Prairie Provident Announces Closing of Rights Offering

31 October 2024 - 8:30PM

Prairie Provident Resources Inc. (“Prairie Provident” or the

“Company”) (TSX:PPR) is pleased to announce the successful

completion of its previously announced equity rights offering (the

“Rights Offering”), which expired at 5:00 p.m. (Mountain time) on

October 28, 2024.

Prairie Provident issued an aggregate of

480,000,000 common shares of the Company (“Common Shares”) pursuant

to the Rights Offering and the Standby Commitment (defined below)

at a price of $0.025 per share, for aggregate gross proceeds of

$12.0 million. This includes the 400,000,000 Common Shares issued

in the initial closing described below. Following completion, there

are 1,196,405,336 Common Shares issued and outstanding.

As previously announced, the Company’s principal

shareholder, PCEP Canadian Holdco, LLC (“PCEP”), fully exercised

its basic subscription privilege under the Rights Offering to

purchase 400,000,000 Common Shares in an initial closing completed

on September 27, 2024, and also provided a standby commitment to

purchase up to an additional 64,000,000 Common Shares not otherwise

subscribed for under the Rights Offering by others (the “Standby

Commitment”). In addition to the 400,000,000 Common Shares

purchased on the early exercise of its basic subscription

privilege, PCEP acquired 15,434,906 Common Shares under the Standby

Commitment at the same subscription price of $0.025 per share.

Following closing of the Rights Offering and Standby Commitment,

PCEP holds 956,360,015 Common Shares, or approximately 79.9% of the

total Common Shares outstanding.

Of the 64,565,094 Common Shares purchased under

the Rights Offering by shareholders other than PCEP, 41,429,021

were issued pursuant to exercise of the basic subscription

privilege and 26,136,073 were issued pursuant to exercise of the

additional subscription privilege. These numbers include 16,600,046

Common Shares acquired by directors and management of the Company

under the Rights Offering (2,087,453 pursuant to the basic

subscription privilege and 14,512,593 pursuant to the additional

subscription privilege).

No fees or commissions were paid by the Company

in connection with the Rights Offering or the Standby

Commitment.

Net proceeds from the Rights Offering are

expected to fund a capital program focused on drilling at least two

wells in the Basal Quartz formation before the end of 2024,

workovers to enhance the productivity of existing wells and general

corporate purposes. A portion of the net proceeds was also used to

settle a US$2.3 million advance under the Company’s second lien

note facility, by way of a $3.13 million setoff (being the Canadian

dollar equivalent of the advance) against the $10.0 million

subscription price paid by PCEP on the early exercise of its basic

subscription privilege.

For details regarding the Rights Offering,

please see Prairie Provident’s rights offering circular dated

September 13, 2024, a copy of which is available under

the Company’s issuer profile on SEDAR+ at www.sedarplus.ca or from

its website at www.ppr.ca.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta, including a position in the emerging Basal

Quartz trend in the Michichi area of Central Alberta.

For further information, please contact:

Dale Miller, Executive ChairmanPhone: (403) 292-8150Email:

investor@ppr.ca

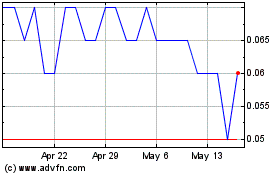

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

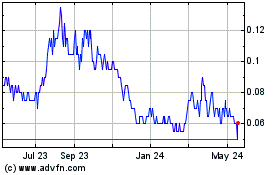

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2023 to Dec 2024