mdf commerce inc. (the “Corporation”) (TSX:MDF), a

SaaS leader in digital commerce technologies, reported Q4 FY2021

financial results for its fourth quarter and the full year ended on

March 31, 2021. Financial references are expressed in Canadian

dollars unless otherwise indicated.

“Fiscal 2021 was the first full year of

implementation of our five-year strategic plan which focuses

operational efforts and investments on our two high-growth

platforms, Unified Commerce and Strategic Sourcing. Tremendous

progress was achieved on many fronts and we’re proud of all that

was accomplished by our employees. Product innovation, accelerated

product development cycles, implementation of our organic growth

plan, attraction and retention of top talent, strengthening of the

executive team, changes on the Board of Directors as well as a

stronger balance sheet are all accomplishments that position us

favorably for the second year of implementation,” said Luc

Filiatreault, CEO of mdf commerce. “The final

quarter of fiscal 2021 continued a trend of exciting growth. We

achieved solid revenue growth while also investing in our

foundation to support our aggressive growth plan. We continue to

win new customers and execute on large customer deployments. We are

encouraged by the solid performance of our US-based Strategic

Sourcing platform, and our overall sales pipeline continues to

expand in tandem with our product offerings.”

Fourth Quarter Fiscal 2021 Financial

Results

Total revenue for the quarter was $22.0M, a

16.5% increase over $18.9M reported for Q4 FY2020. The monthly

recurring revenue (“MRR”)1 portion of total revenue was $16.0M, or

72% of total revenue compared to $15.4M or 81% for the same quarter

of FY2020.

The three business platforms contributed to

revenue for the quarter as follows:

- Revenue from the

Unified Commerce platform, which includes ecommerce and Supply

Chain Collaboration solutions, was $9.7M, a 29.5% increase over

$7.5M reported for the same period last year.

- ecommerce, which

consists of Orckestra and k-ecommerce solutions, represented $6.5M

of Unified Commerce revenue in the quarter, up $2.4M or 59.1% from

$4.1M reported in the corresponding period last year. Professional

services revenue represented $2.9M of ecommerce revenue, an

increase of 143.9% over $1.2M reported for Q4 FY2020. The increase

in professional services during the quarter is related to large

customer deployments.

- The Supply Chain

Collaboration solution represented $3.2M of Unified Commerce

revenue, down 5.8% or $0.2M compared to the fourth quarter of the

previous year. The revenue decline was due mainly to reduced

activities of certain retailers in the context of the COVID-19

pandemic.

Revenue from the Strategic Sourcing platform,

which includes Merx, Bidnet, governmentbids.com and ASC solutions,

was $8.7M, a 15.4% increase over $7.5M reported for the previous

year quarter.

- US-based

Strategic Sourcing, represented revenue of $4.4M, a 32% or $1.1M

increase compared to the previous year corresponding quarter. The

US-based Bidnet solution benefited from additional buying agencies,

which drove an increase in paying suppliers and the acquisition of

Vendor Registry on November 18, 2021.

Revenue from the emarketplaces platform, which

consists of Jobboom, The Broker Forum, Technologies Carrus,

Polygon, Réseau Contact and Power Source Online, was $3.6M,

declining by 6.7% or $0.3M compared to $3.9M reported for the same

quarter of fiscal 2020. Revenues from Jobboom increased by $0.1M,

offset by a decrease in revenues from The Broker Forum,

Technologies Carrus and Polygon totalling $0.3M. The emarketplaces

platform was negatively impacted by the COVID-19 pandemic, as most

of the solutions experienced lower memberships or lower transaction

volumes in their respective industries on a comparative basis.

Gross margin for Q4 FY2021 reached $13.5M or

61.1% compared to $12.7M or 67.2% reported for Q4 FY2020. The

decrease in the gross margin percentage is mainly due to the

investment in the development and implementation of client

solutions, increased salaries and related expenses from additional

headcount, and higher hosting and licencing costs on cloud-based

solutions.

Total operating expenses for Q4 FY2021 were

$16.7M, compared to $14.9M for Q4 FY2020, an increase of $1.8M or

12.2%. The most notable differences are as follows:

- General and

administrative expenses increased to $5.3M during Q4 FY2021 from

$3.4 million for Q4 FY2020 due primarily to higher salary and

related expenses associated with higher headcount, bonus and

share-based compensation expenses totalling $1.4M, and a $0.6M

increase in professional services costs mainly related to the work

of external consultants to support the Corporation in implementing

its strategic initiatives and transformation plan, and also

includes recruiting and restructuring costs. These expense

increases are net of $0.1M in federal wage subsidies in the context

of COVID-19.

