Diversified Royalty Corp. (TSX: DIV and DIV.DB.A) (the

“Corporation” or “DIV”) is pleased to announce its financial

results for the three months ended September 30, 2024 (“Q3 2024”)

and nine months ended September 30, 2024.

Highlights

- The weighted

average organic royalty growth1 of DIV’s diversified royalty

portfolio was 4.3% in Q3 2024 and 4.8% for the nine months ended

September 30, 2024, compared to 6.8% for the three months ended

September 30, 2023 (“Q3 2023”) and 9.1% for the nine months ended

September 30, 2023. The weighted average organic royalty growth1 on

a constant currency basis was 4.0% in Q3 2024 and 4.6% for the nine

months ended September 30, 2024.

- Revenue of $16.1

million in Q3 2024 and $48.0 million for the nine months ended

September 30, 2024, up 18.3% and 19.6%, respectively, compared to

the same periods in 2023.

- Adjusted revenue1

of $17.4 million in Q3 2024 and $51.9 million for the nine months

ended September 30, 2024, up 16.9% and 18.1%, respectively,

compared to the same periods in 2023.

- Distributable cash1

of $11.0 million in Q3 2024 and $32.2 million for the nine months

ended September 30, 2024, up 20.5% and 16.1%, respectively,

compared to the same periods in 2023.

- Payout ratio1 of

94.1% in Q3 2024 based on dividends of $0.0625 per share for the

quarter, compared to 94.4% in Q3 2023 based on dividends of $0.0602

per share for the comparable quarter and 93.0% for the nine months

ended September 30, 2024 based on dividends of $0.1862 per share

for the period, compared to 92.5% based on dividends of $0.1802 per

share for the comparable period.

- DIV celebrated the

10-year anniversary of the closing of its first royalty

transaction.

Third Quarter Results

| |

|

Three months

ended September 30, |

|

Nine months ended

September 30, |

|

|

(000’s) |

|

2024 |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Mr. Lube + Tires |

$ |

7,763 |

|

$ |

7,312 |

|

$ |

22,587 |

|

$ |

20,619 |

|

|

Stratusa |

|

2,154 |

|

|

2,018 |

|

|

6,445 |

|

|

6,072 |

|

|

BarBurrito |

|

2,101 |

|

|

- |

|

|

6,302 |

|

|

- |

|

|

Nurse Next Doorb |

|

1,323 |

|

|

1,297 |

|

|

3,969 |

|

|

3,891 |

|

|

Oxford |

|

930 |

|

|

915 |

|

|

3,325 |

|

|

3,359 |

|

|

Sutton |

|

1,117 |

|

|

1,096 |

|

|

3,307 |

|

|

3,244 |

|

|

Mr. Mikes |

|

1,088 |

|

|

1,180 |

|

|

3,187 |

|

|

3,440 |

|

|

AIR MILES® |

|

924 |

|

|

1,071 |

|

|

2,744 |

|

|

3,308 |

|

|

Adjusted revenuec |

$ |

17,400 |

|

$ |

14,889 |

|

$ |

51,866 |

|

$ |

43,933 |

|

|

a) |

Stratus royalty income for the three and nine months ended

September 30, 2024 was US$1.6 million and US$4.7 million,

respectively, translated at an average foreign exchange rate of

$1.3634 and $1.3600 to US$1, respectively (three and nine months

ended September 30, 2023 – royalty income of US$1.5 million and

US$4.5 million, respectively, translated at an average foreign

exchange rate of $1.3413 and $1.3454 to US$1, respectively). |

|

b) |

Represents the DIV Royalty Entitlement plus management fees

received from Nurse Next Door. |

|

c) |

DIV Royalty Entitlement and adjusted revenue are non-IFRS financial

measures and as such, do not have standardized meanings under IFRS.

