Erdene Resource Development Corporation (TSX: ERD | MSE: ERDN)

(“Erdene” or the “Company”) is pleased to announce results from Q3

2022 drilling in areas of high-grade near-surface mineralization at

the 100% owned Bayan Khundii Gold Deposit within the Khundii Gold

District (the “District”) in southwest Mongolia.

Quotes from the Company

“These results demonstrate the exceptionally

high gold grades present in the areas targeted for the first phase

of the Bayan Khundii development,” said Peter Akerley, Erdene’s

President, and CEO. “This drill program confirmed and locally

extended the near surface, high gold grades identified at the

Midfield Southeast and Striker South zones since the delivery of

the economic pit design for the feasibility study. The program also

collected ore for gravity processing test work. Preliminary studies

concluded that gravity processing compliments the Bayan Khundii CIP

plant, bringing forward cash flow and reducing operating

costs.”

“Our team is also completing exploration and

processing test work at the recent Dark Horse and Ulaan

discoveries, with further drill results anticipated by mid Q4,”

continued Mr. Akerley. “We continue to progress the Bayan Khundii

Gold Project towards development while searching for new

discoveries across the Khundii Minerals District.”

Starter Pit Definition Drill

Summary

The Q3 2022 Bayan Khundii drill program was

designed to increase confidence in the near surface high-grade gold

mineralized zones targeted for initial development at the Bayan

Khundii Gold Project (“Project”). Drilling was also designed to

gather ore to test amenability for gravity processing as an

addition to the Project’s Carbon in Pulp (CIP) plant.

In Q3 2022, Erdene completed a near surface

drill program comprised of 25 PQ diamond core holes, totaling 612

metres (averaging 17 metres vertical depth) in three target areas

within or near the planned Bayan Khundii economic pit. The

objectives of this program were to establish higher confidence in

continuity of grade and geometry of the shallow, very high-grade

potential starter pit areas located at the Midfield Southeast,

Striker South and Striker zones of the Bayan Khundii deposit and to

collect material for gravity processing metallurgical test

work.

The drilling program intersected multiple

high-grade intervals, confirming the continuity of near-surface

high-grade gold mineralization at Midfield SE, Striker, and Striker

South. Multiple holes returned assays greater than 10 g/t gold as

summarized in Table 1, below. These results will be incorporated

into updated models and used for start-up mine planning purposes.

Drill core from these holes will also be used for variability

metallurgical testing to confirm the viability of gravity

recoverable gold in addition to the currently planned CIP ore

processing plant.

Table 1: Bayan Khundii Drilling Highlights

(Drill holes reporting interval(s) exceeding 10 g/t gold)

