Northland Power Inc. (Northland) (TSX: NPI) today announced that

its Hai Long offshore wind project (Hai Long or the project) in

Taiwan has signed a credit agreement to secure 118 billion New

Taiwan Dollars long-term over 20 year non-recourse financing

(equivalent of $5 billion CAD). The weighted average all-in

interest cost for the term of the financing is expected to be

approximately five per cent.

The non-recourse project financing will be

provided by over 15 international and local lenders with support

from multiple Export Credit Agencies (ECAs) from six different

countries. The project is expected to reach financial close

shortly, upon satisfaction of all relevant conditions precedent to

the financing being achieved. Upon the achievement of

financial close, total debt and equity required for the project are

expected to be fully funded, which includes future cash flows

expected to be received from sell-down proceeds and pre-completion

revenues.

“Today’s announcement is a major achievement for

Northland, our partners, and the offshore wind industry, globally

and in Taiwan,” said Mike Crawley, President and Chief Executive

Officer of Northland. “We are progressing yet another world-class

offshore wind project despite a challenging market environment. The

project will produce high quality and stable cashflow over a

30-year period with further optimization opportunities. Offshore

wind is necessary to meet global renewable energy demand in the

years ahead and Northland is one of the few companies able to

originate, develop, finance, construct, and operate such

facilities.”

Hai Long’s total cost is projected to be

approximately $9 billion, with funding from its $5 billion of

non-recourse debt by the project lenders, approximately $1 billion

of pre-completion revenues, and the remaining equity investment

contributed by the project’s partners. Northland’s equity

investment has been fully secured through funds raised under its

At-the-Market equity (ATM) program in 2022 and its minority stake

sale to Gentari International Renewables Pte. Ltd. (Gentari), which

is anticipated to close during the fourth quarter of 2023, subject

to satisfaction of all closing conditions pursuant to the terms of

the purchase and sale agreement. Upon closing of the sell-down

transaction, Gentari will hold a 29.4 per cent indirect equity

interest in the project and Northland will own 30.6 per cent and

will continue with the lead role in construction and operation.

“This financing is Northland’s first in Asia

and, once closed, will be the largest non-recourse offshore wind

project financing to date in the region,” said Pauline

Alimchandani, Northland’s Chief Financial Officer. “We would like

to thank the project team, our partners, and all the financial and

capital providers for working together to achieve this significant

milestone. Once operational, Hai Long is expected to provide

significant, long-term contracted Adjusted EBITDA and Free Cash

Flow to our business and shareholders.”

Northland’s interest in Hai Long is expected to

generate a five-year average of approximately $230 to $250 million

of Adjusted EBITDA (a non-IFRS measure)4 and $75 to $85 million of

Free Cash Flow (a non-IFRS measure)4 per year once operational,

delivering significant long-term value for Northland’s

shareholders. Hai Long’s project financing is denominated primarily

in New Taiwan Dollars, along with Japanese yen and European euros.

Interest rate exposures are being managed with a combination of

fixed rate tranches and long-term interest rate hedges in line with

Northland’s risk management strategy and project finance terms. Hai

Long is also entering into currency hedges to manage foreign

exchange exposures associated with certain construction contracts.

In addition, Northland will use currency hedges to stabilize the

Canadian dollar equivalent for a large portion of its projected

repatriated cash distributions, projected through 2033, and will

enter into additional hedges beyond this time period, on an ongoing

basis.

Hai Long is located approximately 45 – 70

kilometers off the Changhua coast in the Taiwan Strait and consists

of two phases, Hai Long 2 and Hai Long 3, with an expected combined

generating capacity of 1,022 MW. Hai Long 2A was awarded up to 300

MW of grid capacity under a Feed-in-Tariff, while Hai Long 2B and 3

were awarded up to 744 MW of grid capacity in Taiwan’s first

competitive price-based auction in 2018. Hai Long subsequently

signed a CPPA for the 744 MW auction portion in 2022. The project

has obtained all environmental approvals and its major construction

permit and has commenced with early construction work and

fabrication for components. Completion of construction activities

and full commercial operations are expected in 2026/2027. In

addition, the project secured a 15-year operations and maintenance

agreement with the turbine supplier, with options to extend.

Hai Long will play an important role in helping

the Government of Taiwan achieve its renewable energy target of 15

GW of offshore wind to be constructed between 2026 and 2035. Once

operational, Hai Long will be one the largest offshore wind

facilities in Asia, and provide enough clean energy to power more

than one million Taiwanese households.

