Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or the

“Company”) announces today that filing of its unaudited interim

quarterly financial statements and accompanying management’s

discussion and analysis for the quarter ended March 31, 2020

(collectively the “Q1 Filings”) will be postponed due to delays

caused by the COVID-19 pandemic.

The Q1 Filings would ordinarily have been filed

on or before May 15, 2020, the required deadline set by National

Instrument 51-102 – Continuous Disclosure

Obligations (“NI-51-102”). Pulse is issuing this news release

pursuant to Alberta Securities Commission Blanket Order 51-517

– Temporary Exemption from Certain Corporate Finance

Requirements (the “Blanket Order”), which provides the Company with

an additional 45 days to complete its Q1 Filings, which includes

the following continuous disclosure documents:

- Unaudited financial statements for the quarter ended March 31,

2020 as required by section 4.4 of NI 51-102; and

- Management’s discussion and analysis for the quarter ended

March 31, 2020 as required by section 5.1(2) of NI 51-102

The Company expects to file the Q1 Filings no

later than June 11, 2020.

As required by the conditions of the Blanket

Order, until the Company has filed and announced the required Q1

Filings, Pulse’s management and other insiders of the Company will

be subject to an insider trading blackout that reflects the

principles in Section 9 of National Policy 11-207

– Failure-to-file Cease Trade Orders and Revocations in

Multiple Jurisdictions.

Except as identified below, there have been no

material business developments since February 13, 2020, when the

Company filed its annual financial statements for the year ended

December 31, 2019.

Pulse continues to respond to very challenging

business conditions brought about by the combined impact of the

COVID-19 pandemic and the precipitous decline of oil prices brought

on by the unprecedented demand fallout from COVID-19. These global

events have caused significant declines in the 2020 capital budgets

of Pulse’s customers in the oil and natural gas sector of Western

Canada. While the Company continues to see a lack of clarity into

future seismic data licensing opportunities, Pulse remains engaged

with customers to monitor their seismic data requirements.

Highlights of the preliminary financial results

for the first quarter of 2020 include the following estimates:

- Data library sales of $2.2 million;

- Net loss of $2.8 million;

- Cash from operating activities of $2.3 million;

- Cash EBITDA(a) of $1.1 million;

- Shareholder free cashflow(a) of $763,000; and

- Long-term debt balance of $29.4 million.

At March 31, 2020, the Company was in compliance

with all covenants related to its syndicated credit facility. In

January 2019 Pulse borrowed a total of $38 million to partially

fund the acquisition of Seitel Canada Inc. This indebtedness

included approximately $23.0 million in senior debt on its

syndicated credit facility, $10.0 million in subordinated debt and

an additional $5.0 million due to the vendor of Seitel Canada Ltd.

which reflected a potential sales-based deferred payment to the

vendor. This acquisition more than doubled the size of Pulse’s

seismic data library, which we believe has doubled the opportunity

set for future sales. At March 31, 2020 the balance owing on these

credit facilities was $29.4 million, of which $19.4 million was due

on its senior credit facility and $10.0 million in subordinated

debt. The sales-based deferred payment was fully satisfied by

mid-2019.

With ongoing uncertainty as to the length and

continued severity of this oil and gas downturn, Pulse is in

discussions with the lead bank of its syndicated facility to amend

its financial covenants to ensure additional flexibility in future

quarters.

Management and the Board of Directors of the

Company have taken cost-cutting measures in reaction to the decline

in commodity prices and uncertainty surrounding the continuation of

the low oil price environment. Pulse has implemented salary

reductions ranging from 10 percent to 20 percent for its executive

and management team, and compensation for the Board of Directors

has also been reduced. All administrative and operating expenses

and capital spending plans have been evaluated.

Pulse remains committed to the health and safety

of its employees. In response to the public health measures

associated with the pandemic, Pulse implemented its disaster

recovery plan and staff have been working remotely since March 13,

2020. Management is closely monitoring the guidance of the health

authorities and it is anticipated that staff will continue to work

remotely for the foreseeable future. Pulse’s business is supplying

licences to a digitally-based product, seismic data, and as a

result, staff are able to respond to customer needs in a timely

manner. The Company’s primary focus and attention at this time

continues to be the safety of its employees, preserving cash and

protecting the balance sheet while weathering these uncertain and

unprecedented times.

