International Petroleum Corporation Announces TSX Approval for

Renewal of Normal Course Issuer Bid

International Petroleum Corporation

("IPC" or the "Corporation") (TSX, Nasdaq Stockholm: IPCO) is

pleased to announce that the Toronto Stock Exchange (the "TSX") has

approved IPC's notice of intention to renew IPC’s normal course

issuer bid (the "NCIB").

Under the NCIB, IPC is authorized to purchase,

through the facilities of the TSX and/or Nasdaq Stockholm, or as

otherwise permitted under Canadian securities laws, as and when

considered advisable by IPC, up to 7,465,356 common shares in the

capital of the Corporation (the "Common Shares"),

representing approximately 6.2% of the 119,882,701 Common Shares

outstanding as at November 29, 2024 (or 10% of IPC's "public float"

(as defined in the TSX Company Manual) of 74,653,562 Common Shares

as at November 29, 2024), over a period of twelve months commencing

on December 5, 2024 and ending on December 4, 2025, or until such

earlier date as the NCIB is completed or terminated by IPC.

The maximum number of Common Shares which can be

purchased each day on Nasdaq Stockholm will be 25% of the average

daily trading volume of the Common Shares for the 20 trading days

preceding the date of purchase, subject to certain exceptions for

block purchases. In addition, IPC will be limited to daily

purchases of no more than 15,952 Common Shares on the TSX, being

25% of IPC's average daily TSX trading volume of 63,811 Common

Shares during the six months ended November 30, 2024 (excluding

purchases of Common Shares on the TSX by IPC under its previous

NCIB), subject to certain exceptions for block purchases and other

prescribed exemptions available under applicable Canadian

securities laws. IPC currently does not hold any Common Shares in

treasury.

In connection with the NCIB, IPC has entered

into an automatic share purchase plan (the "ASPP")

with its designated broker to allow IPC to repurchase Common Shares

when it would ordinarily not be permitted to purchase Common Shares

due to regulatory restrictions and customary self-imposed blackout

periods. Pursuant to the ASPP, IPC may provide standard

instructions during non-blackout periods to its designated broker,

which instructions may not be varied or suspended during the

blackout period. Outside of any blackout periods, Common Shares

will be purchased in accordance with management's discretion. All

purchases made under the ASPP will be included in computing the

number of Common Shares purchased under the NCIB. The ASPP has been

reviewed and pre-cleared by the TSX and may be terminated by IPC or

its broker in accordance with its terms, or will terminate on the

expiry of the NCIB.

Any Common Shares that IPC purchases under the

NCIB will be purchased on the open market through the facilities of

the TSX and/or Nasdaq Stockholm, or as otherwise permitted under

Canadian securities laws, at the prevailing market price at the

time of such purchase and in accordance with the applicable rules

and policies of the TSX and Nasdaq Stockholm and applicable

Canadian and Swedish securities laws. The actual number of Common

Shares that will be purchased, and the timing of any such

purchases, will be determined by IPC, subject to the limits imposed

by the TSX, Nasdaq Stockholm and under applicable Canadian

securities laws. There cannot be any assurances as to the number of

Common Shares that will ultimately be acquired by IPC. Any Common

Shares purchased by IPC under the NCIB will be cancelled.

IPC believes that the purchase of Common Shares

for cancellation represents an effective use of IPC's capital, is

in the best interest of IPC and is an efficient way to return value

to IPC's shareholders.

IPC's previous normal course issuer bid for the

purchase of up to 8,342,119 Common Shares, commenced on December 5,

2023 and was fully completed by November 15, 2024. The Common

Shares acquired under IPC's previous normal course issuer bid were

acquired for a weighted average price of CAD$17.01 per Common

Share. Purchases were made through the facilities of the TSX and

Nasdaq Stockholm, including pursuant to the previous automatic

share purchase plan.

International Petroleum Corp. (IPC) is an

international oil and gas exploration and production company with a

high quality portfolio of assets located in Canada, Malaysia and

France, providing a solid foundation for organic and inorganic

growth. IPC is a member of the Lundin Group of Companies. IPC is

incorporated in Canada and IPC’s shares are listed on the Toronto

Stock Exchange (TSX) and the Nasdaq Stockholm exchange under the

symbol "IPCO".

For further information, please contact:

Rebecca

Gordon

SVP Corporate Planning and Investor Relations

rebecca.gordon@international-petroleum.com

Tel: +41 22 595 10 50 |

Or |

Robert

Eriksson

Media Manager

reriksson@rive6.ch

Tel: +46 701 11 26 15 |

The information was submitted for publication, through the

contact persons set out above, at 08:00 CET on December 3,

2024.

