SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

| RESULTS 2Q24 |

| | |

São Paulo, August 12 , 2024 - Companhia

Siderúrgica Nacional (“CSN”) (B3: CSNA3) (NYSE: SID) announces its results for the second quarter of 2024 (2Q24)

in Reais, with its consolidated financial statements in accordance with the accounting practices adopted in Brazil issued by the Accounting

Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM") and the Federal

Accounting Council ("CFC") and in accordance with the International Financial Reporting Standards ("IFRS") issued

by the International Accounting Standards Board ("IASB").

The comments address the Company's consolidated results

for the second quarter of 2024 (2Q24) and the comparisons are for the first quarter of 2024 (1Q24) and the second quarter of 2023 (2Q23).

The dollar exchange rate was R$ 4.82 on 06/30/2023; R$ 4.99 on 03/31/2023 and R$ 5.59 on 06/30/2024.

2Q24 Operational and Financial

Highlights

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 2 |

| RESULTS 2Q24 |

| | |

Consolidated Table - Highlights

¹ Adjusted EBITDA is calculated from net income

(loss) plus depreciation and amortization, income taxes, net financial income, income from investments, income from other operating income/expenses

and includes the proportional 37.49% share of EBITDA of the jointly owned subsidiary MRS Logística.

² The Adjusted EBITDA Margin is calculated as

Adjusted EBITDA divided by Management Net Revenue.

³ Adjusted Net

Debt and Adjusted Cash/Availabilities consider 37.49% of MRS, in addition to not considering Forfaiting and Drawn Risk operations.

Consolidated Results

| · | Net Revenue totaled

R$10,881.7 million in 2Q24, representing a 12.0% growth compared to 1Q24, as a result of the improved performance of the steel segment,

in addition to the positive effect of the period's seasonality, which provided greater production and commercial activity for both mining

and cement. Among the main operational highlights in the period, we had record sales in the cement segment and the second largest volume

of iron ore ever produced in the Company's history (own production). |

| · | The Cost of Goods Sold (COGS)

totaled R$7,892.7 million in 2Q24 and was 4.9% higher than in the previous quarter, reflecting stronger commercial activity in the period,

with an increase in the volume of products sold across practically all operating segments. |

| · | Gross profit in the

2Q24 reached R $3.0 billion, with a gross margin of 27.6%, which represents an increase of 5.0 p.p. in comparison to the first quarter

of 2024 and reflects the operational improvement seen in the Company's main operating segments. |

| · | Selling, general and administrative

expenses totaled R$1,564.8 million in 2Q24 and were 12.7% higher than that recorded in the previous quarter and 46.2% higher when

compared to the same period last year. |

| · | The Other Operating Income

and Expenses group reached R$113.6 million in 2Q24, representing a 138.4% growth compared to 1Q24, explained by the positive impact

of iron ore hedging operations which generated a gain of R$447 million in the period, an improvement from the R$6 million gain seen in

1Q24. |

| · | In 2Q24, the Financial Result

was negative by R$1,495 million, which represents an increase of 33% in relation to 1Q24. This was due to an increase in the cost

of debt in dollars, as well as the negative effect of the devaluation of Usiminas shares. |

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 3 |

| RESULTS 2Q24 |

| | |

| · | The Equity Result was

positive at R$98.0 million in 2Q24, an increase of 5.4% compared to the previous quarter, mainly as a consequence of the excellent performance

that MRS has been able to achieve in recent quarters, with an increase in cargo movements. |

| · | In the second quarter of the

year, CSN recorded a Net Loss of R$222.6 million, an improvement of 53.6% on the previous quarter. However, this figure remains

negative due to an increase in financial expenses and a higher incidence of taxes related to the performance of subsidiaries. These factors

directly impact the Income Tax and Social Contribution line, offsetting the operational improvement seen in the period. |

Adjusted EBITDA

*The Company discloses its adjusted EBITDA excluding the participation

in investments and other operating income (expenses) as it believes that they should not be considered in the calculation of recurring

operating cash generation.

| · | In 2Q24, Adjusted

EBITDA increased by 34.5% compared to the previous quarter, reaching R$2,645 million, with an Adjusted EBITDA Margin of 23.2%.

