NXT Energy Solutions Announces Third Quarter 2023 Results

15 November 2023 - 8:10AM

NXT Energy Solutions Inc. ("NXT" or the "Company") (TSX: SFD;

OTCQB: NSFDF) today announced the Company's financial and operating

results for the three and nine months ended September 30, 2023. All

dollar amounts herein are in Canadian Dollars unless otherwise

identified.

Financial and Operating

Highlights

Key financial and operational highlights are

summarized below:

- on September 5, 2023. NXT announced

that it has executed a contract to provide an SFD® survey to an

independent oil and gas exploration company in Turkiye;

- the second tranche of the

convertible debenture with strategic partner Ataraxia Capital

contributed $0.27 million of cash;

- cash at September 30, 2023 was

$0.37 million;

- net working capital was ($3.47)

million at September 30, 2023;

- the Company recorded SFD®-related

revenues of $nil;

- a net loss of $1.70 million was

recorded for Q3-23, including stock-based compensation expense

("SBCE") and amortization expense of $0.48 million;

- a net loss of $5.03 million was

recorded for YTD 2023, including SBCE and amortization expense of

$1.50 million;

- net loss per common share for Q3-23

was $0.02 basic and $0.02 diluted;

- net loss per common share for YTD

2023 was $0.07 basic and $0.07 diluted;

- cash flow used in operating

activities was $0.95 million during Q3-23 and $3.36 million YTD

2023; and

- general and administrative

("G&A") expenses decreased by $0.12 million (13%) in Q3-23 as

compared to Q3-22 and G&A expenses decreased by $0.28 million

(10%) in YTD 2023 as compared to YTD 2022.

Key financial and operational highlights

occurring subsequent to Q3-23 are summarized below:

- mobilization of

the SFD® survey in Turkiye is expected to commence in November,

2023; and

- US$1,000,000

(CDN$1,379,000) of a convertible debenture was received.

On September 5, 2023 NXT announced that it has

executed a contract to provide an SFD® survey to an independent oil

and gas exploration company in Turkiye, which is strategically

located at the junction of Eastern Europe, Central Asia and the

Middle East. Operation planning for this contract has commenced and

NXT’s interpretations and recommendations are expected to be

delivered during the fourth quarter of 2023.

To support this SFD® Survey and other working

capital needs, on November 9, 2023 NXT announced it is offering a

multi-tranche convertible debenture (the "Debenture") under which

the subscribers will be able to purchase a principal amount of up

to US$2,500,000 (approximately CAD$3,447,500.) The Debentures bear

interest at 10.0% per annum, paid quarterly in arears, and are due

and payable two years after issuance of the Debenture. The

Debentures are convertible into common shares of NXT at a

conversion price of US$0.1808 (CAD$0.25) per common share.

US$1,000,000 (approximately CAD$1,379,000) of the Debenture has

already been subscribed by MCAPM, LP and Michael P. Mork.

The Company intends to complete the remaining

US$1,500,000 of the Debenture offering on or before December 15,

2023.

Commenting on the Debenture offering, Bruce G.

Wilcox, Interim CEO of NXT said, “NXT continues to make progress on

its business development plans. We have the capital necessary to

complete the SFD® contract in Turkiye and continue with other

negotiations for the deployment of our SFD® technology in other

regions. MCAPM LP and Michael P. Mork have been significant

shareholders of the Company for over 20 years and we appreciate

their confidence in the potential of NXT.”

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the "1933 Act"), or any state securities laws,

and accordingly, may not be offered or sold within the United

States except in compliance with the registration requirements of

the 1933 Act and applicable state securities requirements or

pursuant to exemptions therefrom. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of the securities in the United States

or in any other jurisdiction in which such offer, solicitation or

sale would be unlawful.

Summary highlights of NXT's 2023 third quarter

financial statements (with comparative figures to 2022) are noted

below. All selected and referenced financial information noted

below should be read in conjunction with the Company's third

quarter 2023 unaudited condensed consolidated interim financial

statements, the related Management's Discussion and Analysis

("MD&A").

(All in Canadian $)

