Rogers Sugar Inc. (the “Company”, “Rogers”, “RSI” or “our,” “we”,

“us”) (TSX: RSI) today reported results for the second quarter and

first six months of fiscal 2024. Consolidated adjusted EBITDA for

the quarter rose 52 per cent to a record $38.1 million, driven by

strong performance in the Company’s Maple and Sugar segments.

Given supportive market conditions and the

impact of management efforts to optimize the business and drive

profitability, the Company is now expecting to deliver higher

consolidated adjusted EBITDA for fiscal 2024 over fiscal 2023.

“The profitable growth we are generating in both

our business segments showcases the combined benefits of strong

demand for our products and our focus on harnessing that demand by

continuously improving our operations,” said Mike Walton, President

and Chief Executive Officer of Rogers and Lantic Inc. “We look

forward to another year of strong financial results as we move

ahead with our capacity expansion that will enable us to further

grow the business by meeting the needs of our customers for years

to come.”

|

Second Quarter 2024 Consolidated

Highlights(unaudited) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Financials

($000s) |

|

|

|

|

| Revenues |

300,944 |

272,949 |

589,643 |

534,392 |

| Gross margin |

44,861 |

41,658 |

89,505 |

82,849 |

| Adjusted gross margin(1) |

51,292 |

38,233 |

93,611 |

80,226 |

| Results from operating

activities |

24,704 |

21,856 |

50,814 |

48,140 |

| EBITDA(1) |

31,664 |

28,445 |

64,709 |

61,158 |

| Adjusted EBITDA(1) |

38,095 |

25,020 |

68,815 |

58,535 |

| Net earnings |

13,936 |

11,062 |

27,788 |

25,736 |

|

per share (basic) |

0.13 |

0.11 |

0.26 |

0.25 |

|

per share (diluted) |

0.11 |

0.10 |

0.22 |

0.23 |

| Adjusted net earnings(1) |

18,891 |

9,115 |

31,504 |

24,462 |

| Adjusted net earnings per

share (basic)(1) |

0.17 |

0.09 |

0.29 |

0.23 |

| Trailing twelve months free

cash flow(1) |

56,570 |

51,807 |

56,570 |

51,807 |

| Dividends per share |

0.09 |

0.09 |

0.18 |

0.18 |

| |

|

|

|

|

| Volumes |

|

|

|

|

| Sugar (metric tonnes) |

180,618 |

195,547 |

362,994 |

388,396 |

| Maple

Syrup (thousand pounds) |

11,777 |

12,059 |

23,629 |

23,878 |

|

(1) See “Cautionary statement on Non-IFRS Measures” section

of this press release for definition and reconciliation to IFRS

measures. |

|

|

- The Company

delivered consolidated adjusted EBITDA(1) for the second quarter

and the first six months of fiscal 2024 of $38.1 million and $68.8

million respectively, up by $13.1 million and $10.3 million from

the same periods last year, driven by the strong performance of

both of our business segments.

- On March 4,

2024, in connection with the financing plan of our announced

expansion of production and logistic capacity of our Eastern

operations in Montréal and Toronto (the “LEAP Project”), Rogers

issued 22,769,232 new common shares at a price of $5.18 per share.

The net proceeds after commissions and related fees associated with

this transaction amounted to $112.5 million.

- On February 1,

2024, the unionized employees of the Vancouver sugar refinery,

represented by the Public and Private Workers of Canada Local 8,

ratified a new five-year collective agreement, concluding a strike

that began on September 28, 2023. The unionized employees have

returned to work and the Vancouver refinery is now operating at its

normal capacity.

- Throughout the

labour disruption, production from our Taber and Montréal

facilities was used to support our customers in Western Canada. The

overall unfavourable impact of the strike is a net reduction of

approximately 23,500 metric tonnes in sales volume, of which 13,500

metric tonnes were related to the second quarter, and a reduction

of adjusted EBITDA(1) of $5.4 million, of which $2.4 million was

related to the second quarter.

- Adjusted

EBITDA(1) in the Sugar segment was very strong in the second

quarter of fiscal 2024 at $33.2 million, an increase of $10.6

million compared to the same period last year, even after

considering the unfavourable impact of the strike at the Vancouver

refinery.

- Sales volumes in

the Sugar segment decreased by approximately 15,000 metric tonnes

to approximately 180,600 metric tonnes in the second quarter,

largely driven by the reduction of activities at our Vancouver

sugar refinery as a result of the labour disruption.

