Snap Inc. (NYSE: SNAP) announced today the pricing of $1.5

billion aggregate principal amount of 6.875% senior notes due 2033,

or the notes, in a private offering that is exempt from the

registration requirements of the Securities Act of 1933, as

amended, or the Securities Act. The sale of the notes is expected

to close on February 14, 2025, subject to customary closing

conditions.

The notes will be senior unsecured obligations of Snap and will

be fully and unconditionally guaranteed in the future, jointly and

severally, by each of Snap’s domestic subsidiaries that guarantees

certain of its other indebtedness, if any, subject to certain

exceptions. The notes will bear interest at a rate of 6.875% per

annum, payable semiannually in arrears on March 1 and September 1

of each year, beginning on September 1, 2025. The notes will mature

on March 1, 2033 unless earlier repurchased or redeemed.

Moody’s Ratings has assigned a “B1” rating with a positive

outlook to Snap and the offering of the notes. Fitch Ratings has

assigned a “BB” rating with a stable outlook to Snap and the

offering of the notes. Standard & Poor’s has assigned a “B+”

rating with a stable outlook to Snap and the offering of the

notes.

Snap estimates that the net proceeds from the offering will be

approximately $1,475.0 million, after deducting the initial

purchasers’ discounts and commissions and estimated expenses

payable by Snap. Snap intends to use the net proceeds from the

offering to repurchase an aggregate principal amount of (i) $45.3

million of its outstanding convertible senior notes due 2026, or

the 2026 notes, (ii) $797.4 million of its outstanding convertible

senior notes due 2027, or the 2027 notes, and (iii) $800.0 million

of its outstanding convertible senior notes due 2028, or the 2028

notes, for an aggregate repurchase price of $1,445.1 million. Snap

intends to use the remaining net proceeds from the offering for

general corporate purposes, including working capital, operating

expenses, capital expenditures, acquisitions of complementary

businesses, or other repurchases of Snap’s securities.

In addition, Snap expects that some or all of the holders of the

2026 notes, the 2027 notes, or the 2028 notes that it repurchases

may purchase shares of Snap Class A common stock in open market

transactions or enter into or unwind various derivatives with

respect to Snap Class A common stock to unwind hedge positions that

they have with respect to their investment in the 2026 notes, the

2027 notes, or the 2028 notes. These transactions, in turn, may

place upward pressure on the trading price of Snap Class A common

stock, causing Snap Class A common stock to trade at higher prices

than would be the case in the absence of these purchases.

The notes have not been and will not be registered under the

Securities Act or any state securities laws. The notes will only be

offered or sold to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A promulgated under the

Securities Act, and outside the United States to non-U.S. persons

pursuant to Regulation S under the Securities Act.

This press release is not an offer to sell and is not soliciting

an offer to buy any securities, nor will it constitute an offer,

solicitation, or sale of the securities in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction. Any offers of

the notes will be made only by means of a private offering

memorandum.

About Snap Inc.

Snap Inc. is a technology company. We believe the camera

presents the greatest opportunity to improve the way people live

and communicate. We contribute to human progress by empowering

people to express themselves, live in the moment, learn about the

world, and have fun together.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended, about Snap and

Snap’s industry that involve substantial risks and uncertainties.

All statements other than statements of historical facts contained

in this press release, including statements regarding the expected

closing of the offering of the notes, the anticipated use of the

net proceeds from the offering of the notes, the expected

repurchases of the 2026 notes, the 2027 notes, and the 2028 notes,

and effects thereof, are forward-looking statements. In some cases,

you can identify forward-looking statements because they contain

words such as “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or the negative of these words or other similar terms or

expressions. Snap cautions you that the foregoing may not include

all of the forward-looking statements made in this press

release.

You should not rely on forward-looking statements as predictions

of future events. Snap has based the forward-looking statements

contained in this press release primarily on its current

expectations and projections about future events and trends,

including its financial outlook, macroeconomic uncertainty, and

geo-political conflicts, that it believes may continue to affect

Snap’s business, financial condition, results of operations, and

prospects. These forward-looking statements are subject to risks

and uncertainties related to: Snap’s financial performance; the

ability to attain and sustain profitability; the ability to

generate and sustain positive cash flow; the ability to attract and

retain users, partners, and advertisers; competition and new market

entrants; managing Snap’s growth and future expenses; compliance

with new laws, regulations, and executive actions; the ability to

maintain, protect, and enhance Snap’s intellectual property; the

ability to succeed in existing and new market segments; the ability

to attract and retain qualified team members and key personnel; the

ability to repay or refinance outstanding debt, or to access

additional financing; future acquisitions, divestitures, or

investments; and the potential adverse impact of climate change,

natural disasters, health epidemics, macroeconomic conditions, and

war or other armed conflict, as well as risks, uncertainties, and

other factors described in “Risk Factors” in Snap’s Annual Report

on Form 10-K for the year ended December 31, 2024 and Snap’s other

filings with the SEC, which are available on the SEC’s website at

www.sec.gov. In addition, any forward-looking statements contained

in this press release are based on assumptions that Snap believes

to be reasonable as of this date. Snap undertakes no obligation to

update any forward-looking statements to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211999569/en/

Investors and Analysts: ir@snap.com

Press: press@snap.com

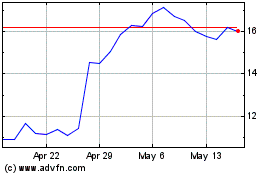

Snap (NYSE:SNAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

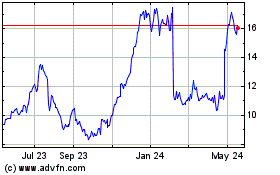

Snap (NYSE:SNAP)

Historical Stock Chart

From Feb 2024 to Feb 2025