|

Hole ID |

From (m) |

To (m) |

Interval(1) |

Au g/t |

| BKD-352 |

6.5 |

26 |

19.5 |

2.51 |

|

Incl |

18 |

23 |

5 |

6.20 |

|

Incl |

19 |

20 |

1 |

15.06 |

|

BKD-354 |

0 |

7 |

7 |

11.79 |

|

Incl |

5 |

6 |

1 |

67.54 |

|

BKD-356 |

6 |

25.6(2) |

19.6 |

3.10 |

| Incl |

7 |

17 |

10 |

5.72 |

|

Incl |

15 |

16 |

1 |

39.60 |

|

BKD-358 |

10.3 |

26(2) |

15.7 |

8.03 |

| Incl |

12 |

16 |

4 |

29.60 |

|

Incl |

14 |

15 |

1 |

100.46 |

|

BKD-361 |

5 |

15 |

10 |

14.36 |

|

Incl |

10 |

12 |

2 |

67.95 |

|

BKD-363 |

12 |

18 |

6 |

1.97 |

|

Incl |

17 |

18 |

1 |

10.05 |

|

BKD-366 |

23 |

29.5(2) |

6.5 |

3.78 |

|

Incl |

25 |

26 |

1 |

11.27 |

|

BKD-368 |

1 |

26(2) |

25 |

1.00 |

|

Incl |

2 |

3 |

1 |

16.96 |

|

BKD-369 |

0 |

20(2) |

20 |

10.44 |

| Incl |

0 |

1 |

1 |

17.88 |

| Incl |

4 |

7 |

3 |

27.04 |

| Incl |

9 |

11 |

2 |

32.57 |

|

Incl |

15 |

16 |

1 |

10.18 |

|

BKD-370 |

2.5 |

20(2) |

17.5 |

4.78 |

| Incl |

2.5 |

9 |

6.5 |

10.64 |

|

Incl |

6 |

7 |

1 |

30.51 |

|

Incl |

8 |

9 |

1 |

10.89 |

|

BKD-371 |

0 |

5 |

5 |

9.27 |

|

Incl |

1 |

3 |

2 |

21.45 |

|

BKD-372 |

0 |

5 |

5 |

1.13 |

| And |

18 |

22 |

4 |

5.69 |

|

Incl |

19 |

20 |

1 |

12.02 |

- Reported intervals

in this release are downhole apparent widths. Continued exploration

is required to confirm anisotropy of mineralization and true

thicknesses

- End of hole

Midfield Southeast Zone

Drilling within the Midfield Southeast (“MFSE”)

zone consisted of nine infill holes targeting high-grade gold

mineralization within 25 metres of surface. Previous drill results

from MFSE include some of the highest-grade, shallow gold

mineralization within the Bayan Khundii deposit including 581.6 g/t

gold over 1 metre, within 125.9 g/t gold over 5.5 metres, beginning

11.5 metres down hole (BKD-288) and 25.6 g/t gold over 15.1 metres,

including 5 metres averaging 74.34 g/t gold, beginning 15 metres

downhole (BKD-274). Gold mineralization at MFSE is related to

southwest dipping quartz-hematite epithermal veins which cross-cut

the tuffaceous host unit of the Bayan Khundii deposit. Gold grades

at MFSE appear to be further enhanced by supergene enrichment,

particularly in zones where the primary gold bearing epithermal

veins intersect along a sub north-south trending structural plane

representing a fault or shear. Gold enrichment along this plane is

typically contained within pervasive hematite altered and

brecciated core with gold grades locally greater than 100 g/t.

Striker and Striker

South Zone

Drilling within the Striker and Striker South

zones consisted of six and ten holes, respectively. Drilling

focused on further definition of previously reported near-surface,

high-grade gold mineralization within these potential starter pit

locations including 14 g/t gold over 8.3 metres, including 1 metre

of 93 g/t gold, beginning 0.7 metres downhole (BKD-44), 29 g/t gold

over 15.1 metres, beginning 0.9 metres downhole (BKD-292), and 10

g/t gold over 7 metres, beginning 8 metres down hole (BKD-46). Gold

mineralization in both Striker and Striker South are related to

southwest dipping quartz-adularia ± hematite epithermal veins which

cross-cut the tuffaceous host unit of the Bayan Khundii deposit.

Localized gold grades in the Striker South Zone exhibit very high

grades (up to 353 g/t gold in hole BKD-292) within the contact

aureole of a monzodiorite plug which intrudes the tuffaceous host.

Current interpretation of the gold grade enrichment around the

intrusive body may be related to remobilization and subsequent

redeposition of gold associated with structural and hydrothermal

processes during the monzodiorite emplacement.

Metallurgical Test Work

The consideration of gravity as part of the

process design circuit for the Bayan Khundii ores has been studied

since the earliest assessment. However, the discovery of high-grade

gold at surface at Dark Horse, combined with the exceptionally

high-grade gold intersections at MFSE and Striker South in 2020,

prompted Erdene’s technical team to complete further gravity

oriented metallurgical test work in mid-2022. The results of that

work are summarized below.

