0000920371false00009203712025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2025

Simpson Manufacturing Co., Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13429 | | 94-3196943 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. Employer Identification No.) |

5956 W. Las Positas Boulevard, Pleasanton, CA 94588

(Address of principal executive offices)

(Registrant’s telephone number, including area code): (925) 560-9000

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | SSD | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-2) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 10, 2025, Simpson Manufacturing Co., Inc. issued a press release announcing financial results for the fourth quarter and full year ended December 31, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

This information is furnished pursuant to Item 2.02 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosures.

Representatives of Simpson Manufacturing Co., Inc. (the “Company”) intend to present the Investor Presentation furnished as Exhibit 99.2 to this Current Report on Form 8-K, to analysts and investors from time to time on or after February 11, 2025. The slide presentation will be available on the Investor Relations page of the Company’s website at ir.simpsonmfg.com.

The information furnished pursuant to this Item 7.01, including Exhibit 99.2 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The information furnished pursuant to this Item 7.01, including Exhibit 99.2 furnished herewith, contains “forward-looking statements” within the meaning of the safe harbor provisions of the federal securities laws. It should be read in conjunction with the “Safe Harbor” statement contained in the Investor Presentation, the risk factors included in the Company’s periodic reports filed with the Securities and Exchange Commission and the other public announcements that the Company may make, by press release or otherwise, from time to time.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Simpson Manufacturing Co., Inc. |

| | | | (Registrant) |

| | | | | |

| | | | | |

| | | | | |

| DATE: | February 10, 2025 | | By | /s/ Matt Dunn |

| | | | | Matt Dunn |

| | | | | Chief Financial Officer |

Exhibit 99.1 Press Release dated February 10, 2025

| | |

| SIMPSON MANUFACTURING CO., INC. ANNOUNCES 2024 FOURTH QUARTER AND FULL-YEAR FINANCIAL RESULTS |

| | | | | |

l | Full year 2024 net sales of $2.2 billion increased 0.8% year-over-year |

l

| Full year 2024 income from operations of $430.0 million, resulting in an operating income margin of 19.3% |

l

| Full year 2024 net income per diluted share of $7.60 |

l

| Declared a $0.28 per share dividend |

l

| Providing full year 2025 outlook |

Pleasanton, CA - February 10, 2025: Simpson Manufacturing Co., Inc. (the “Company”) (NYSE: SSD), an industry leader in engineered structural connectors and building solutions, today announced its financial results for the fourth quarter and full-year of 2024. All comparisons below (which are generally indicated by words such as “increased,” “decreased,” “remained,” or “compared to”), unless otherwise noted, are comparing the quarter ended December 31, 2024 with the quarter ended December 31, 2023 or the fiscal year ended December 31, 2024 with the fiscal year ended December 31, 2023.

Consolidated 2024 Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | | Quarter-Over- | | Twelve Months Ended, | | Year-Over- | | |

| December 31, | | | Quarter | | December 31, | | Year | | |

| 2024 | | | 2023 | | | Change | | 2024 | | 2023 | | Change | | |

| (In thousands, except per share data and percentages) | | (In thousands, except per share data and percentages) |

| Net sales | $ | 517,429 | | | | $ | 501,710 | | | | 3.1 | % | | $ | 2,232,139 | | | $ | 2,213,803 | | | 0.8 | % | | |

| Gross profit | 227,703 | | | | 220,498 | | | | 3.3 | % | | 1,025,851 | | | 1,043,755 | | | (1.7) | % | | |

| Gross profit margin | 44.0 | % | | | 43.9 | % | | | | | 46.0 | % | | 47.1 | % | | | | |

| Total operating expenses | 150,019 | | | | 148,450 | | | | 1.1 | % | | 590,510 | | | 564,250 | | | 4.7 | % | | |

| Income from operations | 76,849 | | | | 71,555 | | | | 7.4 | % | | 429,975 | | | 475,149 | | | (9.5) | % | | |

| Operating income margin | 14.9 | % | | | 14.3 | % | | | | | 19.3 | % | | 21.5 | % | | | | |

| Net income | $ | 55,458 | | | | $ | 54,803 | | | | 1.2 | % | | $ | 322,224 | | | $ | 353,987 | | | (9.0) | % | | |

| Net income per diluted common share | $ | 1.31 | | | | $ | 1.28 | | | | 2.3 | % | | $ | 7.60 | | | $ | 8.26 | | | (8.0) | % | | |

| Adjusted EBITDA1 | $ | 102,035 | | | | $ | 92,872 | | | | 9.9 | % | | 520,082 | | | $ | 554,245 | | | (6.2) | % | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Trailing Twelve Months Ended | | Year-Over- |

| | December 31, | | Year |

| | 2024 | | 2023 | | Change |

| | (In thousands, except percentages) |

| Total U.S. Housing starts2 | | 1,364 | | | 1,420 | | | (3.9) | % |

| | | | | | |

1 Adjusted EBITDA is a non-GAAP financial measure and it is defined in the Non-GAAP Financial Measures section of the press release. For a reconciliation of Adjusted EBITDA to U.S. GAAP ("GAAP") net income see the schedule titled "Reconciliation of Non-GAAP Financial Measures."

2 Source: United States Census Bureau

Management Commentary

“During 2024, we grew revenues modestly in a challenging year where housing starts in both the U.S. and Europe declined,” commented Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co., Inc. “In North America, I am very pleased that volume growth in pounds shipped exceeded U.S. housing starts by approximately 600 basis points. In Europe, sales were flat despite a difficult demand environment.”