- Sugar segment

adjusted gross margin(1) amounted to $249 per metric tonne in the

second quarter of 2024 as compared to $175 per metric tonne for the

same period last year, mainly due to a higher contribution from

sugar refining activities.

- Adjusted

EBITDA(1) in the Maple segment was $4.9 million in the second

quarter, an increase of $2.5 million from the same quarter last

year, largely driven by higher average selling prices and lower

operating costs.

- Adjusted gross

margin percentage(1) in the Maple segment amounted to 10.9%, as

compared to an adjusted gross margin percentage(1) of 7.2% for the

same period last year, driven by higher average selling prices and

lower operating costs following the implementation of automation

and continuous improvement initiatives in the later part of fiscal

2023.

- Free cash

flow(1) for the trailing 12 months ended March 30, 2024, was $56.6

million, an increase of $4.8 million from the same period last

year, driven by higher consolidated adjusted EBITDA(1), partially

offset by an increase in capital expenditures.

- In the second

quarter of fiscal 2024, we distributed $0.09 per share to our

shareholders for a total of $9.5 million.

- On May 9, 2024,

the Board of Directors declared a quarterly dividend of $0.09 per

share, payable on or before July 11, 2024.(1) See “Cautionary

statement on Non-IFRS Measures” section of this press release for

definition and reconciliation to IFRS measures.

Sugar

|

Second Quarter 2024 Sugar

Highlights(unaudited) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

|

Financials ($000s) |

|

|

|

|

| Revenues |

242,957 |

216,135 |

472,765 |

421,423 |

| Gross margin |

39,916 |

37,075 |

76,406 |

73,113 |

| Adjusted gross margin(1) |

44,947 |

34,145 |

81,179 |

71,806 |

|

Per metric tonne ($/ mt) (1) |

248.85 |

174.62 |

223.64 |

184.88 |

| Administration and selling

expenses |

10,815 |

11,101 |

20,194 |

17,737 |

| Distribution costs |

6,192 |

5,340 |

12,278 |

10,402 |

| Results from operating

activities |

22,909 |

20,634 |

43,934 |

44,975 |

| EBITDA(1) |

28,194 |

25,512 |

54,494 |

54,566 |

| Adjusted EBITDA(1) |

33,225 |

22,582 |

59,267 |

53,259 |

| |

|

|

|

|

| Volumes (metric

tonnes) |

|

|

|

|

| Total

volume |

180,618 |

195,547 |

362,994 |

388,396 |

| (1) See

“Cautionary statement on Non-IFRS Measures” section of this press

release for definition and reconciliation to IFRS measures. |

| |

|

|

|

|

In the second quarter of fiscal 2024, revenues increased by

$26.8 million compared to the same period last year. The positive

variance was largely driven by higher average price for Raw #11,

and higher contribution from sugar refining related activities,

partially offset by lower sales volume as a result of the labour

disruption at our Vancouver sugar refinery.

In the second quarter of fiscal 2024, sugar

volume totaled approximately 180,600 metric tonnes, a decrease of

approximately 7.6% or 15,000 metric tonnes compared to the same

period last year, driven mainly by the unfavorable net impact of

the labour disruption at the Vancouver refinery, estimated at

approximately 13,500 metric tonnes.

Gross margin was $39.9 million for the current

quarter and included a loss of $5.0 million for the mark-to-market

of derivative financial instruments. For the same period last year,

gross margin was $37.1 million with a mark-to-market gain of $2.9

million.

Adjusted gross margin was $44.9 million for the

second quarter of 2024 as compared to $34.1 million for the same

period in 2023. Adjusted gross margin increased by $10.8 million in

the second quarter compared to the same period last year mainly as

a result of higher sugar sales margin from increased average

pricing on sugar refining related activities and favorable mix of

products sold. This positive variance was partially offset by

higher production costs mainly driven by increased maintenance

activities and market based inflationary pressure on costs, along

with the unfavourable impact of lower sales volume, as describe

above.

On a per-unit basis, adjusted gross margin for

the second quarter was $249 per metric tonne, higher than last year

by $74 per metric tonne. The favourable variance was mainly due to

the increase in overall margin from improved selling prices and

favourable mix of products sold, partially offset by higher

production costs and lower sales volume.