A single composite sample was selected from

drill core from holes at MFSE and Striker South. This composite

consists of quarter core from 21 one-metre intervals from 13 drill

holes with a calculated head grade of 15.1 g/t gold. The composite

sample was analyzed by Blue Coast Research from Parksville, BC, who

have carried out the majority of the metallurgical test work for

the Bayan Khundii project. The test work consisted of a single

Extended Gravity Recoverable Gold (EGRG) test to evaluate the

gravity recoverable gold content of the composite sample. The test

work included three stages of progressively finer grind size (850

micron, 250 micron and 75 micron) with each stage passing through a

Knelson MD-3 concentrator to produce a concentrate. The tests

resulted show 74.6% of the gold was captured in the gravity

concentrates.

The data from the EGRG test work was sent to

FLSmidth Knelson for review and analysis. Modelling conducted by

FLSmidth was undertaken to predict gravity recovery using a variety

of different circuit configurations and anticipated plant design

and throughput parameters. Modelling showed that gold recovery

could be achieved using concentrators and shaker tables (50%) or

concentrators and intense leach reactor (60%).

Based on the results of the work in mid-2022,

six additional composites will be tested. Sample material for these

composites will be taken from the recently completed PQ drilling

reported herein. The additional test work will include a series of

six variability samples, representing different area and grades,

that will undergo EGRG testing and well as shaker table recovery

testing. These data will assist in determining the most effective

gravity recovery circuit for the Bayan Khundii ore and is expected

to provide support for the inclusion of a gravity circuit at the

front end of the CIP plant.

Erdene’s work to date suggests that a gravity

plant may be brought online prior to commissioning of a full CIP

circuit, pulling forward cash flow, and rapidly repaying the

initial capital outlay. Furthermore, a gravity plant can be

integrated into the CIP circuit, increasing throughput by reducing

load on elution circuit downstream. Gravity circuits are readily

available from a number of Chinese manufacturers, in a modular

format, and can be quickly and cost-effectively constructed.

Projects Overview

Erdene’s deposits are in the Trans Altai

Terrane, within the Central Asian Orogenic Belt, host to some of

the world’s largest gold and copper-gold deposits. The Company has

been the leader in exploration in southwest Mongolia over the past

decade and is responsible for the discovery of the Khundii Gold

District comprised of multiple high-grade gold and base metal

prospects, one of which is currently being developed, the

100%-owned Bayan Khundii Gold Project, and another which is being

considered for development, the 100%-owned Altan Nar Project. The

Khundii District is currently defined based on three gold and base

metal systems related to shallow subduction Paleozoic intrusive

events within a 40 kilometre by 20 kilometre area in the Trans

Altai Terrane (formerly known as the Erden Terrane). Erdene’s 2022

exploration program is focused on the two gold-dominant

systems:

Bayan Khundii (Rich

Valley):

Low sulfidation epithermal gold deposits and

prospects (BK Deposit, Dark Horse, Ulaan and Altan Arrow)

overprinted on a high temperature, intrusive related alteration

zone, located along a 12-kilometres trend related to deep seated

northeast trending structures along a regional dilation zone and

strike slip fault system. Current Resources1 for the BK gold

deposit include 585,100 ounces of 2.19 g/t gold Measured and

Indicated (“M&I”)2 and 35,900 ounces of Inferred resources at

2.18 g/t gold. Resources have not yet been established for the Dark

Horse, Ulaan or Altan Arrow discoveries at Bayan Khundii.

An overview of the recent Dark Horse Mane and

Ulaan discoveries at Bayan Khundii are included below.

Dark Horse Mane

Dark Horse Mane is a 1.5-kilometre trend of

alteration and gold mineralization discovered in 2021. Located 2.4

kilometres north of the BK deposit, this zone begins at surface,

hosting supergene enriched gold zones including an exceptionally

high-grade gold bearing zone in the southern portion with values up

to 195 g/t gold over 1 metre (AAD-178) and ranging in thickness

from 20 to 60 metres vertical depth with locally deeper oxidation

along fractures. The high-grade oxide body exhibits strong

continuity along a north-south strike. Mineralization remains open

along strike and at depth. Limited deeper drilling has intersected

wide zones of gold mineralization (e.g., AAD-57, 48 metres of 1.18

g/t gold from 194 metres down hole) associated with epithermal

veins, white mica, and sulfide alteration up to 230 metres vertical

depth and remaining open.

