Filed Pursuant to Rule 424(b)(5)

Registration No. 333-277563

Prospectus Supplement

(To Prospectus dated March 1, 2024)

Up to $1,000,000,000

ESSENTIAL

UTILITIES, INC.

Common Stock

This prospectus

supplement and the accompanying prospectus relate to the offer and sale from time to time of shares of our common stock, par value $0.50

per share, having an aggregate gross sales price of up to $1,000,000,000 through any of Barclays Capital Inc. (“Barclays”),

BofA Securities, Inc. (“BofA Securities”), Citizens JMP Securities, LLC (“Citizens JMP”), Huntington Securities,

Inc. (“Huntington Capital Markets”), RBC Capital Markets, LLC (“RBC Capital Markets”), TD Securities (USA) LLC

(“TD Securities”), Wells Fargo Securities, LLC (“Wells Fargo Securities”), Robert W. Baird & Co. Incorporated

(“Baird”), Evercore Group L.L.C. (“Evercore ISI”) and Janney Montgomery Scott LLC (“Janney Montgomery Scott”),

as our agents under separate sales agreements. We refer to Barclays, BofA Securities, Citizens JMP, Huntington Capital Markets,

RBC Capital Markets, TD Securities, Wells Fargo Securities, Baird, Evercore ISI and Janney Montgomery Scott, each as a sales agent and

collectively as the sales agents.

The sales agreements

provide that, in addition to the issuance and sale of shares of our common stock by us through the sales agents, we may enter into forward

sale agreements, between us and any of Barclays Bank PLC, Bank of America, N.A., Citizens JMP Securities, LLC, Huntington Securities,

Inc., Royal Bank of Canada, The Toronto-Dominion Bank, Wells Fargo Bank, National Association and Robert W. Baird & Co. Incorporated.

We refer to these affiliated entities, when acting in such capacity, as forward purchasers. In connection with each such forward sale

agreement, the relevant forward purchaser will, at our request, borrow from third parties and, through the relevant sales agent, sell

a number of shares of our common stock equal to the number of shares of our common stock that will underlie such forward sale agreement

to hedge such forward purchaser’s exposure under such forward sale agreement. We refer to sales agents, when acting as agents for

forward purchasers, as forward sellers.

Sales

of common stock pursuant to this prospectus supplement and the accompanying prospectus, if any, may be made in negotiated transactions

or transactions that are deemed to be “at-the-market” transactions as defined in Rule 415 under the Securities Act

of 1933, as amended (the “Securities Act”), including sales made by means of ordinary brokers’ transactions

through the facilities of the New York Stock Exchange (the “NYSE”) at market prices, to or through a market maker,

through an electronic communications network, in negotiated transactions, in any manner permitted by applicable law, or as otherwise

may be agreed between the applicable sales agent and us.

The sales agreements

also provide that we may sell shares of our common stock to a sales agent as principal for its own account at a price agreed upon at

the time of the sale. If we sell shares of our common stock to a sales agent as principal, then we will enter into a separate terms agreement

with that sales agent setting forth the terms of such transaction.

None of

the sales agents is required to sell any specific dollar amount of shares of our common stock, but each will, subject to the terms

and conditions of the applicable sales agreement, use its commercially reasonable efforts to sell the shares offered as instructed

by us. The offering of shares of our common stock pursuant to the sales agreements will terminate upon the earlier of (1) the

sale of shares of our common stock subject to the sales agreements (including shares sold by us to or through the sales agents

and borrowed shares sold through the sales agents, acting as forward sellers) and any terms agreement having an aggregate gross

sales price of $1,000,000,000 and (2) with respect to a particular sales agreement, the termination of such sales agreement by

us or by the applicable sales agent as permitted therein.

In connection

with sales through any of the sales agents under one or more of the sales agreements, we will pay the applicable sales agent a

commission equal to 1.00% of the gross sales price of all shares of our common stock sold by such sales agent. In connection with

any forward sale transaction, the applicable sales agent, as forward seller, will receive an effective per share commission of

1.00% of the volume-weighted average price per share at which the shares of common stock are sold, as adjusted, pursuant to such

forward sale agreement.

The net

proceeds we receive from the sale of our common stock through a sales agent on our behalf pursuant to one or more of the separate

sales agreements or to a sales agent acting as a principal will be the gross proceeds received from such sales less the compensation

paid to the sales agents and any other costs we may incur in issuing and/or selling the shares of our common stock; provided,

however, that we will not initially receive any proceeds from the sale of borrowed shares of our common stock by any forward seller.

We expect to receive proceeds from the sale of shares of our common stock upon future physical settlement(s) of the relevant forward

sale agreement with the relevant forward purchaser on dates specified by us on or prior to the maturity date of such forward sale

agreement, in which case we will expect to receive, subject to certain adjustments, aggregate net cash proceeds at settlement

equal to the number of shares underlying the relevant forward sale agreement, multiplied by the relevant forward sale price. If

we elect to cash settle or net share settle a forward sale agreement, we may not receive any proceeds (in the case of cash settlement)

or will not receive any proceeds (in the case of net share settlement), and we may owe cash (in the case of cash settlement) or

shares of our common stock (in the case of net share settlement) to the relevant forward purchaser.

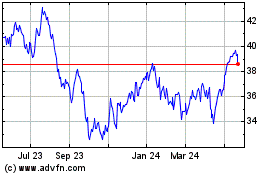

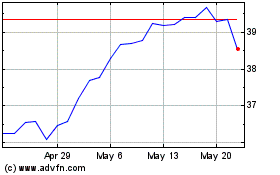

Our common stock

is listed on the NYSE under the symbol “WTRG.” On August 12, 2024, the last reported sale price of our common stock on the

NYSE was $39.11 per share.

Investing

in our common stock involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement, on page

4 of the accompanying prospectus and in the documents we incorporate by reference in this prospectus supplement and the accompanying

prospectus.

Neither the

U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

| Barclays |

BofA Securities |

Citizens

JMP |

| Huntington

Capital Markets |

RBC

Capital Markets |

TD

Securities |

Wells

Fargo Securities |

| Baird |

Evercore

ISI |

Janney

Montgomery Scott |

August

13, 2024

Table

of Contents

Prospectus

Supplement

Prospectus

About

This Prospectus Supplement

Unless

otherwise specified or the context requires otherwise, references in this prospectus supplement to:

| · | “Essential

Utilities,” the “Company,” “we,” “us,” “our”

and similar references refer to Essential Utilities, Inc. and its subsidiaries; and |

| · | “this

offering” refers to the offering of shares of our common stock from time to time

pursuant to this prospectus supplement and the accompanying prospectus. |

All references

to currency amounts included in this prospectus supplement are in U.S. dollars unless specifically noted otherwise.