For additional information, refer to “Non-IFRS Measures” in this

news release. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Q3 2024, DIV generated $16.1 million of

revenue compared to $13.6 million in Q3 2023. After taking into

account the DIV Royalty Entitlement1 (defined below) related to

DIV’s royalty arrangements with Nurse Next Door, DIV’s adjusted

revenue was $17.4 million in Q3 2024, compared to $14.9 million in

Q3 2023. Adjusted revenue increased primarily due to incremental

revenue received through the acquisition of the BarBurrito rights

on October 4, 2023, positive SSSG1 (defined below) at

Mr. Lube + Tires and Oxford, the annual contractual

royalty increases at Stratus, Nurse Next Door and Sutton, partially

offset by negative SSSG from Mr. Mikes and lower royalty income

from AIR MILES®, all as discussed in further detail below.

1. Adjusted revenue, distributable cash and DIV

Royalty Entitlement are non-IFRS financial measures, payout ratio

is a non-IFRS ratio and weighted average organic royalty growth and

SSSG are supplementary financial measures – see “Non-IFRS Measures”

below.

Royalty Partner Business Updates

Mr. Lube + Tires: Mr. Lube

Canada Limited Partnership (“Mr. Lube + Tires”) generated SSSG2 of

7.7% for the Mr. Lube + Tires stores in the royalty pool for Q3

2024, compared to SSSG of 16.4% in Q3 2023.

2. Same-store-sales growth or SSSG is a

supplementary financial measure – see “Non-IFRS Measures”

below.

Stratus: Royalty income from

SBS Franchising LLC (“Stratus”) was $2.2 million (US$1.6 million

translated at an average foreign exchange rate of $1.3634 to

US$1.00) for Q3 2024. The fixed royalty payable by Stratus

increases each November at a rate of 5% until and including

November 2026 and 4% each November thereafter during the term of

the license, with the most recent increase effective November 15,

2023.

Nurse Next Door: The royalty

entitlement to DIV (the “DIV Royalty Entitlement3”) from Nurse Next

Door Professional Homecare Services Inc. (“Nurse Next Door”) was

$1.3 million in Q3 2024. The DIV Royalty Entitlement from Nurse

Next Door grows at a fixed rate of 2.0% per annum during the term

of the license, with the most recent increase effective October 1,

2024.

3. DIV Royalty Entitlement is a non-IFRS measure

– see “Non-IFRS Measures” below.

Mr. Mikes: SSSG4 for the Mr.

Mikes Restaurants Corporation (“Mr. Mikes”) restaurants in the Mr.

Mikes royalty pool was -3.1% in Q3 2024, compared to SSSG of 3.6%

in Q3 2023. The lower SSSG percentage in the current period is due

to lower restaurant guest traffic.

Royalty income and management fees of $1.1

million were generated from Mr. Mikes in Q3 2024, compared to $1.2

million in Q3 2023.

4. Same-store-sales growth or SSSG is a

supplementary financial measure – see “Non-IFRS Measures”

below.

Oxford: The Oxford Learning

Centres, Inc. (“Oxford”) locations in the Oxford royalty pool

generated SSSG5 (on a constant currency basis) of 1.8% in Q3 2024,

compared to SSSG of -0.9% in Q3 2023. Oxford’s SSSG has returned to

being positive after lapping the completion of the Ontario

Government funding of student learning support, which included

private tutoring, which funding completed in the first half of

2023.

5. Same-store-sales growth or SSSG is a

supplementary financial measure – see “Non-IFRS Measures”

below.

AIR MILES®: In Q3 2024, royalty

income of $0.9 million was generated from the AIR MILES® Licenses

compared to $1.1 million generated in Q3 2023, a decrease of 13.7%

from the comparable quarter. The decrease is largely due to

continued softness in the AIR MILES® Rewards Program.

Sutton: In Q3 2024, royalty

income of $1.1 million was generated from Sutton. The fixed royalty

payable by Sutton increases at a rate of 2% per year, with the most

recent increase effective July 1, 2024.

BarBurrito: Royalty income from

BarBurrito Restaurants Inc. (“BarBurrito”) was $2.1 million for Q3

2024. The royalty payable by BarBurrito initially grows at a fixed

rate of 4% per annum for the first seven years and, commencing on

January 1, 2031, will fluctuate based on the gross sales of the

BarBurrito locations in the royalty pool.

