0000821130false--12-312024Q261xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:Rateusm:unitusm:asset_group00008211302024-01-012024-06-300000821130us-gaap:CommonClassBMember2024-01-012024-06-300000821130usm:SixPointTwoFivePercent2069SeniorNotesMember2024-01-012024-06-300000821130usm:FivePointFivePercentSeniorNotesMember2024-01-012024-06-300000821130usm:FivePointFivePercentJune2070SeniorNotesMember2024-01-012024-06-300000821130us-gaap:CommonClassBMember2024-06-300000821130us-gaap:CommonClassAMember2024-06-300000821130us-gaap:ServiceMember2024-04-012024-06-300000821130us-gaap:ServiceMember2023-04-012023-06-300000821130us-gaap:ServiceMember2024-01-012024-06-300000821130us-gaap:ServiceMember2023-01-012023-06-300000821130us-gaap:ProductMember2024-04-012024-06-300000821130us-gaap:ProductMember2023-04-012023-06-300000821130us-gaap:ProductMember2024-01-012024-06-300000821130us-gaap:ProductMember2023-01-012023-06-3000008211302024-04-012024-06-3000008211302023-04-012023-06-3000008211302023-01-012023-06-3000008211302023-12-3100008211302022-12-3100008211302024-06-3000008211302023-06-300000821130us-gaap:RelatedPartyMember2024-06-300000821130us-gaap:RelatedPartyMember2023-12-310000821130us-gaap:CommonClassAMember2023-12-310000821130us-gaap:CommonClassBMember2023-12-310000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberusm:AssetsHeldMember2024-06-300000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberusm:AssetsHeldMember2023-12-310000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:NonrecourseMember2024-06-300000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:NonrecourseMember2023-12-310000821130us-gaap:CommonStockMember2024-03-310000821130us-gaap:AdditionalPaidInCapitalMember2024-03-310000821130us-gaap:TreasuryStockCommonMember2024-03-310000821130us-gaap:RetainedEarningsMember2024-03-310000821130us-gaap:ParentMember2024-03-310000821130us-gaap:NoncontrollingInterestMember2024-03-3100008211302024-03-310000821130us-gaap:RetainedEarningsMember2024-04-012024-06-300000821130us-gaap:ParentMember2024-04-012024-06-300000821130us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000821130us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000821130us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000821130us-gaap:CommonStockMember2024-06-300000821130us-gaap:AdditionalPaidInCapitalMember2024-06-300000821130us-gaap:TreasuryStockCommonMember2024-06-300000821130us-gaap:RetainedEarningsMember2024-06-300000821130us-gaap:ParentMember2024-06-300000821130us-gaap:NoncontrollingInterestMember2024-06-300000821130us-gaap:CommonStockMember2023-03-310000821130us-gaap:AdditionalPaidInCapitalMember2023-03-310000821130us-gaap:TreasuryStockCommonMember2023-03-310000821130us-gaap:RetainedEarningsMember2023-03-310000821130us-gaap:ParentMember2023-03-310000821130us-gaap:NoncontrollingInterestMember2023-03-3100008211302023-03-310000821130us-gaap:RetainedEarningsMember2023-04-012023-06-300000821130us-gaap:ParentMember2023-04-012023-06-300000821130us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000821130us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000821130us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000821130us-gaap:CommonStockMember2023-06-300000821130us-gaap:AdditionalPaidInCapitalMember2023-06-300000821130us-gaap:TreasuryStockCommonMember2023-06-300000821130us-gaap:RetainedEarningsMember2023-06-300000821130us-gaap:ParentMember2023-06-300000821130us-gaap:NoncontrollingInterestMember2023-06-300000821130us-gaap:CommonStockMember2023-12-310000821130us-gaap:AdditionalPaidInCapitalMember2023-12-310000821130us-gaap:TreasuryStockCommonMember2023-12-310000821130us-gaap:RetainedEarningsMember2023-12-310000821130us-gaap:ParentMember2023-12-310000821130us-gaap:NoncontrollingInterestMember2023-12-310000821130us-gaap:RetainedEarningsMember2024-01-012024-06-300000821130us-gaap:ParentMember2024-01-012024-06-300000821130us-gaap:NoncontrollingInterestMember2024-01-012024-06-300000821130us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300000821130us-gaap:TreasuryStockCommonMember2024-01-012024-06-300000821130us-gaap:CommonStockMember2022-12-310000821130us-gaap:AdditionalPaidInCapitalMember2022-12-310000821130us-gaap:TreasuryStockCommonMember2022-12-310000821130us-gaap:RetainedEarningsMember2022-12-310000821130us-gaap:ParentMember2022-12-310000821130us-gaap:NoncontrollingInterestMember2022-12-310000821130us-gaap:RetainedEarningsMember2023-01-012023-06-300000821130us-gaap:ParentMember2023-01-012023-06-300000821130us-gaap:NoncontrollingInterestMember2023-01-012023-06-300000821130us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300000821130us-gaap:TreasuryStockCommonMember2023-01-012023-06-300000821130usm:TelephoneandDataSystemsInc.Memberusm:UnitedStatesCellularCorporationMember2024-06-300000821130usm:RetailServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300000821130usm:RetailServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300000821130usm:RetailServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300000821130usm:RetailServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300000821130usm:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300000821130usm:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300000821130usm:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300000821130usm:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300000821130us-gaap:TransferredOverTimeMember2024-04-012024-06-300000821130us-gaap:TransferredOverTimeMember2023-04-012023-06-300000821130us-gaap:TransferredOverTimeMember2024-01-012024-06-300000821130us-gaap:TransferredOverTimeMember2023-01-012023-06-300000821130usm:EquipmentAndProductSalesMemberus-gaap:TransferredAtPointInTimeMember2024-04-012024-06-300000821130usm:EquipmentAndProductSalesMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300000821130usm:EquipmentAndProductSalesMemberus-gaap:TransferredAtPointInTimeMember2024-01-012024-06-300000821130usm:EquipmentAndProductSalesMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-3000008211302024-07-012024-06-3000008211302025-01-012024-06-3000008211302026-01-012024-06-300000821130us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300000821130us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-06-300000821130us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000821130us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-12-310000821130us-gaap:AccountsReceivableMember2024-06-300000821130us-gaap:AccountsReceivableMember2023-12-310000821130us-gaap:OtherNoncurrentAssetsMember2024-06-300000821130us-gaap:OtherNoncurrentAssetsMember2023-12-310000821130usm:LowestRiskMemberus-gaap:UnbilledRevenuesMember2024-06-300000821130us-gaap:PrimeMemberus-gaap:UnbilledRevenuesMember2024-06-300000821130usm:SlightRiskMemberus-gaap:UnbilledRevenuesMember2024-06-300000821130us-gaap:SubprimeMemberus-gaap:UnbilledRevenuesMember2024-06-300000821130us-gaap:UnbilledRevenuesMember2024-06-300000821130usm:LowestRiskMemberus-gaap:UnbilledRevenuesMember2023-12-310000821130us-gaap:PrimeMemberus-gaap:UnbilledRevenuesMember2023-12-310000821130usm:SlightRiskMemberus-gaap:UnbilledRevenuesMember2023-12-310000821130us-gaap:SubprimeMemberus-gaap:UnbilledRevenuesMember2023-12-310000821130us-gaap:UnbilledRevenuesMember2023-12-310000821130usm:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2024-06-300000821130usm:SlightRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:SubprimeMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130usm:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2023-12-310000821130usm:SlightRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:SubprimeMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130usm:LowestRiskMemberus-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2024-06-300000821130usm:SlightRiskMemberus-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetPastDueMemberus-gaap:SubprimeMemberus-gaap:BilledRevenuesMember2024-06-300000821130us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2024-06-300000821130usm:LowestRiskMemberus-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2023-12-310000821130usm:SlightRiskMemberus-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetPastDueMemberus-gaap:SubprimeMemberus-gaap:BilledRevenuesMember2023-12-310000821130us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2023-12-310000821130usm:LowestRiskMember2024-06-300000821130us-gaap:PrimeMember2024-06-300000821130usm:SlightRiskMember2024-06-300000821130us-gaap:SubprimeMember2024-06-300000821130usm:LowestRiskMember2023-12-310000821130us-gaap:PrimeMember2023-12-310000821130usm:SlightRiskMember2023-12-310000821130us-gaap:SubprimeMember2023-12-310000821130usm:EquipmentInstallmentPlanReceivableMember2024-01-012024-06-300000821130usm:EquipmentInstallmentPlanReceivableMember2023-12-310000821130usm:EquipmentInstallmentPlanReceivableMember2022-12-310000821130usm:EquipmentInstallmentPlanReceivableMember2023-01-012023-06-300000821130usm:EquipmentInstallmentPlanReceivableMember2024-06-300000821130usm:EquipmentInstallmentPlanReceivableMember2023-06-300000821130srt:MaximumMember2024-04-012024-06-300000821130srt:MaximumMember2024-01-012024-06-300000821130srt:MaximumMember2024-06-300000821130usm:PutCallOptionMember2024-06-300000821130us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-04-012024-06-300000821130us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-04-012023-06-300000821130us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-01-012024-06-300000821130us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-06-300000821130usm:LendersCostOfFundsMemberusm:ReceivablesSecuritizationFacilityMember2024-01-012024-06-300000821130usm:ReceivablesSecuritizationFacilityMember2024-01-012024-06-300000821130usm:ReceivablesSecuritizationFacilityMember2024-06-300000821130usm:ReceivablesSecuritizationFacilityMemberus-gaap:AssetPledgedAsCollateralWithoutRightMember2024-06-3000008211302024-04-010000821130us-gaap:SubsequentEventMember2025-04-010000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300000821130us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000821130usm:VariableInterestEntityUsccEipLlcMember2024-01-012024-06-300000821130usm:VariableInterestEntityUsccEipLlcMember2023-01-012023-06-300000821130us-gaap:ServiceMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-04-012024-06-300000821130us-gaap:ServiceMemberusm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300000821130us-gaap:ServiceMembersrt:ConsolidationEliminationsMember2024-04-012024-06-300000821130us-gaap:ProductMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-04-012024-06-300000821130usm:TowersSegmentMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300000821130srt:ConsolidationEliminationsMemberus-gaap:ProductMember2024-04-012024-06-300000821130us-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-04-012024-06-300000821130usm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300000821130srt:ConsolidationEliminationsMember2024-04-012024-06-300000821130us-gaap:ServiceMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-04-012023-06-300000821130us-gaap:ServiceMemberusm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300000821130us-gaap:ServiceMembersrt:ConsolidationEliminationsMember2023-04-012023-06-300000821130us-gaap:ProductMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-04-012023-06-300000821130usm:TowersSegmentMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300000821130srt:ConsolidationEliminationsMemberus-gaap:ProductMember2023-04-012023-06-300000821130us-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-04-012023-06-300000821130usm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300000821130srt:ConsolidationEliminationsMember2023-04-012023-06-300000821130us-gaap:ServiceMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-01-012024-06-300000821130us-gaap:ServiceMemberusm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300000821130us-gaap:ServiceMembersrt:ConsolidationEliminationsMember2024-01-012024-06-300000821130us-gaap:ProductMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-01-012024-06-300000821130usm:TowersSegmentMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300000821130srt:ConsolidationEliminationsMemberus-gaap:ProductMember2024-01-012024-06-300000821130us-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2024-01-012024-06-300000821130usm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300000821130srt:ConsolidationEliminationsMember2024-01-012024-06-300000821130us-gaap:ServiceMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-01-012023-06-300000821130us-gaap:ServiceMemberusm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300000821130us-gaap:ServiceMembersrt:ConsolidationEliminationsMember2023-01-012023-06-300000821130us-gaap:ProductMemberus-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-01-012023-06-300000821130usm:TowersSegmentMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300000821130srt:ConsolidationEliminationsMemberus-gaap:ProductMember2023-01-012023-06-300000821130us-gaap:OperatingSegmentsMemberusm:WirelessSegmentMember2023-01-012023-06-300000821130usm:TowersSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300000821130srt:ConsolidationEliminationsMember2023-01-012023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| (Mark One) | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09712

