Aura Secures Additional US$31 million in Financing and Announces Fully Funded Construction for the Borborema Project

06 December 2023 - 8:20PM

Aura Minerals Inc. (TSX: ORA, B3: AURA33 and OTCQX: ORAAF)

(“Aura” or the “Company”) is pleased to announce that

Borborema Inc. (“

Borborema”), a wholly owned

subsidiary and indirect owner of the Company’s Borborema gold

project in Rio Grande do Norte State, Brazil (the

“

Borborema Project”), has entered into an

agreement with Gold Royalty Corp. (“

Gold Royalty”)

to secure US$31 million in financing to develop the Borborema

Project (the “

Transaction”). The US$31 million in

financing is composed of a US$21 million net smelter return royalty

over the Borborema Project (the “

NSR Royalty”) and

a US$10 million gold-linked loan (the “

Gold-Linked

Loan”).

Together with the US$100 million term loan

previously entered into with Banco Santander Brazil and US$14

million raised through gold collars with several financial

institutions, Aura, through its subsidiaries, has now secured over

US$145 million towards construction of the Borborema Project, which

has an estimated total construction capex of US$188 million.

Key Financing Terms

NSR Royalty:

- Upfront

Payment: US$21.0 million in cash upon closing of the

Transaction.

- Royalty

Terms: Gold Royalty acquired a secured 2.0% net smelter

return royalty on the first 725,000 ounces produced from the

Borborema Project.

-

Stepdown: The NSR Royalty will decrease to 0.5%

after 725,000 ounces of payable gold is produced from the Borborema

Project.

- Buyback

Option: The remaining 0.5% of the NSR Royalty will be

subject to a US$2.5 million buyback at Borborema’s option

exercisable by Borborema after the earlier to occur of (i) of

2,250,000 ounces of payable gold being produced at the Borborema

Project, or (ii) January 1, 2050.

-

Pre-production Payments: Borborema will make

quarterly payments to Gold Royalty of 250 ounces of gold (1,000

ounces per year). The pre-production payments will cease upon the

earlier of (i) the date of commencement of commercial production of

the Borborema Project; and (ii) the tenth (10th) year anniversary

of the closing of the Transaction.

-

ESG Co-Investment Payments: Gold Royalty will make

ongoing payments to Borborema of US$30 per gold equivalent ounce

delivered or paid to Gold Royalty. These payments are earmarked for

ESG related investments by Borborema, up to a maximum of

US$300,000.

Gold-Linked Loan:

- Loan

Principal: US$10.0 million paid to Borborema in cash upon

closing of the Transaction.

-

Maturity: 6 years from closing of the

Transaction.

-

Prepayment: The loan can be prepaid at any time

commencing on the 24 month of the closing of the Transaction

subject to certain prepayment costs.

- Quarterly

Interest Payments: Quarterly coupon payments of minimum

110 ounces of gold (440 ounces per year). Coupon payments can be

made via cash settlement or physical delivery of gold.

-

Conversion: Upon maturity, Gold Royalty has the

option to be:

- Paid US$10 million

cash; or

- Paid US$5 million in

cash plus receive a 0.5% net smelter return royalty over the

Borborema Project.

-

Security: The Gold-Linked Loan will be secured

against certain mining concessions relating to the Borborema

Project and a pledge of the shares of the Borborema operating

entity, with the Company's interests thereunder subordinated to

senior project financing lenders. The Gold-Linked Loan is also

guaranteed by Aura.

Rodrigo Barbosa, President & CEO commented,

“We have successfully concluded our financing plan for the

Borborema project with an additional US$31 million from Royalty and

Gold Loan Agreements, bringing our total external funding to US$

145 million. This amount, together with our own cash fully

addresses the projected US$188 million capital expenditure. This

diversified funding strategy, which encompasses debt, royalty, gold

loan, and positive collars, aligns perfectly with our goal to

mitigate financial risks while enhancing shareholder equity

returns.”

Completion of the Transaction is subject to customary conditions

and is currently expected to be completed in December 2023, with an

outside date of January 31, 2024.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on the development and operation of gold and base

metal projects in the Americas. The Company’s four producing assets

include the San Andres gold mine in Honduras, the EPP and the Almas

gold mines in Brazil and the Aranzazu copper-gold-silver mine in

Mexico. In addition, the Company has the Tolda Fria gold project in

Colombia and four projects in Brazil, of which three gold projects:

Borborema and Matupá, which are in development; and São Francisco,

which is on care and maintenance. The Company also owns the Serra

da Estrela copper project in Brazil, Carajás region, under

exploration stage.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which include, but are not limited to,

statements with respect to the activities, events or developments

that the Company expects or anticipates will or may occur in the

future.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Specific reference is

made to the most recent Annual Information Form on file with

certain Canadian provincial securities regulatory authorities for a

discussion of some of the factors underlying forward-looking

statements, which include, without limitation, the ability of the

Company to close the Transaction, the Company’s ability to achieve

its short-term and longer-term outlook and the anticipated timing

and results thereof, the ability to lower costs and increase

production, the ability of the Company to successfully achieve

business objectives, copper and gold or certain other commodity

price volatility, changes in debt and equity markets, the

uncertainties involved in interpreting geological data, increases

in costs, environmental compliance and changes in environmental

legislation and regulation, interest rate and exchange rate

fluctuations, general economic conditions and other risks involved

in the mineral exploration and development industry. Readers are

cautioned that the foregoing list of factors is not exhaustive of

the factors that may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

For more information, please contact:

Investor Relations

ir@auraminerals.com

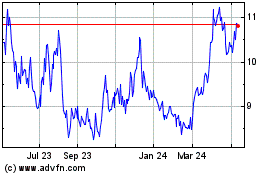

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

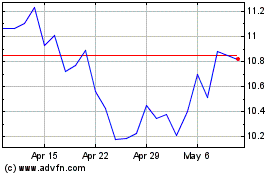

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025