Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, is reporting its

Results of Operations for the year ended December 31, 2019. With

the current Coronavirus presenting a concern; we remain confident

the underlying need for quality multi-family housing will remain

strong. Should circumstances change or our view be less optimistic,

we have the ability to dramatically slow our pace of our new

development efforts. However, to date, TCI’s existing portfolio has

seen a significant increase in value. For FYE 2018, same store

aggregate appraised value of TCI’s holdings was approximately

$244.4 million. Whereas for FYE 2019, same store aggregate

appraised value of TCI’s holdings was $298.7 million. This

represents a $54.2 million or 22% increase in overall asset value

year over year.

Though the Company reported a net loss of $26.9 million or $3.09

per diluted share loss. This was driven by the overall strategic

direction of both investing and expanding the core multi-family

portfolio. In particular, as certain new multifamily development

projects are completed, in which the Company has made significant

new investments, it is expected that net income will be positively

impacted in 2020 and 2021. Also, the Company paid higher interest

rate debt with lower cost capital, purchased a ground lease, and

made sizeable tenant capital improvements tied to the commercial

portfolio.

The significant differences between FYE 2018 and 2019 are

specifically and directly related to the following components:

1. In November 2018 the Company created a new

subsidiary Victory Abode Apartments, LLC (“VAA”) and contributed 52

multi-family projects that it owned and operated to VAA. TCI

subsequently sold a 50% interest to a third party and recorded a

$154.1 million gain. This transaction transferred a significant

portion of Revenue to VAA and is attributed for the reduction in

revenue from $121.0 million in 2018 to $47.9 million in 2019. The

Gain on disposition of this transaction is currently being deployed

for the development of new multifamily properties according to

TCI’s overall strategy. TCI’s efforts in 2019 were to continue to

grow and develop new multifamily properties and the integration of

certain operating processes with regards to VAA.

In February of 2020, Standard & Poor’s

Global Ratings announced the increase of Southern Properties

Capital (a wholly owned subsidiary of TCI) issued rating to A- from

BBB+ for bonds (Series A and B). In addition, Series C bond rating

(secured by one of Southern Properties Capital’s commercial

properties) increased to A from A-. These credit rating increases

are due to S&P’s expectation of continued improvement in

coverage ratios tied to the expansion of The Company’s

portfolio.

In 2019, TCI deployed over $33.7 million

towards the development of over 2,600 units across more than 6

projects. There are also over a dozen projects in the pipeline that

include parcels of land already owned by the Company. This

recapitalization will strengthen TCI’s position in the marketplace

and overall financial health for the benefit of its shareholders.

There was also $25 million dedicated to Windmill Farms development;

the Company anticipates revenues exceeding that amount over the

next few years, plus recovery tied to the reimbursement of

development expenses by the issuance of revenue bond sales tied to

the Water District.

2. All new multifamily real estate projects

within TCI’s future pipeline are progressing in various stages of

development. This requires initial investment with little to no

cash flow from operations until additional assets become

stabilized.

The Company believes that both the development of new projects

and the historically low interest rate environment has positioned

the Company along the strategic lines that it previously indicated.

The Company has created a dynamic platform to continue its

expansion in the multifamily sector. The ongoing plan is to

continue to develop and acquire apartments in the geographic

markets where demand exceeds supply.

Revenues

Rental and other property revenues were $47.9 million for the

year ended December 31, 2019. This represents a decrease of $73.1

million, as compared to the prior year revenues of $121.0 million.

The decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

Expenses

Property operating expenses were $25.2 million for the year

ended December 31, 2019. This represents a decrease of $34.2

million, compared to the prior year operating expenses of $59.4

million. The decrease is primarily due to the contribution of

fifty-two properties to the joint venture VAA on November 19,

2018.

Depreciation and amortization expenses were $13.4 million for

the year ended December 31, 2019. This represents a decrease of

$9.4 million compared to prior year depreciation of $22.8 million.

The decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

General and administrative expenses were $10.9 million for the

year ended December 31, 2019. This represents a decrease of $0.5

million compared to the prior year expenses of $11.4 million. There

was a $0.5 million decrease reflected to Advisory fees. The overall

SG&A costs did not decrease associated with the JV; as the

principal partners contribute resources on a non-allocated

basis.

Other income (expense)

Interest income was $19.6 million for the year ended December

31, 2019 compared to $15.8 million for the year ended December 31,

2018 for an increase of $3.8 million. This increase was primarily

due to an increase of $3.8 million in interest on receivable owed

from the Advisor.

Mortgage and loan interest expense was $31.8 million for the

year ended December 31, 2019. This represents a decrease of $27.1

million compared to the prior year expense of $58.9 million. The

decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

There was no material gain or loss on sales of income producing

properties was recognized during the year ended December 31, 2019,

as our focus was not on the sale of any assets. Over the past

several years we have successfully disposed of underperforming

assets. As such, there are only a few remaining assets we have a

strong intention of selling. There are also a few more strategic

assets that we are positioned for sale as market conditions

dictate.

The company recorded a non-cash charge of $15.1 million tied to

currency rate exposure associated with TCI’s Bond Offering (SPC).

Historically, the exchange ratio reflects an imbalance which is not

expected to continue. To this point; the exchange rate has enhanced

since 12/31/19. It should be noted that we completed a currency

transaction on 3/18/20 that covered the July 2020 Bond payment. In

reality this transaction dropped the projected non-cash loss by

over $1.3 million.

Gain on land sales was $14.9 million and $17.4 million for the

years ended December 31, 2019 and 2018, respectively.

Other income was $0.084 million and $28.2 million for the years

ended December 31, 2019 and 2018, respectively. TCI’s Other income

category is traditionally low and was abnormally high in 2018 due

to a $17.6 million gain recognized in September 2018 for deferred

income associated with the sale of assets, as well as income of

approximately $7.6 million from insurance proceeds on Mahogany Run

Golf Course.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended December

31,

2019

2018

2017

(dollars in thousands, except per share

amounts) Revenues:

Rental and other

property revenues (including $841, $767 and $839 for the years

ended 2019, 2018 and 2017, respectively, from related parties)

$

47,970

$

120,955

$

125,233

Expenses:

Property operating expenses (including $991,

$943 and $929 for the years ended 2019, 2018 and 2017,

respectively, from related parties)

25,213

59,420

63,056

Depreciation and amortization

13,379

22,761

25,558

General and administrative (including $4,144, $4,578 and

$3,120 for the years ended 2019, 2018 and 2017, respectively,

from related parties)

10,951

11,359

6,269

Net income fee to related party

357

631

250

Advisory fee to related party

5,806

10,663

9,995

Total

operating expenses

55,706

104,834

105,128

Net operating (loss) income

(7,736

)

16,121

20,105

Other

income (expenses):

Interest income (including $17,413, $13,132 and $11,485 for

the years ended 2019, 2018 and 2017, respectively, from related

parties)

19,607

15,793

13,862

Other income

84

28,150

625

Mortgage and loan interest (including $1,999, $423 and

$1,174 for the year ended 2019, 2018 and 2017, respectively,

from related parties)

(31,816

)

(58,872

)

(59,944

)

Foreign currency transaction (loss) gain

(15,108

)

12,399

(4,536

)

Loss on debt extinguishment

(5,219

)

-

-

Equity (loss) earnings from VAA

(2,774

)

44

-

Earnings from other unconsolidated investees

16

1,085

26

Total

other expenses

(35,210

)

(1,401

)

(49,967

)

(Loss) income before gain on disposition of 50% interest in

VAA, gain on land sales, non-controlling interest, and taxes

(42,946

)

14,720

(29,862

)

Gain

on disposition of 50% interest in VAA

-

154,126

-

(Loss) gain on sale of income producing properties

(80

)

-

9,842

Gain on land sales

14,889

17,404

4,884

Net (loss) income from continuing operations before taxes

(28,137

)

186,250

(15,136

)

Income tax expense - current

-

(1,210

)

(180

)

Income tax benefit (expense) - deferred

2,000

(2,000

)

-

Net (loss) income from continuing operations

(26,137

)

183,040

(15,316

)

Net (loss) income

(26,137

)

183,040

(15,316

)

Net (income) attributable to non-controlling interest

(783

)

(1,590

)

(499

)

Net (loss) income attributable to Transcontinental Realty

Investors, Inc.