UNITED STATES CELLULAR CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

Delaware | | 62-1147325 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

8410 West Bryn Mawr, Chicago, Illinois 60631

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (773) 399-8900

| | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Shares, $1 par value | | USM | | New York Stock Exchange |

| 6.25% Senior Notes due 2069 | | UZD | | New York Stock Exchange |

| 5.50% Senior Notes due 2070 | | UZE | | New York Stock Exchange |

| 5.50% Senior Notes due 2070 | | UZF | | New York Stock Exchange |

| | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ |

| | | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ |

| | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

| | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ |

The number of shares outstanding of each of the issuer's classes of common stock, as of June 30, 2024, is 53 million Common Shares, $1 par value, and 33 million Series A Common Shares, $1 par value.

| | | | | |

United States Cellular Corporation |

|

| Quarterly Report on Form 10-Q |

| For the Period Ended June 30, 2024 |

| |

| Index | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| United States Cellular Corporation Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Executive Overview

The following discussion and analysis compares United States Cellular Corporation’s (UScellular) financial results for the three and six months ended June 30, 2024, to the three and six months ended June 30, 2023. It should be read in conjunction with UScellular’s interim consolidated financial statements and notes included herein, and with the description of UScellular’s business, its audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) included in UScellular’s Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2023. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

During the second quarter of 2024, UScellular modified its reporting structure due to the planned disposal of its wireless operations and, as a result, disaggregated its operations into two reportable segments – Wireless and Towers. This presentation reflects how UScellular's chief operating decision maker allocates resources and evaluates operating performance following this strategic shift. Prior periods have been updated to conform to the new reportable segments. See Note 11 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information.

