SmartFinancial, Inc. ("SmartFinancial" or the "Company"; NYSE:

SMBK), today announced net income of $9.1 million, or $0.54 per

diluted common share, for the third quarter of 2024, compared to

net income of $2.1 million, or $0.12 per diluted common share, for

the third quarter of 2023, and compared to prior quarter net income

of $8.0 million, or $0.48 per diluted common share. Operating

earnings1, which excludes non-recurring income, net of tax

adjustments, totaled $9.1 million, or $0.54 per diluted common

share, in the third quarter of 2024, compared to $7.2 million, or

$0.43 per diluted common share, in the third quarter of 2023, and

compared to $7.8 million, or $0.46 per diluted common share, in the

second quarter of 2024.

Highlights for the Third Quarter of 2024

- Operating earnings1 of $9.1 million, or $0.54 per diluted

common share

- Net organic loan and lease growth of $144 million with 16%

annualized quarter-over-quarter increase

- Quarter-over-quarter net tax equivalent interest margin

expansion of 14 basis points to 3.11%

- 19% annualized quarter-over-quarter increase in tangible book

value per common share1

- Credit quality remains solid with nonperforming assets to total

assets of 0.26%

- Established a Real Estate Investment Trust (“REIT”) subsidiary

as a tax saving strategy

Billy Carroll, President & CEO, stated: “As we talked about

last quarter, the sales energy throughout our Company remains very

positive as demonstrated by our 16% quarterly annualized loan and

lease growth. Margin continues to inflect, up another 14 basis

points to 3.11% for the quarter, and we continue to position our

balance sheet for optimized returns. Credit quality remained

strong, and I am pleased with our diligence around expense control.

As we look ahead, we are confident in our ability to further

enhance profitability and deliver strong tangible book value per

share growth.”

SmartFinancial's Chairman, Miller Welborn, concluded: “This

quarter was a further demonstration of our team’s ability to

execute our plan. The Board was especially pleased with the

Company’s operating leverage expansion and quarterly tangible book

value per share growth of nearly 9% annualized. And while financial

results are important, we don’t take for granted SmartBank’s

incredible culture. SmartBank’s certification as a Great Place to

Work by over 94% of its employee base is a tremendous honor and we

look forward to continuing our tradition of being a premier

employment destination.”

Net Interest Income and Net Interest Margin

Net interest income was $35.0 million for the third quarter of

2024, compared to $32.8 million for the prior quarter. Average

earning assets totaled $4.5 billion for the current and prior

quarters. The categories of average earnings assets changed

quarter-over-quarter, primarily from an increase in average loans

and leases of $130.5 million, offset by a decrease in average

securities of $15.7 million and average interest-earning cash of

$79.2 million. Average interest-bearing liabilities increased by

$21.4 million from the prior quarter, primarily attributable to an

increase in average borrowings of $40.9 million, offset by a

decrease in average deposits of $18.2 million.

The tax equivalent net interest margin was 3.11% for the third

quarter of 2024, compared to 2.97% for the prior quarter. The tax

equivalent net interest margin was positively impacted by the

increased yield on interest-earning assets, quarter-over-quarter,

coupled with no change in the cost of interest-bearing liabilities,

quarter-over-quarter. The yield on loans and leases, excluding loan

fees, on a fully tax equivalent basis (“FTE”) was 5.95% for the

third quarter, compared to 5.80% for the prior quarter.

The cost of total deposits for the third quarter of 2024 was

2.54% compared to 2.56% in the prior quarter. The cost of

interest-bearing liabilities was 3.29% for the third quarter of

2024 and the prior quarter. The cost of average interest-bearing

deposits was 3.20% for the third quarter of 2024, compared to 3.23%

for the prior quarter, a decrease of 3 basis points.

1 Non-GAAP measure. See “Non-GAAP

Financial Measures” for more information and see the Non-GAAP

Reconciliations

The following table presents selected interest rates and yields

for the periods indicated:

Three Months Ended

Sep

Jun

Increase

Selected Interest Rates and Yields

2024

2024

(Decrease)

Yield on loans and leases, excluding loan

fees, FTE

5.95

%

5.80

%

0.15

%

Yield on loans and leases, FTE

6.02

%

5.87

%

0.15

%

Yield on earning assets, FTE

5.65

%

5.52

%

0.13

%

Cost of interest-bearing deposits

3.20

%

3.23

%

(0.03

)%

Cost of total deposits

2.54

%

2.56

%

(0.02

)%

Cost of interest-bearing liabilities

3.29

%

3.29

%

-

%

Net interest margin, FTE

3.11

%

2.97

%

0.14

%

Provision for Credit Losses on Loans and Leases and Credit

Quality

At September 30, 2024, the allowance for credit losses was $35.6

million. The allowance for credit losses to total loans and leases

was 0.96% as of September 30, 2024, compared to 0.97% as of June

30, 2024.

The following table presents detailed information related to the

provision for credit losses for the periods indicated (dollars in

thousands):

Three Months Ended

Sep

Jun

Increase

Provision for Credit Losses on Loans and

Leases Rollforward

2024

2024

(Decrease)

Beginning balance

$

34,690

$

34,203

$

487

Charge-offs

(1,426

)

(457

)

(969

)

Recoveries

72

48

24

Net (charge-offs) recoveries

(1,354

)

(409

)

(945

)

Provision for credit losses (1)

2,273

896

1,377

Ending balance

$

35,609

$

34,690

$

919

Allowance for credit losses to total loans

and leases, gross

0.96

%

0.97

%

(0.01

)%

(1) The current quarter-ended and prior

quarter-ended excludes unfunded commitments provision of $302

thousand and a release of $13 thousand, respectively. At September

30, 2024, the unfunded commitment liability totaled $2.3

million.