Mr. Olosky continued, “In 2025 we believe a low single-digit recovery in U.S. housing starts is possible and European housing starts to be consistent with 2024 levels. As part of our commitment to maximizing shareholder returns, we have revised our financial ambitions to continue above market growth relative to U.S. housing starts on a trailing twelve-month basis, maintain an operating income margin at or above 20%, and drive EPS growth ahead of net revenue growth. While the midpoint of our 2025 guidance range for operating income margin is below our ambition, we are working to offset significant input cost increases over the past three years and will carefully evaluate avenues to preserve our profitability. We believe our business is capable of achieving a 20% operating income margin or higher with modest market growth and continued above market volume growth. We continue to believe in the mid-to-long term prospects of the housing market and are well positioned to take advantage of future growth.”

North America Segment Financial Highlights

2024 Fourth Quarter

•Net sales of $404.8 million increased 4.4% from $387.8 million due to incremental sales from the Company's 2024 acquisitions and a modest increase in sales volumes.

•Gross margin remained 47.0% as lower material costs were offset by higher factory and overhead as well as warehouse costs, as a percentage of net sales.

•Income from operations of $85.4 million increased 7.0% from $79.8 million. The increase was primarily due to higher gross profit, partly offset by higher operating expenses. The operating expense increases were driven by higher personnel costs, which were partly offset by decreased variable incentive compensation.

2024 Full-Year

•Net sales of $1.7 billion increased approximately 1.1% from 2023 due to higher sales volumes.

•Gross margin decreased to 49.0% from 50.3%, primarily due to higher factory and overhead as well as warehouse costs, partly offset by lower material costs, as a percentage of net sales.

•Income from operations of $439.6 million decreased 7.1% from $473.2 million. The decrease was primarily due to lower gross profit as well as increases in operating expenses. The operating expense increases were driven by higher personnel costs, computer software and hardware costs, and professional fees, which were partly offset by decreased variable incentive compensation.

Europe Segment Financial Highlights

2024 Fourth Quarter

•Net sales of $108.1 million decreased 1.5% from $109.7 million, due to lower sales volumes.

•Gross margin decreased to 32.3% from 34.2%, primarily due to higher factory and overhead as well as warehouse and freight costs, partly offset by lower material costs, as a percentage of net sales.

•Income from operations of $0.8 million decreased 75.2% from $3.1 million primarily due to lower gross profit.

2024 Full-Year

•Net sales of $479.1 million decreased 0.4% from $480.8 million, due to lower sales volumes. Net sales benefited from the positive effect of approximately $3.7 million in foreign currency translation.

•Gross margin decreased to 35.3% from 36.8%, primarily due to higher factory and overhead as well as warehouse and freight costs, partly offset by lower material costs, as a percentage of net sales.

•Income from operations of $33.8 million decreased 26.5% from $46.0 million primarily due to lower gross profit as well as $5.0 million in higher operating expenses including personnel costs.

Refer to the “Segment and Product Group Information” table below for additional segment information (including information about the Company’s Asia/Pacific and Administrative and All Other segments).

Corporate Developments

•The Company’s Board of Directors (the "Board") declared a quarterly cash dividend of $0.28 per share for $11.7 million. The dividend was paid on January 23, 2025, to the Company's stockholders of record on January 2, 2025.

•During the fourth quarter, the Company repurchased 275,906 shares of the Company’s common stock in the open market at an average price of $181.22 per share, for a total of $50.0 million, completing the repurchase of $100.0 million of the Company's common stock that was previously authorized. On October 23, 2024, the Board authorized the Company to repurchase up to $100.0 million of the Company's common stock beginning January 1, 2025 through December 31, 2025.

•On October 28, 2024, the Company announced the appointment of Matt Dunn to Chief Financial Officer and Treasurer, effective January 1, 2025. Mr. Dunn served as Simpson's Senior Vice President of Finance since June 2024 and succeeded Brian Magstadt who will remain employed as an Executive Advisor to assist with an orderly transition until his retirement on June 30, 2025.

•The Board, upon recommendation of the Nominating and CSR Committee, announced the appointment of Angela Drake as an independent, non-employee director of the Company, effective January 1, 2025.

Balance Sheet & Cash Flow Highlights

•As of December 31, 2024, cash and cash equivalents totaled $239.4 million with total debt outstanding of $388.1 million under the Company's $450.0 million credit facility.

•For the 2024 fourth quarter, cash provided by operating activities of $117.7 million increased from $28.8 million, primarily due to decreases in working capital. For the 2024 full year, cash provided by operating activities of $339.8 million decreased from $427.0 million, primarily due to increases in working capital and lower net income.

•For the 2024 fourth quarter, cash used in investing activities of $59.6 million increased from $36.7 million mostly due to increased capital expenditures of $26.8 million. For the 2024 full year, cash used in investing activities of $261.8 million increased from $103.3 million mostly due to increased capital expenditures of $94.2 million and acquisitions of $55.6 million.

•For the 2024 fourth quarter, cash used in financing activities of $142.7 million increased from $140.9 million. For the 2024 full year, cash used in financing activities of $253.8 million increased from $199.0 million, primarily due to repurchases of $50.0 million of the Company's common stock.

Business Outlook

The Company is initiating its 2025 financial outlook to reflect its expectations regarding demand trends, cost of sales, and operating expenses. Based on business trends and conditions as of today, February 10, 2025, the Company's outlook for the full fiscal year ending December 31, 2025 is as follows:

•Given the uncertainty regarding 2025 U.S. housing starts compared to prior year housing starts, consolidated operating margin is estimated to be in the range of 18.5% to 20.5% with the low end of the range based on flat to declining 2025 housing starts compared to prior year. The operating margin range includes a projected benefit on the sale of the Gallatin property based on a contracted sales price of $19.1 million.

•The effective tax rate is estimated to be in the range of 25.5% to 26.5%, including both federal and state income tax rates as well as international income tax rates, and assuming no tax law changes are enacted.

•Capital expenditures are estimated to be in the range of $150.0 million to $170.0 million, which includes approximately $75.0 million remaining for both the Columbus, Ohio facility expansion and the new Gallatin, Tennessee fastener facility construction.