- Selling and

marketing expenses totalled $5.8M for Q4 FY2021 compared to $4.8M

for Q4 FY2020. The increase is mainly attributable to a $0.6M

increase in salaries and related expenses from higher

headcount.

The operating loss of $3.3M for Q4 FY2021

compares to the operating loss of $2.2M reported for

Q4 FY2020.

The Corporation recorded a net loss of $2.9M or

$0.12 loss per share basic and diluted in Q4 FY2021 compared to a

net loss of $6.8M or $0.45 loss per share basic and diluted in the

same quarter of FY2020.

Adjusted EBITDA2 was $0.2M for Q4 FY2021

compared to $0.7M reported for Q4 FY2021. Adjusted EBITDA2 declined

year-over-year due to increased foundational investments in

operations, sales and marketing, R&D, and professional services

to support large deployment contracts. As deployments accelerate

over the coming quarters, professional services expenses are

expected to remain elevated and the Corporation expects to continue

to make foundational investments to improve scalability as the

Corporation grows.

On March 15, 2021, the Corporation completed a

bought deal offering under which a total of 5,517,242 common

shares of the Corporation were sold at a price of $14.50 per common

share for aggregate gross proceeds of $80M.

“mdf commerce is competing

vigorously to capture emerging opportunities in both of our growth

platforms, Unified Commerce and Strategic Sourcing,” remarked CEO

Luc Filiatreault. “We are finding creative approaches to overcome

scaling friction as we acquire new customers. For example, we are

attracting increasingly scarce tech talent by leveraging our global

footprint, especially in Ukraine where we already have an office

and tech resources.”

Full-year Fiscal 2021

Results

Full-year FY2021 total revenue was $84.7M, a

12.3% increase over $75.4M for FY2020.

The Unified Commerce platform generated revenues

of $37.3M for FY2021, an increase of $11.9M or 47.0% compared to

revenues of $25.4 million for the previous fiscal year. The

ecommerce solutions within Unified Commerce grew by 107% from

$11.7M to $24.5M.

The Strategic Sourcing platform generated

revenues of $32.7M, a 7.8% or a $2.4M increase compared to $30.3M

in FY2020. The acquisition of Vendor Registry in fiscal 2021

increased the Corporation’s geographical footprint in the US-based

strategic sourcing network and contributed positively to revenue

growth, with US-based strategic sourcing representing a

year-over-year increase in revenues of 20.8%.

The emarketplaces platform generated revenues of

$14.7M for fiscal 2021, a decrease of $5.0M or 25.3% compared to

revenues of $19.7M the previous fiscal year. The sale of LesPAC on

June 11, 2019 represents a $2.2 million year-over-year decrease,

while the remaining decrease is primarily due to fewer members

using these marketplaces driven by the negative impact of the

COVID-19 pandemic.

Total FY2021 MRR1 represented $64.4M or 76% of

total revenues for fiscal 2021, compared to $58.7M or 77% of total

revenues for FY2020.

FY2021 net loss was $7.6M or $0.38 loss per

share basic and diluted compared to a net loss of $5.8M or $0.39

loss per share basic and diluted for FY2020.

Total Adjusted EBITDA2 for FY2021 was $5.7M,

compared to $10.3M for FY2020. The decline in Adjusted EBITDA2 is

related to ongoing foundational investments, growth in headcount in

sales, marketing, human resources to support our growth as well as

professional services associated with growth strategies.

During FY2021, salary and related expenses were

offset with $3.4M of wage subsidies from the Canadian government’s

assistance program introduced on March 27, 2020, in the context of

the COVID-19 pandemic.

As at March 31st, 2021 the Corporation had $110M

of cash and equivalents on the balance sheet.

“With the completion of three bought deal equity

financings, a new MRR1-based credit facility, and the repayment of

long-term debt during the year, we significantly strengthened our

financial position, while effectively managing the capital

structure,” remarked CFO Deborah Dumoulin. “We now have available

capital to implement key components of our transformation plan

including our M&A strategy, while remaining focused on

maximizing the return on invested capital for shareholders.”

Outlook

The global trend to online commerce, accelerated

by the COVID-19 pandemic, has changed the pace at which businesses

are implementing new or upgraded digital commerce infrastructure.

