STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

announce a client-backed upgrade to our Canadian fracturing fleet

as well as a capital budget and balance sheet update.

Tier Four Canadian Fracturing Fleet

Upgrade Program

STEP announces that it has entered into a

three-year services agreement with a leading intermediate E&P

company (“Producer”) in Canada whereby STEP will refurbish 16 pumps

with 2,500 horsepower (“HP”) Caterpillar Tier 4 Dynamic Gas

Blending (DGB) engines at a cost of $26.8 million. The 40,000 HP

upgrade has been secured by a $10 million prepayment commitment to

STEP by the Producer and a three-year, first-right-of-use

agreement.

Tier 4 DGB engines with dual-fuel (natural gas

and diesel) technology offer up to 85% reduction in diesel fuel

use, in addition to reducing nitrogen oxide and particulate matter

emissions relative to diesel-powered Tier 2 engines. STEP’s

experience has shown that over a 12-month period at high

utilization, leading-edge Tier 4 DGB engines can save clients up to

$10 million in fuel costs while adding enhanced reliability.

Pricing on the Tier 4 fracturing work is linked

to commodity prices and includes cost inflation adjustment

mechanisms, apportioning these risks between STEP and the Producer.

This creates a formula that delivers both cost and availability

certainty to the Producer, while generating returns that will be

sufficient to meet STEP’s internal return thresholds. STEP

anticipates refurbishments will occur at a rate of roughly two

pumps per month over an eight-month period starting in October 2022

and ending in mid-Q2 2023. Given the staggered upgrade timing and

the cycling in of other pumps held out for maintenance back-up,

STEP does not anticipate any reductions to its effective fracturing

capacity over this period. Importantly, the deployment of this

technology does not represent additional capacity to a Canadian

fracturing market that is viewed as roughly in balance from a

supply-demand perspective.

STEP’s President and Chief Operating Officer,

Steve Glanville, commented “STEP began operations in Western Canada

as a technology leader committed to ESG principles. This upgrade

program continues that legacy, combining all elements of STEP’s

core values and uniquely aligning us with a leading E&P

company. We’ve consistently said that the optimal working

relationship between energy service and E&P companies is a

partnership whereby both parties benefit from a close working

arrangement that meets their own economic and ESG requirements. We

believe that the Canadian energy industry’s ability to meaningfully

participate in the world’s growing demand for energy will benefit

from a model where risks and returns are shared by resource owners

and key service providers. We are thrilled to put an arrangement

like this in place.”

In addition to the Tier 4 DGB upgrade, STEP will

retrofit certain other assets, including the upgrade of Tier 2

diesel-powered fracturing pumps to add the Company’s

industry-leading Tier 2 dual-fuel kits. At the conclusion of the

upgrade program, STEP will have 227,500 HP of dual-fuel capable

fracturing equipment, representing approximately 46% of the

Company’s total fracturing horsepower. STEP also operates 80,000 HP

of Tier 4 conventional equipment in the U.S., bringing the total

proportion of low emissions horsepower in STEP’s fleet to just over

60%.

Capital Spending and Balance Sheet

Update

STEP’s Board of Directors has approved an

increase to the Company’s 2022 capital program to $87.5 million.

The increased budget reflects the Tier 4 DGB announcement as well

as the cash component of the recently announced transaction of

acquired coiled tubing assets in the U.S.

STEP expects a cash outlay of $75 million within

calendar 2022, offset in part by the receipt of the $10 million

prepayment which will be received in increments based on agreed

completion milestones. The remaining balance will fall into

2023.

STEP remains on track to exit 2022 with a Net

debt to Adjusted EBITDA ratio of less than 1.0x. The Company will

continue to focus on debt repayment but will invest

opportunistically where returns can be justified. The global

community of energy investors is increasingly relying on free cash

flow generation to value companies and STEP believes that this

fleet upgrade combined with the recent acquisition of deep coil

assets and field professionals will strengthen that free cash flow

profile going forward.

Corporate Presentation

STEP has updated its Corporate Presentation in

line with this announcement. The presentation can be found on the

Company’s website.

Non-IFRS Measures

This press release includes terms and

performance measures commonly used in the oilfield services

industry that are not defined under IFRS. The terms presented are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS

measures have no standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other issuers.

The non-IFRS measure should be read in conjunction with the

Company’s quarterly financial statements and annual financial

statements and the accompanying notes thereto.