Conference Call Details

Investors, analysts and other interested parties are invited to join the Company’s fourth quarter and full-year 2024 financial results conference call on Monday, February 10, 2025, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). To participate, callers may dial (877) 407-0792 (U.S. and Canada) or (201) 689-8263 (International) approximately 10 minutes prior to the start time. The call will be webcast simultaneously and can be accessed through https://viavid.webcasts.com/starthere.jsp?ei=1704184&tp_key=b6f4d4b9dc or a link on the Investor Relations section of the Company’s website at https://ir.simpsonmfg.com/events-and-presentations. For those unable to participate during the live broadcast, a replay of the call will also be available beginning that same day at 8:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on Monday, February 24, 2025, by dialing (844) 512–2921 (U.S. and Canada) or (412) 317–6671 (International) and entering the conference ID: 13751061. The webcast will remain posted on the Investor Relations section of the Company’s website for 90 days.

A copy of this earnings release will be available prior to the call, accessible through the Investor Relations section of the Company's website at www.simpsonmfg.com.

About Simpson Manufacturing Co., Inc.

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiary, Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing carbon and glass fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company's common stock trades on the New York Stock Exchange under the symbol "SSD."

Copies of Simpson Manufacturing's Annual Report to Stockholders and its proxy statements and other SEC filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are made available free of charge on the company's website on the same day they are filed with the SEC. To view these filings, visit the Investor Relations section of the Company's website.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, effective tax rates, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing.

Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, and the operations of our customers, and suppliers and business partners, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

Non-GAAP Financial Measures

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Since not all companies calculate non-GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, these measures should not be considered substitutes for the financial measures calculated in accordance with GAAP. The Company uses Adjusted EBITDA as an additional financial measure in evaluating the ongoing operating performance of its business. The Company believes Adjusted EBITDA allows it to readily view operating trends, perform analytical comparisons, and identify strategies to improve operating performance. Adjusted EBITDA should not be considered in isolation or as a substitute for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. See the Reconciliation of Non-GAAP Financial Measures below.

The Company defines Adjusted EBITDA as net income (loss) before income taxes, adjusted to exclude depreciation and amortization, integration, acquisition and restructuring costs, non-qualified deferred compensation adjustments, goodwill impairment, gain on bargain purchase, net loss or gain on disposal of assets, interest income or expense, and foreign exchange and other expense (income).

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Consolidated Statements of Operations

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 517,429 | | | $ | 501,710 | | | $ | 2,232,139 | | | $ | 2,213,803 | |

| Cost of sales | 289,726 | | | 281,212 | | | 1,206,288 | | | 1,170,048 | |

| Gross profit | 227,703 | | | 220,498 | | | 1,025,851 | | | 1,043,755 | |

| | | | | | | |

| Research and development and engineering expense | 25,273 | | | 25,131 | | | 93,576 | | | 92,167 | |

| Selling expense | 54,394 | | | 52,483 | | | 219,402 | | | 203,980 | |

| General and administrative expense | 70,352 | | | 70,836 | | | 277,532 | | | 268,103 | |

| Total operating expenses | 150,019 | | | 148,450 | | | 590,510 | | | 564,250 | |

| Acquisition and integration related costs | 821 | | | 546 | | | 5,813 | | | 4,632 | |

Net (gain) loss on disposal of assets | 14 | | | (53) | | | (447) | | | (276) | |

| Income from operations | 76,849 | | | 71,555 | | | 429,975 | | | 475,149 | |

Interest income and other finance costs, net | 1,166 | | | 3,373 | | | 5,277 | | | 3,391 | |

Other & foreign exchange loss, net | (1,560) | | | (523) | | | (1,209) | | | (1,993) | |

| | | | | | | |

| | | | | | | |

| Income before taxes | 76,455 | | | 74,405 | | | 434,043 | | | 476,547 | |

| Provision for income taxes | 20,997 | | | 19,602 | | | 111,819 | | | 122,560 | |

| Net income | $ | 55,458 | | | $ | 54,803 | | | $ | 322,224 | | | $ | 353,987 | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 1.32 | | | $ | 1.29 | | | $ | 7.64 | | | $ | 8.31 | |

| Diluted | $ | 1.31 | | | $ | 1.28 | | | $ | 7.60 | | | $ | 8.26 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 41,980 | | | 42,440 | | | 42,182 | | | 42,598 | |

| Diluted | 42,174 | | | 42,668 | | | 42,383 | | | 42,837 | |

| Other data: | | | | | | | |

| Depreciation and amortization | $ | 24,749 | | | $ | 20,483 | | | $ | 84,584 | | | $ | 74,707 | |

| Pre-tax equity-based compensation expense | 3,257 | | | 6,070 | | | 18,346 | | | 23,859 | |

| | | | | | | |

| | | | | | | |

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Consolidated Condensed Balance Sheets

(In thousands)

| | | | | | | | | | | | | | | | | |

| | December 31, | |

| | 2024 | | 2023 | |

| Cash and cash equivalents | | $ | 239,371 | | | $ | 429,822 | | |

| Trade accounts receivable, net | | 284,392 | | | 283,975 | | |

| Inventories | | 593,175 | | | 551,575 | | |

| | | | | |

| Other current assets | | 60,214 | | | 47,069 | | |

| Total current assets | | 1,177,152 | | | 1,312,441 | | |

| Property, plant and equipment, net | | 531,302 | | | 418,612 | | |

| Operating lease right-of-use assets | | 93,933 | | | 68,792 | | |

| Goodwill | | 513,563 | | | 502,550 | | |

| Intangible assets, net | | 374,051 | | | 365,339 | | |

| Other noncurrent assets | | 47,349 | | | 36,990 | | |

| Total assets | | $ | 2,737,350 | | | $ | 2,704,724 | | |

| Trade accounts payable | | $ | 100,972 | | | $ | 107,524 | | |

| Long-term debt, current portion | | 22,500 | | | 22,500 | | |

| | | | | |

| Accrued liabilities and other current liabilities | | 242,875 | | | 231,233 | | |

| Total current liabilities | | 366,347 | | | 361,257 | | |

| | | | | |

| Operating lease liabilities, net of current portion | | 76,184 | | | 55,324 | | |

| Long-term debt, net of current portion and issuance costs | | 362,563 | | | 458,791 | | |

| Deferred income tax | | 90,303 | | | 98,170 | | |

| Other long-term liabilities | | 27,636 | | | 51,436 | | |

Non-qualified deferred compensation plan share awards | | 5,932 | | | — | | |

| Stockholders' equity | | 1,808,385 | | | 1,679,746 | | |

| Total liabilities and stockholders' equity | | $ | 2,737,350 | | | $ | 2,704,724 | | |

| | | | | |

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Segment and Product Group Information

