Nearing Holiday Season, One-Third of Consumers Hide Purchases from Significant Other to Avoid Conflict Over Personal Finances

16 October 2009 - 2:10AM

Business Wire

Americans’ financial stress is causing a range of behaviors,

such as hiding purchases from significant others and hunting early

for holiday bargains, according to the latest Western Union® Global

Business Payments Money Mindset Index. As the holiday season

approaches, one-third of Americans admit they hide their purchases

from spouses or significant others; 40 percent do it to avoid an

argument about finances.

Nearly half (47 percent) of Americans revealed that they have

been successful in the past at staying within their holiday budget,

but this year many are concerned (51 percent) or convinced (33

percent) that they will exceed their budget.

Holiday Shopping Strategies

Consumers are modifying their holiday shopping strategies to

ease stress, the Index reveals, as one-third (33 percent) will shop

for holiday gifts early this year and more than half (58 percent)

are hoping those early sales will provide the best prices.

Additionally:

- More than half of American

households (53 percent) have already set a budget for 2009 holiday

spending;

- About half (46 percent) plan to

cut back on buying holiday gifts; and,

- 41 percent will buy more holiday

gifts at discount stores.

While consumers are focused on holiday spending, they are also

looking ahead to their financial goals in 2010.

“As consumers make plans to celebrate the holidays with friends

and family, even small budget cutbacks can be a big step toward

alleviating stress,” says David Shapiro, senior vice president of

Western Union Global Business Payments. “Consumers can increase

their financial confidence and improve their bill payment

strategies well into the New Year – if they start planning their

budgets now.”

Western Union Tracks America’s Money Mindset

Each quarter, the Western Union® Global Business Payments Money

Mindset Index probes the behavior and attitudes of 3,000 consumers

relating to money management. Longitudinally, the Index reveals

that consumers’ financial stress has ebbed and flowed in the past

year. Half the country (50 percent) was stressed over finances one

year ago; the stress level rose to 61 percent in the first quarter

of 2009, then dropped to less than half (48 percent) in Q2 and

increased to the current level of 53 percent.

The current stress level could likely be from consumers paying

more in bill payment-related fees and interest rates (27 percent

paid late or non-payment fees and 38 percent cite interest rate

increases), and nearly one in four (23 percent) have seen their

credit limit decrease, as compared to only 19 percent in Q1

2009.

Even though consumers continue to streamline their finances by

cutting spending, they are still struggling to pay bills on time.

The average number of late bill payments spiked from 3.1 to 4.0 for

those who pay bills late and fees for late payments increased from

27 percent to 32 percent since Q2.

Resolved to Improve in 2010

However, consumer optimism is increasing: only 23 percent expect

their challenging financial situations to deteriorate in the next

six months, down from 36 percent in Q1. In fact, according to the

Index, here are the top financial-themed New Year’s resolutions

that consumers are planning to make in 2010, and recommendations

from Western Union Global Business Payments to help consumers

realize them:

Resolution #1: Pay bills on time – 65 percent

- Western Union

Recommendation – At the beginning of each month, sit down and

figure out when you need to pay each bill to avoid late fees. Put

the date you need to pay each bill into your calendar so you don’t

forget.

Resolution #2: Save more money out of each paycheck – 65

percent

- Western Union

Recommendation – Determine a set amount of money each month

that you can set aside. Ask your employer to make a direct deposit

for this amount from your paycheck to your savings account. Or, ask

your bank if it offers a monthly or weekly holiday club savings

account.

Resolution #3: Pay all bills online or automatically – 49

percent

- Western Union

Recommendation – Set up recurring payments for monthly bills.

Many billers offer e-mail or text-message notifications that remind

you when your payment will be withdrawn from your account.

Resolution #4: Reprioritize how bill payments get

paid

- Western Union

Recommendation – Contact billers and ask to restructure your

due dates according to when you are paid, so you can manage your

cash flow better and avoid late fees.

Survey Methodology

In August 2009, Javelin Research surveyed more than 3,000

consumers online about their current behaviors and emotional

mindset regarding debt and personal finance issues. The Western

Union Global Business Payments Money Mindset Index has a margin

error of 1.7 percentage points at the 95 percent confidence

level.

About Western Union

The Western Union Company (NYSE: WU) is a leader in global money

transfer services. Together with its affiliates, Orlandi Valuta and

Vigo, Western Union provides consumers with fast, reliable and

convenient ways to send and receive money around the world, as well

as send payments and purchase money orders. It operates through a

network of more than 379,000 Agent locations in over 200 countries

and territories. Famous for its pioneering telegraph services, the

original Western Union dates back to 1851. For more information,

visit www.westernunion.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6074141&lang=en

WU-G

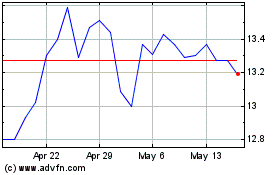

Western Union (NYSE:WU)

Historical Stock Chart

From Oct 2024 to Nov 2024

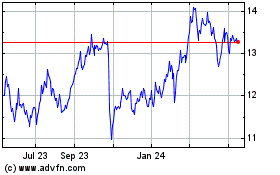

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2023 to Nov 2024