Sonendo, Inc. (OTCQX: SONX) (“Sonendo”), a leading dental

technology company and developer of the GentleWave® System, today

reported financial results for the first quarter ended March 31,

2024

Recent Highlights

- Recorded total revenue of $7.0 million for first quarter of

2024, exceeding previously issued guidance of $6.0 million; ending

the quarter with installed base of 1,142 and achieved a healthy

console backlog

- Increased average procedure instrument selling price from

$71.60 in the fourth quarter of 2023 to $75.00 in the first quarter

of 2024 by limiting certain discount programs and focusing on

utilization opposed to shipments. In the future quarters, we expect

procedure instrument shipments to align with customer

utilization

- Announced strategic reset of commercial and operational

priorities including commercial strategy, cash conservation, and

margin expansion

- Divested TDO practice management software segment in March

2024, resulting in a gain of $5.7 million

- First quarter GAAP gross margin of 28%; non-GAAP gross margin

of 30%, an improvement of more than 700 basis points over the first

quarter of 2023

- First quarter GAAP operating loss of $10.2 million; non-GAAP

operating loss of $7.5 million, a 41% improvement over the first

quarter of 2023

- Raised 2024 full year revenue guidance range to $29 million to

$31 million, from prior guidance of $28 million to $30 million

“Building on our learnings over the past two years, Sonendo has

embarked on a strategic reset to align key priorities for the

long-term health of the Company,” said Bjarne Bergheim, President

and Chief Executive Officer of Sonendo. “We have overhauled our

go-to-market strategy, created efficiencies within the

organization, and pivoted R&D efforts in order to drive

commercial execution, cash conservation, and margin expansion. I am

very encouraged by early indications of the plan’s success

demonstrated in the first quarter. The strategic reset has created

a renewed energy within Sonendo, and I’m excited about the

opportunity going forward.”

First Quarter 2024 Financial Results

Except as otherwise indicated, the GAAP and non-GAAP financial

measures presented in this press release exclude discontinued

operations.

Total revenue from continuing operations was $7.0 million for

the first quarter of 2024, a decrease from $8.7 million for the

first quarter of 2023. GentleWave console revenue was $1.8 million

for the first quarter of 2024 compared to $2.0 million for the

first quarter of 2023. Procedure instrument revenue was $4.2

million, a decrease from $5.7 million for the first quarter of

2023. Other product related revenue was $1.0 million for each of

the first quarter of 2024 and 2023.

Gross margin from continuing operations for the first quarter of

2024 was 28%, compared to 23% for the first quarter of 2023. During

the first quarter of 2024, we recorded in cost of sales $0.1

million impairment charges of long-lived assets. Non-GAAP gross

margin from continuing operations for the first quarter of 2024 was

30% compared to 23% for the first quarter of 2023. Non-GAAP gross

margin excludes impairment of long-lived assets.

Total operating expenses for the first quarter of 2024 were

$12.3 million, compared to $17.0 million for the first quarter of

2023.

Operating loss was $10.2 million for the first quarter of 2024,

compared to $15.1 million for the first quarter of 2023. Non-GAAP

operating loss was $7.5 million for the first quarter of 2024

compared to $12.8 million for the first quarter of 2023. Non-GAAP

operating loss excludes stock-based compensation expense,

depreciation and amortization expense and impairment of long-lived

assets.

Net loss from both continuing and discontinued operations was

$6.8 million for the first quarter of 2024, including a $5.7

million gain from sale of our software business, compared to $15.4

million for the first quarter of 2023.

Cash and cash equivalents and short-term investments as of March

31, 2024 totaled $33.6 million. During the first quarter of 2024,

the company made $16.8 million principal repayments on the

Perceptive term loan.

2024 Financial Guidance

The company expects total revenue for the full year of 2024 to

be in the range of $29.0 million to $31.0 million, which excludes

revenue from the discontinued operations.

Webcast and Conference Call Information

Sonendo will host a conference call to discuss the first quarter

2024 financial results after the market close on Wednesday, May 8,

2024 at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time. Investors

interested in listening to the conference call may do so by dialing

(833) 470-1428 for domestic callers or (404) 975-4893 for

international callers, using access code: 627665. Live audio of the

webcast will be available on the “Investors” section of the

company’s website at: https://investor.sonendo.com. The webcast

will be archived and available for replay for at least 90 days

after the event.