This report contains statements that are not based on historical facts, which may be identified by words such as “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects,” “will” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See the disclosure under the heading Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement elsewhere in this report for additional information.

The accounting policies of UScellular conform to accounting principles generally accepted in the United States of America (GAAP). However, UScellular uses certain “non-GAAP financial measures” in the MD&A. A discussion of the reasons UScellular determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with GAAP are included in the disclosure under the heading Supplemental Information Relating to Non-GAAP Financial Measures within the MD&A of this report.

General

UScellular provides wireless service throughout its footprint, and leases tower space to third-party carriers on UScellular-owned towers. UScellular is an 82%-owned subsidiary of Telephone and Data Systems, Inc. (TDS).

OPERATIONS

▪Serves customers with 4.5 million retail connections including approximately 4.0 million postpaid and 0.4 million prepaid connections

▪Operates in 21 states

▪Employs approximately 4,300 associates

▪Owns 4,388 towers

▪Operates 6,990 cell sites in service

UScellular Mission and Strategy

UScellular’s mission is to connect its customers to what matters most to them. This includes providing exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the markets UScellular serves.

UScellular's strategy is to attract and retain customers by providing a high-quality network, outstanding customer service, and competitive devices, plans and pricing - all provided with a local community focus. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as device protection plans and from services such as fixed wireless home internet. In addition, UScellular is focused on increasing tower rent revenues and expanding its solutions available to business and government customers.

▪UScellular continues to enhance its network capabilities, including by deploying 5G technology. 5G technology helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency. UScellular's initial 5G deployment in 2019-2022 predominantly used low-band spectrum to launch 5G services in portions of substantially all of its markets. During 2023, UScellular continued to invest in 5G with a focus on deployment of mid-band spectrum, which largely overlaps areas already covered with low-band 5G service. During 2024, UScellular is continuing the multi-year deployment of 5G mid-band spectrum. 5G service deployed over mid-band spectrum further enhances speed and capacity for UScellular's mobility and fixed wireless services.

▪UScellular seeks to grow revenue in its Towers segment primarily through increasing third-party colocations on existing towers through providing unique tower locations, attractive terms and streamlined implementation to third-party wireless operators.

Announced Transaction and Strategic Alternatives Review

On August 4, 2023, TDS and UScellular announced that the Boards of Directors of both companies decided to initiate a process to explore a range of strategic alternatives for UScellular. On May 28, 2024, UScellular announced that its Board of Directors unanimously approved the execution of a Securities Purchase Agreement (Securities Purchase Agreement) by and among TDS, UScellular, T-Mobile US, Inc. (T-Mobile) and USCC Wireless Holdings, LLC, pursuant to which, among other things, UScellular agreed to sell its wireless operations and select spectrum assets to T-Mobile for a purchase price, subject to adjustment as specified in the Securities Purchase Agreement, of $4,400 million, which is payable in a combination of cash and the assumption of up to approximately $2,000 million in debt. The transaction is expected to close in mid-2025, subject to the receipt of regulatory approvals and the satisfaction of customary closing conditions.

The strategic alternatives review process is ongoing as UScellular seeks to opportunistically monetize its spectrum assets that are not subject to the Securities Purchase Agreement. During the three and six months ended June 30, 2024, UScellular incurred third-party expenses of $13 million and $21 million, respectively, related to the strategic alternatives review.

Terms Used by UScellular

The following is a list of definitions of certain industry terms that are used throughout this document:

▪4G LTE – fourth generation Long-Term Evolution, which is a wireless technology that enables more network capacity for more data per user as well as faster access to data compared to third generation (3G) technology.

▪5G – fifth generation wireless technology that helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Colocations – represents instances where a third-party wireless carrier rents or leases space on a company-owned tower.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, fixed wireless, and hotspots.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and less Cash paid for software license agreements. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

▪Retail Connections – individual lines of service associated with each device activated by a postpaid or prepaid customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Tower Tenancy Rate – average number of tenants that lease space on company-owned towers, measured on a per-tower basis.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the Federal Communications Commission (FCC) intended to promote universal access to telecommunications services in the United States.

Financial Overview — UScellular

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024 to the three and six months ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 vs. 2023 | | 2024 | | 2023 | | 2024 vs. 2023 |

| (Dollars in millions) | | | | | | | | | | | |

| Operating Revenues | | | | | | | | | | | |

| Wireless | $ | 902 | | | $ | 932 | | | (3) | % | | $ | 1,826 | | | $ | 1,892 | | | (3) | % |

| Towers | 58 | | | 57 | | | 3 | % | | 116 | | | 113 | | | 3 | % |

| Intra-company eliminations | (33) | | | (32) | | | (4) | % | | (65) | | | (63) | | | (3) | % |

| Total operating revenues | 927 | | | 957 | | | (3) | % | | 1,877 | | | 1,942 | | | (3) | % |

| | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | |

| Wireless | 885 | | | 916 | | | (3) | % | | 1,779 | | | 1,868 | | | (5) | % |

| Towers | 39 | | | 39 | | | 1 | % | | 75 | | | 76 | | | (1) | % |

| Intra-company eliminations | (33) | | | (32) | | | (4) | % | | (65) | | | (63) | | | (3) | % |

| Total operating expenses | 891 | | | 923 | | | (3) | % | | 1,789 | | | 1,881 | | | (5) | % |

| | | | | | | | | | | |

| Operating income | 36 | | | 34 | | | 6 | % | | 88 | | | 61 | | | 44 | % |

| | | | | | | | | | | |

| Investment and other income (expense) | | | | | | | | | | | |

| Equity in earnings of unconsolidated entities | 38 | | | 38 | | | 2 | % | | 80 | | | 82 | | | (2) | % |

| Interest and dividend income | 3 | | | 3 | | | 18 | % | | 6 | | | 5 | | | 11 | % |

| | | | | | | | | | | |

| Interest expense | (45) | | | (51) | | | 8 | % | | (91) | | | (99) | | | 8 | % |

| | | | | | | | | | | |

| Total investment and other income | (4) | | | (10) | | | 54 | % | | (5) | | | (12) | | | 61 | % |

| | | | | | | | | | | |

| Income before income taxes | 32 | | | 24 | | | 31 | % | | 83 | | | 49 | | | 69 | % |

| Income tax expense | 14 | | | 19 | | | (28) | % | | 41 | | | 29 | | | 41 | % |

| | | | | | | | | | | |

| Net income | 18 | | | 5 | | | N/M | | 42 | | | 20 | | | N/M |

| Less: Net income attributable to noncontrolling interests, net of tax | 1 | | | — | | | (20) | % | | 7 | | | 2 | | | N/M |

| Net income attributable to UScellular shareholders | $ | 17 | | | $ | 5 | | | N/M | | $ | 35 | | | $ | 18 | | | N/M |

| | | | | | | | | | | |

Adjusted OIBDA (Non-GAAP)1 | $ | 227 | | | $ | 198 | | | 14 | % | | $ | 456 | | | $ | 404 | | | 13 | % |

Adjusted EBITDA (Non-GAAP)1 | $ | 268 | | | $ | 239 | | | 13 | % | | $ | 542 | | | $ | 491 | | | 10 | % |

Capital expenditures2 | $ | 165 | | | $ | 143 | | | 15 | % | | $ | 295 | | | $ | 351 | | | (16) | % |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Refer to individual segment discussions in this MD&A for additional details on operating revenues and expenses at the segment level.