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Twelve Months Ended | | |

| | | December 31, | | % | | December 31, | | % |

| 2024 | | 2023 | | change * | | 2024 | | 2023 | | change * |

| Net Sales by Reporting Segment | | | | | | | | | | | |

| North America | $ | 404,752 | | | $ | 387,805 | | | 4.4% | | $ | 1,735,879 | | | $ | 1,716,422 | | | 1.1% |

| Percentage of total net sales | 78.2 | % | | 77.3 | % | | | | 77.8 | % | | 77.5 | % | | |

| Europe | 108,071 | | | 109,682 | | | (1.5)% | | 479,055 | | | 480,756 | | | (0.4)% |

| Percentage of total net sales | 20.9 | % | | 21.9 | % | | | | 21.4 | % | | 21.7 | % | | |

| Asia/Pacific | 4,606 | | | 4,223 | | | 9.1% | | 17,205 | | | 16,625 | | | 3.5% |

| Percentage of total net sales | 0.9 | % | | 0.8 | % | | | | 0.8 | % | | 0.8 | % | | |

| | | | | | | | | | | | |

| | Total | $ | 517,429 | | | $ | 501,710 | | | 3.1% | | $ | 2,232,139 | | | $ | 2,213,803 | | | 0.8% |

| Net Sales by Product Group** | | | | | | | | | | | |

| Wood Construction | $ | 438,112 | | | $ | 422,834 | | | 3.6% | | $ | 1,899,524 | | | $ | 1,891,449 | | | 0.4% |

| Percentage of total net sales | 84.7 | % | | 84.3 | % | | | | 85.1 | % | | 85.4 | % | | |

| Concrete Construction | 78,665 | | | 78,370 | | | 0.4% | | 330,557 | | | 320,500 | | | 3.1% |

| Percentage of total net sales | 15.2 | % | | 15.6 | % | | | | 14.8 | % | | 14.5 | % | | |

| Other | 652 | | | 506 | | | N/M | | 2,058 | | | 1,854 | | | N/M |

| | Total | $ | 517,429 | | | $ | 501,710 | | | 3.1% | | $ | 2,232,139 | | | $ | 2,213,803 | | | 0.8% |

| Gross Profit (Loss) by Reporting Segment | | | | | | | | | | | |

| North America | $ | 190,217 | | | $ | 182,339 | | | 4.3% | | $ | 850,504 | | | $ | 862,557 | | | (1.4)% |

| North America gross profit margin | 47.0 | % | | 47.0 | % | | | | 49.0 | % | | 50.3 | % | | |

| Europe | 34,893 | | | 37,511 | | | (7.0)% | | 168,982 | | | 177,048 | | | (4.6)% |

| Europe gross profit margin | 32.3 | % | | 34.2 | % | | | | 35.3 | % | | 36.8 | % | | |

| Asia/Pacific | 2,017 | | | 1,164 | | | N/M | | 5,798 | | | 5,679 | | | N/M |

| Administrative and all other | 576 | | | (516) | | | N/M | | 567 | | | (1,529) | | | N/M |

| | Total | $ | 227,703 | | | $ | 220,498 | | | 3.3% | | $ | 1,025,851 | | | $ | 1,043,755 | | | (1.7)% |

| Income (Loss) from Operations | | | | | | | | | | | |

| North America | $ | 85,354 | | | $ | 79,773 | | | 7.0% | | $ | 439,567 | | | $ | 473,229 | | | (7.1)% |

| North America operating profit margin | 21.1 | % | | 20.6 | % | | | | 25.3 | % | | 27.6 | % | | |

| Europe | 769 | | | 3,103 | | | (75)% | | 33,806 | | | 45,998 | | | (26.5)% |

| Europe operating profit margin | 0.7 | % | | 2.8 | % | | | | 7.1 | % | | 9.6 | % | | |

| Asia/Pacific | 323 | | | (183) | | | N/M | | (294) | | | 535 | | | N/M |

| Administrative and all other | (9,597) | | | (11,138) | | | N/M | | (43,104) | | | (44,613) | | | N/M |

| | Total | $ | 76,849 | | | $ | 71,555 | | | 7.4% | | $ | 429,975 | | | $ | 475,149 | | | (9.5)% |

| | | | | | | | |

| * | Unfavorable percentage changes are presented in parentheses. |

| ** | The Company manages its business by geographic segment but is presenting sales by product group as additional information. |

| N/M | Statistic is not material or not meaningful. |

Reconciliation of Non-GAAP Financial Measures

(In thousands) (Unaudited)

A reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net Income | $ | 55,458 | | | $ | 54,803 | | | $ | 322,224 | | | $ | 353,987 | | | | | |

| | | | | | | | | | | |

| Provision for income taxes | 20,997 | | | 19,602 | | | 111,819 | | | 122,560 | | | | | |

Interest income, net and other financing costs | (1,166) | | | (3,373) | | | (5,277) | | | (3,391) | | | | | |

| Depreciation and amortization | 24,749 | | | 20,483 | | | 84,584 | | | 74,707 | | | | | |

| Other* | 1,997 | | | 1,357 | | | 6,732 | | | 6,382 | | | | | |

| Adjusted EBITDA | $ | 102,035 | | | $ | 92,872 | | | $ | 520,082 | | | $ | 554,245 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

*Other: Includes acquisition, integration, and restructuring related expenses, non-qualified deferred compensation adjustments, other & foreign exchange loss net, and net loss or gain on disposal of assets.