This document

is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of our common

stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information about us,

some of which does not apply to this offering of our common stock. To the extent the information in this prospectus supplement

is inconsistent with the information in the accompanying prospectus, you should rely on the information in this prospectus supplement.

We have

not, and the sales agents, the principals, the forward purchasers and the forward sellers have not, authorized anyone to provide

you with any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying

prospectus or in any free writing prospectus we may provide to you in connection with this offering. Neither we nor any of the

sales agents, the principals, the forward purchasers or the forward sellers take any responsibility for, or provide any assurances

as to the reliability of, any additional or different information that others may give you. Neither we nor any of the sales agents,

the principals, the forward purchasers or the forward sellers are offering to sell our common stock or seeking offers to buy our

common stock in jurisdictions where offers or sales are not permitted. You should assume that the information contained in this

prospectus supplement, the accompanying prospectus and any related free writing prospectus is accurate only as of their respective

dates or as of the respective dates specified in such information, as applicable, and the information contained in documents incorporated

by reference is accurate only as of the respective dates of those documents or as of the respective dates specified in such information,

as applicable, in each case regardless of the time of delivery of this prospectus supplement or the accompanying prospectus or

any such free writing prospectus or any sale of our common stock. Our business, financial condition, results of operations and

prospects may have changed since those dates.

The distribution

of this prospectus supplement, the accompanying prospectus and any related free writing prospectus and the offering of our common

stock in certain jurisdictions may be restricted by law. Persons into whose possession this prospectus supplement, the accompanying

prospectus and any such free writing prospectus come should inform themselves about and observe any such restrictions. This prospectus

supplement, the accompanying prospectus and any such free writing prospectus do not constitute, and may not be used in connection

with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which

the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer

or solicitation. See “Plan of Distribution (Conflicts of Interest).”

TRADEMARKS,

TRADE NAMES AND SERVICE MARKS

We own

or have rights to trademarks, trade names and service marks that we use in conjunction with the operation of our business and

that appear in this prospectus supplement. This prospectus supplement may also contain trademarks, trade names and service marks

of other companies which, to our knowledge, are the property of their respective owners. We do not intend our use or display of

other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply,

a relationship with, or endorsement or sponsorship of us by these other parties. Solely for convenience, trademarks, trade names

and service marks referred to in this prospectus supplement may appear without the ® or ™ symbols, but the absence of

such symbols does not indicate the registration status of such trademarks, trade names or service marks and is not intended to

indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable

licensor to such trademarks, trade names and service marks.

Forward-Looking

Statements

Certain

statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus contain, and any free writing prospectus we may provide to you in connection with this

offering are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are made based upon, among other things,

our current assumptions, expectations, plans, and beliefs concerning future events and their potential effect on us. These forward-looking

statements involve risks, uncertainties and other factors, many of which are outside our control that may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied

by these forward-looking statements. In some cases you can identify forward-looking statements where statements are preceded by,

followed by or include the words “believes,” “expects,” “estimates,” “anticipates,”

“plans,” “future,” “potential,” “probably,” “predictions,” “intends,”

“will,” “continue,” “in the event” or the negative of such terms or similar expressions. Such

forward-looking statements include, but are not limited to, statements regarding:

| · | opportunities

for future acquisitions, both within and outside the water, wastewater, and natural gas

industries, the success of pending acquisitions and the impact of future acquisitions; |

| · | acquisition-related

costs and synergies; |

| · | the

impact of decisions of governmental and regulatory bodies, including decisions to raise

or lower rates and decisions regarding potential acquisitions; |

| · | the

sale of water, wastewater, and gas subsidiaries; |

| · | the

impact of conservation awareness of customers and more efficient fixtures and appliances

on water and natural gas usage per customer; |

| · | the

impact of our business on the environment, and our ability to meet our environmental,

social, and governance goals; |

| · | our

authority to carry on our business without unduly burdensome restrictions; |

| · | our

capability to pursue timely rate increase requests; |

| · | the

capacity of our water supplies, water facilities, wastewater facilities, and natural

gas supplies and storage facilities; |

| · | the

impact of public health threats, or the measures implemented by the Company as a result

of these threats; |

| · | the

impact of cybersecurity attacks or other cyber-related events; |

| · | developments,

trends and consolidation in the water, wastewater, and natural gas utility and infrastructure

industries; |

| · | the

impact of changes in and compliance with governmental laws, regulations and policies,

including those dealing with the environment, health and water quality, taxation, and

public utility regulation; |

| · | the

development of new services and technologies by us or our competitors; |

| · | the

availability of qualified personnel; |

| · | the

condition of our assets; |

| · | recovery

of capital expenditures and expenses in rates; |

| · | projected

capital expenditures and related funding requirements; |

| · | the

availability and cost of capital financing, including impacts of increasing financing

costs and interest rates; |

| · | dividend

payment projections; |

| · | the

impact of geographic diversity on our exposure to unusual weather; |

| · | the

continuation of investments in strategic ventures; |

| · | our

ability to obtain fair market value for condemned assets; |

| · | the

impact of fines and penalties; |

| · | the

impact of legal proceedings; |

| · | general

economic conditions, including inflation; |

| · | the

impairment of goodwill resulting in a non-cash charge to earnings; |

| · | the

impact of federal and/or state tax policies and the regulatory treatment of the effects

of those policies; and |

| · | the

amount of income tax deductions for qualifying utility asset improvements and the Internal

Revenue Service’s ultimate acceptance of the deduction methodology. |

Because

forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ

materially from those expressed or implied by these forward-looking statements, including, but not limited to:

| · | the

success in the closing of, and the profitability of, future acquisitions; |

| · | changes

in general economic, business, credit and financial market conditions; |

| · | our

ability to manage the expansion of our business; |

| · | changes

in environmental conditions, including the effects of climate change; |

| · | our

ability to integrate and otherwise realize all of the anticipated benefits of businesses,

technologies or services which we may acquire; |

| · | the

decisions of governmental and regulatory bodies, including decisions on regulatory filings,

including rate increase requests and decisions regarding potential acquisitions; |

| · | our

ability to file rate cases on a timely basis to minimize regulatory lag; |

| · | the

impact of inflation on our business and on our customers; |

| · | abnormal

weather conditions, including those that result in water use restrictions or reduced

or elevated natural gas consumption; |

| · | the

seasonality of our business; |

| · | our

ability to treat and supply water or collect and treat wastewater; |

| · | our

ability to source sufficient natural gas to meet customer demand in a timely manner; |

| · | the

continuous and reliable operation of our information technology systems, including the

impact of cybersecurity attacks or other cyber-related events, and risks associated with

new systems implementation or integration; |

| · | impacts

from public health threats, including on consumption, usage, supply chain, and collections; |

| · | changes

in governmental laws, regulations and policies, including those dealing with taxation,

the environment, health and water quality, and public utility regulation; |

| · | the

extent to which we are able to develop and market new and improved services; |

| · | the

effect of the loss of major customers; |

| · | our

ability to retain the services of key personnel and to hire qualified personnel as we