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents UScellular’s share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method or the net asset value practical expedient. UScellular’s investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pre-tax income of $17 million and $18 million for the three months ended June 30, 2024 and 2023, respectively and $33 million and $38 million for the six months ended June 30, 2024 and 2023, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense decreased for the three and six months ended June 30, 2024 due primarily to a decrease in the average principal balance outstanding on the receivables securitization agreement. See Market Risk for additional information regarding maturities of long-term debt and weighted average interest rates.

Income tax expense

Income tax expense decreased for the three months ended June 30, 2024 due primarily to increases to state valuation allowance adjustments recorded in the second quarter of 2023 that reduced the net value of deferred tax assets, partially offset by an increase in Income before income taxes.

Income tax expense increased for the six months ended June 30, 2024, due primarily to an increase in Income before income taxes, partially offset by state valuation allowance adjustments recorded in the second quarter of 2023 that reduced the net value of deferred tax assets.

Wireless Operations

| | | | | | | | | | | | | | | | | |

| | | | | |

| As of June 30, | | 2024 | | 2023 |

| Retail Connections – End of Period | | |

| Postpaid | | 4,027,000 | | | 4,194,000 |

| Prepaid | | 439,000 | | | 462,000 |

| Total | | 4,466,000 | | | 4,656,000 |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 | | Q2 2023 | | Q2 2024 vs. Q2 2023 | | YTD 2024 | | YTD 2023 | YTD 2024 vs. YTD 2023 |

| Postpaid Activity and Churn | |

| Gross Additions | | | | | | | | | | |

| Handsets | 73,000 | | | 83,000 | | | (12) | % | | 136,000 | | | 176,000 | | (23) | % |

| Connected Devices | 44,000 | | | 42,000 | | | 5 | % | | 87,000 | | | 85,000 | | 2 | % |

| Total Gross Additions | 117,000 | | | 125,000 | | | (6) | % | | 223,000 | | | 261,000 | | (15) | % |

| Net Additions (Losses) | | | | | | | | | | |

| Handsets | (29,000) | | | (29,000) | | | — | | (76,000) | | | (54,000) | | (41) | % |

| Connected Devices | 5,000 | | | 1,000 | | | N/M | | 9,000 | | | 1,000 | | N/M |

| Total Net Additions (Losses) | (24,000) | | | (28,000) | | | 14 | % | | (67,000) | | | (53,000) | | (26) | % |

| Churn | | | | | | | | | | |

| Handsets | 0.97 | % | | 1.01 | % | | | | 1.00 | % | | 1.03 | % | |

| Connected Devices | 2.47 | % | | 2.65 | % | | | | 2.50 | % | | 2.72 | % | |

| Total Churn | 1.16 | % | | 1.21 | % | | | | 1.19 | % | | 1.24 | % | |

N/M - Percentage change not meaningful

Total postpaid handset net losses were flat for the three months ended June 30, 2024, when compared to the same period last year due to lower gross additions as a result of a decrease in the pool of available customers and continued aggressive industry-wide competition. This was offset by lower defections as a result of improvements in churn.

Total postpaid handset net losses increased for the six months ended June 30, 2024 when compared to the same period last year due to lower gross additions as a result of a decrease in the pool of available customers and continued aggressive industry-wide competition.

Total postpaid connected device net additions increased for the three and six months ended June 30, 2024, when compared to the same period last year due to higher demand for fixed wireless home internet as well as a decrease in tablet, hotspot and home phone defections as a result of improvements in churn.

Postpaid Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 vs. 2023 | | 2024 | | 2023 | | 2024 vs. 2023 |

Average Revenue Per User (ARPU) | $ | 51.45 | | | $ | 50.64 | | | 2 % | | $ | 51.69 | | | $ | 50.64 | | | 2 % |

| | | | | | | | | | | |

Average Revenue Per Account (ARPA) | $ | 130.41 | | | $ | 130.19 | | | — | | $ | 131.18 | | | $ | 130.49 | | | 1 % |

| | | | | | | | | | | |

Postpaid ARPU increased for the three and six months ended June 30, 2024, when compared to the same period last year, due to favorable plan and product offering mix and an increase in cost recovery surcharges.

Postpaid ARPA increased slightly for the three and six months ended June 30, 2024, when compared to the same period last year, due to the impacts to Postpaid ARPU, partially offset by a decrease in the number of connections per account.

Financial Overview — Wireless

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024 to the three and six months ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 vs. 2023 | | 2024 | | 2023 | | 2024 vs. 2023 |

| (Dollars in millions) | | | | | | | | | | | |

| Retail service | $ | 666 | | | $ | 686 | | | (3) | % | | $ | 1,344 | | | $ | 1,378 | | | (2) | % |

| | | | | | | | | | | |

| Other | 52 | | | 49 | | | 7 | % | | 102 | | | 99 | | | 3 | % |

| Service revenues | 718 | | | 735 | | | (2) | % | | 1,446 | | | 1,477 | | | (2) | % |

| Equipment sales | 184 | | | 197 | | | (6) | % | | 380 | | | 415 | | | (9) | % |

| Total operating revenues | 902 | | | 932 | | | (3) | % | | 1,826 | | | 1,892 | | | (3) | % |

| | | | | | | | | | | |

| System operations (excluding Depreciation, amortization and accretion reported below) | 194 | | | 203 | | | (4) | % | | 390 | | | 398 | | | (2) | % |

| Cost of equipment sold | 211 | | | 228 | | | (7) | % | | 427 | | | 480 | | | (11) | % |

| Selling, general and administrative | 313 | | | 333 | | | (6) | % | | 637 | | | 670 | | | (5) | % |

| Depreciation, amortization and accretion | 154 | | | 149 | | | 3 | % | | 308 | | | 307 | | | — | |

| | | | | | | | | | | |

| (Gain) loss on asset disposals, net | 5 | | | 3 | | | 40 | % | | 10 | | | 13 | | | (23) | % |

| | | | | | | | | | | |

| (Gain) loss on license sales and exchanges, net | 8 | | | — | | | N/M | | 7 | | | — | | | N/M |

| Total operating expenses | 885 | | | 916 | | | (3) | % | | 1,779 | | | 1,868 | | | (5) | % |

| | | | | | | | | | | |

| Operating income | $ | 17 | | | $ | 16 | | | 5 | % | | $ | 47 | | | $ | 24 | | | 97 | % |

| | | | | | | | | | | |

Adjusted OIBDA (Non-GAAP)1 | $ | 196 | | | $ | 168 | | | 16 | % | | $ | 392 | | | $ | 344 | | | 14 | % |