Results from operating activities for the second

quarter of fiscal 2024 were $22.9 million, an increase of $2.3

million from the same period last year. These results included

gains and losses from the mark-to-market of derivative financial

instruments.

EBITDA for the second quarter of fiscal 2024 was

$28.2 million compared to $25.5 million in the same period last

year. These results include gains and losses from the

mark-to-market of derivative financial instruments.

Adjusted EBITDA for the second quarter increased

by $10.6 million compared to the same period last year, largely as

a result of higher adjusted gross margin, partially offset by

higher distribution costs.

Maple

|

Second Quarter 2024 Maple

Highlights(unaudited) |

Q2 2024 |

Q2 2023 |

YTD 2024 |

YTD 2023 |

| Financials

($000s) |

|

|

|

|

| Revenues |

57,987 |

56,814 |

116,878 |

112,969 |

| Gross margin |

4,945 |

4,583 |

13,099 |

9,736 |

| Adjusted gross margin(1) |

6,345 |

4,088 |

12,432 |

8,420 |

|

As a percentage of revenues (%) (1) |

10.9% |

7.2% |

10.6% |

7.5% |

| Administration and selling

expenses |

2,916 |

2,865 |

5,677 |

5,527 |

| Distribution costs |

234 |

496 |

542 |

1,044 |

| Results from operating

activities |

1,795 |

1,222 |

6,880 |

3,165 |

| EBITDA(1) |

3,470 |

2,933 |

10,215 |

6,592 |

| Adjusted EBITDA(1) |

4,870 |

2,438 |

9,548 |

5,276 |

| |

|

|

|

|

| Volumes (thousand

pounds) |

|

|

|

|

| Total

volume |

11,777 |

12,059 |

23,629 |

23,878 |

| (1) See

“Cautionary statement on Non-IFRS Measures” section of this press

release for definition and reconciliation to IFRS measures. |

| |

Revenues for the second quarter of the current

fiscal year were $1.2 million higher than the same period last

year, largely due to higher average selling price, partially offset

by lower sales volume.

Gross margin was $4.9 million for the current

quarter, including a loss of $1.4 million for the mark-to-market of

derivative financial instruments. For the same period last year,

gross margin was $4.6 million with a mark-to-market gain of $0.5

million.

Adjusted gross margin percentage for the second

quarter was 10.9% as compared to 7.2% for the same period last

year, representing an increase in adjusted gross margin of $2.3

million, mainly due to higher average pricing and lower operating

costs from savings related to continuous improvement and automation

initiatives implemented in the later part of fiscal 2023

Results from operating activities for the second

quarter of fiscal 2024 were $1.8 million, compared to $1.2 million

in the same period last year. These results included gains from the

mark-to-market of derivative financial instruments.

EBITDA for the second quarter of fiscal 2024

amounted to $3.5 million compared to $2.9 million for the same

period last year. These results include gains from the

mark-to-market of derivative financial instruments.

Adjusted EBITDA for the second quarter of fiscal 2024 increased

by $2.4 million to $4.9 million, due mainly to higher adjusted

gross margin, as explained above.

LEAP PROJECT

The planning and design phases associated with

the project are now completed and the construction phase is

expected to begin shortly. Site preparation and permitting

processes are currently in their final stages for the main

construction site in Montréal. Detailed planning for the Toronto

portion of the project is currently being developed. Orders for

sugar refining equipment and other large production and logistic

related equipment have been issued to suppliers.

In connection with the financing plan of the

LEAP Project, RSI issued new common shares in the second quarter of

2024, for a net proceed of $112.5 million. As at March 30, 2024,

$30.9 million, including $1.1 million in interest costs has been

capitalized in construction in progress on the balance sheet for

the LEAP project.

OUTLOOK

Management continues to focus on optimizing the

business and delivering growth in consolidated adjusted EBITDA.

Considering the strong results of the first six months of fiscal

2024 for both of our business segments, we anticipate delivering

higher financial results in 2024 as compared to 2023. The stability

of our operations in both segments, the continued positive outlook

of the Sugar segment from a market demand and pricing point of

view, and the recovery of our Maple segment over the last few

quarters, should drive an increase in consolidated adjusted EBITDA

for fiscal 2024 over fiscal 2023.