expand; |

| · | increasing

difficulties in obtaining insurance and increased cost of insurance; |

| · | cost

overruns relating to improvements to, or the expansion of, our operations; |

| · | inflation

in the costs of goods and services; |

| · | the

effect of natural gas price volatility, including the potential impact of high commodity

prices on usage or rate case outcomes; |

| · | civil

disturbance or terroristic threats or acts; |

| · | changes

to the rules or our assumptions underlying our determination of what qualifies for an

income tax deduction for qualifying utility asset improvements; |

| · | changes

in, or unanticipated, capital requirements; |

| · | changes

in our credit rating or the market price of our common stock; |

| · | changes

in valuation of strategic ventures; |

| · | changes

in accounting pronouncements; |

| · | restrictions

on our subsidiaries’ ability to make dividends and other distributions; |

| · | dilution

to our shareholders related to any equity financing transactions; and |

| · | broad

discretion of our management to use the net proceeds from this offering. |

Given

these risks and uncertainties, you should not place undue reliance on any forward-looking statements. You should read this prospectus

supplement, the accompanying prospectus and the documents that we incorporate by reference into this prospectus supplement and

the accompanying prospectus completely and with the understanding that our actual results, performance and achievements may be

materially different from what we expect. These forward-looking statements represent assumptions, expectations, plans, and beliefs

only as of the date of this prospectus supplement, the date of the document containing the applicable statement or the date specified

in such statement, as applicable. Except for our ongoing obligations to disclose certain information under the federal securities

laws, we are not obligated, and assume no obligation, to update these forward-looking statements, even though our situation may

change in the future. For further information or other factors which could affect our financial results and such forward-looking

statements, see “Risk Factors.” We qualify all of our forward-looking statements by these cautionary statements.

Investing in our

common stock involves risks. You should review and consider carefully the risks, uncertainties and other factors that affect our business,

financial condition and results of operations and the value of our common stock, including those described in the “Business,”

“Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

sections and other sections in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February

29, 2024, in our Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2024, filed with the SEC on May

8, 2024 and for the quarterly period ended June 30, 2024, filed with the SEC on August 6, 2024,

and those described in the “Risk Factors” sections and other sections of this prospectus supplement and the accompanying

prospectus, in each case, as updated by our subsequent annual, quarterly and other reports and documents we file with the SEC that are

incorporated by reference in this prospectus supplement and the accompanying prospectus. See “Where You Can Find Additional Information;

Incorporation of Certain Documents by Reference” in this prospectus supplement. You may obtain copies of these reports and

documents as described under “Where You Can Find Additional Information; Incorporation of Certain Documents by Reference”

in this prospectus supplement. These risks, uncertainties and other factors could cause you to suffer a loss of all or part of your investment

in our shares of common stock. Before making an investment decision, you should carefully consider these risks, uncertainties and other

factors, as well as other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus

and any related free writing prospectus we may provide to you in connection with this offering. However, additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also impair our business, operations, financial condition and financial

results and the value of our shares of common stock.

Market

and Industry Data

This prospectus

supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying

prospectus include, and any free writing prospectus we may provide to you in connection with this offering may include, market,

demographic and industry data and forecasts related to our business that are based on or derived from sources such as independent

industry publications, publicly available information, government data and other information from third parties or that have been

compiled or prepared by our management or employees. We do not guarantee the accuracy or completeness of any of this information,

and we have not independently verified any of the information provided by third-party sources.

In addition,

market, demographic and industry data and forecasts involve estimates, assumptions and other uncertainties and are subject to

change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus supplement

and under similar headings in the documents that are incorporated by reference in this prospectus supplement and the accompanying

prospectus. Accordingly, you should not place undue reliance on any of this information.

Prospectus

Supplement Summary

The

following summary highlights, and should be read together with, the information contained elsewhere in this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein. This summary may not contain all of

the information that may be important to you, and you should carefully read this entire prospectus supplement, the accompanying

prospectus, any free writing prospectus we may provide to you in connection with this offering and the documents incorporated

by reference herein and therein before making an investment decision. You may obtain a copy of the documents incorporated by reference

by following the instructions in the section titled “Where You Can Find Additional Information; Incorporation of Certain

Documents by Reference” in this prospectus supplement.

Unless

we state otherwise or the context otherwise requires, references appearing in this prospectus supplement to “Essential Utilities,”

the “Company,” “we,” “us” and “our” should be read to refer to Essential Utilities,

Inc. and its subsidiaries.

Essential

Utilities, Inc.

Essential Utilities,

Inc. is a Pennsylvania corporation and the holding company for regulated utilities providing water, wastewater or natural gas

services to an estimated 5.5 million people in Pennsylvania, Ohio, Texas, Illinois, North Carolina, New Jersey, Indiana, Virginia, and

Kentucky under the Aqua and Peoples brands.

One of our largest

operating subsidiaries, Aqua Pennsylvania, Inc., or Aqua Pennsylvania, accounted for approximately 56% of our operating revenues

and approximately 68% of income for our regulated water segment in 2023. As of December 31, 2023, Aqua Pennsylvania provided water or

wastewater services to approximately one-half of the total number of water and wastewater customers we serve. Aqua Pennsylvania’s

service territory is located in the suburban areas in counties north and west of the City of Philadelphia and in 27 other counties in

Pennsylvania. Our other regulated water or wastewater utility subsidiaries provide similar services in seven additional states. In 2020,

the Company acquired Peoples Natural Gas Company LLC and its affiliated companies, or the Peoples Gas Acquisition. As of December 31,

2023, our Peoples subsidiaries provide natural gas service to approximately 744,000 customers in western Pennsylvania and Kentucky. As

of June 30, 2024, approximately 95% of the total number of natural gas utility customers we serve are in western Pennsylvania.

The Company’s

growth in revenues over the past five years is primarily a result of the Peoples Gas Acquisition, increases in water and wastewater

rates, increase in the cost of natural gas in 2021 and 2022, and customer growth. The increase in our utility customer base has

been due to customers added through acquisitions, partnerships with developers, and organic growth (excluding dispositions) as

shown below:

| Year | |

Utility

Customer

Growth Rate | |

| 2023 | |

| 1.0 | % |

| 2022 | |

| 1.7 | % |

| 2021 | |

| 1.2 | % |

| 2020 | |

| 42.9 | % |

| 2019 | |

| 2.1 | % |

In 2023,

2022, 2021, 2020, and 2019, our customer count increased by 5,875, 31,537, 21,246, 772,099 and 21,108 customers, respectively,

primarily due to the water and wastewater utility systems that we acquired, organic growth, and in 2020, due to the Peoples Gas

Acquisition that resulted in the addition of approximately 750,000 natural gas utility customers. Overall, for the five year period

of 2019 through 2023, our utility customer base, adjusted to exclude customers associated with utility system dispositions, increased

at an annual compound rate of 13.2%. During the five year period ended December 31, 2023, our utility customer base including

customers associated with utility system acquisitions and dispositions increased from 1,005,590 at January 1, 2019 to 1,857,461

at December 31, 2023.