The growth is the outcome of a combination of stronger operating results recorded in the quarter, with operating records in cement

and mining. The quarter was also marked by a significant recovery in the steel segment, which, despite remaining with very

compressed margins compared to historical averages, is already

showing signs of improvement, especially when looking at the outlook for volumes and prices. |

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 4 |

| RESULTS 2Q24 |

| | |

Adjusted EBITDA (R$ million) and

Adjusted EBITDA Margin (%)

¹ The Adjusted EBITDA Margin is calculated by

dividing Adjusted EBITDA by Adjusted Net Revenue, which takes into account CSN Mineração's 100% stake in consolidation and

37.49% in MRS.

Adjusted Cash Flow

Adjusted Cash Flow in 2Q24 was negative at R$1,164.0

million. This was due to consumption of working capital, in addition to the higher volume of investments made in the period and the impact

of the exchange rate variation on the financial result. This had the effect of more than offsetting the stronger operating result recorded

in the quarter.

2Q24 Adjusted Cash Flow¹ (R$ million)

¹ The concept of adjusted cash flow is calculated

from Adjusted EBITDA, subtracting EBITDA of Jointly Controlled Companies, CAPEX, Income Tax, Financial Result and changes in Assets and

Liabilities², excluding the effect of the Glencore advance.

² Adjusted Working Capital is made up of the

variation in Net Working Capital, plus the variation in long-term asset and liability accounts and disregarding the net variation in Income

Tax and Social Security.

Indebtedness

On June 30, 2024, consolidated Net Debt reached R$37,156.0

million, with the leverage indicator measured by the Net Debt/EBITDA LTM ratio reaching 3.36x. This represents an extraordinary increase

of 23 basis points compared to the previous quarter as a consequence of the impact of exchange rate fluctuations on dollar-denominated

liabilities, which more than offset the operational improvement observed during the period. Even with this unprojected impact, the Company

remains firm in its commitment to reduce its indebtedness level and is advancing in projects that help in the group's capital recycling.

Additionally, CSN maintained its policy of carrying a high cash balance, which in this quarter reached R$16.573 billion.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 5 |

| RESULTS 2Q24 |

| | |

¹Net

Debt / EBITDA: Debt is calculated using the final dollar of each period and net debt and EBITDA are calculated using the average dollar

of the period.

CSN remains very active in its objective of extending

the amortization term, focusing on long-term operations and the local capital market. Among the main movements in 2Q24, the Company made

the payment of principal and interest amortizations on debts that would have matured in 2024, 2025 and 2026.

Amortization

Schedule (R$ Billion)

¹ IFRS: does not consider stake in MRS (37.49%).

² Gross Debt/Management Net Debt considers stake in MRS (37.49%),

without accrued interest.

3 Average time after completion of the Liability Management

Plan.

FX Exposure

The net foreign exchange

exposure in the 2Q24 consolidated balance sheet was US$297.0 million, as shown in the table below. This is in line with the company's

policy of minimizing exchange rate volatility and its impact on results. CSN's hedge accounting strategy aligns the projected flow of

exports in dollars with future debt maturities in the same currency. Consequently, the fluctuations in the value of the dollar-denominated

debt are recorded as a temporary adjustment to shareholders' equity and are subsequently reflected in the income statement when the dollar

revenues from these exports are recognized.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 6 |

| RESULTS 2Q24 |

| | |

Investments

R$1,356 million was invested in 2Q24, representing

a 69.0% increase over the beginning of the year and a 36.8% increase over the same period in 2023. The steel segment led the way with

a series of actions to increase efficiency in the melt shop, sintering and overall modernization of operations at UPV. Additionally, there

were also ongoing investments to maintain the mining operational capacity, in addition to advances in capacity expansion projects, mainly

related to new purchases of equipment for P15.