Third Quarter Commentary

Sean Morrison, President and Chief Executive

Officer of DIV stated, “DIV is pleased with how its royalty

partners performed in the third quarter of 2024. Mr. Lube, our

largest royalty partner, continued to see growth, generating SSSG6

of 7.7% for the three-month period ended September 30, 2024. Oxford

returned to positive SSSG of 1.8% in the third quarter after two

quarters of mildly negative SSSG, while Mr. Mikes continued to show

a slight decline similar to its Q1 and Q2 2024 performance.

However, Mr. Mikes’ management remains optimistic about its future

opportunities for the business, including incremental location

growth. Royalty partners Nurse Next Door, Sutton, Stratus and

BarBurrito made their fixed royalty payments. DIV continues to see

a decrease in royalty income from AIR MILES as a result of softness

in the AIR MILES® Rewards Program. However, DIV management recently

met with the President of AIR MILES and he highlighted their

substantial commitment and continued investment in AIR MILES

Rewards Program under BMO’s ownership.”

6. Same-store-sales growth or SSSG is a

supplementary financial measure – see “Non-IFRS Measures”

below.

Distributable Cash and Dividends Declared

In Q3 2024, distributable cash7 increased to

$11.0 million ($0.0665 per share), compared to $9.1 million

($0.0638 per share) in Q3 2023. The increase in distributable cash7

for the quarter was primarily due to higher adjusted revenue7, and

lower professional fees and general and administrative expenses,

partially offset by higher interest expense, and salaries and

benefits. The increase in distributable cash per share7 for the

quarter was primarily due to an increase in distributable cash,

partially offset by a higher weighted average number of common

shares outstanding.

In Q3 2024, the payout ratio7 was 94.1% on

dividends of $0.0625 per share, compared to the payout ratio of

94.4% on dividends of $0.0600 per share for the same respective

period in 2023. The decrease was primarily due to higher

distributable cash per share, partially offset by higher dividends

declared per share 7.

7. Adjusted revenue and distributable cash are

non-IFRS financial measures and distributable cash per share and

payout ratio are non-IFRS ratios – see “Non-IFRS Measures”

below.

Net Income

Net income for Q3 2024 was $6.9 million compared

to net income of $6.8 million for the three months ended September

30, 2023. The increase in net income in Q3 2024 was primarily due

to higher adjusted revenue8, lower professional fees and general

and administrative expenses, partially offset by higher share-based

compensation expenses, interest expense on credit facilities, and

income tax expense.

8. Adjusted revenue is a non-IFRS financial

measure – see “Non-IFRS Measures” below.

Diversified Royalty Corp. 10-Year

Anniversary

DIV is proud to celebrate the 10-year

anniversary of its first royalty transaction. On September 26,

2014, the Company completed its first royalty transaction and was

renamed Diversified Royalty Corp. In conjunction with this,

the Company began trading on the TSX under the stock symbol “DIV”.

Subsequently, DIV has completed 8 further royalty transactions with

a diversified group of royalty partners. Since November 2014, DIV

has paid a monthly dividend every month, without

exception. These cumulative dividends total over $2.21 per

share as of November 5, 2024. The combination of these

dividends and share price appreciation equates to approximately a

15.9% annualized IRR9 since December 2013. With a diversified

portfolio of royalty partners and proven business model, DIV is

optimistic about its prospects over the next 10 years.

9. IRR is a supplementary financial measure –

see “Non-IFRS Measures” below.

About Diversified Royalty Corp.

DIV is a multi-royalty corporation,

engaged in the business of acquiring top-line royalties from

well-managed multi-location businesses and franchisors in North

America. DIV’s objective is to acquire predictable, growing royalty

streams from a diverse group of multi-location businesses and

franchisors.

DIV currently owns the Mr. Lube + Tires,

AIR MILES®, Sutton, Mr. Mikes, Nurse Next Door, Oxford Learning

Centres, Stratus Building Solutions and BarBurrito trademarks. Mr.

Lube + Tires is the leading quick lube service business in Canada,

with locations across Canada. AIR MILES® is Canada’s largest

coalition loyalty program. Sutton is among the leading residential

real estate brokerage franchisor businesses in Canada. Mr. Mikes

operates casual steakhouse restaurants primarily in western

Canadian communities. Nurse Next Door is a home care provider with

locations across Canada and the United States as well as in

Australia. Oxford Learning Centres is one of Canada’s leading

franchisee supplemental education services. Stratus Building

Solutions is a leading commercial cleaning service franchise

company providing comprehensive building cleaning, and office

cleaning services primarily in the United States. BarBurrito is the

largest quick service Mexican restaurant food chain in

Canada.