Our

principal executive office is located at 762 W. Lancaster Avenue, Bryn Mawr, Pennsylvania 19010-3489, and our telephone number

is 610-527-8000. Our website may be accessed at www.essential.co. The reference to our website is intended to be an inactive textual

reference only, and the contents of our website are not incorporated by reference herein and should not be considered part of

this prospectus supplement.

THE

OFFERING

The

following summary contains basic information about this offering and may not contain all of the information that may be important

to you. You should read this entire prospectus supplement, the accompanying prospectus, any free writing prospectus we may provide

to you in connection with this offering and the documents incorporated by reference herein and therein before making an investment

decision.

As

used in this section, unless the context otherwise requires, references to “Essential Utilities,” the “Company,”

“we,” “us,” “our” and similar references refer only to Essential Utilities, Inc. and not to

its consolidated subsidiaries.

| Issuer |

Essential

Utilities, Inc., a Pennsylvania corporation. |

| |

|

| Common

Stock Offered |

Shares

of our common stock with an aggregate gross sales price of up to $1,000,000,000. The shares of our common stock offered pursuant

to this prospectus supplement and the accompanying prospectus include newly issued shares that may be offered and sold by

us to or through the sales agents, acting as our sales agents or as principal, and borrowed shares of our common stock that

may be offered and sold by the forward purchasers through their respective forward sellers. |

| |

|

| Use

of Proceeds |

We

intend to use the net proceeds from any sales of shares of our common stock to or through

the sales agents and the net cash proceeds from the settlement of any forward sale agreements

for general corporate purposes, which may include working capital, capital expenditures,

water and wastewater utility acquisitions and repaying outstanding indebtedness, including

under our revolving credit facility or the revolving credit facilities of our subsidiaries.

See “Use of Proceeds” and “Plan of Distribution (Conflicts of Interest)—Conflicts

of Interest”.

We

will not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward purchasers

through their respective forward sellers in connection with any forward sale agreement as a hedge of such forward sale

agreement. For additional information, see “Plan of Distribution (Conflicts of Interest)—Sales Through Forward

Sellers”. |

| |

|

| Accounting

Treatment of Forward Sales |

In

the event that we enter into any forward sale agreements, we expect that before any issuance of shares of our common stock upon settlement

of any forward sale agreement, the shares issuable upon settlement of that particular forward sale agreement will be reflected in our

diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of our common stock

used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares that would be

issued upon physical settlement of such forward sale agreement over the number of shares that could be purchased by us in the market

(based on the average market price during the relevant period) using the proceeds receivable upon settlement (based on the adjusted forward

sale price at the end of the reporting period). |

| |

Consequently,

prior to physical or net share settlement of a particular forward sale agreement and subject to the occurrence of certain

events, we anticipate there will be no dilutive effect on our earnings per share except during periods when the average

market price of our common stock is above the per share adjusted forward sale price of such forward sale agreement. However,

if we physically or net share settle any forward sale agreement, delivery of shares of our common stock on any such settlement

of such forward sale agreement will result in dilution to our earnings per share and return on equity. |

| |

|

| Dividend

Policy |

We

have historically paid quarterly dividends on our common stock; however, the declaration, amount, timing and payment of any

future dividends are subject to the determination and approval of our board of directors based on then current or anticipated

future conditions, including our results of operations, capital requirements, financial condition, legal requirements or other

factors deemed relevant by our board of directors. See “Listing of Our Common Stock and Dividends.” |

| |

|

| Listing

|

Our

common stock is listed on the NYSE under the symbol “WTRG.” |

| |

|

| Transfer

Agent and Registrar |

The

registrar and transfer agent for our common stock is Computershare Trust Company, N.A. |

| |

|

| Certain

United States Federal Income Tax Considerations |

Certain

United States federal income tax considerations to non-U.S. holders of the ownership and disposition of our common stock are

described in “Certain United States Federal Income Tax Considerations to Non-U.S. Holders” included in this prospectus

supplement. |

| |

|

| Risk

Factors |

Investing

in our common stock involves risks. See “Risk Factors” in this prospectus supplement, in the accompanying prospectus

and in the documents we incorporate by reference in this prospectus supplement and the accompanying prospectus for a discussion

of some of the risks and other factors you should carefully consider before deciding to invest in our common stock. |

| |

|

| Conflict

of Interests |

Certain of the sales agents and/or their

affiliates are also lenders and/or agents under our and our subsidiaries’ revolving credit facilities and receive customary

fees and expenses in connection therewith. To the extent we use proceeds from this offering to repay indebtedness under our or our

subsidiaries’ revolving credit facilities, such sales agents and/or affiliates may receive proceeds from this offering.

Because such sales agents and/or affiliates may receive more than 5% of the net proceeds of this offering, the sales agents may be

deemed to have a “conflict of interest” under Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule

5121. Accordingly, this offering is being made in compliance with the applicable provisions of FINRA Rule 5121. The appointment of a

“qualified independent underwriter” is not required in connection with this offering as a “bona fide public

market,” as defined in FINRA Rule 5121, exists for our common stock. In addition, to comply with FINRA Rule 5121, each of the

sales agents will not confirm any sales to any account over which it exercises discretionary authority without the specific written

approval of the transaction from the account holder. See “Plan of Distribution (Conflicts of Interest)” and “Use

of Proceeds”. |

Risk

Factors

Investing

in our common stock involves risks. You should review and carefully consider the risks, uncertainties and other factors described

below and all of the information included elsewhere in this prospectus supplement, the accompanying prospectus, any free writing

prospectus we may provide to you in connection with this offering and the documents incorporated by reference herein and therein

before deciding to invest in our common stock. We also urge you to carefully consider the risks, uncertainties and other factors

set forth under the headings “Forward-Looking Statements” and “Market and Industry Data.” However, additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business, operations,

financial condition and financial results and the value of our common stock.

Risks Related to Our

Business

For a discussion

of specific risks related to our business, operations, financial condition and financial results please see the “Business,”

“Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

sections and other sections in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February

29, 2024, in our Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2024, filed with the SEC

on May 8, 2024 and quarterly period ended June 30, 2024 filed with the SEC on August 6, 2024,

as updated by our subsequent annual, quarterly and other reports and documents we file with the SEC that are incorporated by reference

in this prospectus supplement and the accompanying prospectus. See “Where You Can Find Additional Information; Incorporation of

Certain Documents by Reference” in this prospectus supplement.