CAPEX (R$ Million)

Net Working Capital

Net working capital applied to the business was negative

at R$218.0 million in 2Q24, a 74.6% decrease from 1Q24. This is mainly due to a reduction in suppliers and labor obligations, as well

as an increase in accounts receivable.

The calculation of Net Working Capital applied to

the business does not take into account advances on prepayment contracts, as shown in the following table:

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 7 |

| RESULTS 2Q24 |

| | |

¹ Other NWC Assets: Considers

advances and other accounts receivable.

² Other NWC Liabilities:

Considers other accounts payable, dividends payable, taxes paid in installments and other provisions.

³ Inventories: Does not

take into account the effect of the provision for inventory losses. Warehouse stock balances are not taken into account when calculating

the SME.

Dividends

On May 29, 2024, the Company distributed interim

dividends to its shareholders in the amount of R$950 million, which corresponded to R$0.72 per share, as previously announced on May

9, 2024.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 8 |

| RESULTS 2Q24 |

| | |

Business Segments Results

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 9 |

| RESULTS 2Q24 |

| | |

Steel Results

The World Steel Association

(WSA) reports that global crude steel production totaled 954.6 million tons (Mt) in the first six months of 2024, an increase of 1.1%

compared to the same period in 2023. This growth reflects an increase in the steelmaking activity in the Middle East and some European

countries, which helped to offset the weaker dynamics seen in North and South America and Southeast Asia. China, which accounted for 56.1%

of total global production in 2Q24, saw a slight decline of -0.7 p.p. compared to the same period in 2023. However, it increased its share

by 5.2 p.p. compared to the previous quarter, indicating that Chinese production remains at high levels. This is supported by solid demand

in key sectors such as infrastructure, automotive (electric cars), manufacturing (solar panels) and strong export activity. Brazilian

production, on the other hand, reached 16.4 Mt in the first six months of 2024, representing an annual growth of 2.5%, as a consequence

of the operational normalization seen among local producers after

a series of stoppages observed at the beginning of 2023 as already mentioned in the 1Q24 release.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 10 |

| RESULTS 2Q24 |

| | |

The outlook for 2024 is

for continued strong activity levels, with a notable increase in dynamism among Middle Eastern countries and a resumption of activity

among European producers. The Chinese government is also supporting growth in strategic sectors, which will help offset the weaker dynamics

seen in the construction market. The Brazilian market also presents a favorable outlook, with steel consumption driven by sectors such

as the automotive industry, yellow line, agricultural machinery and infrastructure projects.

Furthermore, in May 2024,

the Brazilian government introduced an import control measure for certain steel products. This measure granted import quotas for 11 product

types (NCMs), with a 25% rate applied whenever imports exceed the government-set limit. The measure came into force on June 1, 2024, and

the industry expects to reap the results in the coming months.

Steel Production (thousand tons)

In the case of CSN, Slab Production in 2Q24 was

affected by scheduled maintenance at the sintering plant, which resulted in a 6.5% reduction in production compared to the previous quarter.

In total, 883.4 thousand tons were produced in 2Q24, representing 5.2% decrease from the last quarter, but an increase of 20.7% from the

same period of 2023. This illustrates the normalization of operations and a higher increase in the purchase of slabs from third parties.

In line with this pattern, production of flat-rolled

products, our primary market, reached 828.9 Kton, representing a 3.7% decline from 1Q24 but a 7.0% increase year-on-year. The most notable

achievement during the quarter was the growth in long steel production, which increased by 6.3% in comparison to the previous quarter

and by 29.1% in relation to 2Q23.