Adjusted EBITDA (Non-GAAP)1 | $ | 196 | | | $ | 168 | | | 16 | % | | $ | 392 | | | $ | 344 | | | 14 | % |

Capital expenditures2 | $ | 160 | | | $ | 140 | | | 13 | % | | $ | 286 | | | $ | 346 | | | (17) | % |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Operating Revenues

Three Months Ended June 30, 2024 and 2023

(Dollars in millions)

Operating Revenues

Six Months Ended June 30, 2024 and 2023

(Dollars in millions)

Service revenues consist of:

▪Retail Service - Postpaid and prepaid charges for voice, data and value-added services and cost recovery surcharges

▪Other Service - Amounts received from the Federal USF, inbound roaming, miscellaneous other service revenues and Internet of Things (IoT)

Equipment revenues consist of:

▪Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

Retail service revenues decreased for the three and six months ended June 30, 2024, primarily as result of a decrease in average postpaid and prepaid connections, partially offset by an increase in Postpaid ARPU as previously discussed in the Operational Overview section.

Equipment sales revenues decreased for the three and six months ended June 30, 2024, due primarily to a decline in smartphone devices sold due to lower upgrade and gross additions, partially offset by a higher average price of new smartphone sales.

Wireless service providers have been aggressive promotionally and on price to attract and retain customers. This includes both traditional carriers and cable wireless companies. UScellular expects promotional aggressiveness by traditional carriers and pricing pressures from cable wireless companies to continue into the foreseeable future. Operating revenues and Operating income have been negatively impacted in current and prior periods, and are expected to be negatively impacted in future periods.

Total operating expenses

Total operating expenses for the six months ended June 30, 2023 include $9 million of severance and related expenses associated with a reduction in workforce that was recorded in the first quarter of 2023. These severance expenses are included in System operations expenses and Selling, general and administrative expenses.

System operations expenses

System operations expenses decreased for the three and six months ended June 30, 2024, due primarily to decreases in customer usage and maintenance, utilities, and cell site expenses, partially offset by an increase in roaming expense primarily driven by an increase in outbound roaming usage.

Cost of equipment sold

Cost of equipment sold decreased for the three and six months ended June 30, 2024, due primarily to a decline in smartphone upgrades and gross additions, partially offset by a higher average cost per unit sold.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased for the three and six months ended June 30, 2024, due to decreases in various general and administrative expenses, sales related expenses and bad debts expense, partially offset by an increase related to the strategic alternatives review expenses of $12 million and $20 million, respectively.

Towers Operations

| | | | | | | | | | | | | | | | | |

| As of June 30, | 2024 | | 2023 | | 2024 vs. 2023 |

| Owned towers | 4,388 | | 4,341 | | 1 | % |

| Number of colocations | 2,392 | | 2,458 | | (3) | % |

| Tower tenancy rate | 1.55 | | | 1.57 | | | (1) | % |

Number of colocations

Number of colocations decreased for the period ended June 30, 2024 when compared to the same period last year due to an increase in terminations, partially offset by new tenant and equipment change executions.

Financial Overview — Towers

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024 to the three and six months ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 vs. 2023 | | 2024 | | 2023 | | 2024 vs. 2023 |

| (Dollars in millions) | | | | | | | | | | | |

| Third-party revenues | $ | 25 | | | $ | 25 | | | 1 | % | | $ | 51 | | | $ | 50 | | | 2 | % |

| Intra-company revenues | 33 | | | 32 | | | 4 | % | | 65 | | | 63 | | | 3 | % |

| Total tower revenues | 58 | | | 57 | | | 3 | % | | 116 | | | 113 | | | 3 | % |

| | | | | | | | | | | |

| System operations (excluding Depreciation, amortization and accretion reported below) | 19 | | | 19 | | | (1) | % | | 37 | | | 37 | | | 1 | % |

| Selling, general and administrative | 9 | | | 8 | | | 8 | % | | 16 | | | 16 | | | (3) | % |

| Depreciation, amortization and accretion | 11 | | | 12 | | | (5) | % | | 21 | | | 23 | | | (5) | % |

| (Gain) loss on asset disposals, net | — | | | — | | | N/M | | 1 | | | — | | | N/M |

| Total operating expenses | 39 | | | 39 | | | 1 | % | | 75 | | | 76 | | | (1) | % |

| | | | | | | | | | | |

| Operating income | $ | 19 | | | $ | 18 | | | 7 | % | | $ | 41 | | | $ | 37 | | | 10 | % |

| | | | | | | | | | | |

Adjusted OIBDA (Non-GAAP)1 | $ | 31 | | | $ | 30 | | | 6 | % | | $ | 64 | | | $ | 60 | | | 7 | % |

Adjusted EBITDA (Non-GAAP)1 | $ | 31 | | | $ | 30 | | | 6 | % | | $ | 64 | | | $ | 60 | | | 7 | % |

| Capital expenditures | $ | 5 | | | $ | 3 | | | N/M | | $ | 9 | | | $ | 5 | | | 89 | % |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

Key components of changes in the statement of operations line items were as follows:

Intra-company revenues

Intra-company revenues increased for the three and six months ended June 30, 2024, primarily as a result of an increase in the intra-company rate charged by Towers to Wireless.

Upon closing of the transaction to dispose of the wireless operations and select spectrum assets to T-Mobile, UScellular expects an increase in Third-party revenues that will be recognized under the Master License Agreement that will go into effect under the Securities Purchase Agreement. However, at such time Intra-company revenues would cease, resulting in significantly lower Total tower revenues in periods following the close.

Total operating expenses

Total operating expenses were relatively flat for the three and six months ended June 30, 2024.

Upon closing of the transaction to dispose of the wireless operations and select spectrum assets to T-Mobile, UScellular expects expenses may be incurred to effect the separation including costs to decommission certain towers and record remaining ground lease obligations on such decommissioned towers. These factors and other uncertainties in how the ongoing tower operations will be supported in the long-term may significantly impact operating expenses recorded in periods following the close.