(26,920

)

181,450

(15,815

)

Preferred dividend requirement

-

(900

)

(900

)

Net (loss) income applicable to common shares

$

(26,920

)

$

180,550

$

(16,715

)

Earnings

per share - basic

Net (loss) income from continuing operations

$

(3.00

)

$

20.89

$

(1.86

)

Net (loss) income applicable to common shares

$

(3.09

)

$

20.71

$

(1.92

)

Earnings

per share - diluted

Net (loss) income from continuing operations

$

(3.00

)

$

20.89

$

(1.86

)

Net (loss) income applicable to common shares

$

(3.09

)

$

20.71

$

(1.92

)

Weighted average common shares used in computing earnings per share

8,717,767

8,717,767

8,717,767

Weighted average common shares used in computing diluted

earnings per share

8,717,767

8,717,767

8,717,767

Amounts attributable to Transcontinental Realty Investors,

Inc. Net

(loss) income from continuing operations

$

(26,137

)

$

183,040

$

(15,316

)

Net (loss) income applicable to common shares

$

(26,920

)

$

180,550

$

(16,715

)

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS December 31,

2019

2018

(dollars in thousands, except share and par value

amounts) Assets Real estate, at cost

$

469,997

$

461,718

Real estate subject to sales contracts at cost

7,966

2,014

Less accumulated depreciation

(90,173

)

(79,228

)

Total real estate

387,790

384,504

Notes and interest receivable (including $57,260 in 2019 and

$51,945 in 2018 from related parties)

120,986

83,541

Cash and cash equivalents

51,179

36,358

Restricted cash

32,082

70,207

Investment in VAA

59,148

68,399

Investment in other unconsolidated investees

22,632

22,172

Receivable from related parties

141,541

133,642

Other assets

50,560

63,557

Total assets

$

865,918

$

862,380

Liabilities and Shareholders’ Equity

Liabilities: Notes and interest payable

$

246,546

$

277,237

Bonds and bond interest payable

229,722

158,574

Deferred revenue (including $9,468 in 2019 and $17,522 in 2018 to

related parties)

9,468

17,522

Deferred tax liability

-

2,000

Accounts payable and other liabilities (including $935 in 2019 and

$3 in 2018 to related parties)

26,115

26,646

Total liabilities

511,851

481,979

Shareholders’ equity: Common stock, $0.01 par value,

authorized 10,000,000 shares; issued 8,717,967 shares in 2019 and

2018; outstanding 8,717,767 shares in 2019 and 2018

87

87

Treasury stock at cost, 200 shares in 2019 and 2018

(2

)

(2

)

Paid-in capital

257,853

258,050

Retained earnings

74,665

101,585

Total Transcontinental Realty Investors, Inc. shareholders' equity

332,603

359,720

Non-controlling interest

21,464

20,681

Total shareholders' equity

354,067

380,401

Total liabilities and shareholders' equity

$

865,918

$

862,380

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200330005744/en/

Income Opportunity Realty Investors, Inc. Investor

Relations Daniel Moos (469) 522-4200

investor.relations@transconrealty-invest.com

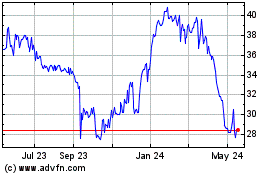

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

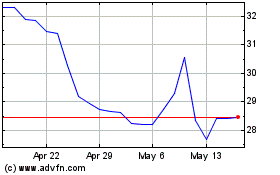

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025