Nonperforming loans and leases as a percentage of total loans

and leases was 0.26% as of September 30, 2024, an increase of 7

basis points from the 0.19% reported in the second quarter of 2024.

Total nonperforming assets (which include nonaccrual loans and

leases, loans and leases past due 90 days or more and still

accruing, other real estate owned and other repossessed assets) as

a percentage of total assets was 0.26% as of September 30, 2024,

and 0.20% as of June 30, 2024.

The following table presents detailed information related to

credit quality for the periods indicated (dollars in

thousands):

Three Months Ended

Sep

Jun

Increase

Credit Quality

2024

2024

(Decrease)

Nonaccrual loans and leases

$

9,319

$

6,432

$

2,887

Loans and leases past due 90 days or more

and still accruing

172

210

(38

)

Total nonperforming loans and leases

9,491

6,642

2,849

Other real estate owned

179

688

(509

)

Other repossessed assets

2,949

2,645

304

Total nonperforming assets

$

12,619

$

9,975

$

2,644

Nonperforming loans and leases to total

loans and leases, gross

0.26

%

0.19

%

0.07

%

Nonperforming assets to total assets

0.26

%

0.20

%

0.06

%

Noninterest Income

Noninterest income increased $1.5 million to $9.1 million for

the third quarter of 2024 compared to $7.6 million for the prior

quarter. The current quarter increase was primarily associated with

a $579 thousand increase in investment services from a higher

volume of investment activity, a $193 thousand increase in

insurance commissions from new policies and renewals and a $607

thousand increase in other from fees related to capital markets

activity.

The following table presents detailed information related to

noninterest income for the periods indicated (dollars in

thousands):

Three Months Ended

Sep

Jun

Increase

Noninterest Income

2024

2024

(Decrease)

Service charges on deposit accounts

$

1,780

$

1,692

$

88

Mortgage banking income

410

348

62

Investment services

1,881

1,302

579

Insurance commissions

1,477

1,284

193

Interchange and debit card transaction

fees

1,349

1,343

6

Other

2,242

1,635

607

Total noninterest income

$

9,139

$

7,604

$

1,535

Noninterest Expense

Noninterest expense increased $1.6 million to $30.8 million for

the third quarter of 2024 compared to $29.2 million for the prior

quarter. The current quarter increase was primarily related to an

increase in salaries and employee benefits related to incentive

accruals for production performance.

The following table presents detailed information related to

noninterest expense for the periods indicated (dollars in

thousands):

Three Months Ended

Sep

Jun

Increase

Noninterest Expense

2024

2024

(Decrease)

Salaries and employee benefits

$

18,448

$

17,261

$

1,187

Occupancy and equipment

3,423

3,324

99

FDIC insurance

825

825

-

Other real estate and loan related

expenses

460

538

(78

)

Advertising and marketing

327

295

32

Data processing and technology

2,519

2,452

67

Professional services

1,201

1,064

137

Amortization of intangibles

604

608

(4

)

Other

3,039

2,834

205

Total noninterest expense

$

30,846

$

29,201

$

1,645

Income Tax Expense

Income tax expense was $1.6 million for the third quarter of

2024, a decrease of $721 thousand, compared to $2.3 million for the

prior quarter. The decrease was due to a reduction in the Bank’s

annual state income tax expense as a result of the establishment of

the Bank’s newly formed REIT. The REIT will create a more

tax-effective structure that will result in a lower effective tax

rate during future periods by lowering the Bank’s state income tax

expense.

Balance Sheet Trends

Total assets at September 30, 2024 were $4.91 billion compared

to $4.83 billion at December 31, 2023. The $79.5 million increase

is primarily attributable to increases loans and leases of $273.0

million and bank owned life insurance of $21.6 million, offset by a

decrease in securities of $60.5 million and cash and cash

equivalents of $159.4 million.

Total liabilities were $4.42 billion at September 30, 2024,

compared to $4.37 billion at December 31, 2023, an increase of

$50.4 million. Total deposits increased $54.6 million, which was

driven primarily by the issuance of brokered deposits of $174.8

million, increase in other time deposits of $44.3 million and

savings deposits of $42.4 million, offset by a decline in

interest-bearing demand deposits of $172.7 million and noninterest

bearing deposits of $34 million. Other liabilities increased $2.3

million, which was offset by a decrease in borrowings of $4.1

million and subordinated debt of $2.4 million. During the quarter,

the Bank elected not to pursue a higher cost public funds

depository relationship and utilized Federal Home Loan Advances

temporarily, which was replaced with brokered deposits.

Shareholders' equity at September 30, 2024, totaled $489.0

million, an increase of $29.1 million, from December 31, 2023. The

increase in shareholders' equity was primarily driven by net income

of $26.5 million for the nine months ended September 30, 2024, and

a positive change of $8.6 million in accumulated other

comprehensive income, offset by dividends paid of $4.1 million.

Tangible book value per share2 was $22.67 at September 30, 2024,

compared to $20.76 at December 31, 2023. Tangible common equity1 as

a percentage of tangible assets1 was 7.99% at September 30, 2024,

compared with 7.47% at December 31, 2023.

The following table presents selected balance sheet information

for the periods indicated (dollars in thousands):

Sep

Dec

Increase

Selected Balance Sheet Information

2024

2023

(Decrease)

Total assets

$

4,908,934

$

4,829,387

$

79,547

Total liabilities

4,419,911

4,369,501

50,410

Total equity

489,023

459,886

29,137

Securities

629,115

689,646

(60,531

)

Loans and leases

3,717,478

3,444,462

273,016

Deposits

4,322,491

4,267,854

54,637

Borrowings

8,997

13,078

(4,081

)

Conference Call Information

SmartFinancial issued this earnings release for the third

quarter of 2024 on Monday, October 21, 2024, and will host a

conference call on Tuesday, October 22, 2024, at 10:00 a.m. ET. To

access this interactive teleconference, dial (833) 470-1428 or

(404) 975-4839 and entering the access code, 599429. A

replay of the conference call will be available through December

21, 2024, by dialing (866) 813-9403 or (929) 458-6194 and entering

the access code, 195203. Conference call materials will be

published on the Company’s webpage located at

http://www.smartfinancialinc.com/CorporateProfile, at 9:00 a.m. ET

prior to the conference call.