About Sonendo

Sonendo is a commercial-stage medical technology company focused

on saving teeth from tooth decay, the most prevalent chronic

disease globally. Sonendo develops and manufactures the GentleWave®

System, an innovative technology platform designed to treat tooth

decay by cleaning and disinfecting the microscopic spaces within

teeth without the need to remove tooth structure. The system

utilizes a proprietary mechanism of action, which combines

procedure fluid optimization, broad-spectrum acoustic energy and

advanced fluid dynamics, to debride and disinfect deep regions of

the complex root canal system in a less invasive procedure that

preserves tooth structure. The clinical benefits of the GentleWave

System when compared to conventional methods of root canal therapy

include improved clinical outcomes, such as superior cleaning that

is independent of root canal complexity and tooth anatomy, high and

rapid rates of healing and minimal to no post-operative pain. In

addition, the GentleWave System can improve the workflow and

economics of dental practices. In March 2024, Sonendo divested the

TDO® Software segment by selling substantially all the assets and

liabilities of TDO Software, Inc.

For more information about Sonendo and the GentleWave System,

please visit www.sonendo.com. To find a GentleWave doctor in your

area, please visit www.gentlewave.com.

Forward Looking Statements

This press release includes forward-looking statements

(statements which are not historical facts) within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements include, but are not limited to, express or implied

forward-looking statements relating to the Company’s anticipated

business and financial performance on an on-going basis and

Sonendo’s 2024 financial guidance. You are cautioned that such

statements are not guarantees of future performance and that our

actual results may differ materially from those set forth in the

forward-looking statements. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions; speak only

as of the date they are made; and, as a result, are subject to

risks and uncertainties that may change at any time. Factors that

could cause the Company’s actual results to differ materially from

these forward-looking statements are described in detail in our

registration statements, reports and other filings with the

Securities and Exchange Commission, including the “Risk Factors”

set forth in our Annual Report on Form 10-K, as supplemented by our

quarterly reports on Form 10-Q. Such filings are available on our

website or at www.sec.gov. We undertake no obligation to publicly

update or revise forward-looking statements to reflect subsequent

developments, events, or circumstances, except as may be required

under applicable securities laws. Readers are cautioned not to put

undue reliance on forward-looking statements, and the Company

assumes no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Use of Non-GAAP Financial Measures

Sonendo’ financial results are prepared in accordance with

generally accepted accounting principles in the United States of

America (“GAAP”). This press release and the reconciliation tables

included in the financial schedules below include non-GAAP gross

profit, non-GAAP gross margin and non-GAAP operating loss

(collectively, the "Non-GAAP measures"). Non-GAAP gross profit and

non-GAAP gross margin exclude impairment of long-lived assets.

Non-GAAP operating loss excludes, as applicable, stock-based

compensation expense, depreciation and amortization and impairment

of long-lived assets. Management believes that Non-GAAP measures

are useful in helping identify the company’s core operating

performance and enables management to consistently analyze the

period-to-period financial performance of the core business

operations. Management also believes that Non-GAAP measures will

enable investors to assess the company in the same way that

management has historically assessed the company’s operating

results against comparable companies with conventional accounting

methodologies. The company’s definition for each of the Non-GAAP

measures has limitations as an analytical tool and may differ from

other companies reporting similarly named measures. Non-GAAP

measures should not be considered measures of financial performance

under GAAP, and the items excluded from such Non-GAAP measures

should not be considered in isolation or as alternatives to

financial statement data presented in the financial statements as

an indicator of financial performance or liquidity. Non-GAAP

measures should be considered in addition to results prepared in

accordance with GAAP but should not be considered a substitute for

or superior to GAAP results.

For a reconciliation of our Non-GAAP measures presented herein

to GAAP measures, the most directly comparable GAAP financial

measure, please see “Reconciliation of GAAP to Non-GAAP Gross

Profit and Gross Margin” and “Reconciliation of GAAP to Non-GAAP

Operating Loss” in the financial schedules below.