DIV’s objective is to increase cash flow

per share by making accretive royalty purchases and through the

growth of purchased royalties. DIV intends to continue to pay a

predictable and stable monthly dividend to shareholders and

increase the dividend over time, in each case as cash flow per

share allows.

Forward-Looking Statements

Certain statements contained in this news

release may constitute “forward-looking information” within the

meaning of applicable securities laws that involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking information. The use

of any of the words “anticipate”, “continue”, “estimate”, “expect”,

“intend”, “may”, “will”, ”project”, “should”, “believe”,

“confident”, “plan” and “intend” and similar expressions are

intended to identify forward-looking information, although not all

forward-looking information contains these identifying words.

Specifically, forward-looking information in this news release

includes, but is not limited to, statements made in relation to:

DIV being optimistic about its prospects over the next 10 years;

Mr. Mikes management being optimistic about future opportunities

for its business, including incremental location growth; AIR MILES®

substantial commitment and continued investment in the AIR MILES®

Reward Program under BMO’s ownership; DIV’s intention to pay

monthly dividends to shareholders; and DIV’s corporate objectives.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events, performance,

or achievements of DIV to differ materially from those anticipated

or implied by such forward-looking information. DIV believes that

the expectations reflected in the forward-looking information

included in this news release are reasonable but no assurance can

be given that these expectations will prove to be correct. In

particular, risks and uncertainties include: DIV’s royalty partners

may not make their respective royalty payments to DIV, in whole or

in part; the decline in royalties received under the AIR MILES®

licenses could cause AM Royalties Limited Partnership (“AM LP”) to

be required to make partial or full repayment of the outstanding

principal amount under its credit agreement, or cause AM LP to be

in default under its credit agreement; current positive trends

being experienced by certain of DIV’s royalty partners (and their

respective franchisees) may not continue and may regress, and

current negative trends experienced by certain of DIV’s royalty

partners (including their respective franchisees) may continue and

may regress; DIV and its royalty partners performance may not meet

management’s expectations; DIV may not be able to make monthly

dividend payments to the holders of its common shares; AIR MILES®

investment in the AIR MILES® Reward Program may not result in

improved performance of the AIR MILES® royalty, and such

investments may be reduced or cease; dividends are not guaranteed

and may be reduced, suspended or terminated at any time; or DIV may

not achieve any of its corporate objectives. Given these

uncertainties, readers are cautioned that forward-looking

information included in this news release is not a guarantee of

future performance, and such forward-looking information should not

be unduly relied upon. More information about the risks and

uncertainties affecting DIV’s business and the businesses of its

royalty partners can be found in the “Risk Factors” section of its

Annual Information Form dated March 21, 2024 and in DIV’s

management’s discussion and analysis for the three and nine months

ended September 30, 2024, copies of which are available under DIV’s

profile on SEDAR+ at www.sedarplus.com.

In formulating the forward-looking information

contained herein, management has assumed that DIV will generate

sufficient cash flows from its royalties to service its debt and

pay dividends to shareholders; lenders will provide any necessary

waivers required in order to allow DIV to continue to pay

dividends; lenders will provide any other necessary covenant

waivers to DIV and its royalty partners; the performance of DIV’s

royalty partners will be consistent with DIV’s and its royalty

partners’ respective expectations; recent positive trends for

certain of DIV’s royalty partners (including their respective

franchisees) will continue and not regress; current negative trends

experienced by certain of DIV’s royalty partners (including their

respective franchisees) will not materially regress; the businesses

of DIV’s respective royalty partners will not suffer any material

adverse effect; and the business and economic conditions affecting

DIV and its royalty partners will continue substantially in the

ordinary course, including without limitation with respect to

general industry conditions, general levels of economic activity

and regulations. These assumptions, although considered reasonable

by management at the time of preparation, may prove to be

incorrect.