Risks Related to this

Offering and Ownership of Our Common Stock

The price of our common

stock may be volatile. This volatility may affect the price at which one could sell our common stock, and the sale or resale of

substantial amounts of our common stock could adversely affect the market price of our common stock.

The price

of our common stock on the NYSE constantly changes. We expect that the market price of our common stock will continue to fluctuate.

Our stock price may fluctuate as a result of a variety of factors, many of which are beyond our control. Further, the sale or

issuance of substantial amounts of our common stock, or the perception that additional sales or issuances could occur, could adversely

affect the market price of our common stock, even if the business is doing well. In addition, the availability for sale of substantial

amounts of our common stock could adversely impact its market price. Any of the foregoing may also impair our ability to raise

additional capital through the sale of our equity securities.

The common stock offered

by us pursuant to this prospectus supplement will be sold in “at the market offerings”, and investors who buy shares

at different times will likely pay different prices.

Investors who

purchase shares of our common stock in this offering at different times will likely pay different prices, and so may experience different

outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares

sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of

share sales made at prices lower than the prices they paid.

Our management will

have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in

ways that you and other shareholders may not approve.

Our management

will have broad discretion in its use of the net proceeds, including for any of the purposes described in the section titled “Use

of Proceeds,” and you will not have the opportunity as part of your investment decision to assess how the net proceeds are

being used. Because of the number and variability of factors that will determine our use of the net proceeds from this offering,

their ultimate use may vary substantially from their currently intended use. The failure of our management to use these funds

effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade,

interest-bearing investments. These investments may not yield a favorable return to our shareholders.

We expect that we will

need to raise additional capital, and raising additional funds by issuing additional equity securities or with additional debt

financing may cause dilution to shareholders, in the case of equity securities, or restrict our operations.

We expect

that we will need to raise additional capital in the future in order to, among other things, repay indebtedness and fund our operations

and future acquisitions, which we may do through equity, including equity-linked, securities offerings or additional debt financings,

as well as borrowings under our credit facilities. Additional issuances of equity securities, including shares of our common stock,

or debt or other securities that are convertible into or exchangeable for, or that represent the right to receive, common stock

could dilute the economic and other rights and interests of holders of shares of our common stock and cause the market price of

our common stock to decline. Subject to certain exceptions, such issuances may be made without any action or approval by our shareholders.

Any new

debt financing we enter into may involve covenants that restrict our operations more than our current outstanding debt and credit

facilities. These restrictive covenants could include limitations on additional borrowings and specific restrictions on the use

of our assets, as well as prohibitions or limitations on our ability to create liens, pay dividends, receive distributions from

our subsidiaries, redeem or repurchase our stock or make investments. These covenants could hinder our access to the capital markets

and limit or delay our ability to carry out our capital expenditure program.

Anti-takeover provisions

in our organizational documents and under Pennsylvania law might discourage, delay or prevent changes in control of our Company

and may result in an entrenchment of management and diminish the value of our common stock.

Certain provisions

of our articles of incorporation and bylaws could have the effect of delaying, deterring or preventing another party from acquiring or

seeking to acquire control of us. These provisions are intended to discourage certain types of coercive takeover practices and inadequate

takeover bids and to encourage anyone seeking to acquire control of us to negotiate first with our board of directors. However, these

provisions could also delay, deter or prevent a change of control or other takeover of our Company that our shareholders might consider

to be in their best interests, including transactions that might result in a premium being paid over the market prices of our common

stock, and may also limit the prices that investors are willing to pay in the future for our common stock. These provisions may also

have the effect of preventing changes in our management.

For example,

our articles of incorporation and bylaws include anti-takeover provisions that:

| · | authorize

our board of directors, without a vote or other action by our shareholders, to cause

the issuance of preferred stock in one or more series and, with respect to each series,

to fix the number of shares constituting that series and to establish the rights, preferences,

privileges and restrictions of that series, which may include, among other things, dividend

and liquidation rights and preferences, rights to convert such shares into common stock,

voting rights and other rights which may adversely affect the voting or other rights

and the economic interests of holders of our common stock; |

| · | require

that certain fundamental transactions must be approved by the holders of 75% of the outstanding

shares of our capital stock entitled to vote on the matter unless at least a majority

of the members of the board of directors has approved the transaction, in which case

the required shareholder approval will be the minimum approval required by applicable

law; |

| · | establish

advance notice requirements and procedures for shareholders to submit nominations of

candidates for election to our board of directors and to propose other business to be

brought before a shareholders meeting; |

| · | provide

that vacancies in our board of directors, including vacancies created by the removal

of any director or any increase in the number of directors, may be filled by a majority

of the directors then in office or by the sole remaining director; |

| · | provide

that no shareholder may cumulate votes in the election of directors, which means that

the holders of a majority of our outstanding shares of common stock can elect all directors

standing for election by our common shareholders; |

| · | require

that any action to be taken by our shareholders must be taken either (1) at a duly called

annual or special meeting of shareholders or (2) by the unanimous written consent of

all of our shareholders; |

| · | require

action by shareholders entitled to cast a majority of the votes which all shareholders

are entitled to cast at the particular meeting in order for our shareholders to call

a special meeting of shareholders; and |

| · | provide

that a state court located within Montgomery County, Pennsylvania (or, in the event such

court lacks jurisdiction over such action or proceeding, the United States District Court

for the Eastern District of Pennsylvania) will be the exclusive forum for the adjudication

of certain disputes, including derivative actions. |

In addition, anti-takeover

provisions in Pennsylvania law could make it more difficult for a third party to acquire control of us including, but not limited to,

provisions relating to (1) control share acquisitions, (2) disgorgement of profits by certain controlling persons, (3) business combination

transactions with interested shareholders, and (4) the rights of shareholders to demand fair value for their stock following a control

transaction. Pennsylvania law permits corporations to opt-out of these anti-takeover provisions, but we have not done so. Such provisions

could have the effect of deterring takeovers or delaying changes in control or management of us. Additionally, such provisions could

limit the price that some investors might be willing to pay in the future for shares of our common stock.

We may be unable to,

or may choose not to, continue to pay dividends on our common stock at current or planned rates or at all.

Any future

payments of cash dividends, and the amount of any cash dividends we pay, on our common stock will depend on, among other things,

our financial condition, capital requirements and results of operations, and the ability of our subsidiaries to distribute cash

to us, as well as other factors that our board of directors may consider relevant. If we were to reduce the amount of cash dividends

per share payable on our common stock, fail to increase the amount of those cash dividends per share in the future or cease paying

those cash dividends altogether, it would likely have an adverse impact on the market price of our common stock. In addition,

under Pennsylvania law, our board of directors (or an authorized committee thereof) may not declare and pay dividends on shares

of our common stock if, after giving effect to the dividend, (1) we would be unable to pay our debts as they become due in the

ordinary course of business, or (2) our total assets would be less than the sum of our total liabilities plus the amount that

would be needed, if we were to be dissolved as of the date for measuring the dividend, to satisfy the preferential rights upon

dissolution of shareholders whose preferential rights are superior to those receiving the dividend.