This acceleration is reflected in both the new deployments for

mdf commerce ecommerce solutions and the increase

of revenue for the quarter and for the full year. Management

believes that the trends to online commerce should continue into

the foreseeable future as companies continue to update and

modernize their commerce infrastructure providing the Corporation

with opportunities for pipeline growth and conversion, even as the

COVID-19 pandemic begins to subside.

“We will continue to invest in our focus

platforms, Unified Commerce and Strategic Sourcing, to capture more

market share, and to improve the scalability of operations as we

gain momentum” said CEO Luc Filiatreault.

For fiscal 2021, Adjusted EBITDA2 was $5.7M,

representing a margin of 6.8%, compared to $10.3M and 13.7% margin

respectively for fiscal 2020. Though the pandemic has allowed the

Corporation to capitalize on the acceleration of commerce

digitalization with both of our high-growth platform - Unified

Commerce and Strategic Sourcing - the unforeseen outcome has been

the impact on demand for tech talent. The demand for programmers

and developers has escalated exponentially, reaching unparalleled

levels as businesses seek to accelerate their digital

transformation, their ecommerce capabilities. The competition for

these resources is global, driving up the cost of labour for tech

companies to unforeseen levels. Over the past fiscal year, the

impact of this extraordinary demand for talent has already

contributed to a compression of our margins, which may experience

fluctuations quarter over quarter. As we move forward, our

challenge will be to strike the right balance between managing

salary costs while staying in the race to capitalize on the window

of opportunity brought on by this market acceleration.

Governance

As part of its ongoing review of its governance

practices and like many other public companies, the Corporation’s

Board of Directors has determined to adopt (i) an advance notice

bylaw (the “Advance Notice Bylaw”) and (ii) a forum selection bylaw

(the “Forum Selection Bylaw” and together with the “Advance Notice

Bylaw, the “Bylaws”). The Bylaws are effective and in full force

and effect as of the date hereof and the Advance Notice Bylaw will

apply to the Corporation’s next annual general meeting of

shareholders that will be held on September 15, 2021 (the

“Shareholders Meeting”). In accordance with applicable laws, the

Bylaws will be put to shareholders for approval at the Shareholders

Meeting. If one of the Bylaws (or both) is not confirmed at the

Shareholders Meeting by ordinary resolution of shareholders, such

Bylaw will terminate and be of no further force and effect

following the termination of the Shareholders Meeting. The full

text of the Bylaws will be available on the Corporation’s SEDAR

profile at www.sedar.com and on its website at

www.mdfcommerce.com.

SUMMARY OF CONSOLIDATED RESULTS

|

|

Quarter ended |

Fiscal year ended |

|

|

March 31st |

March 31st |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| In thousands of Canadian

dollars, except per share amounts |

$ |

$ |

$ |

$ |

| Revenues |

22,030 |

|

18,917 |

|

84,719 |

|

75,428 |

|

| Adjusted

EBITDA2 |

221 |

|

660 |

|

5,746 |

|

10,341 |

|

| Operating (loss)

profit |

(3,284 |

) |

(2,210 |

) |

(6,791 |

) |

559 |

|

| Impairment of assets

net of related taxes |

- |

|

(5,307 |

) |

- |

|

(5,307 |

) |

| Net loss |

(2,858 |

) |

(6,758 |

) |

(7,591 |

) |

(5,752 |

) |

| Adjusted

loss3 |

(2,858 |

) |

(1,451 |

) |

(7,591 |

) |

(362 |

) |

| Adjusted loss per

share3 (basic and

diluted) |

(0.12 |

) |

(0.10 |

) |

(0.38 |

) |

(0.03 |

) |

| Loss per share (basic

and diluted) |

(0.12 |

) |

(0.45 |

) |

(0.38 |

) |

(0.39 |

) |

| Basic and diluted

weighted average number of shares outstanding (in

thousands) |

23,874 |

|

15,052 |

|

19,752 |

|

14,915 |

|

RECONCILIATION OF ADJUSTED EBITDA2 AND

NET LOSS

| |

Quarter ended |

Fiscal year ended |

| |

March 31st |

March 31st |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| In thousands of Canadian