Liquidity and Capital Resources

Sources of Liquidity

UScellular operates a capital-intensive business. In the past, UScellular’s existing cash and investment balances, funds available under its financing agreements, and cash flows from operating and certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for UScellular to meet its day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund wireless spectrum license acquisitions. There is no assurance that this will be the case in the future. UScellular has incurred negative free cash flow at times in past periods, and this could occur in future periods.

UScellular believes that existing cash and investment balances, funds available under its financing agreements, its ability to obtain future external financing, potential dispositions and expected cash flows from operating and investing activities will provide sufficient liquidity for UScellular to meet its day-to-day operating needs and debt service requirements. UScellular may require substantial additional funding for, among other uses, capital expenditures, agreements to purchase goods or services, leases, repurchases of shares, or making additional investments. It may be necessary from time to time to increase the size of its existing credit facilities, to amend existing or put in place new credit agreements, to obtain other forms of financing, issue equity securities, or to divest assets in order to fund potential expenditures. UScellular will continue to monitor the rapidly changing business and market conditions and is taking and intends to take appropriate actions, as necessary, to meet its liquidity needs.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments. The primary objective of UScellular's Cash and cash equivalents investment activities is to preserve principal.

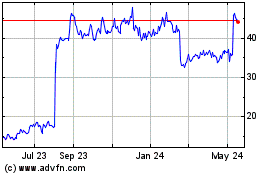

Cash and Cash Equivalents

(Dollars in millions)

The majority of UScellular’s Cash and cash equivalents are held in bank deposit accounts and in money market funds that purchase only debt issued by the U.S. Treasury or U.S. government agencies. Refer to the Consolidated Cash Flow Analysis for additional information related to changes in Cash and cash equivalents.

In addition to Cash and cash equivalents, UScellular had available undrawn borrowing capacity from the following debt facilities at June 30, 2024. See the Financing section below for further details.

| | | | | |

| |

| (Dollars in millions) | |

| Revolving Credit Agreement | $ | 300 | |

| |

| Receivables Securitization Agreement | 448 | |

| |

| |

| Total available undrawn borrowing capacity | $ | 748 | |

Financing

Receivables Securitization Agreement

UScellular, through its subsidiaries, has a receivables securitization agreement that permits securitized borrowings using its equipment installment plan receivables. Amounts under the agreement may be borrowed, repaid and reborrowed from time to time until September 2025. Unless the agreement is amended to extend the maturity date, repayments based on receivable collections commence in October 2025. During the six months ended June 30, 2024, UScellular borrowed $40 million and repaid $188 million under the agreement. As of June 30, 2024, the outstanding borrowings under the agreement were $2 million and the unused borrowing capacity was $448 million, subject to sufficient collateral to satisfy the asset borrowing base provisions of the agreement.

Debt Covenants

The revolving credit agreement, term loan agreements, export credit financing agreement and receivables securitization agreement require UScellular to comply with certain affirmative and negative covenants, which include certain financial covenants that may restrict the borrowing capacity available. UScellular is required to maintain the Consolidated Leverage Ratio as of the end of any fiscal quarter at a level not to exceed the following: 4.00 to 1.00 from April 1, 2024 through March 31, 2025; 3.75 to 1.00 from April 1, 2025 and thereafter. UScellular is also required to maintain the Consolidated Interest Coverage Ratio at a level not lower than 3.00 to 1.00 as of the end of any fiscal quarter. UScellular believes that it was in compliance as of June 30, 2024 with all such financial covenants.

Other Long-Term Financing

UScellular has an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities, preferred shares and depositary shares.

See Note 9 — Debt in the Notes to Consolidated Financial Statements for additional information related to the financing agreements.

Credit Ratings

Following the execution of the Securities Purchase Agreement in May 2024, Moody’s placed UScellular's issuer credit rating on a review for downgrade. There was no change to the Ba1 rating issued by Moody’s in October 2023. At the same time, Fitch Ratings placed UScellular’s issuer credit rating on rating watch negative. There was no change to the BB+ rating issued by Fitch Ratings in October 2023. There was no change to the Standard & Poor’s credit rating or outlook.

Capital Expenditures

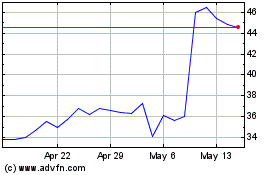

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures; excludes wireless spectrum license additions), which include the effects of accruals and capitalized interest, for the six months ended June 30, 2024 and 2023, were as follows:

Capital Expenditures

(Dollars in millions)

Capital expenditures for the full year 2024 are expected to be between $550 million and $650 million. These expenditures are expected to be used principally for the following purposes:

▪Enhance and maintain UScellular's network capacity and coverage, including continued deployment of 5G with a focus on network deployment that uses mid-band spectrum to provide additional speed and capacity to accommodate increased data usage by current customers; and

▪Invest in information technology to support existing and new services and products.

UScellular intends to finance its capital expenditures for 2024 using primarily Cash flows from operating activities, existing cash balances and, as required, additional debt financing from its existing agreements and/or other forms of available financing.

Divestitures

See Note 7 — Divestitures in the Notes to Consolidated Financial Statements for additional information related to divestitures.

The strategic alternatives review process is ongoing as UScellular seeks to opportunistically monetize its spectrum assets that are not subject to the Securities Purchase Agreement.

Other Obligations

UScellular will require capital for future spending on existing contractual obligations, including long-term debt obligations; lease commitments; commitments for device purchases, network facilities and transport services; agreements for software licensing; long-term marketing programs; and other agreements to purchase goods or services.

Variable Interest Entities

UScellular consolidates certain “variable interest entities” as defined under GAAP. See Note 10 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. UScellular may elect to make additional capital contributions and/or advances to these variable interest entities in future periods to fund their operations.

Consolidated Cash Flow Analysis

UScellular operates a capital-intensive business. UScellular makes substantial investments to acquire wireless spectrum licenses and properties and to construct and upgrade wireless telecommunications networks and facilities with a goal of creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue‑enhancing and cost-saving upgrades to UScellular’s networks. Revenues from certain of these investments are long-term and in some cases are uncertain. To meet its cash-flow needs, UScellular may need to delay or reduce certain investments or sell assets. Refer to Liquidity and Capital Resources within this MD&A and Note 7 — Divestitures in the Notes to Consolidated Financial Statements for additional information. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, timing and other factors. The following discussion summarizes UScellular's cash flow activities for the six months ended June 30, 2024 and 2023.

2024 Commentary

UScellular’s Cash, cash equivalents and restricted cash increased $36 million. Net cash provided by operating activities was $516 million due to net income of $42 million adjusted for non-cash items of $352 million, distributions received from unconsolidated entities of $80 million, including $37 million in distributions from the LA Partnership, and changes in working capital items which increased net cash by $42 million. The working capital changes were primarily driven by reduced inventory balances and the timing of future tax payments, partially offset by payment of associate bonuses.

