The Board of Directors of Baytex Energy Corp. (TSX, NYSE: BTE)

announces a corporate update and board appointment.

Corporate Update

Strong operating performance has continued

across our asset base during the third quarter. Despite the

volatility in crude oil prices, we continue to drive capital

efficiencies across our business, deliver stable production and

meaningful free cash flow.

- We are now forecasting average production for 2019 of

approximately 97,000 boe/d (83% oil and NGL). This compares to our

original guidance range for 2019 of 93,000 to 97,000 boe/d, which

was recently tightened to 96,000 to 97,000 boe/d.

- We expect to exit 2019 producing 95,000-97,000 boe/d. This

represents debt-adjusted production per share growth of 7-9% as

compared to our 2018 exit production rate.

- We continue to drive capital discipline and now anticipate

exploration and development expenditures for 2019 of approximately

$560 million. This compares to our original guidance range of $550

to $650 million, which was recently tightened to $550 to $600

million.

- Based on the forward strip for the balance of 2019(1), we

expect to generate approximately $300 million of free cash flow,

which supports our de-leveraging strategy.

- 2019 full year pricing assumptions: WTI - US$57/bbl; LLS -

US$62/bbl; WCS differential - US$12/bbl; MSW differential –

US$5/bbl, NYMEX Gas - US$2.63/mcf; AECO Gas - $1.46/mcf and

Exchange Rate (CAD/USD) - 1.33.

Redemption of US$150 million

Notes

As discussed in our Q2/2019 press release, we

have called for redemption, effective September 13, 2019, our

US$150 million principal amount of 6.75% senior unsecured notes at

par. The redemption of this note will reduce our long-term notes

outstanding by 13% and result in annual interest expense savings of

approximately $7 million. We continue to maintain strong

liquidity with our credit facilities approximately 40% undrawn.

Board Appointment

The Board of Directors is pleased to announce

the appointment of Jennifer Maki as a director of Baytex.

“We are very pleased that Jennifer has joined

our team. Her business knowledge, strategic perspective and

financial expertise will serve the board and Baytex well in the

years ahead,” commented Neil Roszell, Chairman of Baytex.

Ms. Maki served as Chief Executive Officer of

Vale Canada and Executive Director of Vale SA, Base Metals (2014 to

2017) and previously held several other positions with Vale Base

Metals, including Chief Financial Officer & Executive

Vice-President (2007-2014) and Vice-President & Treasurer, and

with Inco Limited as Assistant Controller. Ms. Maki participated

actively in managing Vale's Base Metals businesses outside Canada

as a member of the Board of Commissioners of PT Vale Indonesia Tbk

(2007 to 2017), serving as its President Commissioner (2014 to

2017) and as a director of Vale Nouvelle-Caledonie SAS. She was

also Chair of Vale Canada’s Pension Committee. Before joining

Vale/Inco, she worked at PricewaterhouseCoopers LLP for 10 years in

roles of increasing responsibility. She has also been a director of

Next Generation Manufacturing Canada (a not-for-profit

organization) since September 2018 and is currently a Director of

the Franco-Nevada Corporation. Ms. Maki has a Bachelor of Commerce

degree from Queen’s University and a postgraduate diploma from the

Institute of Chartered Accountants, both in Ontario, Canada. She

also holds the ICD.D designation from the Institute of Corporate

Directors.

Baytex has an ongoing board renewal process led

by its Nominating and Governance Committee. In the last year, we

have significantly restructured our board. Throughout this renewal

process, our intent has been to create an efficient board with

complementary skill sets suited to our business, ensure

independence and increase diversity.

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

business strategies, plans and objectives; for 2019, our expected

average annual production rate, exit production rate, exploration

and development expenditures and free cash flow; our expected debt

adjusted per share production growth rate from exit 2018 to exit

2019; that we will redeem our US $150 million senior unsecured

notes on September 13, 2019 and the associated expected annual

interest expense savings.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices and price differentials; availability and cost of

gathering, processing and pipeline systems; failure to comply with

the covenants in our debt agreements; the availability and cost of

capital or borrowing; that our credit facilities may not provide

sufficient liquidity or may not be renewed; risks associated with a

third-party operating our Eagle Ford properties; the cost of

developing and operating our assets; depletion of our reserves;

risks associated with the exploitation of our properties and our

ability to acquire reserves; new regulations on hydraulic

fracturing; restrictions on or access to water or other fluids;

changes in government regulations that affect the oil and gas

industry; regulations regarding the disposal of fluids; changes in

environmental, health and safety regulations; public perception and

its influence on the regulatory regime; restrictions or costs

imposed by climate change initiatives; variations in interest rates

and foreign exchange rates; risks associated with our hedging

activities; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; our inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of our operations; risks associated with large

projects; risks related to our thermal heavy oil projects;

alternatives to and changing demand for petroleum products; risks

associated with our use of information technology systems; risks

associated with the ownership of our securities, including changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed

in our Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2018, filed with Canadian securities regulatory authorities and

the U.S. Securities and Exchange Commission and in our other public

filings.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial and Capital

Management Measures

Free cash flow is not a measurement based on

GAAP in Canada. We define free cash flow as adjusted funds flow

less sustaining capital. Sustaining capital is an estimate of the

amount of exploration and development expenditures required to

offset production declines on an annual basis and maintain flat

production volumes.

Exploration and development expenditures is not

a measurement based on GAAP in Canada. We define exploration and

development expenditures as additions to exploration and evaluation

assets combined with additions to oil and gas properties. We use

exploration and development expenditures to measure and evaluate

the performance of our capital programs. The total amount of

exploration and development expenditures is managed as part of our

budgeting process and can vary from period to period depending on

the availability of adjusted funds flow and other sources of

liquidity.

Debt adjusted production per share growth is

defined as growth in production from December 31, 2018 to December

31, 2019 on a per share basis with the number of shares adjusted

based on debt outstanding. Debt-adjusted share count is calculated

as total shares outstanding plus incremental shares issued at

current market price ($1.72) to eliminate net debt (i.e. full

equitization of net debt). Management of Baytex believes that debt

adjusted production per share growth is useful in determining the

production growth on a per share basis as if all debt was

extinguished by the issuance of shares.

Advisory Regarding Oil and Gas Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. BOEs may be misleading,

particularly if used in isolation. A boe conversion ratio of

six thousand cubic feet of natural gas to one barrel of oil is

based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged

in the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 83% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex's common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Vice President, Capital

Markets

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

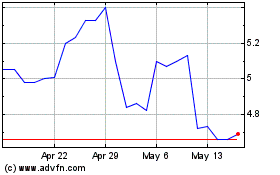

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

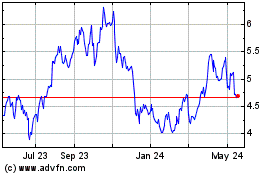

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025