Capital Power Corporation (TSX: CPX) today released financial

results for the quarter ended March 31, 2023.

Financial highlights

- Generated net cash flows from operating activities of $349

million and adjusted funds from operations (AFFO) of $210

million

- Generated net income of $285 million and adjusted EBITDA of

$401 million

- Full-year AFFO and adjusted EBITDA trending to the upper end of

annual guidance ranges for 2023

Strategic highlights

- Appointment of Avik Dey as President and Chief Executive

Officer

- Executed a 6-year contract extension for Goreway with Ontario

IESO

- Positive general developments for Genesee CCS project announced

in the Federal Budget 2023 notably reaffirmation of the role and

mandate for the Canada Growth Fund to support de-risking of large

scale decarbonization

- Announced a 23-year clean electricity supply agreement for

Halkirk 2 Wind

“Financial results were strong for the first quarter despite

unseasonably warm temperatures,” said Brian Vaasjo, President and

CEO of Capital Power. “This included warm temperatures in Alberta

for most of the quarter that resulted in an average power price of

$142 per megawatt hour which was well below our expectations of

$208 per megawatt hour. Our financial forecast and outlook for

Alberta power prices and fleetwide performance continues to be

positive for the remainder of the year. We expect financial results

to be trending to the upper end of the adjusted EBITDA and AFFO

guidance ranges of $1,455 million to $1,515 million and $805

million to $865 million, respectively.”

“The Ontario IESO capacity procurement confirms our natural gas

strategy and is a good investment opportunity for Capital Power,”

stated Mr. Vaasjo. “We were awarded a 6-year IESO contract

extension associated with our 40 megawatt efficiency upgrade bid

for Goreway, which applies to the new combined contracted capacity

of 880 megawatts and extends the current contract from 2029 to

2035. We continue discussions with the IESO on a similar contract

award for York Energy Centre and look forward to the results on our

competitive bids relating to a gas turbine expansion at East

Windsor and battery projects at Goreway and York Energy.”

“On behalf of all of Capital Power, I would like to welcome Avik

Dey to the Company. Avik will be a tremendous catalyst for the team

and as he noted in the April 19th press release, he is looking

forward to accelerating the company’s existing strategic plan. I

would also like to congratulate Kate Chisholm, Senior Vice

President and Chief Strategy and Sustainability Officer on her

retirement. Kate has been an integral part of the executive team

with outstanding service and valuable contributions since the

inception of Capital Power. We wish Kate the very best in

retirement,” added Mr. Vaasjo.

“Capital Power has been very fortunate to have Brian as our

inaugural President & CEO,” said Board Chair, Jill Gardiner.

“On behalf of the Board of Directors and the Company, I want to

thank him for his tremendous leadership and bringing Capital Power

to the strong position it is in today.”Operational and

Financial Highlights1

|

(unaudited, millions of dollars except per share and operational

amounts) |

Three months ended March 31 |

|

|

2023 |

|

2022 |

|

|

Electricity generation (Gigawatt hours) |

|

7,417 |

|

|

6,893 |

|

| Generation facility

availability |

|

94% |

|

|

95% |

|

| Revenues and other

income |

$ |

1,267 |

|

$ |

501 |

|

| Adjusted EBITDA 2 |

$ |

401 |

|

$ |

348 |

|

| Net income 3 |

$ |

285 |

|

$ |

119 |

|

| Net income attributable to

shareholders of the Company |

$ |

286 |

|

$ |

122 |

|

| Basic earnings per share |

$ |

2.39 |

|

$ |

0.96 |

|

| Diluted earnings per

share |

$ |

2.38 |

|

$ |

0.96 |

|

| Net cash flows from operating

activities |

$ |

349 |

|

$ |

415 |

|

| Adjusted funds from operations

2 |

$ |

210 |

|

$ |

200 |

|

| Adjusted funds from operations

per share 2 |

$ |

1.80 |

|

$ |

1.72 |

|

| Purchase of property, plant

and equipment and other assets, net |

$ |

86 |

|

$ |

132 |

|

|

Dividends per common share, declared |

$ |

0.5800 |

|

$ |

0.5475 |

|

- The operational and

financial highlights in this press release should be read in

conjunction with the Management’s Discussion and Analysis and the

unaudited condensed interim financial statements for the three

months ended March 31, 2023.