CONTACT:

Addo Investor Relations

investor.relations@strongtie.com

(310) 829-5400

STRONG FOUNDATION. STRONGER FUTURE. Simpson Manufacturing Co., Inc. Investor Presentation February 2025 Exhibit 99.2

2 Safe Harbor Note: The financial results in this presentation as of and for the fiscal year ended December 31, 2024 are unaudited. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing. Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, and the operations of our customers, suppliers and business partners, as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC. We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

3 Investment Highlights Industry leader with strong business model, above market volume growth(1), high brand recognition and trusted reputation Diversified product offerings and geographies with ~50% exposure to the U.S. housing market Leadership position in structural solutions for wood connections with significant opportunities in all addressable markets Strong gross profit and operating margins with an EPS CAGR of 19% over the last 10 years Strong balance sheet enables financial flexibility ~46% of free cash flow returned to stockholders since 2021(2) exceeding 35% target (1) Above market North America volume in pounds relative to U.S. housing starts. (2) Time frame represents January 1, 2021 to December 31, 2024. Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

4 Celebrating 30 Years as a Public Company Performance Since IPO CEO, Mike Olosky, rings the NYSE Closing Bell on September 6, 2024 to commemorate the Company’s 30th anniversary as a publicly traded company. Note: The financial results as of and for the fiscal year ended December 31, 2024 are unaudited. (1) Since its debut at $11.50 per share ($2.875 split-adjusted) at its initial public offering (IPO) on May 25, 1994. Thirty years and two stock splits later, shares of Simpson closed at $167.59 on February 5, 2025, which, together with quarterly dividends, has resulted in a total compound annual growth rate of approximately 14%. Revenue Growth (1994 – 2024) $0.14 ~15x $2.2 B EPS Growth (1994 – 2024) $150 M ~54x $7.60 $167.59Compound annual growth rate of ~14%(1) since 1994 IPO $0.00 $30.00 $60.00 $90.00 $120.00 $150.00 $180.00 $210.00

5 Simpson’s Brand and Culture At Simpson, we describe the unique culture of our organization as our “Secret Sauce.” To deliver innovative solutions that help people design and build safer, stronger structures. OUR MISSION OUR COMPANY VALUES 1. Relentless Customer Focus 2. Long-Range View 3. High-Quality Products 4. Be The Leader 5. Everybody Matters 6. Enable Growth 7. Risk-Taking Innovation 8. Give Back 9. Be Humble, Have Fun

6 Our Strong Business Model Why Simpson? Our Customer-Centric Approach Broad portfolio of solutions Unparalleled availability & delivery Longstanding relationships Comprehensive service Innovation leader Impactful industry outreach • 26 of top 30 builders on a program • ~250 builders representing >50% of US housing starts • Millions of specifications • Thousands of dealers & retailers • ~98% product fill rate • 24-48 hour typical delivery • 48-hour turnaround on specials • Same-day shipping availability • ~700 field sales reps • Thousands of jobsite visits • Dedicated customer service and technical support • 26 training centers • 700+ training workshops per year • Partnering with organizations to support construction trades education • 15K standard & custom wood products • 3K standard & custom concrete products • 50+ software and web-app solutions • Pioneer of construction solutions • 8 accredited test labs • ~120 code evaluation reports • 500+ patents worldwide Our customer-centric approach and commitment to service differentiates us from other vendors and suppliers.

Broad Portfolio of Solutions Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Wood connectors, shearwalls, connectors for cold-formed steel and structural steel Fasteners for connectors, structural screws, decking screws, and productivity solutions Truss plates, engineered wood product connectors, truss and EWP design software Mechanical and adhesive anchors, injection epoxies, carbon fiber strengthening products Broad and deep product offering with 10,000+ standard and custom products for wood, concrete, and steel connections. Digital solutions to make it easier to specify and order our products. Digital Solutions 50+ software and web applications for design, specification and estimating Note: Excluding ETANCO building envelope products only sold in Europe. 7

Simpson’s Value Proposition Product Installation Per the spec, builders install Simpson products to construct homes Product Procurement Lumber dealers stock and sell Simpson products purchased by builders Product Specification Engineers design and spec Simpson products on their projects Code Compliance Simpson products designed, engineered and tested to meet or exceed the Building Code Our Solutions • Engineered and tested products in compliance with national building codes • Code evaluation reports for products • Product load values, design guidance • Engineered and tested seismic/high- wind products • Design and product selection apps • Highly specified connectors • Innovative anchors and fasteners • LBM management and estimating software • Rebates • Easy-to-install products • Contractual relationships / rebates • Builder spec, management and estimating software • Deck software Our Services • Contribute to test protocols • Involvement with academia and full- scale building tests • Code awareness to improve enforcement • Specification calls (Field Engineers and Sales) • Project specific testing • Delegated design support • Direct relationships, dedicated team • Best-in-class customer service and online ordering • Merchandising • In-store inventory support • Dedicated builder sales team • Technical/field support, jobsite visits • Problem solving (product testing) • Take-offs / value engineering • Project RFIs Our Training • Training for building officials and inspectors • Formalized training with CEUs • Informational webinars • Product knowledge training • Training programs with PDHs (installation guides, workshops, videos, webinars) Our presence at every stage of the construction process — from compliance and specification to procurement and installation — creates an interconnected value chain, setting us apart and ensuring long-term market leadership. Code Officials Specifiers/Engineers Suppliers/Dealers Builders

