alstria is to pay out a dividend of 52 cents per share

12 June 2009 - 12:11AM

Business Wire

alstria office REIT-AG (symbol: AOX, ISIN: DE000A0LD2U1), an

Hamburg-based internally managed Real Estate Investment Trust

(REIT) solely focused on acquiring, owning and managing office real

estate in Germany uses its net income for the fiscal year 2008,

amounting to EUR 28.5 million, to pay out a dividend of EUR 0.52

per share. This resolution was adopted at the company's ordinary

Annual General Meeting held in Hamburg on June 10, 2009. The share

will trade ex-dividend as of today.

Shareholders will be entitled for the first time to exchange

their cash dividend for a stock dividend (Offer). The shares

offered in exchange for the dividend will be valued at a discount

of at least 20% on the average XETRA closing price of the 16th,

17th and the 18th of June 2009. The final price and discount will

be published on the 19th of June 2009.

Dividend claims of shareholders that have not opted for the

stock dividend by June 24, 2009 will be paid out on June 29, 2009.

The shareholders who have opted for the stock dividend will receive

their shares and � in case of an oversubscription of the offer �

the partial payout on July 6, 2009. Shareholders who are tax

resident in Germany are fully exempt from taxes on this year�s

dividend payment by alstria.

Shareholders who want to opt for the stock dividend should get

in touch with their custodian bank or can contact alstria for

further details.

Information on the alstria dividend available on the

Internet

Please note the detailed information on the dividend payout

(offer, dividend announcement, tax notices, etc.) on our website

www.alstria.com website (under "Investor Relations" � "General

Meeting").

Notice to US shareholders:

The Offer is made for the securities of a foreign company. The

Offer is subject to the disclosure requirements of a foreign

country that are different from those of the United States. It may

be difficult for you to enforce your rights and any claim you may

have arising under the US federal securities laws, since the issuer

is located in a foreign country, and some or all of its officers

and directors may be residents of a foreign country. You may not be

able to sue the foreign company or its officers or directors in a

foreign court for violations of the US securities laws. It may be

difficult to compel a foreign company and its affiliates to subject

themselves to a US court�s judgment. The offer is addressed solely

to the shareholders of alstria office REIT-AG.

About alstria:

alstria office REIT-AG (alstria) is an internally managed real

estate investment trust (REIT) focused solely on acquiring, owning

and managing office real estate in Germany. alstria was founded in

January 2006 and converted into the first German REIT in October

2007. The company is headquartered in Hamburg.

alstria owns a diversified portfolio of office properties in

prime locations throughout Germany. alstria's current portfolio

comprises 89 properties with an aggregate lettable space of

approximately 944,000 m2 and is valued at roughly EUR 1.8

billion.

alstria's strategy is based on active building and portfolio

management as well as on establishing and maintaining close,

long-term relationships with tenants and key decision makers. In

the process, alstria focuses on creating sustained and lasting

property values.

For further information, please see: �

www.alstria.com

http://alstria.blogspot.com

Disclaimer:

This release constitutes neither an offer to sell nor a

solicitation of an offer to buy any shares. As far as this press

release contains forward-looking statements with respect to the

business, financial condition and results of operations of alstria

office REIT-AG (alstria), these statements are based on current

expectations or beliefs of alstria's management. These

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results or performance of the

Company to differ materially from those reflected in such

forward-looking statements. Apart from other factors not mentioned

here, differences could occur as a result of changes in the overall

economic situation and the competitive environment � especially in

the core business segments and markets of alstria. Also, the

development of the financial markets and changes in national as

well as international provisions particularly in the field of tax

legislation and financial reporting standards could have an effect.

Terrorist attacks and their consequences could increase the

likelihood and the extent of differences. alstria undertakes no

obligation to publicly release any revisions or updates to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events.

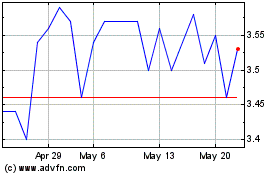

Alstria Office REIT (TG:AOX)

Historical Stock Chart

From Nov 2024 to Dec 2024

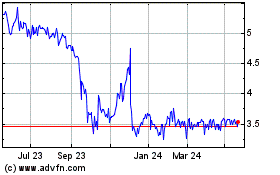

Alstria Office REIT (TG:AOX)

Historical Stock Chart

From Dec 2023 to Dec 2024