CFPB Orders Toyota to Pay $60 Million Over Lending Practices

21 November 2023 - 2:06AM

Dow Jones News

By Dean Seal

Federal regulators have ordered Toyota Motor's auto-lending arm

to pay $60 million in fines and consumer redress for allegedly

preventing borrowers from canceling product bundles that raised

their monthly loan payments.

The U.S. Consumer Financial Protection Bureau said Monday that

Toyota Motor Credit Corporation has violated federal law by

withholding refunds or refunding incorrect amounts on bundled

products, unduly hurting consumers' credit reports.

The Toyota unit neither admits nor denies the agency's findings

but consents to the entry of the CFPB's order, which requires it to

pay $48 million to affected customers and a $12 million

penalty.

A representative for Toyota didn't immediately respond to a

request for comment.

According to the CFPB, the Toyota financing unit offers optional

products and services that can be bundled into packages and added

to car loan contracts. Including those products can significantly

increase the size of a loan, monthly payment or finance charge.

The agency alleges that Toyota Motor Credit made it extremely

difficult to cancel those bundled products and services, and then

failed to properly provide refunds for consumers who were able to

cancel. The unit also lied to consumer reporting companies about

borrowers missing payments, the CFPB said.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

November 20, 2023 09:51 ET (14:51 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

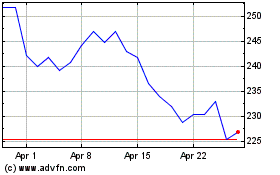

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Sep 2023 to Sep 2024