- Earnings before net

finance expense, income tax expense, depreciation and amortization,

impairments, foreign exchange gains or losses, finance expense and

depreciation expense from joint venture interests, gains or losses

on disposals and unrealized changes in fair value of commodity

derivatives and emissions credits (adjusted EBITDA) and adjusted

funds from operations (AFFO) are used as non-GAAP financial

measures by the Company. The Company also uses AFFO per share which

is a non-GAAP ratio. These measures and ratios do not have

standardized meanings under GAAP and are, therefore, unlikely to be

comparable to similar measures used by other enterprises. See

Non-GAAP Financial Measures and Ratios.

- Includes

depreciation and amortization for the three months ended March 31,

2023 and 2022 of $141 million and $142 million, respectively.

Forecasted depreciation and amortization for the remainder of 2023

is $137 million per quarter.

Significant Events

Approval of normal course issuer

bid

During the first quarter of 2023, the Toronto Stock Exchange

approved Capital Power’s normal course issuer bid to purchase and

cancel up to 5.8 million of its outstanding common shares during

the one-year period from March 3, 2023 to March 2, 2024.

Executed 23-year clean electricity supply

agreement for Halkirk 2 Wind

On February 3, 2023, we announced a 23-year clean electricity

supply agreement with Public Services and Procurement Canada. The

Agreement will provide approximately 250,000 MWh of clean

electricity per year initially through Canada-sourced renewable

energy credits until Capital Power’s proposed Alberta-based Halkirk

2 Wind project is completed, which is expected to be operational by

January 1, 2025 (subject to regulatory approval). The 151 MW

Halkirk 2 Wind project will provide renewable energy for the

remainder of the term – representing approximately 49% of the

facility’s output. As part of the transaction, Capital Power

committed to securing an equity partnership with local Indigenous

communities related to the proposed project.

Subsequent Events

Goreway awarded 6-year contract extension

by Ontario IESO

On April 25, 2023, Capital Power and the Ontario Independent

Electric System Operator (IESO) executed a 6-year contract

extension for Goreway associated with its successful efficiency

upgrade bid of approximately 40 megawatts (MW) in IESO’s

competitive capacity procurement process. The uprate will increase

Goreway’s current combined contracted capacity from 840 MW to 880

MW. The IESO contract extension applies to the new combined

contracted capacity of 880 MW and extends the current Clean Energy

Supply Contract from 2029 to 2035. The upgrade is expected to be

completed in 2025. Goreway is a natural gas-fired combined cycle

facility located in Brampton, Ontario.

Avik Dey appointed of as President and

Chief Executive Officer, Brian Vaasjo to Retire

On April 19, 2023, the Company’s Board of Directors

announced that it unanimously selected Avik Dey to be its next

President and Chief Executive Officer and become a member of the

Board of Directors, effective May 8, 2023. The appointment follows

the planned retirement of Brian Vaasjo who will support Mr. Dey in

an advisory role for six months to ensure a seamless

transition.

Retirement announced for Kate Chisholm,

Senior Vice President and Chief Strategy and Sustainability

Officer

On April 13, 2023, the Company announced internally

that Kate Chisholm, our Senior Vice President and Chief Strategy

and Sustainability Officer has advised of her intention to retire

effective July 4, 2023. Kate has been an integral part of the

Executive Team with outstanding service and valuable contributions

since the inception of Capital Power. Announcement for Kate's

replacement will occur in due course.

Analyst conference call and

webcast

Capital Power will be hosting a conference call and live webcast

with analysts on May 1, 2023 at 9:00 am (MT) to discuss the first

quarter financial results. The conference call dial-in number

is:

(800) 319-4610 (toll-free from Canada and USA)

Interested parties may also access the live webcast on the

Company’s website at www.capitalpower.com with an archive of the

webcast available following the conclusion of the analyst

conference call.

Non-GAAP Financial Measures and

Ratios

Capital Power uses (i) earnings before net finance expense,

income tax expense, depreciation and amortization, impairments,

foreign exchange gains or losses, finance expense and depreciation

expense from our joint venture interests, gains or losses on

disposals and unrealized changes in fair value of commodity

derivatives and emission credits (adjusted EBITDA), and (ii) AFFO

as financial performance measures.

