Black Iron: A Low Cost High Grade Turnaround Iron Ore Play - SECFilings.com

23 January 2018 - 12:00AM

SECFilings.com, a leading financial news and information portal

offering free real time public company filing alerts, announces the

publication of an article discussing Black Iron

Inc. (TSX: BKI) (OTC: BKIRF), a development-stage

iron-ore miner that made significant progress towards

commercialization prior to the market’s sharp decline between 2014

and 2016. With the rebound in iron-ore prices and new Chinese

environmental regulations, the company is uniquely positioned to

benefit from its near-term production of ultrahigh-grade iron-ore

product in a region that’s geographically ideal for exports to many

steel producing regions.

The best value investing opportunities often come

from industries that are experiencing a turnaround after a

prolonged decline. In these situations, many investors have moved

on to other opportunities and it takes time for the market to catch

on to the new reality. The market for iron-ore could be one of

these opportunities with a unique twist: New Chinese environmental

regulations are favoring high-quality producers over low-cost

producers and this is being reflected in iron content grade

premiums and penalties.

Back on Track

The market for iron-ore has experienced a

rollercoaster ride over the past several years. Between 2014 and

2016, iron-ore prices fell from nearly $140 per ton to a low of $40

per ton amid an increase in low-cost Australian production that

outpaced Chinese demand. Iron prices were further impacted by

high cost Chinese miners continuing to operate at a loss since

majority of these mines are owned by steel mills that import

significantly more ore than is mined domestically resulting in

further oversupply to depress global prices. The good news is that

prices have doubled since then from $40 per ton to nearly $80 per

ton and could be heading higher given the state of the global

economy.

China has recently undergone an environmental

crackdown that could divide the iron-ore industry. According to

Reuters, Chinese regulators recently cancelled one third of

domestic iron ore mining licenses, mostly belonging to low grade

high emitting mines, to curb pollution. Further, heavily

polluting industries that operate in provinces like Hebei, Shanxi,

and Shandong are being forced by regulators to reduce output and

curb emissions over the winter heating season that runs from

October to March. This means that mills have to either cut steel

production or find ways to sustainably reduce emissions.

The good news is restrictions on emissions in

China have driven the demand for higher quality feedstock.

For the steel industry this means products with high iron

content as the higher the iron grade in the mill feed the less coal

required to burn and subsequent emissions released per tonne of

steel produced. This has helped companies that produce a higher

iron content product like Brazil’s Vale, and Anglo-American (LON:

AAL) at the expense of lowest-cost and grade Australian mines like

Fortescue or BHP Billiton..

At today’s iron content premium of $7 to $8 per 1%

iron, Black Iron’s ultra high grade 68% product will receive a $40

to $50 per ton premium over the ~$77 per ton benchmark price for a

product that costs $31 per tonne to produce. Even if

benchmark iron ore prices fall, iron content premiums are likely to

remain at or above current levels given global concerns to curb

pollution.

In a Good Place

Black Iron raised $38 million in an initial public

offering on the Toronto Stock Exchange at $1.40 per share,

completed a bankable feasibility study, several major permit

milestones and received a $511 million construction finance

commitment from Metinvest - the 9th largest iron-ore miner and 16th

largest steel producer in the world - just before 2014. The company

also had advanced discussions on prepaid offtake with a well

financially backed international commodities trader to round out

the financing required to construct the project.

What drew Metinvest and this commodity trader to

Black Iron is production of an ultrahigh grade 68% iron content

product and all major infrastructure including railway, port and

power plus highly skilled relative low cost labour being in place

close to the ore body. Having all of the major infrastructure

allows for the project to be built at a much lower capital cost, in

a phased manner and relatively short time frame.

The company’s Shymanivske, Ukraine-based project

covers 2.56 square kilometers and is adjacent to ArcelorMittal’s

iron-ore mine and steel mill and Metinvest and Evraz’s YuGOK

iron-ore mine. In addition, the company has already secured rail,

port, and power access to bring iron-ore to steel mills in nearby

Europe, Turkey, and the Middle East. The distance to India and

China is also about 20% to 25% lower than North and South American

producers.

When iron-ore prices collapsed and war broke out

in Ukraine, the company’s offtake negotiations were halted,

Metinvest divested, and two of its largest shareholders sold their

positions. These setbacks have since been remedied as the Ukraine

situation has improved markedly and iron ore prices have recovered

sharply to nearly $80 per ton. Iron content premiums have also

risen to two to three times the historic levels given China’s new

regulations.

The company’s high-quality iron ore translates to

less emissions generated per ton of steel produced and increased

steel blast furnace productivity that lowers the cost to produce

steel. This combination means that the company’s iron ore output is

uniquely positioned to address China’s new environmental needs.

Looking Ahead

Black Iron Inc. (TSX: BKI; OTC: BKIRF) is a

little-known company that’s well positioned to benefit from the

recovery in iron-ore prices and China’s move to more

environmentally-friendly steel production. The company has a new go

forward plan to construct the mine in a phased approach to

significantly lower the initial capital required to get into

production. Moreover, the construction can be financed

largely through off-take, export credit, and bonds rather than

solely equity capital as was successfully done in 2014.

Please follow the link to read the full

article: For more information, visit the company’s website

at www.blackiron.com.

Please follow the link to read the full

article: http://analysis.secfilings.com/articles/199-black-iron-a-low-cost-high-grade-turnaround-iron-ore-play

About SECFilings.com

Founded in 2004, SECFilings.com provides free real

time filing alerts to over 600,000 registered members and offers

services to help public companies grow their audience of interested

investors.

Disclaimer

SECFilings.com is not an independent financial

investment advisor or broker-dealer. You should always consult with

your own independent legal, tax, and/or investment professionals

before making any investment decisions. The information provided

on http://www.secfilings.com (the ‘Site’) is either

original financial news or paid advertisements drafted by our

in-house team or provided by an affiliate. SECFilings.com, a

financial news media and marketing firm enters into media buys or

service agreements with the companies that are the subject of the

articles posted on the Site or other editorials for advertising

such companies. We are not an independent news media

provider. We make no warranty or representation about the

information including its completeness, accuracy, truthfulness or

reliability and we disclaim, expressly and implicitly, all

warranties of any kind, including whether the Information is

complete, accurate, truthful, or reliable. As such, your use of the

information is at your own risk. Nor do we undertake any obligation

to update the items posted. SECFilings.com received compensation

for producing and presenting high quality and sophisticated content

on SECFilings.com along with financial and corporate news.

The above article is sponsored content. Emerging

Growth LLC, which owns SECFilings.com, has been hired to create

awareness. Please follow the link below to view our full disclosure

outlining our

compensation: http://secfilings.com/Disclaimer.aspx.

Contact:

Paul Archie

406-862-2242

parchie@secfilings.com

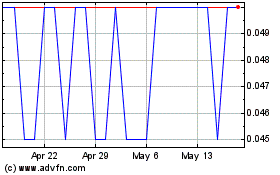

Black Iron (TSX:BKI)

Historical Stock Chart

From Nov 2024 to Dec 2024

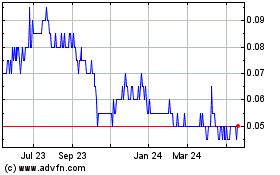

Black Iron (TSX:BKI)

Historical Stock Chart

From Dec 2023 to Dec 2024