Our ability to pay dividends

and to meet our debt obligations largely depends on the performance of our subsidiaries and the ability to utilize the cash flows

from those subsidiaries.

Essential

Utilities is a holding company substantially all of whose assets are owned by its subsidiaries and substantially all of whose

operations are conducted through its subsidiaries. Our ability to pay dividends and meet our debt and other obligations depends

almost entirely on cash flows from our subsidiaries and, in the short term, our ability to raise capital from external sources.

In the long term, cash flows from its subsidiaries depend on their ability to generate operating cash flows in excess of their

own expenditures, common and preferred stock dividends (if any), and debt or other obligations. Our subsidiaries are separate

and distinct legal entities that are not obligated to pay dividends or make loans or distributions to Essential Utilities (whether

to enable Essential Utilities to pay dividends on its common stock, to pay principal and interest on its debt, to settle, repurchase or redeem its debt or other securities, or to satisfy its other obligations). In addition, notwithstanding our controlling interest

in such subsidiaries, many of them are limited in their ability to pay dividends or make loans or distributions to Essential Utilities,

including, without limitation, as a result of legislation, regulation, court order, contractual restrictions and other restrictions

or in times of financial distress. As a result, we may not be able to cause our subsidiaries and other entities to distribute

funds or provide loans sufficient to enable us to pay dividends and meet our debt and other obligations.

Risks Related to Forward

Sale Agreements

Settlement provisions

contained in any forward sale agreement subject us to certain risks.

A forward

purchaser will have the right to accelerate a forward sale agreement that it enters into with us and require us to physically

settle such forward sale agreement on a date specified by such forward purchaser if:

| · | in

such forward purchaser’s commercially reasonable judgment, it or its affiliate

is unable to hedge (or maintain a hedge of) its exposure under such forward sale agreement

in a commercially reasonable manner because (x) insufficient shares of our common stock

have been made available by securities lenders for borrowing or (y) the forward purchaser

or its affiliate would incur a stock borrowing cost in excess of a specified threshold; |

| · | we

declare or issue any dividend or distribution on shares of our common stock |

| o | payable

in cash in excess of specified amounts or that otherwise constitutes an extraordinary

dividend under the forward sale agreement, |

| o | payable

in securities of another company as a result of a spinoff or similar transaction, |

| o | of

any other type of securities (other than our common stock) or assets for consideration

of less than the prevailing market price, as determined in a commercially reasonable

manner by the calculation agent (as defined in the applicable sales agreement), or |

| o | that

is, by its terms or declared intent, outside the normal course of our operations or normal

dividend policies or practices; |

| · | certain

ownership thresholds applicable to such forward purchaser and its affiliates are exceeded; |

| · | an

intended event is announced that if consummated would result in a specified extraordinary

event under such forward sale agreement (including certain mergers or tender offers,

as well as certain events involving our nationalization, insolvency or a delisting of

our common stock) or an event occurs that would constitute a hedging disruption or change

in law; or |

| · | certain

other events of default, termination events or other specified events occur, including,

among others, any material misrepresentation made in connection with such forward sale

agreement or our insolvency (each as more fully described in each forward sale agreement). |

A forward

purchaser’s decision to exercise its right to accelerate any forward sale agreement and to require us to settle any such

forward sale agreement will be made irrespective of our interests, including our need for capital. In such cases, we could be

required to issue and deliver shares of our common stock under the terms of the physical settlement provisions of the applicable

forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and may adversely

affect the market price of our common stock. In addition, upon certain events of bankruptcy or insolvency relating to us, the

forward sale agreement will automatically terminate without further liability of either party (other than in the event of a breach

by us of certain representations or warranties contained in the forward sale agreement). Following any such termination, we would

not issue any shares of common stock and we would not receive any proceeds pursuant to the forward sale agreement.

Under

the terms of each forward sale agreement, we generally have the right to elect physical, cash or net share settlement. Subject

to the provisions of such forward sale agreement, delivery of our shares on any physical settlement or, to the extent we are obligated

to deliver shares of our common stock, net share settlement will result in dilution to our earnings per share and return on equity.

If we elect to cash or net share settle all or a portion of the shares of our common stock underlying any forward sale agreement,

we would expect the relevant forward purchaser or one of its affiliates to purchase shares of our common stock in secondary market

transactions over an unwind period to:

| · | return

shares of our common stock to securities lenders in order to unwind such forward purchaser’s

hedge position (after taking into consideration any shares of our common stock to be

delivered by us to such forward purchaser, in the case of net share settlement); and |

| · | if

applicable, in the case of net share settlement, deliver shares of our common stock to

us to the extent required in settlement of such forward sale agreement. |

If the

price of our common stock at which these purchases are made is below the relevant forward sale price, such forward purchaser will

pay us such difference in cash (if we cash settle) or deliver to us shares of our common stock having a market value equal to

such difference (if we net share settle), subject to a fixed reduction as provided in the applicable forward sale agreement. If

the price of our common stock at which these purchases are made exceeds the applicable forward sale price, we will pay such forward

purchaser an amount in cash equal to such difference (if we elect to cash settle) or we will deliver to such forward purchaser

a number of shares of our common stock having a market value equal to such difference (if we elect to net share settle), subject

to a fixed reduction as provided in the applicable forward sale agreement. Any such difference could be significant. See “Plan

of Distribution (Conflicts of Interest)—Sales Through Forward Sellers.”

In addition,

the purchase of our common stock by a forward purchaser or its affiliate to unwind the forward purchaser’s hedge position

could cause the price of our common stock to increase over time (or prevent a decrease over time), thereby increasing the amount

of cash (in the case of cash settlement) or the number of shares (in the case of net share settlement) that we would owe such

forward purchaser upon settlement of the applicable forward sale agreement or decreasing the amount of cash (in the case of cash

settlement), or the number of shares (in the case of net share settlement), that such forward purchaser would owe us upon settlement

of the applicable forward sale agreement.

The forward

sale price we expect to receive upon physical settlement of any forward sale agreement will be subject to adjustment on a daily

basis based on a floating interest rate factor equal to the overnight bank funding rate less a spread, and will decrease on certain

dates specified in the relevant forward sale agreement by the quarterly dividend amount per share we currently expect to declare

during the term of such forward sale agreement. If the overnight bank funding rate is less than the spread on any day, the interest

rate factor will result in a daily reduction of the forward sale price. If the market value of shares of our common stock during

the relevant valuation period under any forward sale agreement is above the relevant forward sale price, in the case of cash settlement,

we would pay the relevant forward purchaser an amount in cash equal to the difference or, in the case of net share settlement,

we would deliver to the relevant forward purchaser a number of shares of our common stock having a value equal to the difference.