Capital Power also uses AFFO per share as a performance measure.

This measure is a non-GAAP ratio determined by applying AFFO to the

weighted average number of common shares used in the calculation of

basic and diluted earnings per share.

These terms are not defined financial measures according to GAAP

and do not have standardized meanings prescribed by GAAP and,

therefore, are unlikely to be comparable to similar measures used

by other enterprises. These measures should not be considered

alternatives to net income, net income attributable to shareholders

of Capital Power, net cash flows from operating activities or other

measures of financial performance calculated in accordance with

GAAP. Rather, these measures are provided to complement GAAP

measures in the analysis of our results of operations from

management’s perspective.

Adjusted EBITDA

Capital Power uses adjusted EBITDA to measure the operating

performance of facilities and categories of facilities from period

to period. Management believes that a measure of facility operating

performance is more meaningful if results not related to facility

operations such as impairments, foreign exchange gains or losses,

gains or losses on disposals and other transactions, and unrealized

changes in fair value of commodity derivatives and emission credits

are excluded from the adjusted EBITDA measure. A reconciliation of

adjusted EBITDA to net income (loss) is as follows:

|

(unaudited, $ millions) |

Three months ended |

|

|

Mar 2023 |

Dec 2022 |

Sep 2022 |

Jun 2022 |

Mar 2022 |

Dec 2021 |

Sep 2021 |

Jun 2021 |

|

Revenues and other income |

1,267 |

|

929 |

|

786 |

|

713 |

|

501 |

|

672 |

|

377 |

|

387 |

|

| Energy purchases and fuel,

other raw materials and operating charges, staff costs and employee

benefits expense, and other administrative expense |

(723 |

) |

(909 |

) |

(543 |

) |

(429 |

) |

(178 |

) |

(506 |

) |

(162 |

) |

(176 |

) |

| Remove unrealized changes in

fair value of commodity derivatives and emission credits included

within revenues and energy purchases and fuel |

(179 |

) |

247 |

|

136 |

|

28 |

|

18 |

|

123 |

|

66 |

|

24 |

|

|

Adjusted EBITDA from jointventures1 |

36 |

|

36 |

|

4 |

|

7 |

|

7 |

|

5 |

|

5 |

|

6 |

|

|

Adjusted EBITDA |

401 |

|

303 |

|

383 |

|

319 |

|

348 |

|

294 |

|

286 |

|

241 |

|

| Depreciation and

amortization |

(141 |

) |

(139 |

) |

(133 |

) |

(139 |

) |

(142 |

) |

(137 |

) |

(133 |

) |

(132 |

) |

| Unrealized changes in fair

value of commodity derivatives and emission credits |

179 |

|

(247 |

) |

(136 |

) |

(28 |

) |

(18 |

) |

(123 |

) |

(66 |

) |

(24 |

) |

| Impairment (losses)

reversals |

- |

|

- |

|

- |

|

- |

|

- |

|

(52 |

) |

(8 |

) |

2 |

|

| Gains (losses) on acquisition

and disposal transactions |

- |

|

(33 |

) |

(3 |

) |

(1 |

) |

- |

|

6 |

|

31 |

|

(3 |

) |

| Foreign exchange gains

(losses) |

1 |

|

3 |

|

(12 |

) |

(7 |

) |

1 |

|

(1 |

) |

(7 |

) |

(2 |

) |

| Net finance expense |

(48 |

) |

(44 |

) |

(40 |

) |

(35 |

) |

(37 |

) |

(44 |

) |

(43 |

) |

(46 |

) |

| Other items1,2 |

(21 |

) |

(17 |

) |

(4 |

) |

(1 |

) |

- |

|

(4 |

) |

(4 |

) |

(5 |

) |

| Income

tax expense |

(86 |

) |

75 |

|

(24 |

) |

(31 |

) |

(33 |

) |

(8 |

) |

(18 |

) |

(14 |

) |

|

Net income (loss) |

285 |

|

(99 |

) |

31 |

|

77 |

|

119 |

|

(69 |

) |

38 |

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

(1 |

) |

(1 |

) |

(3 |

) |

(3 |

) |

(3 |

) |

(4 |

) |

(2 |

) |

(3 |

) |

|

Shareholders of the Company |

286 |

|

(98 |

) |

34 |

|

80 |

|

122 |

|

(65 |

) |

40 |

|

20 |

|

|

Net income (loss) |

285 |

|

(99 |

) |

31 |

|

77 |

|

119 |

|

(69 |

) |

38 |

|

17 |

|

- Total income from joint ventures as

per our consolidated statements of income (loss).

