UDR Reports Tax Treatment of 2024 Distributions

22 January 2025 - 8:56AM

Business Wire

UDR, Inc. (the “Company”) (NYSE: UDR), a leading multifamily

real estate investment trust, reported today the tax status of its

2024 distributions paid to shareholders. The following table

summarizes the nature of these cash distributions per share and

provides the appropriate Form 1099-DIV box number:

RecordDate PaymentDate DistributionPer Share

Box 1a TotalOrdinaryDividends Box

1bQualifiedDividends1 Box 2aTotal CapitalGain Distr.

Box 2bUnrecaptured Sec.1250 Gain2 Box 2eSec. 897

OrdinaryDividends1 Box 2fSec. 897Capital Gain2 Box

3NondividendDistributions Box 5Sec. 199ADividends1

Common Shares:

1/10/2024

1/31/2024

$0.420000

$0.394862

$0.000015

$0.025138

$0.013787

$0.117052

$0.024824

$0.000000

$0.394847

4/10/2024

4/30/2024

$0.425000

$0.399563

$0.000016

$0.025437

$0.013951

$0.118446

$0.025120

$0.000000

$0.399547

7/10/2024

7/31/2024

$0.425000

$0.399563

$0.000016

$0.025437

$0.013951

$0.118446

$0.025120

$0.000000

$0.399547

10/10/2024

10/31/2024

$0.425000

$0.399563

$0.000016

$0.025437

$0.013951

$0.118446

$0.025120

$0.000000

$0.399547

Total

$1.695000

$1.593551

$0.000063

$0.101449

$0.055640

$0.472390

$0.100184

$0.000000

$1.593488

Preferred Shares Series

E:

1/10/2024

1/31/2024

$0.454800

$0.427580

$0.000017

$0.027220

$0.014929

$0.126751

$0.026881

$0.000000

$0.427563

4/10/2024

4/30/2024

$0.460200

$0.432657

$0.000017

$0.027543

$0.015106

$0.128256

$0.027199

$0.000000

$0.432640

7/10/2024

7/31/2024

$0.460200

$0.432657

$0.000017

$0.027543

$0.015106

$0.128256

$0.027199

$0.000000

$0.432640

10/10/2024

10/31/2024

$0.460200

$0.432657

$0.000017

$0.027543

$0.015106

$0.128256

$0.027199

$0.000000

$0.432640

Total

$1.835400

$1.725551

$0.000068

$0.109849

$0.060247

$0.511519

$0.108478

$0.000000

$1.725483

(1) - These amounts are a subset of, and included in,

the amounts in Box 1a.

(2) - These amounts are a subset of,

and included in, the amounts in Box 2a.

Pursuant to Treas. Reg. § 1.1061-6(c), UDR, Inc. is disclosing

below two additional amounts for purposes of Section 1061 of the

Internal Revenue Code. Section 1061 is generally applicable to

direct and indirect holders of “applicable partnership

interests.”

Record Date

Payment Date

Form 1099-DIV Box 2a, Total

Capital Gain Distr. Per Share

One Year Amounts Disclosure

Per Share

Three Year Amounts Disclosure

Per Share

Common

Shares:

1/10/2024

1/31/2024

$0.025138

$0.000325

$0.000549

4/10/2024

4/30/2024

$0.025437

$0.000329

$0.000556

7/10/2024

7/31/2024

$0.025437

$0.000329

$0.000556

10/10/2024

10/31/2024

$0.025437

$0.000329

$0.000556

Total

$0.101449

$0.001312

$0.002217

Preferred Shares

Series E:

1/10/2024

1/31/2024

$0.027220

$0.000352

$0.000595

4/10/2024

4/30/2024

$0.027543

$0.000356

$0.000602

7/10/2024

7/31/2024

$0.027543

$0.000356

$0.000602

10/10/2024

10/31/2024

$0.027543

$0.000356

$0.000602

Total

$0.109849

$0.001420

$0.002401

Shareholders of record of the Company's common and preferred

stock will receive an Internal Revenue Service Form 1099-DIV from

EQ Shareowner Services, the Company's 2024 distribution paying

agent. The form will report the distributions paid and the amounts

designated as total ordinary dividends, qualified dividends, total

capital gains, unrecaptured section 1250 gains, section 897

ordinary dividends, section 897 capital gain, nondividend

distributions, and section 199A dividends. If shares were held in

"street name" during 2024, the IRS form will be provided by a bank,

brokerage firm, or nominee. Because the Company's tax return has

not yet been filed for the year ended December 31, 2024, the

distribution allocations presented herein have been calculated

using the best available information to date.

The tax treatment of these distributions by state and local

authorities varies and may not be the same as the IRS's treatment.

Because federal and state tax laws affect individuals differently,

the Company cannot advise shareholders on how distributions should

be reported on their tax returns. The Company encourages

shareholders to consult with their own tax advisors with respect to

the federal, state and local income tax consequences of these

distributions.

About UDR, Inc.

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading

multifamily real estate investment trust with a demonstrated

performance history of delivering superior and dependable returns

by successfully managing, buying, selling, developing and

redeveloping attractive real estate properties in targeted U.S.

markets. As of September 30, 2024, UDR owned or had an ownership

position in 60,123 apartment homes. For over 52 years, UDR has

delivered long-term value to shareholders, the best standard of

service to residents and the highest quality experience for

associates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121287318/en/

UDR, Inc. Trent Trujillo

ttrujillo@udr.com 720-283-6135

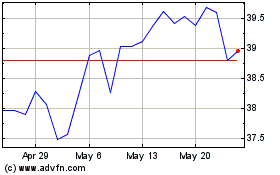

UDR (NYSE:UDR)

Historical Stock Chart

From Dec 2024 to Jan 2025

UDR (NYSE:UDR)

Historical Stock Chart

From Jan 2024 to Jan 2025