mdf commerce inc. (“

mdf commerce”) (TSX: MDF), a

leader in SaaS commerce technology solutions, is pleased to

announce that it has completed today its previously announced $67.8

million bought deal public offering of subscription receipts and

$52.6 million private placement of subscription receipts for

aggregate gross proceeds of $120.4 million.

mdf commerce issued 8,480,000 subscription

receipts (the “Public Subscription

Receipts”) at a price of $8.00 per Public Subscription

Receipt (the “Offering Price”), on a bought-deal

public offering basis, for gross proceeds of $67.8 million (the

“Public Offering”), through a syndicate of

underwriters co-led by Scotiabank, as sole bookrunner, and Echelon

Wealth Partners Inc., and including Acumen Capital Finance Partners

Limited, Desjardins Securities Inc., Laurentian Bank Securities

Inc. and National Bank Financial Inc. (collectively, the

“Underwriters”). In addition, mdf commerce has

granted the Underwriters an option to purchase up to 1,272,000

additional Public Subscription Receipts at the Offering Price at

any time up to 30 days after closing of the Public Offering, for

additional gross proceeds of up to $10.2 million.

Concurrently with the closing of the Public

Offering, mdf commerce also completed with Fonds de solidarité FTQ

and Investissement Québec the private placement (the

“Concurrent Private Placement”), at the Offering

Price, of 3,587,667 and 2,989,722 subscription receipts

(collectively, the “Private Subscription

Receipts”, and collectively with the Public Subscription

Receipts, the “Subscription Receipts”),

respectively, for aggregate gross proceeds of $52.6 million. The

Private Subscription Receipts are subject to a four month hold

pursuant to Canadian securities laws.

Each Subscription Receipt will entitle the

holder thereof to receive, upon the satisfaction of certain

conditions and without payment of additional consideration or

further action, one common share of mdf commerce.

mdf commerce will use the net proceeds of the

Public Offering and the Concurrent Private Placement, along with

funds drawn on new revolving and term credit facilities and funds

drawn from its cash on hand, to fund the purchase price and related

transaction costs payable in connection with the previously

announced acquisition of the business of Periscope Intermediate

Corp. (“Periscope”), a portfolio company of

Parthenon Capital Partners (the

“Acquisition”).

The gross proceeds from the Public Offering

(less 50% of the Underwriters’ fee) and from the Concurrent Private

Placement will be held by Computershare Trust Company of Canada

(the “Subscription Receipt Agent”), as escrow

agent on behalf of the holders of Subscription Receipts and

deposited in an interest-bearing trust account to be maintained by

the Subscription Receipt Agent, pending the completion of the

Acquisition.

Certain insiders of mdf commerce participated in

the Public Offering and purchased an aggregate of 25,750 Public

Subscription Receipts. Participation of insiders of mdf commerce in

the Public Offering constitutes a “related party transaction” as

defined under Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions (“MI

61-101”), but is exempt from the formal valuation and

minority shareholder approval requirements of MI 61-101, as neither

the fair market value of securities being issued to insiders nor

the consideration being paid by insiders exceeds 25% of mdf

commerce’s market capitalization. mdf commerce did not file a

material change report 21 days prior to the closing of the Public

Offering as the details of the participation of the insiders of mdf

commerce had not been confirmed at that time.

Availability of Documents

Copies of related documents, such as the (final)

short form prospectus, underwriting agreement, subscription

agreements, subscription receipt agreements and stock purchase

agreement relating to the Acquisition are available under mdf

commerce’s profile on SEDAR at www.sedar.com.

General Information

In this press release, “mdf commerce” or the

words “we”, “our” and “us” refer, depending on the context, either

to mdf commerce inc. or to mdf commerce inc. together with its

subsidiaries and entities in which it has an economic interest. All

dollar amounts refer to Canadian dollars, unless otherwise

expressly stated.

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable securities

legislation, including those regarding the Acquisition.

