Algoma Central Corporation Reports Operating Results for the Three and Nine Months Ended September 30, 2018

13 November 2018 - 11:00PM

Business Wire

Algoma Central Corporation (“Algoma” or “the Company”) (TSX:

ALC), a leading provider of marine transportation services, today

announced its results for the three and nine months ended September

30, 2018.

All amounts reported below are in thousands of Canadian dollars,

except for per share data and unless otherwise noted. Third quarter

and year to date 2018 highlights include:

- A 16% increase in revenue in the third

quarter and a 14% increase for the nine months ended September 30,

2018 compared to the same periods in 2017.

- EBITDA increased 8% during the third

quarter and 32% for the nine months ended September 30, 2018.

- Net earnings from continuing operations

increased 35% for the nine months ended September 30, 2018. This

was due to higher operating earnings, including higher earnings

from joint ventures and a gain on the disposition of assets within

the Domestic Dry-Bulk fleet.

- For the third quarter of 2018:

- Domestic Dry-Bulk net earnings

increased 8% as a result of improved freight rates.

- Product Tanker revenue increased 24%

compared to 2017. The segment is experiencing strong customer

demand from its major customer. Subsequent to the quarter, the

strong outlook for volumes and sustained levels led the decision to

purchase a seventh product tanker.

- Ocean Self-Unloaders revenue increased

28% compared to the prior year. This was mainly as a result of the

fleet being at full utilization with the return of the Algoma

Integrity to the Pool.

- Steps were taken to begin the

cancellation of four shipbuilding contracts with a Croatian

shipyard as a result of delays encountered in the construction of

the ships.

- During the third quarter, a new Global

Short Sea joint venture, NovaAlgoma Bulk Holdings (“NABH”) was

created with the purchase of four deep-sea bulkers.

“Customer demand is strengthening and we expect this will

continue to have positive impacts on daily rates in the Domestic

Dry-Bulk segment,” said Ken Bloch Soerensen, President and CEO of

Algoma. “In order to provide capacity, we are currently reviewing

options to replace the cancelled vessels and in the meantime we

look forward to the arrival of the Algoma Conveyer from China in

early 2019,” Mr. Soerensen added.

Results from continuing operations for the third quarter 2018

and the nine months ended September 30, 2018 compared to the same

periods in 2017 were as follows:

Three Months

Nine Months

Ended September 30 Ended September 30

2018 2017

2018 2017

Revenues

Domestic Dry-Bulk

$ 100,128 $ 89,540

$ 208,272

$ 188,919 Product Tankers

31,233 25,247

74,081 59,577

Ocean Self-Unloaders

24,262 18,902

66,263 55,074

155,623 133,689

348,616 303,570 Investment Properties

2,597 2,868

8,401 8,731 Corporate

509 643

1,641 1,137

$ 158,729 $ 137,200

$

358,658 $ 313,438

Three Months Nine Months

Ended September 30 Ended September 30

2018 2017

2018 2017

Operating Earnings Net

of Income Tax Domestic Dry-Bulk

$ 17,426 $ 15,992

$ 16,486 $ 13,745

Unrealized (loss) gain on foreign currency

exchange contracts and cancellation of shipbuilding contracts

(1,577) (1,291)

(54) 1,103

15,849 14,701

16,432 14,848 Product Tankers

1,669 4,596

4,144 2,832 Ocean Self-Unloaders

4,354 4,553

8,622 8,100 Global Short Sea Shipping

1,988 1,473

5,954 2,529

23,860 25,323

35,152 28,309

Investment Properties

94 595

586 (499) Corporate

(2,459) (2,243)

(6,659) (8,005) Segment operating

earnings

21,495 23,675

29,079 19,805 Not

specifically identifiable to segments: Interest expense

(2,325) (1,419)

(6,025) (3,018) Interest income

172 256

576 661 Foreign currency gain

122 510

1,286 1,424 Income tax recovery (expense)

175 (505)

25 (403) Net earnings from continuing operations

19,639 22,517

24,941 18,469 Net earnings from

discontinued operations

- 10,251

- 24,358 Net

earnings

$ 19,639 $ 32,768

$ 24,941 $ 42,827

Basic Earnings per Share Continuing operations

$ 0.51

$ 0.58

$ 0.65 $ 0.47 Discontinued operations

- 0.26

- 0.63

$ 0.51 $ 0.84

$ 0.65 $ 1.10

Diluted Earnings per Share Continuing operations

$

0.49 $ 0.56

$ 0.65 $ 0.43 Discontinued operations

- 0.24

- 0.56

$ 0.49 $ 0.80

$

0.65 $ 0.99

Cash Dividends

On November 12, 2018 the Company’s Board of Directors authorized

payment of a quarterly dividend to shareholders of $0.10 per common

share. The dividend is payable on December 3, 2018 to shareholders

of record on November 19, 2018.

Investor Conference Call/Webcast

The conference call will be held on Tuesday November 13th, 2018

at 10:00 am EST. Participants desiring audio only should dial

1-855-327-6837 or 1-631-891-4304 and are asked to dial in 5 minutes

before the conference call begins. A live audio webcast of the

conference call, which includes a presentation to investors, will

also be available on our website at

http://www.algonet.com/investor-relations/. Immediately following

the formal presentations, Algoma executives will be available to

answer questions.

Details of the Company’s fiscal 2018 third quarter results and

the presentation to investors will be available at

http://www.algonet.com/investor-relations/ prior to the conference

call/webcast. We are not incorporating information contained on the

website in this news release.

A replay of the conference call will be available from 1:00 pm

ET on November 13, 2018, until 11:59 pm ET, November 27, 2018. To

access the replay, call 1-844-512-2921 or 1-412-317-6671, followed

by passcode 10005734.

Normal Course Issuer Bid

During the third quarter of 2018 and during the nine months

ended September 30, 2018, 39,300 and 91,700 shares, respectively,

were purchased for cancellation.

Use of Non-GAAP Measures

There are measures included in this press release that do not

have a standardized meaning under generally accepted accounting

principles (GAAP). The Company includes these measures because it

believes certain investors use these measures as a means of

assessing financial performance. EBITDA is a non-GAAP measure that

does not have any standardized meaning prescribed by IFRS and may

not be comparable to similar measures presented by other companies.

Please refer to page 1 of the Management’s Discussions and Analysis

for the three and nine months ended September 30, 2018 for further

information regarding non-GAAP measures.

About Algoma Central

Algoma Central Corporation is a publicly traded company which

operates the largest fleet of dry and liquid bulk carriers on the

Great Lakes - St. Lawrence Waterway, including self-unloading

dry-bulk carriers, gearless dry-bulk carriers and product tankers.

Algoma also owns ocean self-unloading dry-bulk vessels operating in

international markets and a 50% interest in NovaAlgoma, which

includes a diversified portfolio of dry-bulk fleets operating

internationally.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181113005212/en/

Algoma Central CorporationKen Bloch Soerensen, +1

905-687-7885President and CEOorPeter D. Winkley, CPA, CA, +1

905-687-7897Chief Financial Officerwww.algonet.com

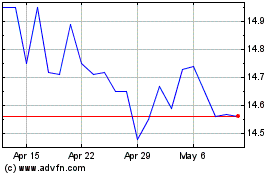

Algoma Central (TSX:ALC)

Historical Stock Chart

From Dec 2024 to Jan 2025

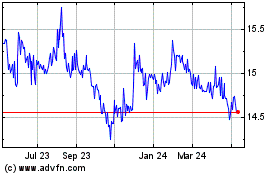

Algoma Central (TSX:ALC)

Historical Stock Chart

From Jan 2024 to Jan 2025