Sugar

We expect the Sugar segment to perform well in

fiscal 2024 and to exceed the results of fiscal 2023, despite the

unfavourable impact of the recent labour disruption in Vancouver

that ended on February 1. Underlying North American demand remains

strong across all customer segments supported by favourable market

dynamics. The expected increase in sugar margin from recently

negotiated agreements is having a positive impact on our financial

results, allowing us to mitigate the recent inflationary pressures

on costs, and the lower sales volume related to the recent labour

disruption in Vancouver.

The initial volume expectation for fiscal year

2024 was set at 800,000 metric tonnes, representing an increase of

4,700 metric tonnes compared to fiscal year 2023. Considering the

recently ended labour disruption in Vancouver and its impact on the

volume delivered to customers, we expect our initial outlook for

fiscal year 2024 to decrease by 20,000 metric tonnes, to 780,000

metric tonnes.

In Taber, the harvest season delivered a

higher-than-expected volume of sugar beets, and the processing

campaign was completed in late February. The expected sugar

production from the crop is 115,000 metric tonnes, higher than the

prior year production by 10,000 metric tonnes. The

higher-than-expected production is attributable to the higher

quality of the beets received in 2024 due to favourable weather

conditions during the growing season, and the improved performance

of the plant throughout the slicing process. The Alberta sugar beet

growers are currently seeding for the next year crop, under the

second year of a two-year agreement signed in April 2023.

Negotiations with the Alberta Sugar Beet Growers Association for

subsequent crops should begin later in fiscal 2024.

Production costs and maintenance programs for

our three production facilities are expected to increase moderately

in 2024 as such related expenditures continue to be impacted by the

current inflationary market-based pressures, and as we continue to

perform the necessary maintenance activities to ensure a smooth

production process to meet the needs of our customers. We are

committed to managing our costs responsibly and have put forward

optimization and control initiatives in all our plants.

Distribution costs are expected to increase

slightly in 2024. These expenditures reflect the current market

dynamics requiring the transfer of sugar produced between our

refineries to meet demand from customers, and some of the costs

associated with servicing customers with imported refined

sugar.

Administration and selling expenses are expected

to increase in 2024 as compared to 2023, due mainly to market-based

increases in compensation expenditures and external services.

Considering the elements discussed above, we

expect the Sugar segment adjusted EBITDA to increase in fiscal 2024

over fiscal 2023, reflecting the strong prevailing market dynamics

and the stability of our operations.

We anticipate our financing costs to decrease in

fiscal 2024 due mainly to the timing of the equity financing

portion for the LEAP project, which is providing a temporary

increase in our available cash that will reduce the interest costs

associated with our revolving credit facility. We have been able to

mitigate the impact of recent increases in interest rates and

energy costs through our multi-year hedging strategy. We expect our

hedging strategy will continue to mitigate such exposure in fiscal

2024.

Spending on regular business capital projects is

also expected to remain stable for fiscal 2024. We anticipate

spending approximately $26.0 million on various initiatives related

to our regular operations. This capital spending estimate excludes

expenditures relating to our LEAP Project, which are currently

estimated at $46.0 million for fiscal 2024.

Maple

We expect financial results in our Maple segment

to improve in 2024 over the prior year. The Maple segment financial

results were lower than anticipated in fiscal 2023. Over the last

few months, we focused on negotiating market-based price increases

and optimizing our operations at our Granby and Dégelis plants

through automation and continuous improvement initiatives. Such

initiatives are supporting the recovery of our Maple business

segment noted over the last three quarters.

The expected sales volume for fiscal 2024 is

higher than last year by approximately 2.0 million lbs at 46.0

million lbs. The sales volume expectation reflects the current

market conditions, and the availability of new maple syrup from the

producers. The 2024 maple syrup crop was significantly better than

anticipated and will support the current market demand, while also

allowing for the partial replenishment of the reserve held by the

Producteurs et Productrices Acéricoles du Québec (“PPAQ”). The

reserve of PPAQ has been depleted in recent years from below

average crops.

Considering the elements discussed above, we

expect the Maple segment adjusted EBITDA to increase in fiscal 2024

over fiscal 2023, reflecting the benefits of the positive changes

we implemented over the last year.

Capital investments in the Maple segment have

decreased significantly in recent years. We expect to spend between

$1 million and $1.5 million annually on capital projects in this

segment. The main driver for the selected projects is improvement

in productivity and profitability through automation.

See “Forward-Looking Statements” section

below.

A full copy of Rogers second quarter 2024,

including management’s discussion and analysis and unaudited

condensed consolidated interim financial statements, can be found

at www.LanticRogers.com or on SEDAR+ at www.sedarplus.ca.