|

|

Q3-23 |

Q3-22 |

2023 YTD |

2022 YTD |

|

Operating results: |

|

|

|

|

|

SFD®-related revenues |

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

|

SFD®-related costs, net |

|

348,169 |

|

|

230,518 |

|

|

968,199 |

|

|

974,292 |

|

|

General & administrative expenses |

|

841,200 |

|

|

963,433 |

|

|

2,644,261 |

|

|

2,922,660 |

|

|

Amortization and other expenses |

|

514,587 |

|

|

454,037 |

|

|

1,412,952 |

|

|

1,366,575 |

|

|

Net loss |

|

(1,703,956 |

) |

|

(1,647,988 |

) |

|

(5,025,412 |

) |

|

(5,263,527 |

) |

|

|

|

|

|

|

| Loss per common share, basic

and diluted: |

$ |

(0.02 |

) |

$ |

(0.03 |

) |

$ |

(0.07 |

) |

$ |

(0.08 |

) |

|

|

|

|

|

|

| Common shares outstanding as

at end of the period |

|

77,958,928 |

|

|

65,585,902 |

|

|

77,958,928 |

|

|

65,585,902 |

|

| Weighted average of common

shares, basic and diluted: |

|

77,735,682 |

|

|

65,386,959 |

|

|

77,283,442 |

|

|

65,333,954 |

|

|

|

|

|

|

|

|

Cash provided by (used in): |

|

|

|

|

|

Operating activities |

$ |

(953,051 |

) |

$ |

(533,787 |

) |

$ |

(3,363,362 |

) |

$ |

(2,229,816 |

) |

|

Financing activities |

|

253,114 |

|

|

(25,694 |

) |

|

3,469,891 |

|

|

(24,573 |

) |

|

Investing activities |

|

- |

|

|

500,000 |

|

|

- |

|

|

550,000 |

|

| Effect of foreign rate changes

on cash |

|

18,921 |

|

|

16,481 |

|

|

(558 |

) |

|

20,376 |

|

|

Net cash inflow (outflow) |

|

(681,016 |

) |

|

(43,000 |

) |

|

105,971 |

|

|

(1,684,013 |

) |

| Cash

and cash equivalents, beginning of the period |

|

1,050,424 |

|

|

616,842 |

|

|

263,437 |

|

|

2,257,855 |

|

| Cash

and cash equivalents, end of the period |

|

369,408 |

|

|

573,842 |

|

|

369,408 |

|

|

573,842 |

|

|

Short-term investments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Total

cash and short-term investments, end of the period |

|

369,408 |

|

|

573,842 |

|

|

369,408 |

|

|

573,842 |

|

|

|

|

|

|

|

|

Net working capital balance |

$ |

(3,468,900 |

) |

$ |

(1,060,858 |

) |

$ |

(3,468,900 |

) |

$ |

(1,060,858 |

) |

NXT's 2023 third quarter financial and operating

results have been filed in Canada on SEDAR at www.sedarplus.ca, and

will soon be available in the USA on EDGAR at www.sec.gov/edgar, as

well as on NXT's website at www.nxtenergy.com.

About NXT Energy Solutions

Inc.

NXT Energy Solutions Inc. is a Calgary-based

technology company whose proprietary SFD® survey system utilizes

quantum-scale sensors to detect gravity field perturbations in an

airborne survey method which can be used both onshore and offshore

to remotely identify traps and reservoirs with hydrocarbon and

geothermal exploration potential. The SFD® survey system enables

our clients to focus their exploration decisions concerning land

commitments, data acquisition expenditures and prospect

prioritization on areas with the greatest potential. SFD® is

environmentally friendly and unaffected by ground security issues

or difficult terrain and is the registered trademark of NXT Energy

Solutions Inc. NXT Energy Solutions Inc. provides its clients with

an effective and reliable method to reduce time, costs, and risks

related to exploration.

Contact Information

For investor and media inquiries please contact:

| Eugene Woychyshyn |

Michael

Baker |

| Vice President of Finance &

CFO |

Investor Relations |

| 302, 3320 – 17th AVE SW |

302, 3320 – 17th AVE SW |

| Calgary, AB, T3E 0B4 |

Calgary, AB, T3E 0B4 |

| +1 403 206 0805 |

+1 403 264 7020 |

| nxt_info@nxtenergy.com |

nxt_info@nxtenergy.com |

| www.nxtenergy.com |

www.nxtenergy.com |

Forward-Looking

Statements

Certain information provided in this press

release may constitute forward-looking information within the

meaning of applicable securities laws. Forward-looking information

typically contains statements with words such as "anticipate",

"believe", "estimate", "will", "expect", "plan", "schedule",

"intend", "propose" or similar words suggesting future outcomes or

an outlook. Forward-looking information in this press release

includes, but is not limited to, information regarding: timing of

the delivery of interpretation and recommendations of the Turkish

SFD® survey, business negotiations, opportunities and discussions,

including the timing thereof, business strategies, and timing of

the receipt and amount of the final tranche of the Debenture.

Although the Company believes that the expectations and assumptions

on which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because the Company can give no assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. Additional risk factors facing the Company are

described in its most recent Annual Information Form for the year

ended December 31, 2022 and MD&A for the three and nine month

periods ended September 30, 2023, which have been filed

electronically by means of the System for Electronic Document

Analysis and Retrieval (“SEDAR”) located at www.sedarplus.ca. The

forward-looking statements contained in this press release are made

as of the date hereof, and except as may be required by applicable

securities laws, the Company assumes no obligation to update

publicly or revise any forward-looking statements made herein or

otherwise, whether as a result of new information, future events or

otherwise.

Non-GAAP Measures

This news release contains disclosure respecting

non-GAAP performance measures including net working capital which

does not have a standardized meaning prescribed by US GAAP and may

not be comparable to similar measures presented by other entities.

This measure is included to enhance the overall understanding of

NXT’s ability to assess liquidity at a point in time. Readers are

urged to review the section entitled "Non-GAAP Measures” in NXT’s

MD&A for the three and nine month periods ended September 30,

2023 which is available under NXT's profile on SEDAR at

www.sedarplus.ca, for a further discussion of such non-GAAP

measures. The financial information accompanying this news release

was prepared in accordance with US GAAP unless otherwise noted.

Management's discussion and analysis of financial results and the

unaudited condensed consolidated interim financial statements and

notes for the three and nine months ended September 30, 2023, are

available through the Internet in the Investor Relations section of

www.nxtenergy.com or under NXT's SEDAR profile at

www.sedarplus.ca.

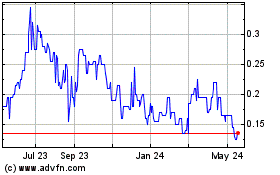

NXT Energy Solutions (TSX:SFD)

Historical Stock Chart

From Nov 2024 to Dec 2024

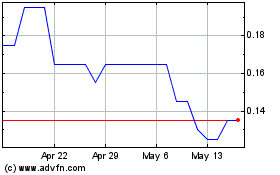

NXT Energy Solutions (TSX:SFD)

Historical Stock Chart

From Dec 2023 to Dec 2024