Webster Financial Corporation (NYSE: WBS) today announced that

its principal bank subsidiary Webster Bank, N.A. ("Webster") has

signed a definitive agreement to acquire Ametros Financial Corp

(“Ametros”), a custodian and administrator of medical funds from

insurance claim settlements, from funds managed by Long Ridge

Equity Partners (“Long Ridge”).

Ametros, the nation’s largest professional administrator of

medical insurance claim settlements, helps individuals manage their

ongoing medical care through their CareGuard service and

proprietary technology platform. CareGuard provides settlement

advisory support, saves its members money on medical expenses,

ensures compliance with government reporting, and facilitates the

navigation of the complex U.S. healthcare system.

The acquisition of Ametros will provide a fast-growing source of

low-cost and long-duration deposits, provide new sources of

noninterest income, and enhance Webster’s healthcare financial

services expertise. As of December 2023, Ametros has over 24,000

members and $804 million in deposits under custody, which will

become deposits of Webster following the closing of the

transaction; deposits under custody have more than doubled over the

past three years and the average deposit balance per account was

$33,000. Ametros’ deposit characteristics provide a unique value to

Webster:

- Average cost of less than 10 basis points with near-zero

beta;

- Average duration of more than 20 years;

- Member accounts receive FDIC insurance coverage; and

- Deposits are projected to grow at a five-year CAGR of

approximately 25%.

“This acquisition closely aligns with our strategic focus on

building a diverse and unique funding base,” said John Ciulla,

President and Chief Executive Officer of Webster Financial

Corporation. “Ametros’ market position and value proposition for

its clients and partners underpin a robust growth trajectory for

this highly complementary business. Ametros builds on Webster’s

history of developing non-traditional deposit verticals with a

favorable financial profile, including HSA Bank and interLINK.”

“Webster is the perfect growth partner for our unique business,”

says Ametros’ CEO, Porter Leslie. “We are thankful for our clients

and members who continue to place their trust in us and are excited

for this next phase of growth together.”

Webster will acquire Ametros for $350 million in cash, subject

to customary adjustments. The acquisition is anticipated to be over

2% accretive to FY25 consensus estimates, generate an IRR over 25%,

and has a five-year earn-back of tangible book value dilution. Upon

the close of the transaction, Ametros will operate as a subsidiary

of Webster. The transaction is expected to close in the first

quarter of 2024, subject to the satisfaction of customary closing

conditions and anti-trust review. Webster was advised by Wachtell,

Lipton, Rosen & Katz. Ametros and Long Ridge were advised by

Choate, Hall & Stewart LLP.

About Webster

Webster Financial Corporation (NYSE:WBS) is the holding company

for Webster Bank, N.A. and its HSA Bank Division. Webster is a

leading commercial bank in the Northeast that provides a wide range

of digital and traditional financial solutions across three

differentiated lines of business: Commercial Banking, Consumer

Banking and its HSA Bank division, one of the country’s largest

providers of employee benefits solutions. Headquartered in

Stamford, CT, Webster is a values-driven organization with more

than $70 billion in assets. Its core footprint spans the

northeastern U.S. from New York to Massachusetts, with certain

businesses operating in extended geographies. Webster Bank is a

member of the FDIC and an equal housing lender. For more

information about Webster, including past press releases and the

latest annual report, visit the Webster website at

www.websterbank.com.

About Ametros

Ametros is the industry leader in post-settlement medical

administration and a trusted partner for thousands of members

receiving funds from workers’ compensation and liability

settlements. Headquartered in Wilmington, Massachusetts, Ametros

may be reached at 877.275.7415 or via www.ametros.com.

About Long Ridge

Long Ridge is a growth oriented private equity firm focused on

financial and business technology. Since its founding, Long Ridge

has sponsored some of the most successful growth companies,

providing leading management teams with partnership, strategic

resources, and capital to drive profitable expansion. Long Ridge

manages over $1.75 billion of committed capital.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

This communication may contain certain forward-looking

statements, including, but not limited to, certain plans,

expectations, goals, projections, and statements about the benefits

of the proposed transaction, the plans, objectives, expectations

and intentions of Webster, and other statements that are not

historical facts. Such statements are subject to numerous

assumptions, risks, and uncertainties. Statements that do not

describe historical or current facts, including statements about

beliefs and expectations, are forward-looking statements.

Forward-looking statements may be identified by words such as

expect, anticipate, believe, intend, estimate, plan, target, goal,

or similar expressions, or future or conditional verbs such as

will, may, might, should, would, could, or similar variations. The

forward-looking statements are intended to be subject to the safe

harbor provided by Section 27A of the Securities Act of 1933,

Section 21E of the Securities Exchange Act of 1934, and the Private

Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and

uncertainties or risk factors is complete, below are certain

factors which could cause actual results to differ materially from

those contained or implied in the forward-looking statements:

changes in general economic, political, or industry conditions;

uncertainty in U.S. fiscal and monetary policy, including the

interest rate policies of the Federal Reserve Board; volatility and

disruptions in global capital and credit markets; movements in

interest rates; reform of LIBOR; competitive pressures on product

pricing and services; success, impact, and timing of our business

strategies, including market acceptance of any new products or

services; the nature, extent, timing, and results of governmental

actions, examinations, reviews, reforms, regulations, and

interpretations, including those related to the Dodd-Frank Wall

Street Reform and Consumer Protection Act and the Basel III

regulatory capital reforms, as well as those involving the OCC,

Federal Reserve, FDIC, and CFPB; the outcome of any legal

proceedings that may be instituted against Webster or Ametros; the

possibility that the transaction may not close in the anticipated

timeline or at all or that the anticipated benefits of the

transaction are not realized when expected or at all; and other

factors that may affect the future results of Webster or Ametros.

Additional factors that could cause results to differ materially

from those described above can be found in Webster's Annual Report

on Form 10-K for the year ended December 31, 2022, which is on file

with the Securities and Exchange Commission (the "SEC") and

available on Webster's investor relations website,

https://investors.websterbank.com/, under the heading "Financials"

and in other documents Webster files with the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Webster does not assume any obligation to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements were made or to reflect the

occurrence of unanticipated events except as required by federal

securities laws. As forward-looking statements involve significant

risks and uncertainties, caution should be exercised against

placing undue reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231214511386/en/

Media Contact: Alice Ferreira, 203-578-2610

acferreira@websterbank.com

Investor Contact: Emlen Harmon, 212-309-7646

eharmon@websterbank.com

Ametros Contact: Melissa Coleman, 978-381-4329

mailto:mcoleman@ametros.com

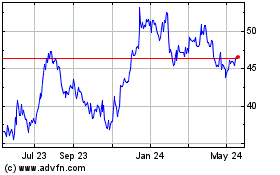

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Dec 2024 to Jan 2025

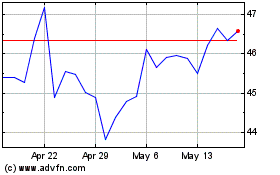

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Jan 2024 to Jan 2025