All of the forward-looking information in this

news release is qualified by these cautionary statements and other

cautionary statements or factors contained herein, and there can be

no assurance that the actual results or developments will be

realized or, even if substantially realized, that it will have the

expected consequences to, or effects on, DIV. The forward-looking

information in this news release is made as of the date of this

news release and DIV assumes no obligation to publicly update or

revise such information to reflect new events or circumstances,

except as may be required by applicable law.

Non-IFRS Measures

Management believes that disclosing certain

non-IFRS financial measures, non-IFRS ratios and supplementary

financial measures provides readers with important information

regarding the Corporation’s financial performance and its ability

to pay dividends and the performance of its royalty partners. By

considering these measures in combination with the most closely

comparable IFRS measure, management believes that investors are

provided with additional and more useful information about the

Corporation and its royalty partners than investors would have if

they simply considered IFRS measures alone. The non-IFRS financial

measures, non-IFRS ratios and supplementary financial measures do

not have standardized meanings prescribed by IFRS and therefore are

unlikely to be comparable to similar measures presented by other

issuers. Investors are cautioned that non-IFRS measures should not

be construed as a substitute or an alternative to net income or

cash flows from operating activities as determined in accordance

with IFRS.

“Adjusted revenue”, “adjusted royalty income”,

“DIV Royalty Entitlement” and “distributable cash” are used as

non-IFRS financial measures in this news release.

Adjusted revenue is calculated as royalty income

plus DIV Royalty Entitlement and management fees. The following

table reconciles adjusted revenue and adjusted royalty income to

royalty income, the most directly comparable IFRS measure disclosed

in the financial statements:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

(000's) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Mr. Lube + Tires |

$ |

7,703 |

|

$ |

7,254 |

|

$ |

22,410 |

|

$ |

20,446 |

|

|

Stratus |

|

2,154 |

|

|

2,018 |

|

|

6,445 |

|

|

6,072 |

|

|

BarBurrito |

|

2,080 |

|

|

- |

|

|

6,240 |

|

|

- |

|

|

Oxford |

|

919 |

|

|

905 |

|

|

3,293 |

|

|

3,329 |

|

|

Sutton |

|

1,089 |

|

|

1,068 |

|

|

3,224 |

|

|

3,161 |

|

|

Mr. Mikes |

|

1,078 |

|

|

1,168 |

|

|

3,156 |

|

|

3,405 |

|

|

AIR MILES® |

|

924 |

|

|

1,071 |

|

|

2,744 |

|

|

3,308 |

|

|

Royalty income |

$ |

15,947 |

|

$ |

13,484 |

|

$ |

47,512 |

|

$ |

39,721 |

|

|

DIV Royalty Entitlement |

|

1,303 |

|

|

1,277 |

|

|

3,908 |

|

|

3,831 |

|

|

Adjusted royalty income |

$ |

17,250 |

|

$ |

14,761 |

|

$ |

51,420 |

|

$ |

43,552 |

|

|

Management fees |

|

150 |

|

|

128 |

|

|

446 |

|

|

381 |

|

|

Adjusted revenue |

$ |

17,400 |

|

$ |

14,889 |

|

$ |

51,866 |

|

$ |

43,933 |

|

| |

|

|

|

|

For further details with respect to adjusted

revenue and adjusted royalty income, refer to the subsection

“Non-IFRS Financial Measures” under “Description of Non-IFRS

Financial Measures, Non-IFRS Ratios and Supplementary Financial

Measures” in the Corporation’s management’s discussion and analysis

for the three and nine months ended September 30, 2024, a copy of

which is available on SEDAR+ at www.sedarplus.com.

