Sprott Inc. Announces Letter of Intent for the Acquisition of Toscana Capital Corporation and Toscana Energy Corporation

29 February 2012 - 11:00PM

PR Newswire (Canada)

TORONTO, Feb. 29, 2012 /CNW/ - Sprott Inc. ("Sprott") today

announced the signing of a letter of intent (the "LOI") reflecting

an agreement in principle to acquire Toscana Capital Corporation

and Toscana Energy Corporation (collectively, the "Toscana

Companies"). Upon closing of the proposed transaction, Sprott will

pay approximately $14 million in cash and common shares of Sprott

in consideration for the acquisition of the Toscana Companies, with

the possibility of up to an additional approximately $5.25 million

in common shares of Sprott to be issued as additional consideration

in three years upon the attainment of certain financial performance

hurdles ("Earn-out Shares"). As at the date hereof, the

Toscana Companies' managed entities have aggregate assets of

approximately $161 million. The transaction is subject to, among

other things, satisfactory results of due diligence investigations

of the Toscana Companies and the negotiation of definitive

agreements. The transaction is an arm's length transaction and is

subject to the approval of all applicable regulatory authorities,

including the Toronto Stock Exchange, as well as other third

parties, as necessary. In addition, the transaction remains subject

to approval by Sprott's board of directors. The parties will seek

to close the transaction by the middle of the second quarter of

2012. The transaction is expected to provide benefits across the

Sprott organization through the sharing of investment ideas, deal

origination, the development of new products, and by leveraging

Toscana's and Sprott's products and brands in the oil and gas

sector. "In the Toscana Companies, we are acquiring a leading team

of energy specialists and lenders as well as a Calgary presence,"

said Peter Grosskopf, Chief Executive Officer of Sprott. "We

believe that each of Toscana's energy lending business, managed

working interest portfolio and flow through investment vehicles

have significant growth potential. We look forward to working

with the team to enhance the available investment opportunities and

products for our combined clients." "We are excited to become part

of the Sprott organization. Sprott is a well-known natural

resources investor and with the combination of our two companies,

Sprott's footprint in Calgary will only grow," said Joseph Durante,

Chief Executive Officer of each of the Toscana Companies. About the

Toscana Companies Toscana Capital Corporation manages Toscana

Financial Income Trust ("TFIT"), an open-ended trust established in

June 2006 focused on providing mezzanine debt financing to

mid-sized private and public oil & gas companies. TFIT has a

current loan portfolio of approximately $54 million. Toscana Energy

Corporation manages Toscana Resource Corporation ("TRC"), a mutual

fund corporation established in April 2010 focused on investing in

medium and long-term non-operating working interests in oil &

gas assets, unitized production interests and royalties. TRC

currently has aggregate assets that have a value of approximately

$90 million. In addition, Toscana Energy Corporation is a technical

advisor to and co-manager of Maple Leaf 2011 Energy Income Fund LP

("MLEI"), a flow-through limited partnership focused on investing

in non-operated, direct working interests by participating in oil

& gas development projects (drilling programs). MLEI is

co-managed by Toscana Energy Corporation and a third party

manager. MLEI currently has aggregate assets that have a

value of approximately $17 million. About Sprott Inc. Sprott Inc.

is a leading independent asset manager dedicated to achieving

superior returns for its clients over the long term. The Company

currently operates through four business units: Sprott Asset

Management LP, Sprott Private Wealth LP, Sprott Consulting LP, and

Sprott U.S. Holdings Inc. Sprott Asset Management is the

investment manager of the Sprott family of mutual funds and hedge

funds and discretionary managed accounts; Sprott Private Wealth

provides wealth management services to high net worth individuals;

and Sprott Consulting provides management, administrative and

consulting services to other companies, including Sprott Resource

Corp. , Sprott Resource Lending Corp. and Sprott Power Corp. .

Sprott U.S. Holdings Inc. includes Global Resource Investments Ltd,

Terra Resource Investment Management Inc., and Resource Capital

Investments Inc. Sprott Inc. is headquartered in Toronto, Canada,

and its common shares are listed on the Toronto Stock Exchange

under the symbol "SII". For more information on Sprott Inc., please

visit www.sprottinc.com. Forward-Looking Statements This release

contains "forward-looking statements" which reflect the current

expectations of Sprott Inc. These statements reflect

management's current beliefs with respect to future events and are

based on information currently available to management.

Forward-looking statements in this press release include, but are

not limited to, statements with respect to the negotiation of the

definitive agreements for the transaction, the terms of such

definitive agreements, the closing of the transaction and the

anticipated benefits from the transaction. Forward-looking

statements involve significant known and unknown risks,

uncertainties and assumptions, including with respect to the

anticipated completion of the negotiation of the definitive

agreements, the closing of the transaction, the timing and receipt

of all applicable regulatory approvals and third party consents,

the anticipated benefits from the transaction and the satisfaction

of other conditions to the completion of the transaction.

Many factors could cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements including, without limitation,

those listed under the heading "Risk Factors" in Sprott's annual

information form dated March 22, 2011 as well as that the closing

of the transaction could be delayed if the necessary regulatory

approvals and third party consents are not obtained on the

timelines planned or the transaction may not be completed at all if

these approvals are not obtained or any other conditions to closing

are not satisfied. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking statements prove incorrect, actual results,

performance or achievements could vary materially from those

expressed or implied by the forward-looking statements contained in

this release. Although the forward-looking statements contained in

this release are based upon what Sprott believes to be reasonable

assumptions, management cannot assure investors that actual

results, performance or achievements will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this release and Sprott does not assume any

obligation to update or revise them to reflect new events or

circumstances, except as required by law. Sprott Inc. CONTACT:

Investor contact information: (416) 203-2310 or 1 (877) 403-2310or

ir@sprott.com.

Copyright

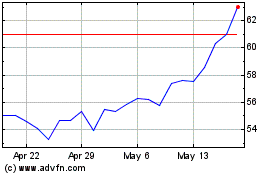

Sprott (TSX:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

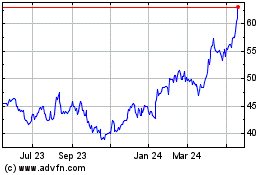

Sprott (TSX:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024