Mainstreet Announces Normal Course Issuer Bid

31 May 2023 - 9:00PM

Business Wire

Mainstreet Equity Corp. (“Mainstreet” or the “Corporation”)

(TSX:MEQ) today announced that the Toronto Stock Exchange (“TSX”)

has accepted its notice of intention to make a normal course issuer

bid to purchase outstanding common shares of the Corporation

(“Shares”) on the open market in accordance with the rules of the

TSX.

The Corporation is authorized to purchase up to 474,499 Shares

under the normal course issuer bid, representing approximately 10%

of its public float of issued and outstanding Shares, as of May 19,

2023. As of that date, there were 9,318,818 Shares issued and

outstanding. The average daily trading volume of the Shares for the

past six months ended April 30, 2023, calculated in accordance with

the rules of the TSX, was 2,895 and Mainstreet is subject to a

daily repurchase limit of 1,000 Shares. Mainstreet intends to

commence the normal course issuer bid on June 1, 2023 and terminate

the bid on May 31, 2024 or such earlier time as the bid is

completed or terminated at the option of Mainstreet.

All shares purchased under this bid will be purchased in the

open market through the facilities of the TSX and/or alternative

Canadian trading systems at the prevailing market price at the time

of such transaction. Shares acquired under the bid will be

cancelled.

Mainstreet intends to acquire Common Shares from time to time in

amounts and prices which its management believes are favourable and

consistent with prudent economic and financial considerations.

During the period between June 1, 2022 and the date hereof,

Mainstreet repurchased 17,300 Shares under its previous normal

course issuer bid, at an average weighted price of $114.81 per

Share, with such repurchases being made through the facilities of

the TSX and alternative Canadian trading systems. Mainstreet had

approval from the TSX to acquire up to 477,109 Shares under such

previous normal course issuer bid.

Mainstreet’s Board of Directors believes that, from time to

time, the market price of its Shares may not reflect their

underlying value. At such times, the Board of Directors believe

that the purchase of Shares for cancellation pursuant to the normal

course issuer bid is in the best interests of Mainstreet and its

shareholders, as the cancellation of the Shares will increase the

value of the remaining Shares.

Forward-Looking Information

Certain statements contained herein constitute "forward-looking

statements" as such term is used in applicable Canadian securities

laws. These statements relate to, among other things, Mainstreet’s

intentions to acquire Shares pursuant to the normal course issuer

bid, the timing of such bid and that the repurchase and

cancellation of the Shares pursuant to the bid is in the best

interests of the shareholders and that it will increase the value

of the remaining Shares. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions of future events or

performance (often, but not always, using such words or phrases as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans", "estimates" or "intends", or

stating that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

forward-looking statements.

Such forward-looking statements are not guarantees of future

events or performance and by their nature involve known and unknown

risks, uncertainties and other factors, including those risks

described in the Corporation’s Annual Information Form under the

heading "Risk Factors" and the failure to realize anticipated

benefits of the normal course issuer bid, that may cause the actual

results, performance or achievements of the Corporation to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Although the Corporation has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, other factors may cause actions, events

or results to be different than anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate as actual results and future events could vary or differ

materially from those anticipated in such forward-looking

statements. Accordingly, readers should not place undue reliance on

forward-looking statements contained herein.

Forward-looking statements are based on management's beliefs,

estimates and opinions on the date the statements are made, and the

Corporation undertakes no obligation to update forward-looking

statements if these beliefs, estimates or opinions should change,

except as required by applicable securities laws or as otherwise

described therein.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding the Corporation’s reasonable expectations

as to the anticipated results of its proposed business activities

for the periods indicated. Readers are cautioned that the financial

outlook may not be appropriate for other purposes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230531005365/en/

For more information: Bob Dhillon, Founder, President &

CEO Direct: +1 (403) 215-6063 Executive Assistant: +1 (403)

215-6070 100, 305 10 Avenue SE, Calgary, AB T2G 0W2 Canada TSX: MEQ

https://www.mainst.biz https://www.sedar.com

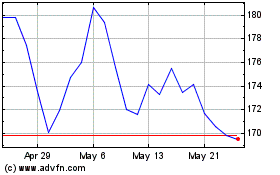

Mainstreet Equity (TSX:MEQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mainstreet Equity (TSX:MEQ)

Historical Stock Chart

From Nov 2023 to Nov 2024