dollars |

$ |

$ |

$ |

$ |

| Net loss |

(2,858 |

) |

(6,758 |

) |

(7,591 |

) |

(5,752 |

) |

|

Impairment loss on assets |

- |

|

7,221 |

|

- |

|

7,221 |

|

|

Income tax recovery |

(704 |

) |

(1,890 |

) |

(1,618 |

) |

(1,515 |

) |

|

Depreciation of property, plant and equipment and amortization of

intangible assets |

1,155 |

|

1,264 |

|

4,217 |

|

3,474 |

|

|

Amortization of acquired intangible assets |

1,014 |

|

934 |

|

3,815 |

|

2,816 |

|

|

Amortization of right-of-use assets |

437 |

|

483 |

|

1,735 |

|

1,665 |

|

|

Amortization of deferred financing costs |

57 |

|

10 |

|

135 |

|

39 |

|

| Interest on lease

liability |

91 |

|

105 |

|

381 |

|

380 |

|

| Interest on long-term

debt |

9 |

|

291 |

|

536 |

|

892 |

|

| Interest revenue |

(50 |

) |

- |

|

(61 |

) |

- |

|

|

EBITDA |

(849 |

) |

1,660 |

|

1,549 |

9,220 |

|

|

Foreign exchange loss (gain) |

171 |

|

(1,188 |

) |

1,427 |

(788 |

) |

|

Loss on disposal of a subsidiary |

- |

|

- |

|

- |

83 |

|

|

Stock-based compensation expense |

124 |

|

- |

|

467 |

- |

|

|

Restructuring costs |

723 |

|

97 |

|

1,966 |

1,400 |

|

|

Acquisition-related costs |

52 |

|

91 |

|

337 |

426 |

|

| Adjusted

EBITDA2 |

221 |

|

660 |

|

5,746 |

10,341 |

|

RECONCILIATION OF NET LOSS AND ADJUSTED

LOSS3

| |

Quarter ended |

Fiscal year ended |

| |

March 31st |

March 31st |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| In thousands of Canadian

dollars. |

$ |

$ |

$ |

$ |

| Net loss |

(2,858 |

) |

(6,758 |

) |

(7,591 |

) |

(5,752 |

) |

|

Loss on sale of subsidiary |

- |

|

- |

|

- |

|

83 |

|

|

Impairment of assets, net of related taxes |

- |

|

5,307 |

|

- |

|

5,307 |

|

| Adjusted

loss3 |

(2,858 |

) |

(1,451 |

) |

(7,591 |

) |

(362 |

) |

| Loss per share (basic

and diluted) |

(0.12 |

) |

(0.45 |

) |

(0.38 |

) |

(0.39 |

) |

| Adjusted loss per

share3 (basic and diluted) |

(0.12 |

) |

(0.10 |

) |

(0.38 |

) |

(0.03 |

) |

About mdf commerce inc.

mdf commerce inc. (TSX:MDF)

enables the flow of commerce by providing a broad set of SaaS

solutions that optimize and accelerate commercial interactions

between buyers and sellers. Our platforms and services empower

businesses around the world, allowing them to generate billions of

dollars in transactions on an annual basis. Our Strategic Sourcing,

Unified Commerce and emarketplace platforms are supported by a

strong and dedicated team of approximately 700 based in Canada, the

United States, Denmark, Ukraine and China. For more information,

please visit us at mdfcommerce.com, follow us on LinkedIn or call

at 1-877-677-9088.

Forward-Looking Statements

In this press release, “mdf commerce”, the

“Corporation” or the words “we”, “our” and “us” refer, depending on

the context, either to mdf commerce inc. or to mdf commerce inc.

together with its subsidiaries and entities in which it has an

economic interest. All dollar amounts refer to Canadian dollars,

unless otherwise expressly stated.

This press release is dated June 9, 2021 and,

unless specifically stated otherwise, all information disclosed

herein is provided as at March 31, 2021, the end of the most recent

fiscal year of the Corporation.

Certain statements in press release and in the

documents incorporated by reference herein constitute

forward-looking statements. These statements relate to future

events or our future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause mdf

commerce’s, or the Corporation’s industry’s actual results, levels

of activity, performance or achievements to be materially different

from those expressed or implied by any of the Corporation’s

statements. Such factors may include, but are not limited to, risks

and uncertainties that are discussed in greater detail in the “Risk

Factors and Uncertainties” section of the Corporation’s Annual

Information Form as of June 9, 2021. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as “may”, “will”, “should”, “could”, “expects”,

“plans”, “anticipates”, “intends”, “believes”, “estimates”,

“predicts”, “potential” or “continue” or the negatives of these

terms or other comparable terminology. These statements are only

predictions. Forward-looking statements are based on management’s

current estimates, expectations and assumptions, which management

believes are reasonable as of the date hereof, and are inherently

subject to significant business, economic, competitive and other

uncertainties and contingencies regarding future events and are

accordingly subject to changes after such date. Undue importance

should not be placed on forward-looking statements, and the

information contained in such forward-looking statements should not

be relied upon as of any other date. Actual events or results may

differ materially. We cannot guarantee future results, levels of

activity, performance or achievement. We disclaim any intention,

and assume no obligation, to update these forward-looking

statements, except as required by applicable securities laws.