Thus, we could be responsible for a potentially substantial cash or stock payment. If the market value of shares of our common

stock during the relevant valuation period under any forward sale agreement is below the relevant forward sale price, in the case

of cash settlement, we would be paid the difference in cash by the relevant forward purchaser or, in the case of net share settlement,

we would receive from the relevant forward purchaser a number of shares of our common stock having a value equal to the difference.

See “Plan of Distribution (Conflicts of Interest)—Sales Through Forward Sellers” for information on the forward

sale agreements.

In

the case of our bankruptcy or insolvency, any forward sale agreement that is in effect will automatically terminate, and we would

not receive the expected proceeds from any forward sales of our common stock.

If we

or a regulatory authority with jurisdiction over us institutes, or we consent to, a proceeding seeking a judgment in bankruptcy

or insolvency or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights,

or we or a regulatory authority with jurisdiction over us presents a petition for our winding-up or liquidation, or we consent

to such a petition, any forward sale agreement that is then in effect will automatically terminate. If any such forward sale agreement

so terminates under these circumstances, we would not be obligated to deliver to the relevant forward purchaser any common stock

not previously delivered, and the relevant forward purchaser would be discharged from its obligation to pay the applicable forward

sale price per share in respect of any shares of common stock not previously settled under the applicable forward sale agreement.

Therefore, to the extent that there are any shares of common stock with respect to which any forward sale agreement has not been

settled at the time of the commencement of any such bankruptcy or insolvency proceedings, we would not receive the relevant forward

sale price per share in respect of those shares.

Use

Of Proceeds

The shares

of our common stock offered pursuant to this prospectus supplement and the accompanying prospectus include newly issued shares

that may be offered and sold by us to or through the sales agents, acting as our sales agents or as principals, and borrowed shares

of our common stock that may be offered and sold by the forward purchasers through their respective forward sellers. We intend

to use the net proceeds from this offering for general corporate purposes, which may include working capital, capital expenditures,

water and wastewater utility acquisitions and repaying outstanding indebtedness, including under our revolving credit facility

or the revolving credit facilities of our subsidiaries. Pending their use, we may invest the net proceeds from this offering in

short-term, investment-grade, interest-bearing investments.

The amount

of proceeds from this offering will depend upon the number of shares of our common stock sold, the market price at which they

are sold and, with respect to any forward sale transaction, the settlement method as described below. There can be no assurance

that we will be able to sell any shares under or fully utilize the sales agreements or any forward sale agreement as a source

of financing.

We will

not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward purchasers through their

respective forward sellers in connection with any forward sale agreement as a hedge of such forward sale agreement. In the event

of full physical settlement of a forward sale agreement, which we expect to occur on or prior to the maturity date of such forward

sale agreement, we expect to receive aggregate cash proceeds equal to the product of the initial forward sale price per share

under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject

to the price adjustment and other provisions of such forward sale agreement. If, however, we elect to cash settle or net share

settle any forward sale agreement, we would expect to receive an amount of proceeds that is significantly lower than the product

set forth in the immediately preceding sentence (in the case of any cash settlement) or will not receive any proceeds (in the

case of any net share settlement), and we may owe cash (in the case of any cash settlement) or shares of our common stock (in

the case of any net share settlement) to the relevant forward purchaser. We intend to use any cash proceeds that we receive upon

physical settlement of any forward sale agreement, if physical settlement applies, or upon cash settlement of any forward sale

agreement, if we elect cash settlement, for the purposes provided in the first paragraph of this section.

Certain

of the sales agents and/or their affiliates are also lenders and/or agents under our and our subsidiaries’ revolving credit

facilities and receive customary fees and expenses in connection therewith. To the extent we use proceeds from this offering to

repay indebtedness under our or our subsidiaries’ revolving credit facilities, such sales agents and/or affiliates may receive

proceeds from this offering. See “Plan of Distribution (Conflicts of Interest)—Conflicts of Interest”.

Listing

of Our Common Stock and Dividends

Our common

stock is listed on the NYSE under the symbol “WTRG.” As of August 8, 2024, there were 273,674,394 shares of

our common stock outstanding and as of June 30, 2024, there were options to acquire 986,480 shares of our common stock

outstanding.

On August 12,

2024, the last reported sale price of our common stock on the NYSE was $39.11. As of August 7, 2024, there were 17,576 holders

of record of our common stock.

We have

historically paid quarterly dividends on our common stock; however, the declaration, amount, timing and payment of any future

dividends are subject to the determination and approval of our board of directors, subject to our earnings and financial condition,

restrictions set forth in our debt instruments, regulatory requirements and such other factors as our board of directors may deem

relevant. See “Risk Factors—Risks Related to this Offering and Our Common Stock—We may be unable to, or may

choose not to, continue to pay dividends on our common stock at current or planned rates or at all.”

Certain

United States Federal Income Tax

Considerations to Non-U.S. Holders

The following

is a summary of certain United States federal income tax consequences of the ownership and disposition of our common stock. This

summary deals only with common stock that is held as a capital asset by a non-U.S. holder (as defined below).

A “non-U.S.

holder” means a beneficial owner of our common stock (other than an entity or arrangement treated as a partnership for United

States federal income tax purposes) that is not, for United States federal income tax purposes, any of the following:

| · | an

individual who is a citizen or resident of the United States; |

| · | a

corporation (or any other entity treated as a corporation for United States federal income

tax purposes) created or organized in or under the laws of the United States, any state

thereof or the District of Columbia; |

| · | an

estate the income of which is subject to United States federal income taxation regardless

of its source; or |

| · | a

trust if it (1) is subject to the primary supervision of a court within the United States

and one or more United States persons have the authority to control all substantial decisions

of the trust or (2) has a valid election in effect under applicable United States Treasury

regulations to be treated as a United States person. |

This summary

is based upon provisions of the Internal Revenue Code of 1986, as amended (the “Code”), and regulations, rulings and

judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in United States

federal income tax consequences different from those summarized below. This summary does not address all of the United States

federal income tax consequences that may be relevant to you in light of your particular circumstances, nor does it address the

Medicare tax on net investment income, United States federal estate and gift taxes or the effects of any state, local or foreign

tax laws. In addition, it does not represent a detailed description of the United States federal income tax consequences applicable

to you if you are subject to special treatment under the United States federal income tax laws (including if you are a United

States expatriate, foreign pension fund, “controlled foreign corporation,” “passive foreign investment company”

or a partnership or other pass-through entity for United States federal income tax purposes). We cannot assure you that a change

in law will not alter significantly the tax considerations that we describe in this summary.

If a partnership

(or other entity or arrangement treated as a partnership for United States federal income tax purposes) holds our common stock,

the tax treatment of a partner will generally depend upon the status of the partner and the activities of the partnership. If

you are a partnership or a partner of a partnership considering an investment in our common stock, you should consult your tax

advisors.