The Company conducted data compilation,

interpretation and drill hole targeting for the broader Dark Horse

prospect area in late 2021 and early 2022. This work focused on

gold anomalism, identifying feeder structures, shallow oxide gold

mineralization, and areas with similar characteristics to Dark

Horse Mane, as well as the potential for deeper zones of gold

mineralization. This work has defined numerous drill targets for

testing.

Ulaan

The Ulaan gold target is a blind top discovery

identified in Q3 of 2021. The discovery is characterized by

hundreds of metres of gold mineralization (up to 354 metres) over

an area 200 metres by 250 metres. Gold mineralization begins

approximately 80 metres from surface and remains open along strike

to the west/northwest and at depth. Intervals include 152 metres of

1.7 g/t gold in UDH-22 (from 85 metres) and 77 metres of 3.2 g/t

gold in UDH-21 (from 115 metres). Similar to the BK gold deposit,

located 300 metres to the east, the mineralizing event is

characterized by exceptionally high-grade quartz ± hematite and

adularia veins and stockwork zones enveloped by the same gold

bearing, silicified, white mica altered lapilli tuff sequence.

Stockwork zones identified in the northern portion of the Ulaan

discovery were the target of the initial Q2 2022 drilling and

helped to better define the orientation and extent of these

exceptionally high-grade zones where intervals of 5 metres of 20

g/t gold (UDH-14) to 1 metre to 156 g/t gold (UDH-21) have been

returned within broad high grade zones including 27 metres of 8.74

g/t gold (UDH-21) and 34 metres of 5.43 g/t gold (UDH-14). In

addition, the 2022 exploration program included the extension of a

series of existing drill holes to test for continuity at depth.

Expansion drilling at Ulaan Southeast is ongoing.

The southern portion of the Ulaan license has

areas of anomalous gold-in-soil over an area 3.5 kilometres by 1

kilometre. The underlying geology and alteration appear to be

analogous to the gold mineralization at Ulaan Southeast and Bayan

Khundii, namely tuffaceous units with white mica and silica

alteration.

Altan Nar (Golden Sun):

Intermediate sulfidation, carbonate base metal gold deposits and

prospects located along a 5.6-kilometre long alteration zone

located within a regional north-northeast trending structural

corridor within which structural intersections or zones of dilation

provide the setting for the emplacement of broader zones of

mineralization. Current Resource for Altan Nar includes an

Indicated gold-only resource of 317,700 ounces at a grade of 2.0

g/t gold and an Inferred gold-only resource of 185,700 ounces at a

grade of 1.7 g/t gold.

About Erdene

Erdene Resource Development Corp. is a

Canada-based resource company focused on the acquisition,

exploration, and development of precious and base metals in

underexplored and highly prospective Mongolia. The Company has

interests in three mining licenses and an exploration license in

Southwest Mongolia, where exploration success has led to the

discovery and definition of the Khundii Gold District. Erdene

Resource Development Corp. is listed on the Toronto and the

Mongolian stock exchanges. Further information is available at

www.erdene.com. Important information may be disseminated

exclusively via the website; investors should consult the site to

access this information.