Forward-looking information also includes, but is not limited to,

statements regarding mdf commerce's business objectives, expected

growth, results of operations, performance and financial results,

statements with respect to the expected timing and completion of

the Acquisition, and statements with respect to the anticipated

benefits of the Acquisition and mdf commerce's ability to

successfully integrate Periscope’s business. This press release

also contains forward-looking information with respect to the

indebtedness to be incurred under a new credit facilities and the

aggregate purchase price payable in connection with the

Acquisition. Although the forward-looking information is based on

what mdf commerce believes are reasonable assumptions, current

expectations and estimates, investors are cautioned from placing

undue reliance on this information as actual results may vary from

the forward-looking information. Forward-looking information may be

identified by the use of forward-looking terminology such as

“believe”, “forecast”, “synergies”, “intend”, “may”, “will”,

“expect”, “estimate”, “anticipate”, “continue” or similar terms,

variations of those terms or the negative thereof, and the use of

the conditional tense as well as similar expressions. Actual

results and developments are likely to differ, and may differ

materially, from those expressed or implied by the forward-looking

statements contained in this press release. Such statements are

based on a number of assumptions which may prove to be incorrect,

including, but not limited to, assumptions about, mdf commerce’s

ability to retain its customers, mdf commerce’s ability to

implement its growth strategy through acquisition, mdf commerce’s

response to the industry’s rapid pace of change, the competitive

environment, mdf commerce’s ability to protect its computer

environment and deal with defects in software or failures in

processing transactions, mdf commerce’s use of “open source”

software, intellectual property and other proprietary rights, mdf

commerce’s management and employees, mdf commerce’s cyber security,

regulatory changes, mdf commerce’s ability to do business in

emerging countries, mdf commerce’s ability to execute its strategic

plan, the effect of the COVID-19 global pandemic, foreign currency,

liquidity, credit, current global financial conditions, additional

financing and dilution and market liquidity of the common shares of

mdf commerce, all as further and more fully described in the “Risk

Factors and Uncertainties” section of mdf commerce’s annual

information form dated June 9, 2021 for the fiscal year ended March

31, 2021, management’s discussion and analysis of financial

condition and results of operation of mdf commerce dated June 9,

2021, as at and for the years ended March 31, 2021 and 2020,

management’s discussion and analysis of financial condition and

results of operation of mdf commerce dated August 11, 2021, as at

and for the three-month period ended June 30, 2021 and elsewhere in

mdf commerce’s filings with the Canadian securities regulators, as

applicable.

About mdf commerce inc.

mdf commerce inc. (TSX: MDF) enables the flow of

commerce by providing a broad set of SaaS solutions that optimize

and accelerate commercial interactions between buyers and sellers.

Our platforms and services empower businesses around the world,

allowing them to generate billions of dollars in transactions on an

annual basis. Our Strategic Sourcing, Unified Commerce and

emarketplace platforms are supported by a strong and dedicated team

of approximately 700 employees based in Canada, the United States,

Denmark, Ukraine and China. For more information, please visit us

at mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

About Periscope Intermediate

Corp.

Periscope is a leading eProcurement solution

provider with over 20 years of industry experience that offers a

fully integrated, end-to-end procurement solution to both state and

local government agencies and suppliers in the U.S. Periscope’s

end-to-end eProcurement solution is built specifically for U.S.

government agencies, allowing them to more efficiently purchase

goods and services, source contracts, analyze spend, post bids and

transact on a public procurement platform that offers a

consumer-like shopping experience. For more information, visit

www.periscopeholdings.com

For further information:

mdf commerce inc.

Luc Filiatreault, President & CEOToll free:

1-877-677-9088, ext. 2004 Email:

luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial Officer Toll

free: 1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

André Leblanc, Vice President, Marketing and

Public AffairsToll Free: 1-877-677-9088, ext. 8220 Email:

andre.leblanc@mdfcommerce.com

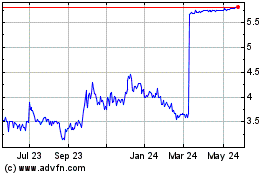

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Jan 2025 to Feb 2025

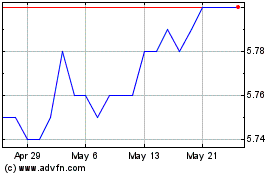

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Feb 2024 to Feb 2025