If you are

considering the purchase of our common stock, you should consult your own tax advisors concerning the particular United States federal

income tax consequences to you of the ownership and disposition of our common stock, as well as the consequences to you arising under

other United States federal tax laws and the laws of any other taxing jurisdiction.

Dividends

In the

event that we make a distribution of cash or other property (other than certain pro rata distributions of our stock) in respect

of our common stock, the distribution generally will be treated as a dividend for United States federal income tax purposes to

the extent it is paid from our current or accumulated earnings and profits, as determined under United States federal income tax

principles. Any portion of a distribution that exceeds our current and accumulated earnings and profits generally will be treated

first as a tax-free return of capital, causing a reduction in the adjusted tax basis of a non-U.S. holder’s common stock,

and to the extent the amount of the distribution exceeds a non-U.S. holder’s adjusted tax basis in our common stock, the

excess will be treated as gain from the disposition of our common stock (the tax treatment of which is discussed below under “—Gain

on Disposition of Common Stock”).

Dividends

paid to a non-U.S. holder generally will be subject to withholding of United States federal income tax at a 30% rate or such lower

rate as may be specified by an applicable income tax treaty. However, dividends that are effectively connected with the conduct

of a trade or business by the non-U.S. holder within the United States (and, if required by an applicable income tax treaty, are

attributable to a United States permanent establishment) are not subject to the withholding tax, provided certain certification

and disclosure requirements are satisfied. Instead, such dividends are subject to United States federal income tax on a net income

basis generally in the same manner as if the non-U.S. holder were a United States person as defined under the Code. Any such effectively

connected dividends received by a foreign corporation may be subject to an additional “branch profits tax” at a 30%

rate or such lower rate as may be specified by an applicable income tax treaty.

A non-U.S.

holder who wishes to claim the benefit of an applicable treaty rate and avoid backup withholding, as discussed below, for dividends

will be required (a) to provide the applicable withholding agent with a properly executed Internal Revenue Service (“IRS”)

Form W-8BEN or Form W-8BEN-E (or other applicable form) certifying under penalty of perjury that such holder is not a United States

person as defined under the Code and is eligible for treaty benefits or (b) if our common stock is held through certain foreign

intermediaries, to satisfy the relevant certification requirements of applicable United States Treasury regulations. Special certification

and other requirements apply to certain non-U.S. holders that are pass-through entities rather than corporations or individuals.

A non-U.S.

holder eligible for a reduced rate of United States federal withholding tax pursuant to an income tax treaty may obtain a refund

of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Gain on Disposition of

Common Stock

Subject

to the discussion of backup withholding below, any gain realized by a non-U.S. holder on the sale or other disposition of our

common stock generally will not be subject to United States federal income tax unless:

| · | the

gain is effectively connected with a trade or business of the non-U.S. holder in the

United States (and, if required by an applicable income tax treaty, is attributable to

a United States permanent establishment of the non-U.S. holder); |

| · | the

non-U.S. holder is an individual who is present in the United States for 183 days or

more in the taxable year of that disposition, and certain other conditions are met; or |

| · | we

are or have been a “United States real property holding corporation” for

United States federal income tax purposes and certain other conditions are met. |

A non-U.S.

holder described in the first bullet point immediately above will be subject to tax on the gain derived from the sale or other

disposition in the same manner as if the non-U.S. holder were a United States person as defined under the Code. In addition, if

any non-U.S. holder described in the first bullet point immediately above is a foreign corporation, the gain realized by such

non-U.S. holder may be subject to an additional “branch profits tax” at a 30% rate or such lower rate as may be specified

by an applicable income tax treaty. An individual non-U.S. holder described in the second bullet point immediately above will

be subject to a 30% (or such lower rate as may be specified by an applicable income tax treaty) tax on the gain derived from the

sale or other disposition, which gain may be offset by United States source capital losses even though the individual is not considered

a resident of the United States.

Generally, a

corporation is a “United States real property holding corporation” if the fair market value of its United States real

property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its other

assets used or held for use in a trade or business (all as determined for United States federal income tax purposes). We believe we

are not and do not anticipate becoming a “United States real property holding corporation” for United States federal

income tax purposes. If, however, we are or become a “United States real property holding corporation,” so long as our

common stock is regularly traded on an established securities market during the calendar year in which the sale or other disposition

occurs, only a non-U.S. holder who holds or held (at any time during the shorter of the five-year period preceding the date of

disposition or the holder’s holding period) more than 5% of our common stock will be subject to United States federal income

tax on the sale or other disposition of our common stock.

Information Reporting

and Backup Withholding

Distributions

paid to a non-U.S. holder and the amount of any tax withheld with respect to such distributions generally will be reported to

the IRS. Copies of the information returns reporting such distributions and any withholding may also be made available to the

tax authorities in the country in which the non-U.S. holder resides under the provisions of an applicable income tax treaty.

A non-U.S.

holder will not be subject to backup withholding on distributions received if such holder certifies under penalty of perjury that

it is a non-U.S. holder (and the payor does not have actual knowledge or reason to know that such holder is a United States person

as defined under the Code), or such holder otherwise establishes an exemption.

Information

reporting and, depending on the circumstances, backup withholding will apply to the proceeds of a sale or other disposition of

our common stock made within the United States or conducted through certain United States-related financial intermediaries, unless

the beneficial owner certifies under penalty of perjury that it is a non-U.S. holder (and the payor does not have actual knowledge

or reason to know that the beneficial owner is a United States person as defined under the Code), or such owner otherwise establishes

an exemption.

Backup withholding

is not an additional tax and any amounts withheld under the backup withholding rules will be allowed as a refund or a credit against

a non-U.S. holder’s United States federal income tax liability, provided the required information is timely furnished to the IRS.

Additional Withholding

Requirements

Under

Sections 1471 through 1474 of the Code (such Sections commonly referred to as “FATCA”), a 30% United States federal

withholding tax may apply to any dividends paid on our common stock to (1) a “foreign financial institution” (as specifically

defined in the Code and whether such foreign financial institution is the beneficial owner or an intermediary) which does not

provide sufficient documentation, typically on IRS Form W-8BEN-E, evidencing either (a) an exemption from FATCA, or (b) its compliance

(or deemed compliance) with FATCA (which may alternatively be in the form of compliance with an intergovernmental agreement with

the United States) in a manner which avoids withholding, or (2) a “non-financial foreign entity” (as specifically

defined in the Code and whether such non-financial foreign entity is the beneficial owner or an intermediary) which does not provide

sufficient documentation, typically on IRS Form W-8BEN-E, evidencing either (a) an exemption from FATCA, or (b) adequate information

regarding certain substantial United States beneficial owners of such entity (if any). If a dividend payment is both subject to

withholding under FATCA and subject to the withholding tax discussed above under “—Dividends,” an applicable