Qualified Person and Sample

Protocol

Peter Dalton, P.Geo. (Nova Scotia), Senior

Geologist for Erdene, is the Qualified Person as that term is

defined in National Instrument 43-101 and has reviewed and approved

the technical information contained in this news release. All

samples have been assayed at SGS Laboratory in Ulaanbaatar,

Mongolia. In addition to internal checks by SGS Laboratory, the

Company incorporates a QA/QC sample protocol utilizing prepared

standards and blanks. All samples undergo standard fire assay

analysis for gold and ICP-OES (Inductively Coupled Plasma Optical

Emission Spectroscopy) analysis for 33 additional elements. For

samples that initially return a grade greater than 5 g/t gold,

additional screen-metallic gold analysis is carried out which

provides a weighted average gold grade from fire assay analysis of

the entire +75 micron fraction and three 30-gram samples of the -75

micron fraction from a 500 gram sample.

Erdene’s drill core sampling protocol consisted

of collection of samples over 1 or 2 metre intervals (depending on

the lithology and style of mineralization) over the entire length

of the drill hole, excluding minor post-mineral lithologies and

un-mineralized granitoids. Sample intervals were based on meterage,

not geological controls, or mineralization. All drill core was cut

in half with a diamond saw, with half of the core placed in sample

bags and the remaining half securely retained in core boxes at

Erdene’s Bayan Khundii exploration camp. All samples were organized

into batches of 30 including a commercially prepared standard,

blank and either a field duplicate, consisting of two quarter-core

intervals, or a laboratory duplicate. Sample batches were

periodically shipped directly to SGS in Ulaanbaatar via Erdene’s

logistical contractor, Monrud Co. Ltd.

Reported intervals are apparent thicknesses,

i.e., downhole widths. The current Bayan Khundii drill holes

(reported in this release) are all dipping from 45 to 60 degrees

and oriented to intersect SW dipping WNW trending gold bearing

veins. Additional study is required to confirm true widths.

Reported grades for intervals are weighted averages based on length

of sampling intervals. No top cut has been applied; however, all

intervals greater than 10 g/t gold and 100 g/t gold are reported

individually for clarity.

Forward-Looking Statements

Certain information regarding Erdene contained

herein may constitute forward-looking statements within the meaning

of applicable securities laws. Forward-looking statements may

include estimates, plans, expectations, opinions, forecasts,

projections, guidance, or other statements that are not statements

of fact. Although Erdene believes that the expectations reflected

in such forward-looking statements are reasonable, it can give no

assurance that such expectations will prove to have been correct.

Erdene cautions that actual performance will be affected by a

number of factors, most of which are beyond its control, and that

future events and results may vary substantially from what Erdene

currently foresees. Factors that could cause actual results to

differ materially from those in forward-looking statements include

the ability to obtain required third party approvals, market

prices, exploitation, and exploration results, continued

availability of capital and financing and general economic, market

or business conditions. The forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

The information contained herein is stated as of the current date

and is subject to change after that date. The Company does not

assume the obligation to revise or update these forward-looking

statements, except as may be required under applicable securities

laws.

NO REGULATORY AUTHORITY HAS APPROVED OR

DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

Peter C. Akerley, President and CEO, or Robert

Jenkins, CFO

|

Phone: |

(902)