9 Long-Term Housing Market Reasons to believe in the market in the mid- to long-term: • Sizable shortage of new homes after more than a decade of under-building relative to population growth • Estimated shortage of ~2 million homes in the U.S. • Rising population entering housing demand years • Aging housing stock and insufficient resale inventory is supporting demand for new construction 0 500 1,000 1,500 2,000 2,500 US Housing Starts Target housing starts needed to keep up with demand 500k starts 1.8M starts U.S. Housing Market Shortage 2024 to 2034 total projected US housing demand (for sale and for rent) to satisfy growth and undersupply is 18.6M 2.1M starts Source: John Burns Research and Consulting, U.S. Census Bureau

10 Core Addressable Market(1) Wood Connectors, Truss & Lateral Concrete & Steel Connections Addressable Market $3.8 B SSD Share $1.3 B (33%) Fasteners $1.7 B (17%) Expanded view of our product lines across market segments shows many opportunities Addressable Market $5.1 B SSD Share $0.5 B (11%) Addressable Market $2.8 B SSD Share $0.3 B (12%) (1) Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited. Market share based on unaudited net sales as of the full year ended December 31, 2024. Market sizes based on internal estimates using information as of October 2023. Includes North America, Europe and Pacific Rim.

11 5 Key End Use Markets in North America Our market focused approach enables us to better serve current customers and identify opportunities to reach new customers and product opportunities. See Appendix for additional details.

12 Driving Growth with Digital Solutions Key focus areas to make it easier to specify and order our products: Specification tools (apps/selectors) Design/visualization, estimating, online ordering Option management, estimating Project management and truss design Free design software and plans Digital Solutions Building out our digital offerings to serve customers across the building industry Make it easier to do business with Simpson through best-in-class online portal and digital experience Use technology to streamline and strengthen partnerships with key customer groups Provide software solutions that drive the specification and use of our products 1 2 3

13 Europe Strategy BUILDING STRONG BRANDS IN OUR CORE BUSINESS GROW WITH OUR STRONG SOLUTIONS IN OUR HIGHEST POTENTIAL MARKETS DOUBLE STRUCTURAL FASTENERS OFFER COMPLETE PRODUCT SOLUTIONS CONNECTORS FASTENERS ANCHORS STRONGER EFFORT IN COMMERCIAL NEW BUILDING AND RESIDENTIAL RENOVATION #1 IN WOOD CONNECTORS BUILD ON OUR STRONG POSITION IN FACADE TARGETED EXPANSION IN PAVEMENT REINFORCEMENT EXPLOIT THE MASS TIMBER TREND FOCUS ON THE COUNTRIES WHERE WE ALREADY OPERATE

14 North America $1,736 Europe $479 Asia/Pacific $17 Strong Business Drives Stockholder Value Our 2024 Sales by Product… ($ USD Millions) and Across Operating Segments ($ USD Millions) EPS Dividends Per Share(1) Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited. (1) Chart represents annual dividends declared. Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in December 2012 is included in 2013. Wood Construction $1,900 Concrete Construction $331 Other $2 $1.05 $1.29 $1.38 $1.86 $1.94 $2.72 $2.98 $4.27 $6.12 $7.76 $8.26 $7.60 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $0.50 $0.55 $0.62 $0.70 $0.81 $0.87 $0.91 $0.92 $0.98 $1.03 $1.07 $1.11 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

15 Historical Market and Financial Performance Total Company Revenue & Profitability Relative to U.S. Housing Starts 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 H ousing Starts (M ) ($ M ) North America Net Sales Total Net Sales Gross Profit Income from Operations Housing Starts

16 Accelerating Above Market Growth Our North America operations continue to outperform U.S. housing and we are highly focused on accelerating above market volume growth beyond historical average performance while continuing to pursue strong profitability. 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 - 50 100 150 200 250 300 350 400 450 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 H ousing Starts (M ) Sa le s Vo lu m es North America Volume US Housing Starts ~3% pts. on avg. above market ~7% pts. on avg. above market

17 2020 vs 2024: Significant Progress Made in a Flat Market ~ 1.4 million U.S. housing starts in 2020 and 2024 Revenue = $1.25 B Op. Income = $250 M Net Pricing = ~$450 M Revenue = $2.2 B Op. Income= $430 M ETANCO = $300 M Share Gains = ~$200 M 2020 2024 1.38 M U.S. housing starts (Census Bureau) 1.36 M U.S. housing starts (Census Bureau)

Our Business in 2020 vs. 2024 ~$1B more revenue ~$200M more operating profit Clearer targets and strategies Stronger market leadership in connectors, improved share in fasteners and anchors Shifted to market-focused sales Promoted high-potential talent and external experts to senior leadership Despite market headwinds, entering 2025 from a position of strength Transitioned to direct sales, away from two-step distribution Streamlined processes and focused on high-impact products Improved M&A process for smoother integrations Grew European business and nearing right-sized footprint Investments in manufacturing, logistics, and software development

19 9.8% 4.3% 3.6% 4.0% 4.8% 5.1% 7.6% 7.3% 8.8% 11.1% 13.6% 14.0% 13.1% 13.0% 14.3% 16.5% 17.2% 17.0% 14.7% 19.9% 15.1% 13.2% 6.0% 14.1% 12.3% 9.4% 11.6% 13.3% 13.8% 16.5% 14.2% 16.0% 15.9% 19.9% 23.4% 21.7% 21.5% 19.3% 18.5% - 20.5%(2) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E Simpson Historical Operating Income Margin Versus Proxy Peer Average(1) Proxy Peer Average SSD-US(1) (1) Proxy peer average includes: AOS, AAON, WMS, ALLE, AMWD, APOG, AWI, ATKR, AZEK, EXP, ROCK, JHX, LPX, PATK, NX, SUM, TREX for the years 2006-2023. Includes AOS, PATK, and WMS for the year ended December 31, 2024, AKEK and ATKR for the full year ended September 30, 2024 and NX for the year ended October 31, 2024. Financials results for SSD as of and for the fiscal year ended December 31, 2024 are unaudited. (2) Fiscal 2025 operating margin outlook as of February 10, 2025. Please refer to the fourth quarter and full year 2024 earnings press release issued on February 10, 2025 for additional details. Operating Income Margin Outperformance Operating Income Margin Average 2006 - 2019 2020-2021 2022-2024 Proxy Peer Average(1) 8.6% 15.4% 16.3% SSD 13.7% 21.7% 20.8%