About SmartFinancial, Inc.

SmartFinancial, Inc., based in Knoxville, Tennessee, is the bank

holding company for SmartBank. SmartBank is a full-service

commercial bank founded in 2007, with branches across Tennessee,

Alabama, and Florida. Recruiting the best people, delivering

exceptional client service, strategic branching, and a disciplined

approach to lending have contributed to SmartBank’s success. More

information about SmartFinancial can be found on its website:

www.smartfinancialinc.com.

1 Non-GAAP measure. See “Non-GAAP

Financial Measures” for more information and see the Non-GAAP

Reconciliation

Non-GAAP Financial Measures

Statements included in this earnings release include measures

not recognized under U.S. generally accepted accounting principles

(“GAAP”) and therefore are considered Non-GAAP financial measures

(“Non-GAAP”) and should be read along with the accompanying tables,

which provide a reconciliation of Non-GAAP financial measures to

GAAP financial measures. SmartFinancial management uses several

Non-GAAP financial measures and ratios derived therefrom in its

analysis of the Company's performance, including:

- Operating earnings

- Operating noninterest income

- Operating noninterest expense

- Operating pre-provision net revenue (“PPNR”) earnings

- Tangible common equity

- Average tangible common equity

- Tangible book value per common share

- Tangible assets

Operating earnings, operating noninterest income, operating

noninterest expense and operating PPNR earnings exclude

non-operating related income and expense items from net income,

noninterest income and noninterest expense, respectively. Tangible

common equity and average tangible common equity exclude goodwill

and other intangible assets from shareholders' equity and average

shareholders' equity, respectively. Tangible book value per common

share is tangible common equity divided by common shares

outstanding. Tangible assets excludes goodwill and other

intangibles from total assets. A detailed reconciliation of these

items and the ratios derived therefrom is available in the Non-GAAP

reconciliations.

Management believes that Non-GAAP financial measures provide

additional useful information that allows investors to evaluate the

ongoing performance of the company and provide meaningful

comparisons to its peers. Management also believes these Non-GAAP

financial measures enhance investors' ability to compare

period-to-period financial results and allow investors and company

management to view our operating results excluding the impact of

items that are not reflective of the underlying operating

performance.

Non-GAAP financial measures should not be considered as an

alternative to any measure of performance or financial condition as

promulgated under GAAP, and investors should consider

SmartFinancial's performance and financial condition as reported

under GAAP and all other relevant information when assessing the

performance or financial condition of the company. Non-GAAP

financial measures have limitations as analytical tools, and

investors should not consider them in isolation or as a substitute

for analysis of the results or financial condition as reported

under GAAP.

Forward-Looking Statements

This news release may contain statements that are based on

management’s current estimates or expectations of future events or

future results, and that may be deemed to constitute

forward-looking statements as defined under the Private Securities

Litigation Reform Act of 1995. These statements are not historical

in nature and can generally be identified by such words as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “may,”

“estimate,” and similar expressions. All forward-looking statements

are subject to risks, uncertainties, and other factors that may

cause the actual results of SmartFinancial to differ materially

from future results expressed or implied by such forward-looking

statements. Such risks, uncertainties, and other factors include,

among others,

- risks associated with our growth strategy, including a failure

to implement our growth plans or an inability to manage our growth

effectively;

- claims and litigation arising from our business activities and

from the companies we acquire, which may relate to contractual

issues, environmental laws, fiduciary responsibility, and other

matters;

- general risks related to our merger and acquisition activity,

including risks associated with our pursuit of future

acquisitions;

- changes in management’s plans for the future;

- prevailing, or changes in, economic or political conditions,

particularly in our market areas, including the effects of declines

in the real estate market, high unemployment rates, inflationary

pressures, elevated interest rates and slowdowns in economic

growth, as well as the financial stress on borrowers as a result of

the foregoing;

- our ability to anticipate interest rate changes and manage

interest rate risk (including the impact of higher interest rates

on macroeconomic conditions, competition, and the cost of doing

business and the impact of interest rate fluctuations on our

financial projections, models and guidance);

- increased technology and cybersecurity risks, including

generative artificial intelligence risks;

- credit risk associated with our lending activities;

- changes in loan demand, real estate values, or

competition;

- developments in our mortgage banking business, including loan

modifications, general demand, and the effects of judicial or

regulatory requirements or guidance;

- changes in accounting principles, policies, or guidelines;

- changes in applicable laws, rules, or regulations;

- adverse results from current or future litigation, regulatory

examinations or other legal and/or regulatory actions;

- potential impacts of adverse developments in the banking

industry highlighted by high-profile bank failures, including

impacts on customer confidence, deposit outflows, liquidity and the

regulatory response thereto;

- significant turbulence or a disruption in the capital or

financial markets and the effect of a fall in stock market prices

on our investment securities;

- the effects of war or other conflicts including the impacts

related to or resulting from Russia’s military action in Ukraine or

the conflict in Israel and surrounding areas; and

- other general competitive, economic, political, and market

factors, including those affecting our business, operations,

pricing, products, or services.