423-6419 |

| Email: |

info@erdene.com |

| Twitter: |

https://twitter.com/ErdeneRes |

| Facebook: |

https://www.facebook.com/ErdeneResource |

| LinkedIn: |

https://www.linkedin.com/company/erdene-resource-development-corp-/ |

Appendix – Drilling Assays Summary - Intervals averaging greater

than 0.30 g/t gold

|

Hole ID |

From |

To |

Interval(1) |

Au g/t |

| BKD-351 |

3.56 |

9 |

5.44 |

1.54 |

| Incl |

3.56 |

7 |

3.44 |

2.36 |

|

And |

19 |

30(2) |

11 |

0.53 |

|

BKD-352 |

6.5 |

26 |

19.5 |

2.51 |

| Incl |

10 |

24 |

14 |

3.33 |

|

Incl |

18 |

23 |

5 |

6.20 |

|

Incl |

19 |

20 |

1 |

15.06 |

|

BKD-353 |

15 |

24 |

9 |

0.55 |

|

BKD-354 |

0 |

7 |

7 |

11.79 |

|

Incl |

5 |

6 |

1 |

67.54 |

|

BKD-355 |

10.5 |

30(2) |

19.5 |

0.58 |

|

BKD-356 |

6 |

25.6(2) |

19.6 |

3.10 |

| Incl |

7 |

17 |

10 |

5.72 |

|

Incl |

15 |

16 |

1 |

39.60 |

|

BKD-357 |

0 |

15 |

15 |

0.59 |

|

And |

24 |

26 |

2 |

1.09 |

|

BKD-358 |

10.3 |

26(2) |

15.7 |

8.03 |

| Incl |

12 |

16 |

4 |

29.60 |

|

Incl |

14 |

15 |

1 |

100.46 |

|

BKD-359 |

0 |

6 |

6 |

0.70 |

|

BKD-360 |

7 |

17 |

10 |

1.62 |

|

BKD-361 |

5 |

15 |

10 |

14.36 |

|

Incl |

10 |

12 |

2 |

67.95 |

|

BKD-362 |

14 |

18 |

4 |

2.84 |

|

BKD-363 |

12 |

18 |

6 |

1.97 |

|

Incl |

17 |

18 |

1 |

10.05 |

|

BKD-364 |

6 |

15.5(2) |

9.5 |

1.66 |

|

BKD-365 |

0 |

7 |

7 |

1.07 |

| And |

17 |

23 |

6 |

1.37 |

|

And |

27 |

28 |

1 |

0.62 |

|

BKD-366 |

15 |

18 |

3 |

0.44 |

| And |

23 |

29.5(2) |

6.5 |

3.78 |

|

Incl |

25 |

26 |

1 |

11.27 |

|

BKD-367 |

9 |

25 |

16 |

0.65 |

|

Incl |

15 |

19 |

4 |

1.54 |

|

BKD-368 |

1 |

26(2) |

25 |

1.00 |

|

Incl |

2 |

3 |

1 |

16.96 |

|

BKD-369 |

0 |

20(2) |

20 |

10.44 |

| Incl |

0 |

1 |

1 |

17.88 |

| Incl |

4 |

7 |

3 |

27.04 |

| Incl |

9 |

11 |

2 |

32.57 |

|

Incl |

15 |

16 |

1 |

10.18 |

|

BKD-370 |

2.45 |

20(2) |

17.55 |

4.78 |

| Incl |

2.45 |

9 |

6.55 |

10.64 |

|

Incl |

6 |

7 |

1 |

30.51 |

|

Incl |

8 |

9 |

1 |

10.89 |

|

BKD-371 |

0 |

5 |

5 |

9.27 |

| Incl |

1 |

3 |

2 |

21.45 |

|

And |

13 |

15 |

2 |

0.48 |

|

BKD-372 |

0 |

5 |

5 |

1.13 |

| And |

8 |

9 |

1 |

0.47 |

| And |

18 |

22 |

4 |

5.69 |

|

Incl |

19 |

20 |

1 |

12.02 |

|

BKD-373 |

0 |

10 |

10 |

0.64 |

|

BKD-374 |

7 |

20(2) |

13 |

0.87 |

|

Incl |

7 |

10 |

3 |

2.56 |

|

BKD-275 |

0 |

9 |

9 |

1.42 |

- Reported intervals

in this release are downhole apparent widths. Continued exploration

is required to confirm anisotropy of mineralization and true

thicknesses

- End of hole

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/97e65fcc-299b-42df-80ea-1163538cb941

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e2a71de-6e50-4992-8dbb-fa0365e955b1

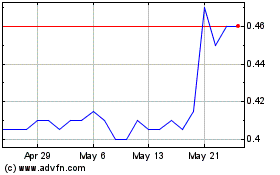

Erdene Resource Developm... (TSX:ERD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Erdene Resource Developm... (TSX:ERD)

Historical Stock Chart

From Jan 2024 to Jan 2025