- Includes finance expense,

depreciation expense and unrealized changes in fair value of

derivative instruments from joint ventures.

Adjusted funds from operations and adjusted

funds from operations per share

AFFO and AFFO per share are measures of the Company’s ability to

generate cash from its operating activities to fund growth capital

expenditures, the repayment of debt and the payment of common share

dividends.

AFFO represents net cash flows from operating activities

adjusted to:

- remove timing impacts of cash

receipts and payments that may impact period-to-period

comparability which include deductions for net finance expense and

current income tax expense, the removal of deductions for interest

paid and income taxes paid and removing changes in operating

working capital,

- include the Company’s share of the

AFFO of its joint venture interests and exclude distributions

received from the Company’s joint venture interests which are

calculated after the effect of non-operating activity joint venture

debt payments,

- include cash from off-coal

compensation that will be received annually,

- remove the tax equity financing

project investors’ shares of AFFO associated with assets under tax

equity financing structures so only the Company’s share is

reflected in the overall metric,

- deduct sustaining capital

expenditures and preferred share dividends,

- exclude the impact of fair value

changes in certain unsettled derivative financial instruments that

are charged or credited to the Company’s bank margin account held

with a specific exchange counterparty, and

- exclude other typically

non-recurring items affecting cash from operations that are not

reflective of the long-term performance of the Company’s underlying

business.

Commencing with the Company’s December 31, 2022 quarter-end, the

Company refined its AFFO measure to better reflect the purpose of

the measure and include in its adjustment to exclude other

typically non-recurring items affecting cash from operations that

are not reflective of the long-term performance of the Company’s

underlying business. No comparative AFFO figures have impacted or

restated for this change.

A reconciliation of net cash flows from operating activities to

adjusted funds from operations is as follows:

|

(unaudited, $ millions) |

Three months ended March 31 |

|

|

2023 |

|

2022 |

|

|

Net cash flows from operating activities per condensed

interim consolidated statements of cash flows |

349 |

|

415 |

|

|

Add (deduct) items included in calculation of net cash flows from

operating activities per condensed interim consolidated statements

of cash flows: |

|

|

|

Interest paid |

50 |

|

38 |

|

|

Change in fair value of derivatives reflected as cash

settlement |

(111 |

) |

(7 |

) |

|

Distributions received from joint ventures |

(9 |

) |

- |

|

|

Miscellaneous financing charges paid1 |

2 |

|

2 |

|

|

Income taxes paid |

14 |

|

12 |

|

|

Change in non-cash operating working capital |

3 |

|

(180 |

) |

|

|

(51 |

) |

(135 |

) |

|

Net finance expense2 |

(35 |

) |

(31 |

) |

| Current income tax

expense |

(51 |

) |

(15 |

) |

| Sustaining capital

expenditures3 |

(15 |

) |

(25 |

) |

| Preferred share dividends

paid |

(7 |

) |

(10 |

) |

| Remove tax equity interests’

respective shares of adjusted funds from operations |

(2 |

) |

(4 |

) |

| Adjusted funds from operations

from joint ventures |

22 |

|

5 |

|

|

Adjusted funds from operations |

210 |

|

200 |

|

|

Weighted average number of common shares outstanding

(millions) |

116.9 |

|

116.2 |

|

|

Adjusted funds from operations per share ($) |

1.80 |

|

1.72 |

|

- Included in other cash items on the

condensed interim consolidated statements of cash flows to

reconcile net income to net cash flows from operating

activities.

- Excludes unrealized changes on

interest rate derivative contracts, amortization, accretion charges

and non-cash implicit interest on tax equity investment

structures.

- Includes sustaining capital

expenditures net of partner contributions of $3 million and $1

million for the three months ended March 31, 2023 and 2022,

respectively.