The most closely comparable IFRS measure to DIV

Royalty Entitlement is “distributions received from NND LP”. DIV

Royalty Entitlement is calculated as distributions received from

NND LP, before any deduction for expenses incurred by NND Holdings

Limited Partnership (“NND LP”), which expenses include legal,

audit, tax and advisory services. Note that distributions received

from NND LP is derived from the royalty paid by Nurse Next Door to

NND LP. The following table reconciles DIV Royalty Entitlement to

distributions received from NND LP in the financial statements:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

(000's) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Distributions received from NND LP |

$ |

1,292 |

|

|

$ |

1,277 |

|

$ |

3,883 |

|

|

$ |

3,811 |

|

|

|

Add: NND Royalties LP expenses |

|

11 |

|

|

|

- |

|

|

25 |

|

|

|

20 |

|

|

|

DIV Royalty Entitlement |

|

1,303 |

|

|

|

1,277 |

|

|

3,908 |

|

|

|

3,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: NND Royalties LP expenses |

|

(11 |

) |

|

|

- |

|

|

(25 |

) |

|

|

(20 |

) |

|

|

DIV Royalty Entitlement, net of NND Royalties LP

expenses |

$ |

1,292 |

|

|

$ |

1,277 |

|

$ |

3,883 |

|

|

$ |

3,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For further details with respect to DIV Royalty

Entitlement, refer to the subsection “Non-IFRS Financial Measures”

under “Description of Non-IFRS Financial Measures, Non-IFRS Ratios

and Supplementary Financial Measures” in the Corporation’s

management’s discussion and analysis for the three and nine months

ended September 30, 2024, a copy of which is available on SEDAR+ at

www.sedarplus.com.

The following table reconciles distributable

cash to cash flows generated from operating activities, the most

directly comparable IFRS measure disclosed in the financial

statements:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

(000's) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows generated from operating

activities |

$ |

12,712 |

|

|

$ |

10,424 |

|

|

$ |

34,767 |

|

|

$ |

23,416 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current tax expense |

|

(2,075 |

) |

|

|

(1,501 |

) |

|

|

(5,216 |

) |

|

|

(4,216 |

) |

|

|

Accrued interest on convertible debentures |

|

(788 |

) |

|

|

(788 |

) |

|

|

(788 |

) |

|

|

(788 |

) |

|

|

Accrued interest on bank loans |

|

17 |

|

|

|

- |

|

|

|

(425 |

) |

|

|

- |

|

|

|

Distributions on exchangeable MRM units |

|

(30 |

) |

|

|

(53 |

) |

|

|

(104 |

) |

|

|

(126 |

) |

|

|

Mandatory principal payments on credit facilities |

|

- |

|

|

|

(431 |

) |

|

|

(643 |

) |

|

|

(431 |

) |

|

|

Payment of lease obligations |

|

(28 |

) |

|

|

(26 |

) |

|

|

(82 |

) |

|

|

(79 |

) |

|

|

NND LP expenses |

|

(4 |

) |

|

|

- |

|

|

|

(25 |

) |

|

|

(20 |

) |

|

|

Accrued DIV Royalty Entitlement, net of distributions |

|

4 |

|

|

|

56 |

|

|

|

25 |

|

|

|

- |

|

|

|

Foreign exchange and other |

|

31 |

|

|

|

315 |

|

|

|

159 |

|

|

|

(166 |

) |

|

|

Changes in working capital |

|

(342 |

) |

|

|

(503 |

) |

|

|

336 |

|

|

|

4,105 |

|

|

|

Taxes paid |

|

1,501 |

|

|

|

1,637 |

|

|

|

4,500 |

|

|

|

6,043 |

|

|

|

Note receivable |

|

- |

|

|

|

- |

|

|

|

(305 |

) |

|

|

- |

|

|

|

Distributable cash |

$ |

10,998 |

|

|

$ |

9,130 |

|

|

$ |

32,199 |

|

|

$ |

27,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For further details with respect to

distributable cash, refer to the subsection “Non-IFRS Financial

Measures” under “Description of Non-IFRS Financial Measures,

Non-IFRS Ratios and Supplementary Financial Measures” in the

Corporation’s management’s discussion and analysis for the three

and nine months ended September 30, 2024, a copy of which is

available on SEDAR+ at www.sedarplus.com.

“Distributable cash per share” and “payout

ratio” are non-IFRS ratios that do not have a standardized meaning

prescribed by IFRS, and therefore may not be comparable to similar

ratios presented by other issuers. Distributable cash per share is

defined as distributable cash, a non-IFRS measure, divided by the

weighted average number of common shares outstanding during the

period. The payout ratio is calculated by dividing the dividends

per share during the period by the distributable cash per share, a

non-IFRS measure, generated in that period. For further details,

refer to the subsection entitled “Non-IFRS Ratios” under

“Description of Non-IFRS Financial Measures, Non-IFRS Ratios and

Supplementary Financial Measures” in the Corporation’s management’s

discussion and analysis for the three and nine months ended

September 30, 2024, a copy of which is available on SEDAR+ at

www.sedarplus.com.