Additional information about mdf commerce,

including the Corporation’s most recent annual audited consolidated

financial statements, Management’s Discussion and Analysis and its

latest Annual Information Form are available on www.mdfcommerce.com

and have been filed with SEDAR at www.sedar.com.

Non-IFRS Financial Measures and Key

Performance Indicators

The Corporation’s annual consolidated financial

statements for the years ended March 31, 2021 and March 31, 2020

are prepared in accordance with International Financial Reporting

Standards (“IFRS”).

In Q4 FY2021, the Corporation amended the

definition of Adjusted EBITDA to adjust for acquisition related

costs and restructuring costs. Comparative figures prior to March

31, 2021 have been restated to be consistent with the current

presentation. Adjusted EBITDA is calculated as profit (loss) before

interest, taxes, depreciation and amortization (“EBITDA”), adjusted

for foreign exchange gain (loss), gain (loss) on the sale of a

subsidiary, compensation under the stock option plan, acquisition

related costs and restructuring costs. Refer to the “Non-IFRS

Financial Measures and Key Performance Indicators” in Management’s

Discussion and Analysis for the fourth quarter ended March 31,

2021.

The Corporation presents non-IFRS financial

performance measures and key performance indicators to assess

operating performance. The Corporation presents Adjusted profit

(loss), Adjusted profit (loss) per share, net profit (loss) before

interest, taxes, depreciation and amortization (“EBITDA”) and

Adjusted EBITDA as a non-IFRS measure and Monthly Recurring

Revenues as a key performance indicator. These non-IFRS measures

and key performance indicators do not have standardized meanings

under IFRS standards and are not likely to be comparable to

similarly designated measures reported by other corporations. The

reader is cautioned that these measures are being reported in order

to complement, and not replace, the analysis of financial results

in accordance with IFRS standards. Management uses both measures

that comply with IFRS standards and non-IFRS measures, in planning,

overseeing and assessing the Corporation’s performance. The terms

and definitions associated with non-IFRS measures as well as a

reconciliation to the most comparable IFRS measures, and key

performance indicators are presented in the section “Non-IFRS

Financial Measures and Key Performance Indicators” in Management’s

Discussion and Analysis for the fourth quarter ended March 31,

2021.

Conference call for fourth quarter of fiscal 2021

financial results

Date: Thursday, June 10, 2021Time: 8:30 a.m. Eastern TimeLength:

30 minutesDial-in: (833) 732-1201 (toll-free) or (720) 405-2161

(international)Live webcast: register hereMore details

For further information:

mdf commerce inc.Luc Filiatreault, President

& CEO Toll free: 1-877-677-9088, ext. 2004Email:

luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial OfficerToll free:

1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

André Leblanc, Vice President, Marketing and Public AffairsToll

Free: 1 877 677-9088, ext. 8220Email:

andre.leblanc@mdfcommerce.com

1 MRR is a key performance indicator and is

composed of subscription and support revenues that are recurring in

nature. Therefore, they exclude onetime fees and professional fees

and other types of non-recurring revenues. Refer to the “Non-IFRS

Financial Measures and Key Performance Indicators” section.2

Adjusted EBITDA is a non-IFRS measure. In the fourth quarter of

fiscal 2021, the definition of adjusted EBITDA was amended, and

certain comparative figures have been restated to conform with the

current presentation. Refer to the “Non-IFRS Financial Measures and

Key Performance Indicators” section.3 Adjusted loss and Adjusted

loss per share (basic and diluted) are non-IFRS financial measures.

Refer to the “Non-IFRS Financial Measures and Key Performance

Indicators” section.

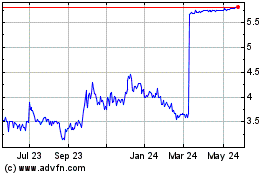

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Mar 2025 to Apr 2025

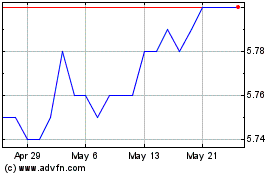

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Apr 2024 to Apr 2025