Forward-looking Information

Forward-looking information or statements included in this press

release are provided to inform the Company’s shareholders and

potential investors about management’s assessment of Capital

Power’s future plans and operations. This information may not be

appropriate for other purposes. The forward-looking information in

this press release is generally identified by words such as will,

anticipate, believe, plan, intend, target, and expect or similar

words that suggest future outcomes.

Material forward-looking information in this press release

includes disclosures regarding (i) status of the Company’s 2023

AFFO and adjusted EBITDA guidance, (ii) budgeted 2023 depreciation,

and (iii) the generation capacity and timing of Goreway’s

efficiency upgrade.

These statements are based on certain assumptions and analyses

made by the Company considering its experience and perception of

historical trends, current conditions, expected future developments

and other factors it believes are appropriate including its review

of purchased businesses and assets. The material factors and

assumptions used to develop these forward-looking statements relate

to: (i) electricity, other energy and carbon prices, (ii)

performance, (iii) business prospects (including potential

re-contracting of facilities) and opportunities including expected

growth and capital projects, (iv) status of and impact of policy,

legislation and regulations and (v) effective tax rates.

Whether actual results, performance or achievements will conform

to the Company’s expectations and predictions is subject to a

number of known and unknown risks and uncertainties which could

cause actual results and experience to differ materially from the

Company’s expectations. Such material risks and uncertainties are:

(i) changes in electricity, natural gas and carbon prices in

markets in which the Company operates and the use of derivatives,

(ii) regulatory and political environments including changes to

environmental, climate, financial reporting, market structure and

tax legislation, (iii) generation facility availability, wind

capacity factor and performance including maintenance expenditures,

(iv) ability to fund current and future capital and working capital

needs, (v) acquisitions and developments including timing and costs

of regulatory approvals and construction, (vi) changes in the

availability of fuel, (vii) ability to realize the anticipated

benefits of acquisitions, (viii) limitations inherent in the

Company’s review of acquired assets, (ix) changes in general

economic and competitive conditions and (x) changes in the

performance and cost of technologies and the development of new

technologies, new energy efficient products, services and programs.

See Risks and Risk Management in the Company’s Integrated Annual

Report for the year ended December 31, 2022, prepared as of

February 28, 2023, for further discussion of these and other

risks.

Readers are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the specified

approval date. The Company does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in the Company’s expectations or any change in events, conditions

or circumstances on which any such statement is based, except as

required by law.

Territorial Acknowledgement

In the spirit of reconciliation, Capital Power respectfully

acknowledges that we operate within the ancestral homelands,

traditional and treaty territories of the Indigenous Peoples of

Turtle Island, or North America.

Capital Power’s head office is located within the traditional

and contemporary home of many Indigenous Peoples of the Treaty 6

region and Métis Nation of Alberta Region 4. We acknowledge the

diverse Indigenous communities that are located in these areas and

whose presence continues to enrich the community.

About Capital Power

Capital Power (TSX: CPX) is a growth-oriented North American

wholesale power producer with a strategic focus on sustainable

energy headquartered in Edmonton, Alberta. We build, own, and

operate high-quality, utility-scale generation facilities that

include renewables and thermal. We have also made significant

investments in carbon capture and utilization to reduce carbon

impacts. Capital Power owns approximately 7,500 MW of power

generation capacity at 29 facilities across North America. Projects

in advanced development include approximately 151 MW of owned

renewable generation capacity in Alberta and 512 MW of incremental

natural gas combined cycle capacity, from the repowering of Genesee

1 and 2 in Alberta.

For more information, please

contact:

|

Media Relations: |

Investor Relations: |

| Katherine Perron |

Randy Mah |

| (780) 392-5335 |

(780) 392-5305 or (866) 896-4636

(toll-free) |

| kperron@capitalpower.com |

investor@capitalpower.com |

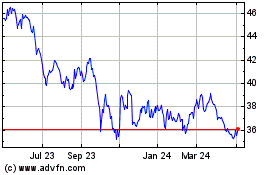

Capital Power (TSX:CPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

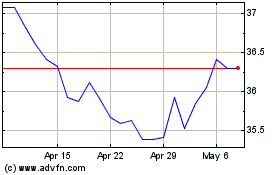

Capital Power (TSX:CPX)

Historical Stock Chart

From Jan 2024 to Jan 2025