Current Report Filing (8-k)

30 March 2022 - 11:54PM

Edgar (US Regulatory)

00013769862022FYFALSE00013769862022-03-252022-03-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13, 15(d), or 37 of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 25, 2022

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 000-52313 (Commission file number) | | 62-0474417 (IRS Employer Identification No.) |

| | | | | |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | | | 37902 (Zip Code) |

(865) 632-2101

(Registrant's telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On March 25, 2022, TVA entered into a Second Amended and Restated $1,000,000,000 March Maturity Credit Agreement (the “Credit Agreement”) that amends and restates the Amended and Restated $1,000,000,000 September Maturity Credit Agreement dated as of September 28, 2018. Toronto Dominion (Texas) LLC serves as Administrative Agent for the Credit Agreement, and The Toronto-Dominion Bank, New York Branch, serves as Letter of Credit Issuer, and a Lender. Other Lenders include Bank of America, N.A., Canadian Imperial Bank of Commerce, New York Branch, First Horizon Bank, Morgan Stanley Bank, N.A., and The Bank of New York Mellon. TD Securities (USA) LLC serves as Lead Arranger and Bookrunner.

The Credit Agreement allows TVA to access up to $1,000,000,000 in either loans or letters of credit and will expire on March 25, 2027, unless the maturity date is extended in accordance with the terms of the agreement. The interest rate on any borrowing under the Credit Agreement is variable based on market factors and the rating of TVA’s senior unsecured long-term non-credit enhanced debt. TVA is required to pay an unused facility fee on the portion of the $1,000,000,000 against which TVA has not borrowed or committed under letters of credit. This fee, along with the fee on any letter of credit, may fluctuate depending on the rating of TVA’s senior unsecured long-term non-credit enhanced debt.

This description of the Credit Agreement is a summary only and is qualified in its entirety by the full and complete text of the Credit Agreement. A copy of the Credit Agreement is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | | | | |

| EXHIBIT NO. | DESCRIPTION OF EXHIBIT |

| 10.1 | Second Amended and Restated March Maturity Credit Agreement Dated as of March 25, 2022, Among Tennessee Valley Authority, as the Borrower, Toronto Dominion (Texas) LLC, as Administrative Agent, The Toronto-Dominion Bank, New York Branch, as Letter of Credit Issuer, and a Lender, Bank of America, N.A., Canadian Imperial Bank of Commerce, New York Branch, First Horizon Bank, Morgan Stanley Bank, N.A., and The Bank of New York Mellon |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| |

| Tennessee Valley Authority |

| (Registrant) |

| |

| |

| |

| Date: March 30, 2022 | /s/ John M. Thomas, III |

| John M. Thomas, III |

| Executive Vice President and |

| Chief Financial and Strategy Officer |

EXHIBIT INDEX

This exhibit is filed pursuant to Items 1.01 and 2.03 hereof.

| | | | | |

| EXHIBIT NO. | DESCRIPTION OF EXHIBIT |

| Second Amended and Restated March Maturity Credit Agreement Dated as of March 25, 2022, Among Tennessee Valley Authority, as the Borrower, Toronto Dominion (Texas) LLC, as Administrative Agent, The Toronto-Dominion Bank, New York Branch, as Letter of Credit Issuer, and a Lender, Bank of America, N.A., Canadian Imperial Bank of Commerce, New York Branch, First Horizon Bank, Morgan Stanley Bank, N.A., and The Bank of New York Mellon |

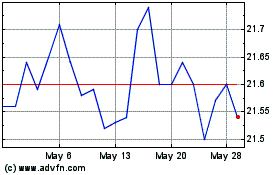

Tennessee Valley Power (NYSE:TVE)

Historical Stock Chart

From Dec 2024 to Jan 2025

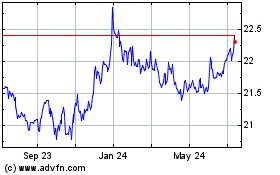

Tennessee Valley Power (NYSE:TVE)

Historical Stock Chart

From Jan 2024 to Jan 2025