Sales Volume – 2Q24 (thousand tons) –

Steel Industry

Total Sales in 2Q24 reached 1,122.6 thousand tons,

representing a 3.3% increase over the first quarter and a 6.8% increase over the same period in 2023. This marks the first time since

3Q22 that CSN's sales have exceeded 1.1 million tons, indicating not only a normalization of operations but also greater dynamism in the

local market.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 11 |

| RESULTS 2Q24 |

| | |

When

analyzing the behavior in the different markets, it is clear that the domestic market was the main driver of this increase, totaling

797.7 thousand tons of steel products in this quarter, which represents an increase of 8.9% compared to the beginning of the year, a movement

in line with the seasonality of the period and with a higher consumption of steel seen in the local industry. In the foreign market,

sales reached 325.6 thousand tons in 2Q24, representing a robust 4.2% growth compared to the same period last year. Of this volume, 2.1

thousand tons were exported directly, while 323.5 thousand tons were sold by subsidiaries abroad. The breakdown of these sales is as follows:

76.4 thousand tons by LLC, 162.5 thousand tons by SWT, and 84.6 thousand tons by Lusosider.

In terms of total sales volume, the General Industry

segment was the main highlight in 2Q24, with a 2.1 p.p. increase compared to the volume sold in the previous quarter, reaching 17.4% of

total volume. Conversely, Distribution (31.3%) experienced the greatest decline in sales volume due to seasonal factors and heightened

commercial activity in other segments. When compared on a year-over-year basis, notable recoveries were observed in Construction and General

Industry, while declines were seen in Packaging, Auto sector, White Goods, and Distribution.

|

|

|

According to ANFAVEA (the National Association of

Motor Vehicle Manufacturers), the production of vehicles in 2Q24 reached 599,800 units, representing a 0.7% increase compared to the same

period last year. As previously indicated, ANFAVEA anticipates growth in the number of vehicles sold in 2024, driven by the production

of heavy vehicles, which for the second consecutive quarter grew by more than 19%.

A review of data from the Brazil Steel Institute

(IABr) indicates that crude steel production in the first half of 2024 reached 16.4 thousand tons, representing a 2.4% increase over the

same period in 2023. Apparent consumption reached 12.4 thousand tons, representing a 6.0% increase year-on-year. Meanwhile, the Steel

Industry Confidence Indicator (ICIA) for June reached 53.4 points, surpassing the 50-point threshold, and indicating a notable increase

in confidence regarding the domestic market outlook over the next six months.

IBGE data indicates that production of household

appliances for June 2024 increased by 25.6% compared to the previous year. This reinforces the resumption of the white goods sector after

poor performances seen in 2022 and 2023.

·

Net revenues in the steel sector reached R$5,590.5

million in 2Q24, representing a 3.8% increase from the previous quarter. This growth was driven by higher volumes and an improved

product mix. In this regard, the 2Q24 Average Price demonstrated a 3.4% increase compared to 1Q24, with the average price for the

domestic market exhibiting a 1.4% growth. This outcome reflects the rise in sales of higher value-added products. Conversely, the price

on the foreign market grew by 7.5% during the period, attributable to a better shift in the product mix exported.

·

The Slab Cost in 2Q24 reached R$3,549.4/t, an

increase of 3.8% compared to the previous quarter. This was due to a lower dilution of fixed costs resulting from scheduled stoppages,

coupled with an increase in the average exchange rate in the period. However, when compared to the same period last year, we can see a

13.7% reduction in slab cost, which reflects the gradual normalization of the production process.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 12 |

| RESULTS 2Q24 |

| | |

| · | Adjusted EBITDA from

the Steel Industry reached R$324.7 million in 2Q24, 38.8% higher than in 1Q24, with an Adjusted EBITDA Margin of 5.8%, or 1.5 p.p. above

that recorded in the previous quarter. This increase in profitability is an important sign that the segment is gradually regaining its

efficiency, with a more positive environment regarding steel demand and prospects for better prices in the coming months. |

Adjusted EBITDA and Adjusted Margin

EBITDA (R$ Million and %)