These and other factors that could cause results to differ

materially from those described in the forward-looking statements

can be found in SmartFinancial’s most recent annual report on Form

10-K, quarterly reports on Form 10-Q, and current reports on Form

8-K, in each case filed with or furnished to the Securities and

Exchange Commission (the “SEC”) and available on the SEC’s website

(www.sec.gov). Undue reliance should not be placed on

forward-looking statements. SmartFinancial disclaims any obligation

to update or revise any forward-looking statements contained in

this release, which speak only as of the date hereof, whether as a

result of new information, future events, or otherwise.

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

Ending Balances

Sep

Jun

Mar

Dec

Sep

2024

2024

2024

2023

2023

Assets:

Cash and cash equivalents

$

192,914

$

342,835

$

477,941

$

352,271

$

400,258

Securities available-for-sale, at fair

value

501,336

500,821

474,347

408,410

385,131

Securities held-to-maturity, at amortized

cost

127,779

128,996

180,169

281,236

282,313

Other investments

20,352

13,780

13,718

13,662

13,805

Loans held for sale

5,804

3,103

4,861

4,418

2,734

Loans and leases

3,717,478

3,574,158

3,477,555

3,444,462

3,378,999

Less: Allowance for credit losses

(35,609

)

(34,690

)

(34,203

)

(35,066

)

(33,687

)

Loans and leases, net

3,681,869

3,539,468

3,443,352

3,409,396

3,345,312

Premises and equipment, net

91,055

91,315

92,694

92,963

92,020

Other real estate owned

179

688

696

517

1,370

Goodwill and other intangibles, net

105,324

105,929

106,537

107,148

107,792

Bank owned life insurance

105,025

84,483

83,957

83,434

82,914

Other assets

77,297

79,591

76,418

75,932

83,522

Total assets

$

4,908,934

$

4,891,009

$

4,954,690

$

4,829,387

$

4,797,171

Liabilities:

Deposits:

Noninterest-bearing demand

$

863,949

$

903,300

$

907,254

$

898,044

$

923,763

Interest-bearing demand

834,207

988,057

996,298

1,006,915

993,717

Money market and savings

1,854,777

1,901,281

1,952,410

1,812,427

1,766,409

Time deposits

769,558

524,018

538,159

550,468

562,620

Total deposits

4,322,491

4,316,656

4,394,121

4,267,854

4,246,509

Borrowings

8,997

12,732

9,849

13,078

14,117

Subordinated debt

39,663

42,142

42,120

42,099

42,078

Other liabilities

48,760

47,014

41,804

46,470

47,815

Total liabilities

4,419,911

4,418,544

4,487,894

4,369,501

4,350,519

Shareholders' Equity:

Common stock

16,926

16,926

17,057

16,989

16,995

Additional paid-in capital

293,909

293,586

296,061

295,699

295,542

Retained earnings

195,537

187,751

181,103

173,105

168,271

Accumulated other comprehensive loss

(17,349

)

(25,798

)

(27,425

)

(25,907

)

(34,156

)

Total shareholders' equity

489,023

472,465

466,796

459,886

446,652

Total liabilities & shareholders'

equity

$

4,908,934

$

4,891,009

$

4,954,690

$

4,829,387

$

4,797,171

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands except share and

per share data)

Three Months Ended

Nine Months Ended

Sep

Jun

Mar

Dec

Sep

Sep

Sep

2024

2024

2024

2023

2023

2024

2023

Interest income:

Loans and leases, including fees

$

54,738

$

50,853

$

50,020

$

48,767

$

47,539

$

155,611

$

137,712

Investment securities:

Taxable

5,233

5,320

4,548

4,344

4,335

15,101

12,322

Tax-exempt

350

353

352

352

356

1,056

1,066

Federal funds sold and other earning

assets

3,635

4,759

4,863

4,032

3,045

13,255

9,448

Total interest income

63,956

61,285

59,783

57,495

55,275

185,023

160,548

Interest expense:

Deposits

27,350

27,439

27,035

24,926

23,433

81,824

59,333

Borrowings

709

148

128

162

210

985

775

Subordinated debt

865

884

899

890

626

2,647

1,877

Total interest expense

28,924

28,471

28,062

25,978

24,269

85,456

61,985

Net interest income

35,032

32,814

31,721

31,517

31,006

99,567

98,563

Provision for credit losses

2,575

883

(440

)

1,571

795

3,018

1,458

Net interest income after provision for

credit losses

32,457

31,931

32,161

29,946

30,211

96,549

97,105

Noninterest income:

Service charges on deposit accounts

1,780

1,692

1,612

1,673

1,736

5,084

4,838

Loss on sale of securities, net

—

—

—

—

(6,801

)

—

(6,801

)

Mortgage banking

410

348

280

227

309

1,038

813

Investment services

1,881

1,302

1,380

1,339

1,461

4,563

3,766

Insurance commissions

1,477

1,284

1,103

1,133

1,153

3,865

3,551

Interchange and debit card transaction

fees

1,349

1,343

1,253

1,370

1,357

3,945

4,087

Other

2,242

1,635

2,752

1,837

1,476

6,627

4,492

Total noninterest income

9,139

7,604

8,380

7,579

691

25,122

14,746

Noninterest expense:

Salaries and employee benefits

18,448

17,261

16,639

16,275

16,785

52,348

49,474

Occupancy and equipment

3,423

3,324

3,396

3,378

3,547

10,144

10,073

FDIC insurance

825

825

915

915

825

2,565

2,241

Other real estate and loan related

expense

460

538

584

781

603

1,582

1,616

Advertising and marketing

327

295

302

336

346

924

1,006

Data processing and technology

2,519

2,452

2,465

2,458

2,378

7,435

6,777

Professional services

1,201

1,064

924

1,136

735

3,190

2,307

Amortization of intangibles

604

608

612

643

647

1,824

1,981

Merger related and restructuring

expenses

—

—

—

—

110

—

110

Other

3,039

2,834

2,716

3,773

2,540

8,587

7,870

Total noninterest expense

30,846

29,201

28,553

29,695

28,516

88,599

83,455

Income before income taxes

10,750

10,334

11,988

7,830

2,386

33,072

28,396

Income tax expense

1,610

2,331

2,630

1,640

319

6,572

5,993

Net income

$

9,140

$

8,003

$

9,358

$

6,190

$

2,067

$

26,500

$

22,403

Earnings per common share:

Basic

$

0.55

$

0.48

$

0.56

$

0.37

$

0.12

$

1.58

$

1.33

Diluted

$

0.54

$

0.48

$

0.55

$

0.37

$

0.12

$

1.57

$

1.33

Weighted average common shares

outstanding:

Basic

16,726,658

16,770,819

16,849,735

16,814,647

16,807,548

16,782,200

16,801,840

Diluted

16,839,998

16,850,250

16,925,408

16,918,234

16,918,635

16,874,316

16,907,325

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

YIELD ANALYSIS

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Average

Yield/

Average

Yield/

Average

Yield/

Balance

Interest

Cost

Balance

Interest

Cost

Balance

Interest

Cost

Assets:

Loans and leases, including fees1

$

3,634,808

$

54,993

6.02

%

$

3,504,265

$

51,110

5.87

%

$

3,360,678

$

47,539

5.61

%

Taxable securities

564,978

5,233

3.68

%

580,517

5,320

3.69

%

743,054

4,335

2.31

%

Tax-exempt securities2

63,561

443

2.77

%

63,690

447

2.82

%

64,707

451

2.77

%

Federal funds sold and other earning

assets

267,252

3,634

5.41

%

346,459

4,759

5.52

%

229,487

3,045

5.26

%

Total interest-earning assets

4,530,599

64,303

5.65

%

4,494,931

61,636

5.52

%

4,397,926

55,370

4.99

%

Noninterest-earning assets

381,306

383,697

379,456

Total assets

$

4,911,905

$

4,878,628

$

4,777,382

Liabilities and Shareholders’

Equity:

Interest-bearing demand deposits

$

925,307

5,289

2.27

%

$

983,433

5,950

2.43

%

$

969,122

5,463

2.24

%

Money market and savings deposits

1,917,301

16,608

3.45

%

1,909,125

16,529

3.48

%

1,753,671

13,744

3.11

%

Time deposits

560,699

5,453

3.87

%

528,985

4,960

3.77

%

551,191

4,226

3.04

%

Total interest-bearing deposits

3,403,307

27,350

3.20

%

3,421,543

27,439

3.23

%

3,273,984

23,433

2.84

%

Borrowings

53,592

709

5.26

%

12,684

148

4.69

%

16,228

210

5.13

%

Subordinated debt

40,846

865

8.42

%

42,129

884

8.44

%

42,065

626

5.90

%

Total interest-bearing liabilities

3,497,745

28,924

3.29

%

3,476,356

28,471

3.29

%

3,332,277

24,269

2.89

%

Noninterest-bearing deposits

884,938

888,693

951,179

Other liabilities

50,580

47,208

48,494

Total liabilities

4,433,263

4,412,257

4,331,950

Shareholders' equity

478,642

466,371

445,432

Total liabilities and shareholders'

equity

$

4,911,905

$

4,878,628

$

4,777,382

Net interest income, taxable

equivalent

$

35,379

$

33,165

$

31,101

Interest rate spread

2.36

%

2.22

%

2.11

%

Tax equivalent net interest margin

3.11

%

2.97

%

2.81

%

Percentage of average interest-earning

assets to average interest-bearing liabilities

129.53

%

129.30

%

131.98

%

Percentage of average equity to average

assets

9.74

%

9.56

%

9.32

%

1 Yields computed on tax-exempt loans on a

tax equivalent basis include $255 thousand, $257 thousand, and $0

thousand of taxable equivalent income for the quarters ended

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively.

2 Yields computed on tax-exempt

instruments on a tax equivalent basis include $93 thousand, $94

thousand, and $95 thousand of taxable equivalent income for the

quarters ended September 30, 2024, June 30, 2024, and September 30,

2023, respectively.

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

YIELD ANALYSIS

Nine Months Ended

September 30, 2024

September 30, 2023

Average

Yield/

Average

Yield/

Balance

Interest

Cost

Balance

Interest

Cost

Assets:

Loans and leases, including fees1

$

3,532,768

$

156,123

5.90

%

$

3,309,616

$

137,712

5.56

%

Taxable securities

588,679

15,101

3.43

%

745,694

12,322

2.21

%

Tax-exempt securities2

63,804

1,336

2.80

%

65,170

1,349

2.77

%

Federal funds sold and other earning

assets

322,339

13,255

5.49

%

267,124

9,448

4.73

%

Total interest-earning assets

4,507,590

185,815

5.51

%

4,387,604

160,831

4.90

%

Noninterest-earning assets

381,743

365,123

Total assets

$

4,889,333

$

4,752,727

Liabilities and Shareholders’

Equity:

Interest-bearing demand deposits

$

968,139

17,299

2.39

%

$

954,585

14,583

2.04

%

Money market and savings deposits

1,910,452

49,285

3.45

%

1,770,232

35,912

2.71

%

Time deposits

543,887

15,240

3.74

%

508,600

8,838

2.32

%

Total interest-bearing deposits

3,422,478

81,824

3.19

%

3,233,417

59,333

2.45

%

Borrowings

25,941

985

5.07

%

19,309

775

5.37

%

Subordinated debt

41,691

2,647

8.48

%

42,044

1,877

5.97

%

Total interest-bearing liabilities

3,490,110

85,456

3.27

%

3,294,770

61,985

2.52

%

Noninterest-bearing deposits

882,168

972,507

Other liabilities

48,299

44,703

Total liabilities

4,420,577

4,311,980

Shareholders' equity

468,756

440,747

Total liabilities and shareholders'

equity

$

4,889,333

$

4,752,727

Net interest income, taxable

equivalent

$

100,359

$

98,846

Interest rate spread

2.24

%

2.39

%

Tax equivalent net interest margin

2.97

%

3.01

%

Percentage of average interest-earning

assets to average interest-bearing liabilities

129.15

%

133.17

%

Percentage of average equity to average

assets

9.59

%

9.27

%

1Yields computed on tax-exempt loans on a

tax equivalent basis included $512 thousand and $0 thousand of

taxable equivalent income for the nine months ended September 30,

2024, and 2023, respectively.