20 Well-Positioned to Drive Growth We are well-positioned to execute our growth strategy given our demonstrated commitment to disciplined capital allocation. $206 $208 $151 $400 $427 $340 $33 $33 $44 $62 $89 $183 $7 $8 $6 $811 $23 $79 $40 $40 $42 $44 $45 $47 $61 $76 $24 $79 $50 $100 $142 $158 $116 $995 $207 $408 2019 2020 2021 2022 2023 2024 Cash Generated by Operations Capital Expenditures Acquisitions & Purchases of Intangible Assets Dividends Share Repurchases Note: Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

21 Quarterly Cash Dividends Capital Return History $940.0 Million 2021 – 2024(1) Cumulative Free Cash Flow defined as: Cash flow from operations ($1,318.0 M) less Capital expenditures ($377.9 M) 26.9% 18.9% Repurchases of Common Stock(2) (1) Time frame represents January 1, 2021 to December 31, 2024. Financials results as of and for the fiscal year ended December 31, 2024 are unaudited.

22 Use of Cash Priorities Cash Flow From Operations Share Repurchases • Evaluating potential M&A in the markets we operate (support key growth initiatives) • Integrating ETANCO remains the priority • Maintain quarterly cash dividends(1) • Consistently and moderately raise dividends • Capital return target of 35% of free cash flow(2) • Selective and opportunistic share repurchases • Board approved $100 M share repurchase authorization through December 2025 • Capital return target of 35% of free cash flow(2) Organic Growth Dividends (1) On January 31, 2025, the Company's Board of Directors declared a quarterly dividend of $0.28 per share, payable on April 24, 2025 to stockholders of record on April 3, 2025. (2) The Company defines free cash flow as cash flow from operations less capital expenditures. • Focused on repaying debt incurred to finance the acquisition of ETANCODebt Repayment Acquisitions • Prioritizing facility expansions (capacity, service, efficiencies and safety) • Investing in growth initiatives (engineering, marketing, sales personnel, testing capabilities, etc.) Past and Potential Future Uses of Cash Flows

23 Investments to Meet Growing Demand Expansion of Columbus, OH Facility Greenfield Gallatin, TN Facility • Support fastener sales growth • Balance supply chain and reduce risk • Reduce lead times • Achieve company fill rate standards • Vertically integrate manufacturing • Future capacity to support growth • Maintain safety standards • Ensure excellent service levels • Allow needed headcount growth • Improve production costs Expansion of North American manufacturing operations to better serve our customers Expected H1 2025 Expected H2 2025

24 Acquisition Strategy • Focused on strengthening our business model by expanding our product lines to develop complete solutions for the markets in which we operate • Improve our manufacturing capabilities and supply chain efficiencies to reduce lead-times and bring production closer to the end customer • The majority of actionable opportunities are smaller / tuck-in type acquisitions Evaluate potential M&A opportunities to accelerate our strategic growth priorities

25 Company Ambitions(1) Strengthening our values-based culture Being the business partner of choice Striving to be an innovative leader in the markets we operate Continuing above market growth relative to U.S. housing starts Maintain operating income margin of >20% EPS growth ahead of net revenue growth 1 2 4 3 5 6 (1) Revised January 1, 2025.

Social Responsibility Diversity, Equity and Inclusion Leadership & Development Human Capital Management Health and Safety Striving to ensure everyone at our Company feels included and empowered, and equipping our employees with the tools and confidence to nurture themselves and their careers • GOAL: Foster diversity in our workforce and maintain representation of differing genders, ages, races, ethnicities, and abilities Partnered with DiversityJobs to promote our job postings, and recently established a promotion guide to ensure a fair and consistent approach • GOAL: Ensure all employees have access to opportunities to grow and thrive in their careers with the Company Launched employee skills assessment and began creating meaningful development programs to ensure continued employee growth • GOAL: Strengthen our values-based leadership and culture based on our Company value that Everybody Matters Formed a partnership with Gallup to conduct our biannual Global Employee Engagement Survey • GOAL: Provide the highest standard of safety and create a healthy working environment In 2024, improved the global Total Recordable Incident Rate to 0.98, below the gold standard of recognized international experts 26 We operate in an environmentally responsible manner to protect our employees, customers and communities while prioritizing an inclusive, equitable and diverse company Corporate Social Responsibility Environmental Manufacturing Facilities Energy Conservation Waste Reduction and Recycling Sustainable Building Practices Committed to continuously improving the efficiency of our resource use to lessen our impact, and designing and manufacturing products with environmental conservation in mind • GOAL: Minimize amount of total waste generated by manufacturing processes through companywide lean practices In 2024, continued the work at each of our facilities to advance toward appropriate environmental stewardship practices • GOAL: Improve energy efficiencies at facilities globally to ensure eco- friendly, cost-effective operations In 2024, continued various energy conservation initiatives across our operations • GOAL: Support the Circular Economy by minimizing our largest recognized waste stream and sending unused steel back upstream Continuously work to improve the design of our products to minimize scrap steel during the stamping process, reducing both costs and energy • GOAL: Support sustainable business practices through use of green building technology and non-toxic materials Completed testing on a 10-story mass-timber structure, paving the way for increased adoption of regenerative construction materials