Forward-Looking Statements

This press release contains statements and information which

constitute "forward-looking statements" or "forward-looking

information" (within the meaning of applicable securities

legislation). Such statements and information (together,

"forward-looking statements") relate to future events, including

the Corporation's future performance, business prospects or

opportunities. Actual results may differ materially from those

expressed or implied by forward-looking statements. The

forward-looking statements contained in this press release are

expressly qualified by this cautionary statement. Forward-looking

statements speak only as of the date of this press release, unless

otherwise indicated. IPC does not intend, and does not assume any

obligation, to update these forward-looking statements, except as

required by applicable laws.

All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, forecasts, guidance,

budgets, objectives, assumptions or future events or performance

(often, but not always, using words or phrases such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", “forecast”, "predict", "potential", "targeting",

"intend", "could", "might", "should", "believe", "budget" and

similar expressions) are not statements of historical fact and may

be "forward-looking statements". Forward-looking statements

include, but are not limited to, statements with respect to: the

commencement of the NCIB; the ability to IPC to acquire Common

Shares under the NCIB, including the timing of any such purchases;

and the return of value to IPC's shareholders as a result of the

NCIB.

The forward-looking statements are based on

certain key expectations and assumptions made by IPC, including

expectations and assumptions concerning: prevailing commodity

prices and currency exchange rates; applicable royalty rates and

tax laws; interest rates; future well production rates and reserve

and contingent resource volumes; operating costs; our ability to

maintain our existing credit ratings; our ability to achieve our

performance targets; the timing of receipt of regulatory approvals;

the performance of existing wells; the success obtained in drilling

new wells; anticipated timing and results of capital expenditures;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the timing, location and extent of future

drilling operations; the successful completion of acquisitions and

dispositions and that we will be able to implement our standards,

controls, procedures and policies in respect of any acquisitions

and realize the expected synergies on the anticipated timeline or

at all; the benefits of acquisitions; the state of the economy and

the exploration and production business in the jurisdictions in

which IPC operates and globally; the availability and cost of

financing, labour and services; our intention to complete share

repurchases under our normal course issuer bid program, including

the funding of such share repurchases, existing and future market

conditions, including with respect to the price of our common

shares, and compliance with respect to applicable limitations under

securities laws and regulations and stock exchange policies; and

the ability to market crude oil, natural gas and natural gas

liquids successfully.

Although IPC believes that the expectations and

assumptions on which such forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because IPC can give no assurances that

they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to:

general global economic, market and business conditions; the risks

associated with the oil and gas industry in general such as

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

estimates and projections relating to reserves, resources,

production, revenues, costs and expenses; health, safety and

environmental risks; commodity price fluctuations; interest rate

and exchange rate fluctuations; marketing and transportation; loss

of markets; environmental and climate-related risks; competition;

innovation and cybersecurity risks related to our systems,

including our costs of addressing or mitigating such risks; the

ability to attract, engage and retain skilled employees; incorrect

assessment of the value of acquisitions; failure to complete or

realize the anticipated benefits of acquisitions or dispositions;

the ability to access sufficient capital from internal and external

sources; failure to obtain required regulatory and other approvals;

geopolitical conflicts, including the war between Ukraine and

Russia and the conflict in the Middle East, and their potential

impact on, among other things, global market conditions; and

changes in legislation, including but not limited to tax laws,

royalties and environmental regulations. Readers are cautioned that

the foregoing list of factors is not exhaustive.

Additional information on these and other

factors that could affect IPC, or its operations or financial

results, are included in IPC’s annual information form for the year

ended December 31, 2023 (See “Cautionary Statement Regarding

Forward-Looking Information", “Risks Factors” and "Reserves and

Resources Advisory” therein), in the management's discussion and

analysis (MD&A) for the three and nine months ended September

30, 2024 (See "Cautionary Statement Regarding Forward-Looking

Information", “Risks Factors” and "Reserves and Resources Advisory"

therein) and other reports on file with applicable securities

regulatory authorities, including previous financial reports,

management’s discussion and analysis and material change reports,

which may be accessed through the SEDAR+ website (www.sedarplus.ca)

or IPC's website (www.international-petroleum.com).

- IPC PR TSX Approval Renewal NCIB 3-12-2024

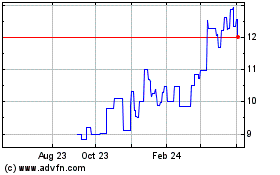

International Petroleum (TG:IPT)

Historical Stock Chart

From Dec 2024 to Jan 2025

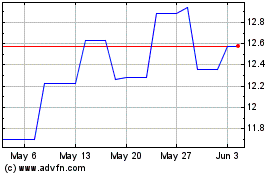

International Petroleum (TG:IPT)

Historical Stock Chart

From Jan 2024 to Jan 2025