Mining Results

As mentioned at the beginning of the year, the

second quarter of 2024 was marked by lower rainfall in Brazil and solid performance in other countries, resulting in an increase in the

supply of iron ore in the seaborne market. In addition, the high level of iron ore inventories in Chinese ports and the continued contraction

of the real estate sector raised concerns about the sustainability of Chinese demand, keeping the price of the commodity at a lower level

than that seen at the end of 2023. On the other hand, steel production in China remained at high levels, very similar to those seen in

the same period last year, supported by solid demand in the infrastructure, automotive and manufacturing sectors, and a strong export

volume. In this context, the price of iron ore has shown high volatility, fluctuating between US$ 143.95/dmt and US$ 98.30/dmt during

the first semester of the year. The iron ore price averaged US$ 111.80/dmt in 2Q24 (Platts, Fe62%, N. China), 9.7% lower

than the average 1Q24 (US$ 123.56/dmt) and 0.6% higher than 2Q23 (US$ 110.90/dmt).

Regarding Sea freight, the BCI-C3 (Tubarão-Qingdao)

route presented an average of US$ 25.81/wmt in 2Q24, practically stable compared to the previous quarter, still reflecting the impacts

of (i) the conflicts in the Gulf of Aden and the Middle East, which continue to divert sea routes to avoid the Suez Canal, (ii) the high

level of fuel costs, and (iii) the strong demand for cargo vessels due to the solid export volumes of bauxite and iron ore.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 13 |

| RESULTS 2Q24 |

| | |

Total Production – Mining (Thousand

tons)

| · | Iron Ore Production (including

purchases from third parties) reached a volume of 10,425.5 thousand tons in 2Q24, a growth of 14.2% compared to the first quarter of 2024,

but a decrease of 6.6% compared to the volume recorded in 2Q23. Despite this drop in the annual comparison, the Company has been increasing

the efficiency of its operations every quarter and the volume produced in the 2Q24 was the highest ever recorded in the history of CSN

in the current configuration of the plants and the highest since 2016. In other words, the decrease compared to 2Q23 is exclusively due

to a lower volume of iron ore purchased from third parties, a move in line with the strategy adopted for this year to prioritize margin

over volume. |

Sales Volume – Mining (Thousand tons)

| · | Sales volume, in turn,

reached 10,792.2 thousand tons in 2Q24, 18.0% higher than the volume recorded in the first quarter of 2024, which is in line with seasonality

and the operational improvement that has been recorded each quarter. Compared to 2Q23, there was a 4.1% decrease in sales volume, despite

the strong reduction in the volume of purchases from third parties. |

·

In 2Q24, Adjusted Net Revenue amounted to R$3,347,1

million, a performance 18.5% higher than in 1Q24, as a direct result of the higher shipments volumes. Net Unitary Revenue was US$

58.64 per ton, a decrease of 5.4% from 1Q24, reflecting the downward trend in the average price of the iron ore and a greater demerit

of the exported product, consistent with the higher Chinese demand for lower-quality iron ore.

·

In turn, the Cost of Goods Sold totaled R$1,998,5

million in 2Q24, an increase of 43.0% over the previous quarter, due to the higher pace of production and sales. C1 costs

reached USD 21.2/t in 2Q24, a decrease of 10.2% compared to the previous quarter, reflecting the greater dilution of fixed costs,

exchange rate variations and lower railroad costs.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 14 |

| RESULTS 2Q24 |

| | |

·

Adjusted EBITDA reached R$1,590,4 million in

2Q24, with a quarterly Adjusted EBITDA margin of 47.5%, which represents an increase of 8.1 p.p. compared to 1Q24. This increase in profitability,

even in a period of falling realized prices, is a direct result of the operational excellence achieved by the Company, combining record

of own production in the current plant configuration with optimization of the logistics network and cost reduction. In addition, the exchange

rate devaluation also had a positive impact on the quarter's results.

Build-up Adjusted EBITDA (R$ Million)

Cement Results

The National Cement Industry Union (SNIC) reported

that the first half of 2024 was marked by an interruption in the decline in interest rates, high household indebtedness, and extreme weather

events, including heavy rains in the South and drought in the Midwest and North region of Brazil. Even so, cement sales accumulated an

increase of 1.2% compared to the same period in 2023, with the sale of 30.6 million tons in the first six months of the year.