(a)The Company’s continuous disclosure documents

provide discussion and analysis of “cash EBITDA” and “shareholder

free cash flow”. These financial measures do not have standard

definitions prescribed by IFRS and, therefore, may not be

comparable to similar measures disclosed by other companies. The

Company has included these non-GAAP financial measures because

management, investors, analysts and others use them as measures of

the Company’s financial performance. The Company’s definition of

cash EBITDA is cash available for interest payments, cash taxes,

repayment of debt, purchase of its shares, discretionary capital

expenditures and the payment of dividends, and is calculated as

earnings (loss) from operations before interest, taxes,

depreciation and amortization less participation survey revenue,

lease payments treated as capital and warehouse storage fees, plus

any non-cash and non-recurring expenses. Shareholder free cash flow

further refines the calculation of capital available to invest in

growing the Company’s 2D and 3D seismic data library, to repay

debt, to purchase its common shares and to pay dividends by

deducting non-discretionary expenditures from cash EBITDA.

Non-discretionary expenditures are defined as debt financing costs

(net of deferred financing expenses amortized in the current

period) and current tax provisions.

CORPORATE

PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to the western

Canadian energy sector. Pulse owns the largest licensable seismic

data library in Canada, currently consisting of approximately

65,310 square kilometres of 3D seismic and 829,207 kilometres of 2D

seismic. The library extensively covers the Western Canada

Sedimentary Basin where most of Canada’s oil and natural gas

exploration and development occur.

For further information, please

contact:Neal Coleman, President and

CEO403-531-0689OrPamela Wicks, Vice President

Finance and CFOTel.: 403-531-0207Toll-free: 1-877-460-5559E-mail:

info@pulseseismic.comPlease visit our website at

www.pulseseismic.com

This document contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation, including, but

not limited to, statements regarding:

|

> |

The outlook of the Company for the year ahead; |

| > |

Recent

events on the political, economic, regulatory, public health and

legal fronts affecting the industry’s medium- to longer-term

prospects; |

| > |

The

Company’s capital resources and sufficiency thereof to finance

future operations, meet its obligations associated with financial

liabilities and carry out the necessary capital expenditures

through the balance of 2020; |

| > |

Oil and

natural gas prices and forecasted trends; |

| > |

Oil and

natural gas company capital budgets; |

| > |

Future

demand for seismic data; |

| > |

Future

seismic data sales; and |

| > |

Other

expectations, beliefs, plans, goals, objectives, assumptions,

information and statements about possible future events,

conditions, results and performance, as they relate to the Company

or to the oil and gas industry as a whole. |

By its very nature, forward-looking information

involves inherent risks and uncertainties, both general and

specific, and risks that predictions, forecasts, projections and

other forward-looking statements will not be achieved. We caution

readers not to place undue reliance on these statements as a number

of important factors could cause the actual results to differ

materially from the beliefs, plans, objectives, expectations and

anticipations, estimates and intentions expressed in such

forward-looking information. These factors include, but are not

limited to: volatility of oil and natural gas prices; risks

associated with the oil and gas industry in general; the Company’s

ability to access external sources of debt and equity capital;

credit, liquidity and commodity price risks; environmental, health

and safety risks, including those related to the COVID-19 pandemic;

federal and provincial government laws and regulations, including

those pertaining to taxation, royalty rates, environmental

protection, public health and safety; competition; the loss of

seismic data; the introduction of new products; and climate

change.

Pulse cautions that the foregoing list of

factors that may affect future results is not exhaustive.

Additional risks and factors and information related thereto which

could affect the Company’s operations and financial results is

included under “Risk Factors” in the in the Company’s most recent

annual information form, and in the Company’s most recent audited

annual financial statements, most recent MD&A, management

information circular, quarterly reports, material change reports

and news releases. Copies of the Company’s public filings are

available on SEDAR at www.sedar.com.

The forward-looking information contained in

this document is provided as of the date of this document and the

Company does not undertake any obligation to update publicly or to

revise any of the included forward-looking information, except as

required by law. The forward-looking information in this document

is provided for the limited purpose of enabling current and

potential investors to evaluate an investment in Pulse. Such

forward-looking information may not be appropriate, and should not

be used, for other purposes.

PDF

available: http://ml.globenewswire.com/Resource/Download/e426831d-c2db-49b8-9acf-765f73d37372

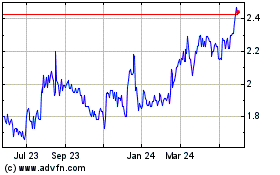

Pulse Seismic (TSX:PSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Pulse Seismic (TSX:PSD)

Historical Stock Chart

From Jan 2024 to Jan 2025