SONENDO, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

March 31,

December 31,

2024

2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

18,580

$

14,009

Short-term investments

15,009

32,773

Accounts receivable, net

4,176

4,790

Inventory

12,116

11,074

Prepaid expenses and other current

assets

1,611

1,969

Current assets of discontinued

operations

1,162

656

Total current assets

52,654

65,271

Property and equipment, net

767

461

Operating lease right-of-use assets

3,227

2,703

Other assets

127

128

Non-current assets of discontinued

operations

—

9,597

Total assets

$

56,775

$

78,160

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

916

$

1,142

Accrued expenses

2,737

3,072

Accrued compensation

1,470

2,413

Operating lease liabilities

1,172

1,250

Current portion of term loan

10,800

24,900

Other current liabilities

1,786

1,844

Current liabilities of discontinued

operations

73

700

Total current liabilities

18,954

35,321

Operating lease liabilities, net of

current

1,888

1,423

Term loan, net of current

10,911

12,467

Other liabilities

491

530

Total liabilities

32,244

49,741

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value;

authorized —10,000,000 shares; issued and outstanding - none

—

—

Common stock, $0.001 par value; authorized

— 500,000,000 shares; issued and outstanding— 70,449,873 shares as

of March 31, 2024 and 63,547,467 shares as of December 31, 2023

70

64

Additional paid-in-capital

461,237

458,357

Accumulated other comprehensive loss

(1

)

11

Accumulated deficit

(436,775

)

(430,013

)

Total stockholders’ equity

24,531

28,419

Total liabilities and stockholders’

equity

$

56,775

$

78,160

SONENDO, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

LOSS

(unaudited)

(In thousands, except share

and per share data)

Three Months Ended March

31,

2024

2023

Revenue, net

$

7,047

$

8,678

Cost of sales

Product and service

4,900

6,700

Impairment of long-lived assets

146

—

Total cost of sales

5,046

6,700

Gross profit

2,001

1,978

Operating expenses:

Selling, general and administrative

10,061

14,114

Research and development

2,189

2,927

Total operating expenses

12,250

17,041

Operating loss

(10,249

)

(15,063

)

Other expense, net:

Interest and financing costs, net

(1,940

)

(579

)

Loss before income tax expense

(12,189

)

(15,642

)

Income tax expense

—

—

Loss from continuing operations, net of

tax

(12,189

)

(15,642

)

Income from discontinued operations, net

of tax

5,427

271

Net loss

$

(6,762

)

$

(15,371

)

Other comprehensive income (net of

tax):

Unrealized (loss) gain on short-term

investments

(12

)

56

Comprehensive loss

$

(6,774

)

$

(15,315

)

Net loss per share from continuing

operations – basic and diluted

$

(0.13

)

$

(0.16

)

Net income per share from discontinued

operations – basic and diluted

$

0.06

$

0.00

Net loss per share – basic and diluted

$

(0.07

)

$

(0.16

)

Weighted-average shares outstanding –

basic and diluted

94,822,835

93,391,444

SONENDO, INC.

RECONCILIATION OF GAAP TO

NON-GAAP

GROSS PROFIT AND GROSS

MARGIN

(unaudited, in

thousands)

Three Months Ended March

31

2024

2023

Gross profit

$

2,001

$

1,978

Gross margin

28

%

23

%

Adjustments:

Impairment of long-lived assets

146

—

Non-GAAP gross profit

$

2,147

$

1,978

Non-GAAP gross margin

30

%

23

%

SONENDO, INC.

RECONCILIATION OF GAAP TO

NON-GAAP

OPERATING LOSS

(unaudited, in

thousands)

Three Months Ended March

31

2024

2023

GAAP operating loss

$

10,249

$

15,063

Adjustments:

Stock based compensation:

Included in cost of sales

(302

)

(139

)

Included in selling, general and

administrative

(1,724

)

(1,540

)

Included in research and development

(495

)

(224

)

Depreciation and amortization

Included in cost of sales

—

(177

)

Included in selling, general and

administrative

(55

)

(150

)

Included in research and development

—

(31

)

Impairment of long-lived assets

Included in cost of sales

(146

)

—

Non-GAAP operating loss

$

7,527

$

12,802

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508041029/en/

Investor Contact: Gilmartin Group Greg Chodaczek

IR@Sonendo.com

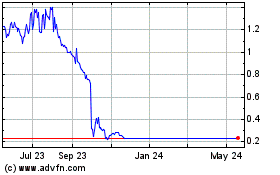

Sonendo (NYSE:SONX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sonendo (NYSE:SONX)

Historical Stock Chart

From Mar 2024 to Mar 2025