In the case of CSN, the performance was no different

and the Company continued to advance in its strategy of entering new markets, with an increasingly larger and more efficient logistics

network and distribution centers. With this, the Company managed to achieve new historical records in production and sales, with commercial

activity reaching a total of 3,608.0 Kton sold, which represents an increase of 19.6% compared to the previous quarter and 8.3% compared

to the same period in 2023.

Sales Volume – Cement (Thousand tons)

| · | Net revenue reached

R$1,238.4 million in 2Q24, an increase of 14.7% compared to the previous quarter. This reflects the higher sales volume, which offset

the still very pressured price environment during the period. |

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 15 |

| RESULTS 2Q24 |

| | |

| · | In 2Q24, cement COGS

increased by 7.0% compared to the first quarter of 2024. This is in line with the typical seasonal pattern of commercial activity and

represents a much lower increase than the growth in revenue. This further demonstrates the positive impact of our strategic initiatives

on capturing synergies and enhancing operational efficiency across the segment. |

| · | As a result, Adjusted EBITDA

increased by 24.5% compared to the previous quarter, reaching R$346 million in 2Q24 and with an EBITDA margin of 28.0%. This represents

an 8.4 p.p. increase in profitability which demonstrates the success of leveraging synergies from acquisitions and highlights the effectiveness

of the segment's assertive commercial strategy in recent quarters. |

Energy Results

The energy segment was significantly impacted

by the extreme weather event that occurred in Rio Grande do Sul in May of this year. Consequently, Net Revenue reached R$102.8

million in the second quarter of 2024, representing a 1.1% reduction compared to the first quarter of 2024. Adjusted EBITDA reached

R$13.9 million, with an adjusted EBITDA margin of 13.6%. This represents a reduction of 14.3 p.p. compared to the previous quarter.

CSN recognizes that these are one-time results

due to an unparalleled climatic event in Brazil's history and is taking measures to normalize affected operations, with the goal of resuming

the upward trajectory of results previously demonstrated by this business unit.

Logistics Results

In the most recent quarter, the Logistics segment

achieved another quarter of positive results, with an Adjusted EBITDA growth of 11.7% compared to the previous quarter and 13.3% compared

to the same period last year, reaching R$413.6 million. The adjusted EBITDA margin saw a slight decline of 0.8 p.p. to 49.3% in 2Q24.

Railway Logistics generated Net Revenue

of R$759.5 million in 2Q24, with an Adjusted EBITDA of R$387.6 million and an adjusted EBITDA margin of 51.0%. In comparison

with the first quarter of 2024, revenue increased by 13.0%, with adjusted EBITDA 10.2% higher.

In the Port Logistics, Sepetiba Tecon

handled 342,000 tons of steel products, 25,000 containers, 6,000 tons of general cargo, and 62,000 tons of bulk cargo in the second quarter

of 2024. In comparison with the same period in the previous year, the company increased its shipments, resulting in a 45.9% increase in

net revenue from the port segment, reaching R$79.2 million. The adjusted EBITDA was also affected, reaching R$26.0 million in 2Q24 with

an adjusted EBITDA margin of 32.9%, or 27.9 p.p. higher than in 2Q23.

ESG – Environmental, Social & Governance

ESG PERFOMANCE – GRUPO CSN

Since the beginning of 2023, CSN has adopted

a new format for disclosing its ESG actions and performance, making its performance in ESG indicators available on an individualized basis.

The new model allows stakeholders to have quarterly access to key results and indicators and to monitor them in an effective and even

more agile way. Access can be made through the results center of CSN's IR website: https://ri.csn.com.br/informacoes-financeiras/central-de-resultados/.

The information included in this release has

been selected based on its relevance and materiality to the company. Quantitative indicators are presented in comparison with the period

that best represents the metric for monitoring them. Thus, some are compared with the same quarter of the previous year, and others with

the average of the previous period, ensuring a comparison based on seasonality and periodicity. In addition, it is important to highlight

that the ESG Performance Report also incorporates the performance indicators of CSN Cimentos' new assets, acquired in 2022, so that some

absolute indicators will undergo significant changes when compared to the previous period.