Cautionary Statement Regarding Non-IFRS

Measures

In analyzing results, we supplement the use of

financial measures that are calculated and presented in accordance

with IFRS with a number of non-IFRS financial measures. A non-IFRS

financial measure is a numerical measure of a company’s

performance, financial position or cash flow that excludes

(includes) amounts or is subject to adjustments that have the

effect of excluding (including) amounts, that are included

(excluded) in most directly comparable measures calculated and

presented in accordance with IFRS. Non-IFRS financial measures are

not standardized; therefore, it may not be possible to compare

these financial measures with the non-IFRS financial measures of

other companies having the same or similar businesses. We strongly

encourage investors to review the audited consolidated financial

statements and publicly filed reports in their entirety, and not to

rely on any single financial measure.

We use these non-IFRS financial measures in

addition to, and in conjunction with, results presented in

accordance with IFRS. These non-IFRS financial measures reflect an

additional way of viewing aspects of the operations that, when

viewed with the IFRS results and the accompanying reconciliations

to corresponding IFRS financial measures, may provide a more

complete understanding of factors and trends affecting our

business. Refer to “Non-IFRS measures” section at the end of the

MD&A for the current quarter for additional information.

The following is a description of the non-IFRS

measures we used in this press release:

- Adjusted gross margin is defined as gross margin adjusted for

“the adjustment to cost of sales”, which comprises the

mark-to-market gains or losses on sugar futures and foreign

exchange forward contracts as shown in the notes to the

consolidated financial statements and the cumulative timing

differences as a result of mark-to-market gains or losses on sugar

futures and foreign exchange forward contracts.

- Adjusted results from operating activities are defined as

results from operating activities adjusted for the adjustment to

cost of sales and goodwill impairment.

- EBITDA is defined as earnings before interest, taxes,

depreciation, amortization and goodwill impairment.

- Adjusted EBITDA is defined as adjusted results from operating

activities adjusted to add back depreciation and amortization

expenses.

- Adjusted net earnings is defined as net earnings adjusted for

the adjustment to cost of sales, goodwill impairment and the income

tax impact on these adjustments.

- Adjusted gross margin rate per MT is defined as adjusted gross

margin of the Sugar segment divided by the sales volume of the

Sugar segment.

- Adjusted gross margin percentage is defined as the adjusted

gross margin of the Maple segment divided by the revenues generated

by the Maple segment.

- Adjusted net earnings per share is defined as adjusted net

earnings divided by the weighted average number of shares

outstanding.

- Free cash flow is defined as cash flow from operations

excluding changes in non-cash working capital, mark-to-market and

derivative timing adjustments and financial instruments’ non-cash

amounts, and including the payment of deferred financing fees,

lease obligations, and capital expenditures and intangible assets,

net of value-added capital expenditures and LEAP Project related

capital expenditures.

In this press release, we discuss the non-IFRS

financial measures, including the reasons why we believe these

measures provide useful information regarding the financial

condition, results of operations, cash flows and financial

position, as applicable. We also discuss, to the extent material,

the additional purposes, if any, for which these measures are used.

These non-IFRS measures should not be considered in isolation, or

as a substitute for, analysis of our results as reported under

IFRS. Reconciliations of non-IFRS financial measures to the most

directly comparable IFRS financial measures are as follows:

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES TO

IFRS FINANCIAL MEASURES

|

|

Q2 2024 |

Q2 2023 |

|

Consolidated results(In thousands of dollars) |

Sugar |

Maple Products |

Total |

Sugar |

Maple Products |

Total |

|

Gross margin |

39,916 |

4,945 |

44,861 |

37,075 |

4,583 |

41,658 |

| Total

adjustment to the cost of sales(1) |

5,031 |

1,400 |

6,431 |

(2,930) |

(495) |

(3,425) |

|

Adjusted Gross Margin |

44,947 |

6,345 |

51,292 |

34,145 |

4,088 |

38,233 |

|

|

|

|

|

|

|

|

| Results from operating

activities |

22,909 |

1,795 |

24,704 |

20,634 |

1,222 |

21,856 |

| Total

adjustment to the cost of sales(1) |

5,031 |

1,400 |

6,431 |

(2,930) |

(495) |

(3,425) |

|

Adjusted results from operating activities |

27,940 |

3,195 |

31,135 |

17,704 |

727 |

18,431 |

|

|

|

|

|

|

|

|

| Results from operating

activities |

22,909 |

1,795 |

24,704 |

20,634 |

1,222 |

21,856 |

| Depreciation of property,

plant and equipment, amortization of intangible assets and

right-of-use assets |

5,285 |

1,675 |

6,960 |

4,878 |

1,711 |

6,589 |

|

EBITDA(1) |

28,194 |

3,470 |

31,664 |

25,512 |

2,933 |

28,445 |

|

|

|

|

|

|

|

|

| EBITDA(1 |

28,194 |

3,470 |

31,664 |

25,512 |

2,933 |

28,445 |

| Total

adjustment to the cost of sales(1) |

5,031 |

1,400 |

6,431 |

(2,930) |

(495) |

(3,425) |

|

Adjusted EBITDA |

33,225 |

4,870 |

38,095 |

22,582 |

2,438 |

25,020 |

|

|

|

|

|

|

|

|

| Net earnings |

|

|

13,936 |

|

|

11,062 |

| Total adjustment to the cost

of sales(1) |

|

|

6,431 |

|

|

(3,425) |

| Net change in fair value in

interest rate swaps(1) |

|

|

236 |

|

|

479 |

| Income

taxes on above adjustments |

|

|

(1,712) |

|

|

999 |

|

Adjusted net earnings |

|

|

18,891 |

|

|

9,115 |

| Net earnings per share

(basic) |

|

|

0.13 |

|

|

0.11 |

|

Adjustment for the above |

|

|

0.04 |

|

|

(0.02) |

|

Adjusted net earnings per share (basic) |

|

|

0.17 |

|

|

0.09 |

| (1) See

“Adjusted results” section of the MD&A for additional

information |

| |

|

|

YTD 2024 |

YTD 2023 |

|

Consolidated results(In thousands of dollars) |

Sugar |

Maple Products |

Total |

Sugar |

Maple Products |

Total |

|

Gross margin |

76,406 |

13,099 |

89,505 |

73,113 |

9,736 |

82,849 |

| Total

adjustment to the cost of sales(1) |

4,773 |

(667) |

4,106 |

(1,307) |

(1,316) |

(2,623) |

|

Adjusted gross margin |

81,179 |

12,432 |

93,611 |

71,806 |

8,420 |

80,226 |

|

|

|

|

|

|

|

|

| Results from operating

activities |

43,934 |

6,880 |

50,814 |

44,975 |

3,165 |

48,140 |

| Total adjustment to the cost

of sales(1) |

4,773 |

(667) |

4,106 |

(1,307) |

(1,316) |

(2,623) |

|

Adjusted results from operating activities |

48,707 |

6,213 |

54,920 |

43,668 |

1,849 |

45,517 |

|

|

|

|

|

|

|

|

| Results from operating

activities |

43,934 |

6,880 |

50,814 |

44,975 |

3,165 |

48,140 |

| Depreciation of property,

plant and equipment, amortization of intangible assets and

right-of-use assets |

10,560 |

3,335 |

13,895 |

9,591 |

3,427 |

13,018 |

|

EBITDA(1) |

54,494 |

10,215 |

64,709 |

54,566 |

6,592 |

61,158 |

|

|

|

|

|

|

|

|

| EBITDA(1) |

54,493 |

10,215 |

64,709 |

54,566 |

6,592 |

61,158 |

| Total adjustment to the cost

of sales(1) |

4,773 |

(667) |

4,106 |

(1,307) |

(1,316) |

(2,623) |

|

Adjusted EBITDA(1) |

59,267 |

9,548 |

68,815 |

53,259 |

5,276 |

58,535 |

|

|

|

|

|

|

|

|

| Net (loss) earnings |

|

|

27,788 |

|

|

25,736 |

| Total adjustment to the cost

of sales(1) |

|

|

4,106 |

|

|

(2,623) |

| Net change in fair value in

interest rate swaps(1) |

|

|

894 |

|

|

525 |

| Income

taxes on above adjustments |

|

|

(1,284) |

|

|

824 |

|

Adjusted net earnings |

|

|

31,504 |

|

|

24,462 |

| Net earnings per share

(basic) |

|

|

0.26 |

|

|

0.25 |

|

Adjustment for the above |

|

|

0.03 |

|

|

(0.02) |

|

Adjusted net earnings per share (basic) |

|

|

0.29 |

|

|

0.23 |

| (1) See

“Adjusted results” section |

| |

Conference Call and Webcast

Rogers will host a conference call to discuss

its second quarter fiscal 2024 results on May 9, 2024 starting at

17:30p.m. ET. To participate, please dial 1-888-717-1738. A

recording of the conference call will be accessible shortly after

the conference, by dialing 1-877-674-7070, access code 361624#.