“Weighted average organic royalty growth” is the

average same store sales growth percentage related to Mr. Lube +

Tires, Oxford and Mr. Mikes (excluding the collection of Mr. Mikes

deferred royalty management fees) plus the average increase in

adjusted royalty income from AIR MILES®, Sutton, Nurse Next Door

and Stratus over the prior comparable period taking into account

the percentage weighting of each royalty partner’s adjusted royalty

income in proportion of the total adjusted royalty income for the

period, excluding BarBurrito as there was no adjusted royalty

income generated from BarBurrito in the prior period. Weighted

average organic royalty growth is a supplementary financial measure

and does not have a standardized meaning prescribed by IFRS.

However, the Corporation believes that weighted average organic

royalty growth is a useful measure as it provides investors with an

indication of the change in year-over-year growth of each royalty

partner, taking into account the percentage weighting of royalty

partner’s growth in proportion of total growth, as applicable. The

Corporation’s method of calculating weighted average organic

royalty growth may differ from those of other issuers or companies

and, accordingly, weighted average organic royalty growth may not

be comparable to similar measures used by other issuers or

companies.

“Same store sales growth” or “SSSG” and “system

sales” are supplementary financial measures and do not have

standardized meanings prescribed by IFRS and therefore may not be

comparable to similar measures presented by other issuers. SSSG and

system sales figures are reported to DIV by its Royalty Partners –

see “Third Party Information”. For further details, refer to the

subsection entitled “Supplementary Financial Measures” under

“Description of Non-IFRS Financial Measures, Non-IFRS Ratios and

Supplementary Financial Measures” in the Corporation’s management’s

discussion and analysis for the three and nine months ended

September 30, 2024, a copy of which is available on SEDAR+ at

www.sedarplus.com.

“IRR” or Internal Rate of Return, is the

compound annual rate of return that would have been generated on an

investment in shares of DIV, calculated using the annual rate of

return from all monthly dividends per share paid by DIV, plus the

DIV share price appreciation per share over the relevant period.

IRR is a supplementary financial measure and does not have a

standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other issuers.

Third Party Information

This news release includes information obtained

from third party company filings and reports and other publicly

available sources as well as financial statements and other reports

provided to DIV by its royalty partners. Although DIV believes

these sources to be generally reliable, such information cannot be

verified with complete certainty. Accordingly, the accuracy and

completeness of this information is not guaranteed. DIV has not

independently verified any of the information from third party

sources referred to in this news release nor ascertained the

underlying assumptions relied upon by such sources.

THE TORONTO STOCK EXCHANGE HAS NOT

REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR THE

ACCURACY OF THIS RELEASE.

Additional Information

The information in this news release should be

read in conjunction with DIV’s consolidated financial statements

and management’s discussion and analysis (“MD&A”) for the three

and nine months ended September 30, 2024, which are available on

SEDAR+ at www.sedarplus.com.

Additional information relating to the

Corporation and other public filings, is available on SEDAR+ at

www.sedarplus.com.

Contact:Sean Morrison, President and Chief

Executive OfficerDiversified Royalty Corp. (236) 521-8470

Greg Gutmanis, Chief Financial Officer and VP

Acquisitions Diversified Royalty Corp. (236) 521-8471

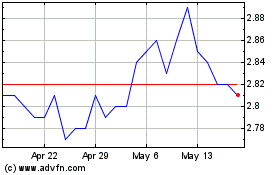

Diversified Royalty (TSX:DIV)

Historical Stock Chart

From Jan 2025 to Feb 2025

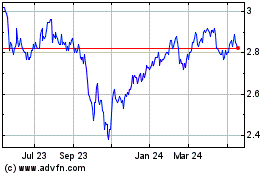

Diversified Royalty (TSX:DIV)

Historical Stock Chart

From Feb 2024 to Feb 2025