Project Overview

|

(C$) |

Total Project |

Northland’s Interest1 |

|

Installed Capacity |

1,022 MW |

313 MW |

|

Hai Long 2A |

294 MW |

n/a |

|

Hai Long 2B & 3 |

728 MW |

n/a |

|

Contracted Life |

|

|

|

Hai Long 2A |

20 years |

n/a |

|

Hai Long 2B & 3 |

30 years |

n/a |

|

|

|

|

|

Total Capital Costs |

$9 billion |

$2.7 billion |

|

Non-Recourse Project Financing |

$5 billion |

$1.5 billion |

|

Total Equity |

$3 billion |

$0.9 billion |

|

Pre-Completion Revenues used to fund Capital costs |

$1 billion3 |

$0.3 billion3 |

|

|

|

|

|

5-year Average Annual Adjusted EBITDA (a non-IFRS measure)4 |

n/a |

$230 -250 million2 |

|

5-year Average Annual Free Cash Flow (a non-IFRS measure)4 |

n/a |

$75-85 million |

|

|

|

|

|

Estimated annual net production |

4,500 GWh |

n/a |

|

Non-Recourse Debt Term |

Over 20 years |

n/a |

|

Weighted Average All-in Interest Cost |

~5 per cent |

n/a |

|

1. |

Northland’s interest reflects sell-down of a 49% interest to

Gentari expected in the fourth quarter of 2023, resulting in net

interest of 30.6%. |

|

2. |

Assumed NTD/CAD exchange rate at 0.046. |

|

3. |

It is projected a total of $1.1 billion Pre-Completion Revenues

will be generated prior to full commercial operations. $1.0 billion

of those Pre-Completion Revenues will be assumed to be part of Hai

Long’s funding plan with the remainder to be distributed to

sponsors at commercial operations (approximately $30 million net to

Northland). |

|

4. |

See Non-IFRS Financial Measures and Forward-Looking Statements

below. |

|

|

|

Expected Financial Contribution from

Oneida, Baltic Power and Hai Long

In 2023, Northland has achieved or expects to

achieve financial close on three projects: Oneida, Baltic Power and

Hai Long. These projects have and/or will be funded through an

aggregate equity investment by Northland, net of sell-down

proceeds, of $1.75 billion. The net proceeds have been fully

secured primarily through: ATM proceeds in 2022, corporate hybrid

issuance in 2023, and available cash and liquidity on hand. Once

all three projects are fully operational, anticipated by 2027, they

are expected to collectively generate an aggregate Adjusted EBITDA

and Free Cash Flow (non-IFRS measures)4 of $570 to $615 million 5 6

and $185 to $210 million 5 6, respectively, resulting in

significant value creation and accretion for Northland’s

shareholders.

|

5. |

Based on a 5-year annual average from the completion date. |

|

6. |

The projected Adjusted EBITDA and Free Cash Flow are presented to

provide additional information relating to the projects’

contributions to the Company’s results of operations. This

information may not be appropriate for other purposes. |

|

|

|

ABOUT NORTHLAND POWER

Northland Power is a global power producer

dedicated to helping the clean energy transition by producing

electricity from clean renewable resources. Founded in 1987,

Northland has a long history of developing, building, owning and

operating clean and green power infrastructure assets and is a

global leader in offshore wind. In addition, Northland owns and

manages a diversified generation mix including onshore renewables,

efficient natural gas energy, as well as supplying energy through a

regulated utility.

Headquartered in Toronto, Canada, with global

offices in eight countries, Northland owns or has an economic

interest in approximately 3.2 GW (net 2.7 GW) of operating

capacity. The company also has a significant inventory of projects

in construction and in various stages of development encompassing

approximately 16 GW of potential capacity.

Publicly traded since 1997, Northland's common shares, Series 1

and Series 2 preferred shares trade on the Toronto Stock Exchange

under the symbols NPI, NPI.PR.A and NPI.PR.B, respectively.

NON-IFRS FINANCIAL MEASURES

This press release includes references to the

Company’s adjusted earnings before interest, income taxes,

depreciation and amortization (“Adjusted EBITDA”) and Free Cash

Flow, which are measures not prescribed by International Financial

Reporting Standards (“IFRS”), and therefore do not have any

standardized meaning under IFRS and may not be comparable to

similar measures presented by other companies. Non-IFRS financial

measures are presented at Northland’s share of underlying

operations. These measures should not be considered alternatives to

net income (loss), cash flow from operating activities or other

measures of financial performance calculated in accordance with

IFRS. Rather, these measures are provided to complement IFRS

measures in the analysis of Northland’s results of operations from

management’s perspective. Management believes that Northland’s

non-IFRS financial measures are widely accepted and understood

financial indicators used by investors and securities analysts to

assess the performance of a company, including its ability to

generate cash through operations. For a detailed description of

each of the non-IFRS financial measures referred to above,

including the reconciliations for such non-IFRS financial measure

to their most directly comparable IFRS financial measure, see

Section 1: Non-IFRS Financial Measures, Section 4.5: Adjusted

EBITDA, and Section 4.6: Adjusted Free Cash Flow and Free Cash Flow

in our MD&A for the three and six-month periods ended June 30,

2023, which is incorporated by reference and available under the

Company’s profile on SEDAR+ at www.sedarplus.com.