2Yields computed on tax-exempt instruments

on a tax equivalent basis included $280 thousand and $283 thousand

of taxable equivalent income for the nine months ended September

30, 2024, and 2023, respectively.

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

As of and for The Three Months

Ended

Sep

Jun

Mar

Dec

Sep

2024

2024

2024

2023

2023

Composition of Loans and

Leases:

Commercial real estate:

Owner occupied

$

868,077

$

829,085

$

804,557

$

798,416

$

776,402

Non-owner occupied

1,031,708

986,278

938,648

940,789

890,774

Commercial real estate, total

1,899,785

1,815,363

1,743,205

1,739,205

1,667,176

Commercial & industrial

731,600

701,460

667,903

645,918

617,115

Construction & land development

315,006

294,575

321,860

327,185

373,068

Consumer real estate

690,504

678,331

659,209

649,867

638,518

Leases

67,052

70,299

71,909

68,752

68,538

Consumer and other

13,531

14,130

13,469

13,535

14,584

Total loans and leases

$

3,717,478

$

3,574,158

$

3,477,555

$

3,444,462

$

3,378,999

Asset Quality and Additional Loan

Data:

Nonperforming loans and leases

$

9,491

$

6,642

$

6,266

$

8,101

$

4,163

Other real estate owned

179

688

696

517

1,370

Other repossessed assets

2,949

2,645

2,033

1,117

348

Total nonperforming assets

$

12,619

$

9,975

$

8,995

$

9,735

$

5,881

Modified loans and leases1 not included in

nonperforming loans and leases

$

4,053

$

4,241

$

4,413

$

4,245

$

2,376

Net charge-offs to average loans and

leases (annualized)

0.15

%

0.05

%

0.09

%

0.04

%

0.04

%

Allowance for credit losses to loans and

leases

0.96

%

0.97

%

0.98

%

1.02

%

1.00

%

Nonperforming loans and leases to total

loans and leases, gross

0.26

%

0.19

%

0.18

%

0.24

%

0.12

%

Nonperforming assets to total assets

0.26

%

0.20

%

0.18

%

0.20

%

0.12

%

Capital Ratios:

Equity to Assets

9.96

%

9.66

%

9.42

%

9.52

%

9.31

%

Tangible common equity to tangible assets

(Non-GAAP)2

7.99

%

7.66

%

7.43

%

7.47

%

7.23

%

SmartFinancial, Inc.3

Tier 1 leverage

8.44

%

8.32

%

8.23

%

8.27

%

8.13

%

Common equity Tier 1

10.06

%

10.06

%

10.20

%

10.14

%

10.07

%

Tier 1 capital

10.06

%

10.06

%

10.20

%

10.14

%

10.07

%

Total capital

11.63

%

11.68

%

11.85

%

11.78

%

11.90

%

SmartBank

Estimated4

Tier 1 leverage

9.18

%

9.11

%

9.07

%

9.18

%

9.00

%

Common equity Tier 1

10.92

%

11.02

%

11.23

%

11.26

%

11.15

%

Tier 1 capital

10.92

%

11.02

%

11.23

%

11.26

%

11.15

%

Total capital

11.70

%

11.79

%

12.00

%

12.02

%

11.87

%

1Borrowers that have experienced financial

difficulty.

2Total common equity less intangibles

divided by total assets less intangibles. See reconciliation of

Non-GAAP measures.

3All periods presented are estimated.

4 Current period capital ratios are

estimated as of the date of this earnings release.

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands except share and

per share data)

As of and for The

As of and for The

Three Months Ended

Nine Months Ended

Sep

Jun

Mar

Dec

Sep

Sep

Sep

2024

2024

2024

2023

2023

2024

2023

Selected Performance Ratios

(Annualized):

Return on average assets

0.74

%

0.66

%

0.77

%

0.52

%

0.17

%

0.72

%

0.63

%

Return on average shareholders' equity

7.60

%

6.90

%

8.16

%

5.46

%

1.84

%

7.55

%

6.80

%

Return on average tangible common

equity¹

9.75

%

8.94

%

10.63

%

7.18

%

2.43

%

9.77

%

9.02

%

Noninterest income / average assets

0.74

%

0.63

%

0.69

%

0.63

%

0.06

%

0.69

%

0.41

%

Noninterest expense / average assets

2.50

%

2.41

%

2.35

%

2.47

%

2.37

%

2.42

%

2.35

%

Efficiency ratio

69.83

%

72.25

%

71.20

%

75.95

%

89.96

%

71.06

%

73.65

%

Operating Selected Performance Ratios

(Annualized):