Cash flows used for investing activities were $284 million, due primarily to payments for property, plant and equipment of $270 million.

Cash flows used for financing activities were $196 million, due primarily to $188 million in repayments on the receivables securitization agreement and cash paid for software license agreements of $20 million, partially offset by a borrowing of $40 million on the receivables securitization agreement.

2023 Commentary

UScellular’s Cash, cash equivalents and restricted cash decreased $84 million. Net cash provided by operating activities was $390 million due to net income of $20 million adjusted for non-cash items of $345 million, distributions received from unconsolidated entities of $78 million, including $37 million in distributions from the LA Partnership, and changes in working capital items which decreased net cash by $53 million. The working capital changes were primarily driven by timing of vendor payments and payment of associate bonuses, partially offset by reduced inventory purchases and timing of collection on receivables.

Cash flows used for investing activities were $345 million, due primarily to payments for property, plant and equipment of $351 million.

Cash flows used for financing activities were $129 million, due primarily to a repayment of $150 million on the receivables securitization agreement, a $60 million repayment on the EIP receivables repurchase agreement and cash paid for software license agreements of $19 million, partially offset by $115 million borrowed under the receivables securitization agreement.

Consolidated Balance Sheet Analysis

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Notable balance sheet changes during 2024 were as follows:

Inventory, net

Inventory, net decreased $56 million due primarily to the sell through of inventory on hand which was elevated at the end of 2023 to support holiday promotions and ensure adequate device supply.

Property, plant and equipment

The gross basis of Property, plant and equipment as well as the related Accumulated depreciation and amortization, decreased by $1,266 million and $1,230 million, respectively, due primarily to the decommissioning of fully depreciated assets no longer in service related to the CDMA network shutdown.

Accrued compensation

Accrued compensation decreased $26 million due primarily to associate bonus payments in March 2024.

Supplemental Information Relating to Non-GAAP Financial Measures

UScellular sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with GAAP to evaluate the performance of its business. Specifically, UScellular has referred to the following measures in this report:

▪EBITDA

▪Adjusted EBITDA

▪Adjusted OIBDA

▪Free cash flow

These measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commission Rules. Following are explanations of each of these measures.

EBITDA, Adjusted EBITDA and Adjusted OIBDA

EBITDA, Adjusted EBITDA and Adjusted OIBDA are defined as Net income adjusted for the items set forth in the reconciliation below. EBITDA, Adjusted EBITDA and Adjusted OIBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. UScellular does not intend to imply that any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Adjusted EBITDA is a segment measure reported to the chief operating decision maker for purposes of assessing the segments' performance. See Note 11 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability, and therefore reconciliations to applicable GAAP income measures are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of UScellular’s operating results before significant recurring non-cash charges, nonrecurring expenses, gains and losses, and other items as presented below as they provide additional relevant and useful information to investors and other users of UScellular’s financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, gains and losses, and expenses related to the strategic alternatives review of UScellular, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entities and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following tables reconcile EBITDA, Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measures, Net income and/or Operating income. Income and expense items below Operating income are not provided at the individual segment level for Wireless and Towers; therefore, the reconciliations begin with EBITDA and the most directly comparable GAAP measure is Operating income rather than Net income at the segment level.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| UScellular | 2024 | | 2023 | | 2024 | | 2023 |

| (Dollars in millions) | | | | | | | |

| Net income (GAAP) | $ | 18 | | | $ | 5 | | | $ | 42 | | | $ | 20 | |

| Add back: | | | | | | | |

| Income tax expense | 14 | | | 19 | | | 41 | | | 29 | |

| Interest expense | 45 | | | 51 | | | 91 | | | 99 | |

| Depreciation, amortization and accretion | 165 | | | 161 | | | 329 | | | 330 | |

| EBITDA (Non-GAAP) | 242 | | | 236 | | | 503 | | | 478 | |

| Add back or deduct: | | | | | | | |

| Expenses related to strategic alternatives review | 13 | | | — | | | 21 | | | — | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 5 | | | 3 | | | 11 | | | 13 | |

| | | | | | | |

| (Gain) loss on license sales and exchanges, net | 8 | | | — | | | 7 | | | — | |

| | | | | | | |

| Adjusted EBITDA (Non-GAAP) | 268 | | | 239 | | | 542 | | | 491 | |

| Deduct: | | | | | | | |

| Equity in earnings of unconsolidated entities | 38 | | | 38 | | | 80 | | | 82 | |

| Interest and dividend income | 3 | | | 3 | | | 6 | | | 5 | |

| | | | | | | |

| Adjusted OIBDA (Non-GAAP) | 227 | | | 198 | | | 456 | | | 404 | |

| Deduct: | | | | | | | |

| Depreciation, amortization and accretion | 165 | | | 161 | | | 329 | | | 330 | |

| Expenses related to strategic alternatives review | 13 | | | — | | | 21 | | | — | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 5 | | | 3 | | | 11 | | | 13 | |

| | | | | | | |

| (Gain) loss on license sales and exchanges, net | 8 | | | — | | | 7 | | | — | |

| Operating income (GAAP) | $ | 36 | | | $ | 34 | | | $ | 88 | | | $ | 61 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| UScellular Wireless | 2024 | | 2023 | | 2024 | | 2023 |

| (Dollars in millions) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| EBITDA (Non-GAAP) | $ | 171 | | | $ | 165 | | | $ | 355 | | | $ | 331 | |

| Add back or deduct: | | | | | | | |

| Expenses related to strategic alternatives review | 12 | | | — | | | 20 | | | — | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 5 | | | 3 | | | 10 | | | 13 | |

| | | | | | | |

| (Gain) loss on license sales and exchanges, net | 8 | | | — | | | 7 | | | — | |

| Adjusted EBITDA and Adjusted OIBDA (Non-GAAP) | 196 | | | 168 | | | 392 | | | 344 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Deduct: | | | | | | | |

| Depreciation, amortization and accretion | 154 | | | 149 | | | 308 | | | 307 | |

| Expenses related to strategic alternatives review | 12 | | | — | | | 20 | | | — | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 5 | | | 3 | | | 10 | | | 13 | |

| | | | | | | |

| (Gain) loss on license sales and exchanges, net | 8 | | | — | | | 7 | | | — | |

| Operating income (GAAP) | $ | 17 | | | $ | 16 | | | $ | 47 | | | $ | 24 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| UScellular Towers | 2024 | | 2023 | | 2024 | | 2023 |

| (Dollars in millions) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| EBITDA (Non-GAAP) | $ | 30 | | | $ | 30 | | | $ | 62 | | | $ | 60 | |

| Add back or deduct: | | | | | | | |

| Expenses related to strategic alternatives review | 1 | | | — | | | 1 | | | — | |

| (Gain) loss on asset disposals | — | | | — | | | 1 | | | — | |

| Adjusted EBITDA and Adjusted OIBDA (Non-GAAP) | 31 | | | 30 | | | 64 | | | 60 | |

| Deduct: | | | | | | | |

| Depreciation, amortization and accretion | 11 | | | 12 | | | 21 | | | 23 | |

| Expenses related to strategic alternatives review | 1 | | | — | | | 1 | | | — | |

| (Gain) loss on asset disposals, net | — | | | — | | | 1 | | | — | |

| Operating income (GAAP) | $ | 19 | | | $ | 18 | | | $ | 41 | | | $ | 37 | |

Free Cash Flow

The following table presents Free cash flow, which is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and Cash paid for software license agreements. Free cash flow is a non-GAAP financial measure which UScellular believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducting Cash paid for additions to property, plant and equipment and Cash paid for software license agreements.