APPENDIX

28 Innovation Leader 1956 1970 1984 1996 1997 1999 2005 Simpson is a pioneer of construction solutions and the industry standard for structural connectors. 1994 NYSE LISTING (SSD) OUR FOUNDER BARC SIMPSON EXPANSION INTO CONCRETE EXPANSION INTO FASTENERS FIRST CONNECTOR CONNECTOR MARKET LEADER EXPANSION INTO WOOD SHEAR WALLS EXPANSION INTO FASTENING SYSTEMS 2001 OPENED TYE GILB TEST LAB EXPANSION INTO STEEL SHEAR WALLSFIRST HOLDOWN 2008 EXPANSION INTO STAINLESS STEEL FASTENERS

29 Innovation Leader (Continued) Simpson is an innovation leader in fasteners, concrete repair, lateral systems, construction software and structural steel solutions. 2011 2016 20192012 2017 FURTHER EXPANSION INTO COLD-FORMED STEEL EXPANSION INTO CARBON FIBER SOLUTIONS EXPANSION INTO BUILDER & LBM SOFTWARE EXPANSION INTO STRUCTURAL STEEL EXPANSION INTO OUTDOOR DECORATIVE HARDWARE 2021 FURTHER EXPANSION INTO WOOD SHEAR WALLS 2022 EXPANSION INTO EUROPEAN COMMERCIAL BUILDING MARKET 2023 FURTHER EXPANSION INTO MASS TIMBER EXPANSION INTO TRUSS SOFTWARE 2013 EXPANSION INTO ENGINEERED WOOD PRODUCTS SOFTWARE EXPANSION INTO EQUIPMENT SPACE (ESTIFRAME) 2024 (MONET DESAUW) FURTHER EXPANSION INTO ENGINEERED WOOD PRODUCT SOFTWARE

30 Innovation Leader (Continued) ~300 Engineers ~1,700 Trademarks Worldwide 8 Accredited Test Labs ~500 Patents Worldwide ~200 Patents Pending ~120 Code Reports A dedication to innovation through extensive research and development, academic partnerships and state-of-the-art structural testing. Testing is in our DNAInnovation by the numbers(1) Large scale structural testing and individual solution testing provides us with a better understanding of how structures perform, advances our design technology and improves building safety. (1) Data as of February 2025.

31 Residential End Use Market KEY PRODUCT LINES KEY MARKET FOCUS AREAS STRATEGY • Single family construction • Multifamily construction • Outdoor living (e.g. decks, pergolas, fences) • Repair, remodel and retrofit applications • National home builder relationships • Lumber and building materials (LBM) relationships • Build and maintain strong relationships with Builders and pro-dealers • Specify and create demand through national builders • Ensure product availability through national pro- dealers • Utilize connectors to grow other product lines • Deliver digital solutions to accelerate building safer stronger structures Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems (Truss) Digital Solutions

32 Commercial End Use Market KEY MARKET FOCUS AREAS STRATEGY • Retail and office buildings • Institutional (education, healthcare) • Public and utilities (water supply, pipelines, ports) • Transportation (bridges, tunnels, airports) • Manufacturing (factories, warehouses, data centers) • Structural steel buildings • Call on and educate engineers and designers to drive specifications • Provide training and support to contractors and distributors • Deliver digital solutions that make it easy for engineers to specify and contractors to use our products • Continue to build out solutions portfolio to increase breadth of line in structural steel, anchors, fasteners, strengthening and products for cold-formed steel • Strategic partnership with Structural Technologies – largest installer of carbon fiber products KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

33 OEM End Use Market KEY MARKET FOCUS AREAS STRATEGY • Aligned with our business model; identify opportunity for existing connectors, fasteners, anchors and truss plates products into this market • Engineer and launch value-added OEM-specific structural solutions • Leverage our engineering testing capabilities • Develop direct and distribution sales channels • Utilize external innovation opportunities • Offer custom connector fabrication for the Mass Timber industry • Off-site construction (manufactured housing, modular construction, post-frame construction, prefab sheds) • Mass timber construction • Wood and steel fastening (crates, trailers, RV manufacturers, etc.) • Concrete anchoring and kitting (material handling and precast concrete mfrs, private label & kitting) KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions

34 National Retail End Use Market KEY MARKET FOCUS AREAS STRATEGY • Improve retail execution through merchandising, product development, and marketing • Continue expanding availability of all product lines, and increase in-store training • Enable consumers to customize, design and create bill-of-materials with software • Partner with home center brand advocates, and invest in retail media to maximize e-commerce sales • Utilize external innovation opportunities • Large home centers • Co-ops / retail chains • Farm & hardware supply retailers • Pro customer strategy • eCommerce growth • DIY customers KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

35 Component Manufacturer End Use Market KEY MARKET FOCUS AREAS STRATEGY • Component manufactures who build roof and floor trusses, offer EWP solutions and/or wall panel solutions • Equipment solutions • Large LBMs • Offsite construction – i.e., fully integrated builders Wall Panels 35 Roof Truss Floor Truss I-Joist (EWP) Simpson Hardware Multi Module Software Offering • Continue to develop functional, stable, open software • Continue to increase truss plate manufacturing capacity to support growth • Further build internal talent pool for implementation, training and high touch service and support • Provide a modest equipment offering • Industry involvement and strong relationships KEY PRODUCT LINES Wood Connection Products Fastening Systems Concrete Connection Products Integrated Component Systems Digital Solutions ---

36 Digital Solutions Building out our digital offerings to serve customers across the building industry ~30 specification tools (apps/selectors) Design/visualization, estimating Option management, estimating Project management and design Free design software and plans

STRONG FOUNDATION. STRONGER FUTURE.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

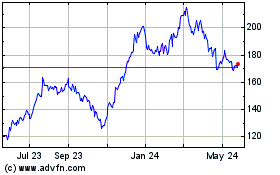

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

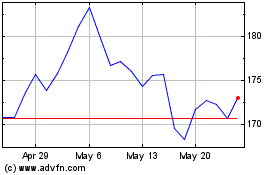

Simpson Manufacturing (NYSE:SSD)

Historical Stock Chart

From Feb 2024 to Feb 2025