FORWARD-LOOKING STATEMENTS

This press release contains certain

forward-looking statements including certain future oriented

financial information that are provided for the purpose of

presenting information about management’s current expectations and

plans. Northland’s actual results could differ materially from

those expressed in, or implied by, these forward-looking statements

and, accordingly, the events anticipated by the forward-looking

statements may or may not transpire or occur. Readers are cautioned

that such statements may not be appropriate for other purposes.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions, or

include words such as “expects,” “anticipates,” “plans,”

“predicts,” “believes,” “estimates,” “intends,” “targets,”

“projects,” “forecasts” or negative versions thereof and other

similar expressions or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could.” These statements may

include, without limitation, statements regarding Northland’s

expectations for guidance, the completion of construction, the

timing for and attainment of commercial operations, the project’s

anticipated contributions to Adjusted EBITDA and Free Cash Flow,

the expected generating capacity of the project, and the future

operations, business, financial condition, financial results,

priorities, ongoing objectives, strategies and outlook of Northland

and its subsidiaries, all of which may differ from the expectations

stated herein. These statements are based upon certain material

factors or assumptions that were applied in developing the

forward-looking statements, including the design specifications of

development the projects, issuance of notices to proceed to

contractors in accordance with contractual milestones, the

provisions of contracts to which Northland or a subsidiary is a

party, management’s current plans and its perception of historical

trends, current conditions and expected future developments, as

well as other factors, estimates, and assumptions that are believed

to be appropriate in the circumstances. Although these

forward-looking statements are based upon management’s current

reasonable expectations and assumptions, they are subject to

numerous risks and uncertainties. Some of the factors include, but

are not limited to, risks associated with sales contracts,

Northland’s reliance on the performance of its offshore wind

facilities at Gemini, Nordsee One and Deutsche Bucht for

approximately 50% of its Adjusted EBITDA and Free Cash Flow,

counterparty risks, impacts of regional or global conflicts,

contractual operating performance, variability of sales from

generating facilities powered by intermittent renewable resources,

offshore wind concentration, natural gas and power market risks,

commodity price risks, operational risks, recovery of utility

operating costs, Northland’s ability to resolve issues/delays with

the relevant regulatory and/or government authorities, permitting,

construction risks, procurement and supply chain risk, project

development risks, disposition and joint venture risk, competition

risks, acquisition risks, financing risks, interest rate and

refinancing risks, liquidity risk, credit rating risk, currency

fluctuation risk, variability of cash flow and potential impact on

dividends, taxation, natural events, environmental risks, climate

change, health and worker safety risks, market compliance risk,

government regulations and policy risks, utility rate regulation

risks, international activities, cybersecurity, data protection and

reliance on information technology, labour relations, reputational

risk, insurance risk, risks relating to co-ownership, bribery and

corruption risk, legal contingencies, and the other factors

described in the “Risks Factors” section of Northland’s 2022 Annual

Information Form, which can be found at www.sedarplus.ca under

Northland’s profile and on Northland’s website at

northlandpower.com. Northland has attempted to identify important

factors that could cause actual results to materially differ from

current expectations, however, there may be other factors that

cause actual results to differ materially from such expectations.

Northland’s actual results could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, and Northland cautions you not to place undue reliance upon

any such forward-looking statements.

The forward-looking statements contained in this

release are based on assumptions that were considered reasonable as

of the date hereof. Other than as specifically required by law,

Northland undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after such date or to

reflect the occurrence of unanticipated events, whether as a result

of new information, future events or results, or otherwise.

For further information, please

contact:

Mr. Adam Beaumont, Vice PresidentMr. Dario Neimarlija, Vice

President647-288-1019investorrelations@northlandpower.com

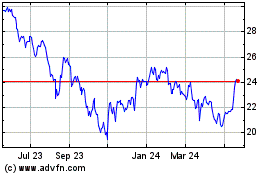

Northland Power (TSX:NPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

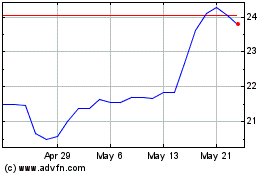

Northland Power (TSX:NPI)

Historical Stock Chart

From Jan 2024 to Jan 2025