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| (Dollars in millions) | | | |

| Cash flows from operating activities (GAAP) | $ | 516 | | | $ | 390 | |

| Cash paid for additions to property, plant and equipment | (270) | | | (351) | |

| Cash paid for software license agreements | (20) | | | (19) | |

| Free cash flow (Non-GAAP) | $ | 226 | | | $ | 20 | |

Application of Critical Accounting Policies and Estimates

UScellular prepares its consolidated financial statements in accordance with GAAP. UScellular’s significant accounting policies are discussed in detail in Note 1 — Summary of Significant Accounting Policies, Note 2 — Revenue Recognition and Note 10 — Leases in the Notes to Consolidated Financial Statements included in UScellular's Form 10-K for the year ended December 31, 2023. UScellular’s application of critical accounting policies and estimates is discussed in detail in Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in UScellular’s Form 10-K for the year ended December 31, 2023.

Private Securities Litigation Reform Act of 1995

Safe Harbor Cautionary Statement

This Form 10-Q, including exhibits, contains statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that UScellular intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to, those set forth below, as more fully described under “Risk Factors” in UScellular’s Form 10-K for the year ended December 31, 2023 and in this Form 10-Q. Each of the following risks could have a material adverse effect on UScellular’s business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. UScellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors in UScellular’s Form 10-K for the year ended December 31, 2023, the following factors and other information contained in, or incorporated by reference into, this Form 10-Q to understand the material risks relating to UScellular’s business, financial condition or results of operations.

Announced Transaction and Strategic Alternatives Review Risk Factors

▪TDS and UScellular entered into a Securities Purchase Agreement dated as of May 24, 2024 with T-Mobile US, Inc. and USCC Wireless Holdings, LLC, pursuant to which, among other things, UScellular has agreed to sell its wireless operations and select spectrum assets to T-Mobile. There is no guarantee that the transactions contemplated by the Securities Purchase Agreement will be able to be consummated or that UScellular will be able to find buyers at mutually agreeable prices for its spectrum assets not subject to the Securities Purchase Agreement.

Operational Risk Factors

▪Intense competition involving products, services, pricing, promotions and network speed and technologies could adversely affect UScellular’s revenues or increase its costs to compete.

▪Changes in roaming practices or other factors could cause UScellular's roaming revenues to decline from current levels, roaming expenses to increase from current levels and/or impact UScellular's ability to service its customers in geographic areas where UScellular does not have its own network, which could have an adverse effect on UScellular's business, financial condition or results of operations.

▪An inability to attract diverse people of outstanding talent throughout all levels of the organization, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on UScellular's business, financial condition or results of operations.

▪UScellular’s smaller scale relative to larger competitors that may have greater financial and other resources than UScellular could cause UScellular to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

▪Changes in various business factors, including changes in demand, consumer preferences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪A failure by UScellular to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Advances or changes in technology could render certain technologies used by UScellular obsolete, could put UScellular at a competitive disadvantage, could reduce UScellular’s revenues or could increase its costs of doing business.

▪Complexities associated with deploying new technologies present substantial risk and UScellular investments in unproven technologies may not produce the benefits that UScellular expects.

▪Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or wireless spectrum licenses and/or expansion of UScellular’s business could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪A failure by UScellular to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

▪Difficulties involving third parties with which UScellular does business, including changes in UScellular's relationships with or financial or operational difficulties, including supply chain disruptions, of key suppliers or independent agents and third-party national retailers who market UScellular’s services, could adversely affect UScellular's business, financial condition or results of operations.

▪A failure by UScellular to maintain flexible and capable telecommunication networks or information technologies, or a material disruption thereof, could have an adverse effect on UScellular’s business, financial condition or results of operations.

Financial Risk Factors

▪Uncertainty in UScellular’s or TDS' future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, changes in interest rates, other changes in UScellular’s or TDS' performance or market conditions, changes in UScellular’s or TDS' credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to UScellular, which has required and could in the future require UScellular to reduce or delay its construction, development or acquisition programs, reduce the amount of wireless spectrum licenses acquired, divest assets or businesses, and/or reduce or cease share repurchases.

▪UScellular has a significant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

▪UScellular’s assets and revenue are concentrated in the U.S. wireless telecommunications industry. Consequently, its operating results may fluctuate based on factors related primarily to conditions in this industry.

▪UScellular has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on UScellular’s financial condition or results of operations.

Regulatory, Legal and Governance Risk Factors

▪Failure by UScellular to timely or fully comply with any existing applicable legislative and/or regulatory requirements or changes thereto could adversely affect UScellular’s business, financial condition or results of operations.

▪UScellular receives significant regulatory support, and is also subject to numerous surcharges and fees from federal, state and local governments – the applicability and the amount of the support and fees are subject to uncertainty, including the ability to pass through certain fees to customers, and this uncertainty could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪The possible development of adverse precedent in litigation or conclusions in professional or environmental studies to the effect that potentially harmful emissions from devices or network equipment, including but not limited to radio frequencies emitted by wireless signals, may cause harmful health or environmental consequences, including cancer, tumors or otherwise harmful impacts, or may interfere with various electronic medical devices or frequencies used by other industries, could have an adverse effect on UScellular's business, financial condition or results of operations.

▪Claims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement claims, could prevent UScellular from using necessary technology to provide products or services or subject UScellular to expensive intellectual property litigation or monetary penalties, which could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪There are potential conflicts of interests between TDS and UScellular.

▪Certain matters, such as control by TDS and provisions in the UScellular Restated Certificate of Incorporation, may serve to discourage or make more difficult a change in control of UScellular or have other consequences.

General Risk Factors

▪UScellular has experienced, and in the future expects to experience, cyber-attacks or other breaches of network or information technology security of varying degrees on a regular basis, which could have an adverse effect on UScellular's business, financial condition or results of operations.