This recording will be available until June 9, 2024. A live audio

webcast of the conference call will also be available via

www.LanticRogers.com.

About Rogers Sugar

Rogers is a corporation established under the

laws of Canada. The Corporation holds all of the common shares of

Lantic and its administrative office is in Montréal, Québec.

Lantic operates cane sugar refineries in Montréal, Québec and

Vancouver, British Columbia, as well as the only Canadian sugar

beet processing facility in Taber, Alberta. Lantic also operate a

distribution center in Toronto, Ontario. Lantic’s sugar products

are mainly marketed under the “Lantic” trademark in Eastern Canada,

and the “Rogers” trademark in Western Canada and include

granulated, icing, cube, yellow and brown sugars, liquid sugars,

and specialty syrups. Lantic owns all of the common shares of TMTC

and its head office is headquartered in Montréal, Québec. TMTC

operates bottling plants in Granby, Dégelis and in

St-Honoré-de-Shenley, Québec and in Websterville, Vermont. TMTC’s

products include maple syrup and derived maple syrup products

supplied under retail private label brands in approximately fifty

countries and sold under various brand names.

For more information about Rogers please visit

our website at www.LanticRogers.com.

Cautionary Statement Regarding

Forward-Looking Information

This report contains statements or information

that are or may be “forward-looking statements” or “forward-looking

information” within the meaning of applicable Canadian Securities

laws. Forward-looking statements may include, without limitation,

statements and information which reflect our current expectations

with respect to future events and performance. Wherever used, the

words “may,” “will,” “should,” “anticipate,” “intend,” “assume,”

“expect,” “plan,” “believe,” “estimate,” and similar expressions

and the negative of such expressions, identify forward-looking

statements. Although this is not an exhaustive list, we caution

investors that statements concerning the following subjects are, or

are likely to be, forward-looking statements:

- Future demand and related sales volume for refined sugar and

maple syrup;

- our LEAP Project;

- future prices of Raw #11;

- expected inflationary pressures on costs;

- natural gas costs;

- beet sugar production forecast for our Taber facility;

- the level of future dividends; and

- the status of government regulations and investigations.

Forward-looking statements are based on

estimates and assumptions made by us in light of our experience and

perception of historical trends, current conditions and expected

future developments, as well as other factors that we believe are

appropriate and reasonable in the circumstances, but there can be

no assurance that such estimates and assumptions will prove to be

correct. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Actual performance or results

could differ materially from those reflected in the forward-looking

statements, historical results, or current expectations.

Readers should also refer to the section “Risks

and Uncertainties” in this current quarter MD&A and the 2023

fourth quarter MD&A for additional information on risk factors

and other events that are not within our control. These risks are

also referred to in our Annual Information Form in the “Risk

Factors” section. Although we believe that the expectations and

assumptions on which forward-looking information is based are

reasonable under the current circumstances, readers are cautioned

not to rely unduly on this forward-looking information as no

assurance can be given that it will prove to be correct.

Forward-looking information contained herein is made as at the date

of this press release, and we do not undertake any obligation to

update or revise any forward-looking information, whether a result

of events or circumstances occurring after the date hereof, unless

so required by law.

For further information Mr.

Jean-Sébastien CouillardVice President of Finance, Chief Financial

Officer and Corporate SecretaryPhone: (514) 940-4350 Email:

jscouillard@lantic.ca

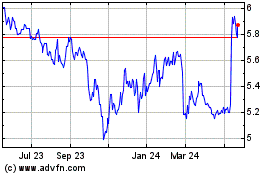

Rogers Sugar (TSX:RSI)

Historical Stock Chart

From Nov 2024 to Dec 2024

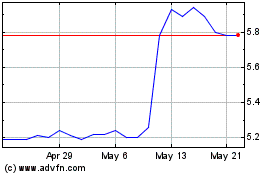

Rogers Sugar (TSX:RSI)

Historical Stock Chart

From Dec 2023 to Dec 2024