Operating return on average assets1

0.74

%

0.64

%

0.69

%

0.57

%

0.60

%

0.69

%

0.77

%

Operating PPNR return on average

assets1

1.08

%

0.90

%

0.84

%

0.86

%

0.84

%

0.94

%

1.03

%

Operating return on average shareholders'

equity1

7.60

%

6.72

%

7.29

%

6.07

%

6.41

%

7.21

%

8.35

%

Operating return on average tangible

common equity1

9.75

%

8.70

%

9.49

%

7.98

%

8.46

%

9.32

%

11.09

%

Operating efficiency ratio1

69.28

%

72.13

%

73.50

%

73.41

%

73.60

%

71.55

%

69.23

%

Operating noninterest income / average

assets1

0.74

%

0.60

%

0.58

%

0.63

%

0.62

%

0.64

%

0.61

%

Operating noninterest expense / average

assets1

2.50

%

2.41

%

2.35

%

2.39

%

2.36

%

2.42

%

2.34

%

Selected Interest Rates and

Yields:

Yield on loans and leases, excluding loan

fees, FTE

5.95

%

5.80

%

5.71

%

5.61

%

5.52

%

5.82

%

5.37

%

Yield on loans and leases, FTE

6.02

%

5.87

%

5.82

%

5.68

%

5.61

%

5.90

%

5.56

%

Yield on earning assets, FTE

5.65

%

5.52

%

5.36

%

5.22

%

4.99

%

5.51

%

4.90

%

Cost of interest-bearing deposits

3.20

%

3.23

%

3.16

%

3.00

%

2.84

%

3.19

%

2.45

%

Cost of total deposits

2.54

%

2.56

%

2.52

%

2.35

%

2.20

%

2.54

%

1.89

%

Cost of interest-bearing liabilities

3.29

%

3.29

%

3.23

%

3.07

%

2.89

%

3.27

%

2.52

%

Net interest margin, FTE

3.11

%

2.97

%

2.85

%

2.86

%

2.81

%

2.97

%

3.01

%

Per Common Share:

Net income, basic

$

0.55

$

0.48

$

0.56

$

0.37

$

0.12

$

1.58

$

1.33

Net income, diluted

0.54

0.48

0.55

0.37

0.12

1.57

1.33

Operating earnings, basic¹

0.55

0.47

0.50

0.41

0.43

1.51

1.64

Operating earnings, diluted¹

0.54

0.46

0.49

0.41

0.43

1.50

1.63

Book value

28.89

27.91

27.37

27.07

26.28

28.89

26.28

Tangible book value¹

22.67

21.66

21.12

20.76

19.94

22.67

19.94

Common shares outstanding

16,926,374

16,925,902

17,056,704

16,988,879

16,994,543

16,926,374

16,994,543

1Non-GAAP measure. See reconciliation of

Non-GAAP measures.

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

NON-GAAP RECONCILIATIONS

Three Months Ended

Nine Months Ended

Sep

Jun

Mar

Dec

Sep

Sep

Sep

2024

2024

2024

2023

2023

2024

2023

Operating Earnings:

Net income (GAAP)

$

9,140

$

8,003

$

9,358

$

6,190

$

2,067

$

26,500

$

22,403

Noninterest income:

Securities (gains) losses, net

—

—

—

—

6,801

—

6,801

Gain on sale of former branch building

—

(283

)

(1,346

)

—

—

(1,629

)

—

Noninterest expenses:

Donation of a former branch location

—

—

—

250

—

—

—

Accruals for pending litigation

—

—

—

675

—

—

—

Merger related and restructuring

expenses

—

—

—

—

110

—

110

Income taxes:

Income tax effect of adjustments

—

73

348

(239

)

(1,785

)

421

(1,785

)

Operating earnings (Non-GAAP)

$

9,140

$

7,793

$

8,360

$

6,876

$

7,193

$

25,292

$

27,529

Operating earnings per common share

(Non-GAAP):

Basic

$

0.55

$

0.47

$

0.50

$

0.41

$

0.43

$

1.51

$

1.64

Diluted

0.54

0.46

0.49

0.41

0.43

1.50

1.63

Operating Noninterest Income:

Noninterest income (GAAP)

$

9,139

$

7,604

$

8,380

$

7,579

$

691

$

25,122

$

14,746

Securities (gains) losses, net

—

—

—

—

6,801

—

6,801

Gain on sale of former branch building

—

(283

)

(1,346

)

—

—

(1,629

)

—

Operating noninterest income

(Non-GAAP)

$

9,139

$

7,321

$

7,034

$

7,579

$

7,492

$

23,493

$

21,547

Operating noninterest income

(Non-GAAP)/average assets1

0.74

%

0.60

%

0.58

%

0.63

%

0.62

%

0.64

%

0.61

%

Operating Noninterest Expense:

Noninterest expense (GAAP)

$

30,846

$

29,201

$

28,553

$

29,695

$

28,516

$

88,599

$

83,455

Donation of a former branch location

—

—

—

(250

)

—

—

—

Accruals for pending litigation

—

—

—

(675

)

—

—

—

Merger related and restructuring

expenses

—

—

—

—

(110

)

—

(110

)

Operating noninterest expense

(Non-GAAP)

$

30,846

$

29,201

$

28,553

$

28,770

$

28,406

$

88,599

$

83,345

Operating noninterest expense

(Non-GAAP)/average assets2

2.50

%

2.41

%

2.35

%

2.39

%

2.36

%

2.42

%

2.34

%

Operating Pre-provision Net revenue

("PPNR") Earnings:

Net interest income (GAAP)

$

35,032

$

32,814

$

31,721

$

31,517

$

31,006

$

99,567

$

98,563

Operating noninterest income

(Non-GAAP)

9,139

7,321

7,034

7,579

7,492

23,493

21,547

Operating noninterest expense

(Non-GAAP)

(30,846

)

(29,201

)

(28,553

)

(28,770

)

(28,406

)

(88,599

)

(83,345

)

Operating PPNR earnings (Non-GAAP)

$

13,325

$

10,934

$

10,202

$

10,326

$

10,092

$

34,461

$

36,765

Non-GAAP Return Ratios:

Operating return on average assets

(Non-GAAP)3

0.74

%

0.64

%

0.69

%

0.57

%

0.60

%

0.69

%

0.77

%

Operating PPNR return on average assets

(Non-GAAP)4

1.08

%

0.90

%

0.84

%

0.86

%

0.84

%

0.94

%

1.03

%

Return on average tangible common equity

(Non-GAAP)5

9.75

%

8.93

%

10.63

%

7.18

%

2.43

%

9.77

%

9.02

%

Operating return on average shareholders'

equity (Non-GAAP)6

7.60

%

6.72

%

7.29

%

6.07

%

6.41

%

7.21

%

8.35

%

Operating return on average tangible

common equity (Non-GAAP)7

9.75

%

8.70

%

9.49

%

7.98

%

8.46

%

9.32

%

11.09

%

Operating Efficiency Ratio:

Efficiency ratio (GAAP)

69.83

%

72.25

%

71.20

%

75.95

%

89.96

%

71.06

%

73.65

%

Adjustment for taxable equivalent

yields

(0.55

)

%

(0.63

)

%

(0.17

)

%

(0.18

)

%

(0.27

)

%

(0.45

)

%

(0.18

)

%

Adjustment for securities gains

(losses)

—

%

—

%

—

%

—

%

(15.89

)

%

—

%

(4.17

)

%

Adjustment for sale of branch location

—

%

0.51

%

2.46

%

—

%

—

%

0.94

%

—

%

Adjustment for donation of a former branch

location

—

%

—

%

—

%

(0.64

)

%

—

%

—

%

—

%

Adjustment for accruals for pending

litigation

—

%

—

%

—

%

(1.72

)

%

—

%

—

%

—

%

Adjustment for merger related income and

costs

—

%

—

%

—

%

—

%

(0.20

)

%

—

%

(0.07

)

%

Operating efficiency ratio (Non-GAAP)

69.28

%

72.13

%

73.50

%

73.41

%

73.60

%

71.55

%

69.23

%

1Operating noninterest income (Non-GAAP)

is annualized and divided by average assets.

2Operating noninterest expense (Non-GAAP)

is annualized and divided by average assets.

3Operating return on average assets

(Non-GAAP) is the annualized operating earnings (Non-GAAP) divided

by average assets.

4Operating PPNR return on average assets

(Non-GAAP) is the annualized operating PPNR earnings (Non-GAAP)

divided by average assets.

5Return on average tangible common equity

(Non-GAAP) is the annualized net income divided by average tangible

common equity (Non-GAAP).

6Operating return on average shareholders’

equity (Non-GAAP) is the annualized operating earnings (Non-GAAP)

divided by average equity.

7Operating return on average tangible

common equity (Non-GAAP) is the annualized operating earnings

(Non-GAAP) divided by average tangible common equity

(Non-GAAP).

SmartFinancial, Inc. and

Subsidiary

Condensed Consolidated Financial

Information - (unaudited)

(dollars in thousands)

NON-GAAP RECONCILIATIONS

Three Months Ended

Sep

Jun

Mar

Dec

Sep

2024

2024

2024

2023

2023

Tangible Common Equity:

Shareholders' equity (GAAP)

$

489,023

$

472,465

$

466,796

$

459,886

$

446,652

Less goodwill and other intangible

assets

105,324

105,929

106,537

107,148

107,792

Tangible common equity (Non-GAAP)

$

383,699

$

366,536

$

360,259

$

352,738

$

338,860

Average Tangible Common Equity:

Average shareholders' equity (GAAP)

$

478,642

$

466,371

$

461,148

$

449,526

$

445,432

Less average goodwill and other intangible

assets

105,701

106,301

106,920

107,551

108,194

Average tangible common equity

(Non-GAAP)

$

372,941

$

360,070

$

354,228

$

341,975

$

337,238

Tangible Book Value per Common

Share:

Book value per common share (GAAP)

$

28.89

$

27.91

$

27.37

$

27.07

$

26.28

Adjustment due to goodwill and other

intangible assets

(6.22)

(6.25)

(6.25)

(6.31)

(6.34)

Tangible book value per common share

(Non-GAAP)1

$

22.67

$

21.66

$

21.12

$

20.76

$

19.94

Tangible Common Equity to Tangible

Assets:

Total Assets (GAAP)

$

4,908,934

$

4,891,009

$

4,954,690

$

4,829,387

$

4,797,171

Less goodwill and other intangibles

105,324

105,929

106,537

107,148

107,792

Tangible Assets (Non-GAAP)

$

4,803,610

$

4,785,080

$

4,848,153

$

4,722,239

$

4,689,379

Tangible common equity to tangible assets

(Non-GAAP)

7.99%

7.66%

7.43%

7.47%

7.23%

1Tangible book value per share (Non-GAAP)

is computed by dividing total shareholders’ equity, less goodwill

and other intangible assets, by common shares outstanding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021822998/en/

Investor Contacts Billy Carroll President & Chief

Executive Officer Email: billy.carroll@smartbank.com Phone: (865)

868-0613 Nathan Strall Vice President and Director of Strategy

& Corporate Development Email: nathan.strall@smartbank.com

Phone: (865) 868-2604

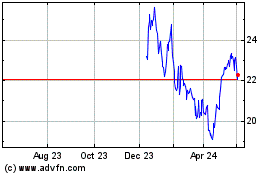

SmartFinancial (NYSE:SMBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

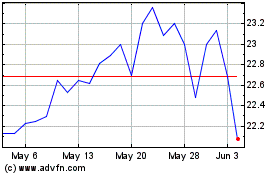

SmartFinancial (NYSE:SMBK)

Historical Stock Chart

From Dec 2023 to Dec 2024