the total price of R$742,500,000.00 (seven hundred and

forty-two million and five hundred thousand reais), of which R$300,000.00.00 (three hundred million reais) will be paid upon completion

of the transaction and the remainder of the total price will be paid in 3 annual installments (“Potential Transaction”).

Estrela

is the Holding Company of the Tora Transportes Group (“Tora Group”) (https://tora.com.br), one of the largest logistics operators

in the country, which has accumulated expertise in the area of road-rail

integration and terminal operations for over 50 years, focused on the movement of large tonnages. The commercial relationship between

the Tora Group and the Company has lasted for 35 years and this strategic acquisition aims to promote strong growth in intermodal operations

by more intensively exploiting the current infrastructure in the regions of operation, strengthening CSN’s performance in the logistics

segment.

By virtue of the signing of the Binding Proposal,

the shareholders of Estrela and Estrela granted the Company exclusivity in the analysis, negotiation, formalization and consummation of

the Potential Transaction.

According to the Binding Proposal, the eventual

consummation of the Potential Transaction will depend on obtaining the legal and regulatory approvals required in accordance with applicable

legislation, including, without limitation, approval from the Administrative Council for Economic Defense (CADE), in addition to compliance

with other conditions precedent to be provided for in the definitive documents of the Potential Transaction.

CSN undertakes to keep its shareholders and

the market in general duly informed about any relevant developments related to the Potential Transaction, in accordance with applicable

legislation.

São Paulo, December 11, 2024.

Antonio Marco Campos Rabello

Chief Financial Officer and Investor Relations

Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 11, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Antonio Marco Campos Rabello

|

| |

Antonio Marco Campos Rabello

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

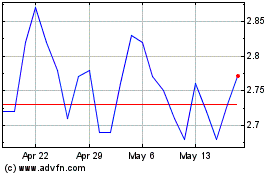

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2024 to Dec 2024

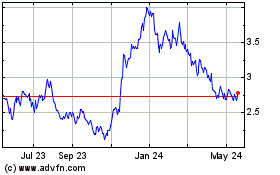

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Dec 2023 to Dec 2024