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 16 |

| RESULTS 2Q24 |

| | |

More detailed historical data on CSN's performance

and initiatives can be found in the 2023 Integrated Report, released in May 2024 (https://esg.csn.com.br/nossa-empresa/relatorio-integrado-gri).

The review of ESG indicators occurs annually for the closing of the Integrated Report, so the information contained in the quarterly releases

is subject to adjustments resulting from this process.

It is also possible to monitor CSN's ESG performance

in an agile and transparent manner, on our website, through the following electronic address: https://esg.csn.com.br.

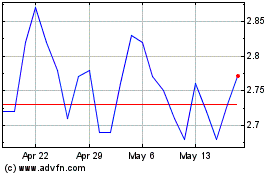

Capital Markets

In the second quarter of 2024, CSN shares

fell 217.8%, while the Ibovespa fell 3.3%. The average daily volume (CSNA3) traded on B3 was R$101.1 million in 2Q24. On the New York

Stock Exchange (NYSE), the company's American Depositary Receipts (ADRs) fell by 26.5% in 2Q24, while the Dow Jones index

fell by 1.6%. The average daily trading of ADRs (SID) on the NYSE in 2Q24 was US$ 6.6 million.

| |

2Q24 |

| No. of shares in thousands |

|

1.326.094 |

| Market Value |

|

|

| Closing Price (R$/share) |

|

12,91 |

| Closing Price (US$/ADR) |

|

2,30 |

| Market Value (R$ million) |

|

17.120 |

| Market Value (US$ million) |

|

3.050 |

| Change over the period |

|

|

| CSNA3 (BRL) |

|

-17,8% |

| SID (USD) |

|

-26,5% |

| Ibovespa (BRL) |

|

-3,3% |

| Dow Jones (USD) |

|

1,6% |

| Volume |

|

|

| Daily average (thousand shares) |

|

7.379 |

| Daily average (R$ thousand) |

|

101.130 |

| Daily average (thousand ADRs) |

|

2.465 |

| Daily average (US$ thousand) |

|

6.614 |

|

Source: Bloomberg

|

|

|

| |

|

|

|

Earnings Conference Call:

2Q24

Results Presentation Webcast Investor Relations Team

| Conference call in Portuguese with simultaneous translation into English August 13th, 2024 11:30 a.m. (Brasília time) 10:30 a.m. (New York time) Webinar: click here |

Antonio Marco Campos Rabello - CFO and IR Executive Director

Pedro Gomes de Souza (pedro.gs@csn.com.br)

Mayra Favero Celleguin (mayra.celleguin@csn.com.br)

|

Some of the statements contained herein are forward-looking

statements that express or imply expected results, performance or events. These outlooks include future results that may be influenced

by historical results and by the statements made under 'Outlook'. Actual results, performance and events may differ materially from the

assumptions and outlook and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange

rate levels; protectionist measures in the US, Brazil and other countries; changes in laws and regulations; and general competitive factors

(on a global, regional or national basis).

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 17 |

| RESULTS 2Q24 |

| | |

INCOME STATEMENT

Corporate Law – In Thousands of Reais

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 18 |

| RESULTS 2Q24 |

| | |

BALANCE SHEET

Corporate Law – In Thousands of Reais

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 19 |

| RESULTS 2Q24 |

| | |

CASH FLOW STATEMENT

Corporate Law – In Thousands of Reais

| | |

| For more information, visit our website: https://ri.csn.com.br/ | 20 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 13, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Antonio Marco Campos Rabello

|

| |

Antonio Marco Campos Rabello

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

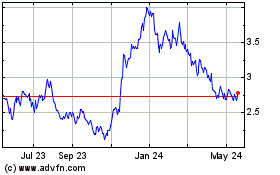

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Oct 2024 to Nov 2024

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2023 to Nov 2024