“Adjusted EBITDA” is a financial measure not

presented in accordance with IFRS and is equal to net (loss) income

before finance costs, depreciation and amortization, (gain) loss on

disposal of property and equipment, current and deferred income tax

provisions and recoveries, equity and cash settled share-based

compensation, transaction costs, foreign exchange forward contract

(gain) loss, foreign exchange (gain) loss, and impairment losses.

Adjusted EBITDA is presented because it is widely used by the

investment community as it provides an indication of the results

generated by the Company’s normal course business activities prior

to considering how the activities are financed and the results are

taxed. The Company uses Adjusted EBITDA internally to evaluate

operating and segment performance, because management believes it

provides better comparability between periods. “Net debt” is equal

to loans and borrowings before deferred financing charges less cash

and cash equivalents. Adjusted Net debt to Adjusted EBITDA ratio is

a non-IFRS ratio and is calculated as Net debt divided by Adjusted

EBITDA.

Reconciliations of the non-IFRS financial

measure of Adjusted EBITDA to the IFRS financial measure of net

income (loss), and the composition of Net debt can be found in

STEP’s Management Discussion and Analysis for the second quarter

2022 dated as of June 30, 2022 (under “Non-IFRS Measures and

Ratios”) which is available on SEDAR (www.sedar.com) and

incorporated herein by reference.

Forward-Looking Information &

Statements and Future Oriented Financial Information and Financial

Outlooks

Certain statements contained in this press

release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipates”, “expects”,

“expected”, “opportunity”, “may”, “should”, and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. While STEP believes the expectations reflected in the

forward-looking statements included in this press release are

reasonable, such statements are not guarantees of future

performance or outcomes and may prove to be incorrect and should

not be unduly relied upon.

In particular, but without limitation, this

press release contains forward-looking statements pertaining to:

potential reductions to diesel fuel use (and related cost savings)

using Tier 4 DGB engines, expected rate and duration of the Tier 4

DGB engine refurbishment process, anticipated effect on the

Company’s effective fracturing capacity, anticipated receipt of

prepayment amounts, anticipated STEP fleet capacity, and the cost

to refurbish equipment.

The forward-looking information and statements

contained in this press release reflect several material factors

and expectations and assumptions of STEP including, without

limitation: the general continuance of current or, where

applicable, assumed industry conditions; the effect of inflation on

the cost of goods and equipment; the ability of suppliers to

complete the Tier 4 DBG upgrade process; the fulfilment of the

Producer’s obligations under its contract with the Company; STEP’s

ability to utilize its equipment; STEP’s ability to collect on

trade and other receivables; STEP’s ability to obtain and retain

qualified staff and equipment in a timely and cost effective

manner; levels of deployable equipment in the marketplace; future

capital expenditures to be made by STEP; future funding sources for

STEP’s capital program; STEP’s future debt levels; and the

availability of unused credit capacity on STEP’s credit lines. STEP

believes the material factors, expectations and assumptions

reflected in the forward-looking information and statements are

reasonable, but no assurance can be given that these factors,

expectations and assumptions will prove correct.

This press also release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about STEP’s expected cash outlay, Net debt,

Adjusted EBITDA, and Net debt to Adjusted EBITDA ratio, all of

which are subject to the same assumptions, risk factors,

limitations, and qualifications as set forth in the above

paragraphs. The actual results of operations of STEP and the

resulting financial results will likely vary from the amounts set

forth in this press release and such variation may be material.

STEP and its management believe that the FOFI has been prepared on

a reasonable basis, reflecting management's best estimates and

judgments as of the date hereof; however, because this information

is subjective and subject to numerous risks, it should not be

relied on as necessarily indicative of future results.

The forward-looking information and FOFI

contained in this press release speak only as of the date of the

document, and none of STEP or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. Actual results could also differ materially from those

anticipated in these forward‐looking statements and FOFI due to the

risk factors set forth under the heading “Risk Factors” in STEP’s

Annual Information Form for the year ended December 31, 2021 dated

March 16, 2022 and under the heading “Risk Factors and Risk

Management” in STEP’s Management Discussion and Analysis for the

second quarter 2022 dated as of June 30, 2022.

About STEP

STEP is an energy service company providing deep

capacity coiled tubing and hydraulic fracturing services to

operators in North America. In Canada, STEP delivers coiled tubing

and fracturing services in the Western Canadian Sedimentary Basin.

In the U.S., STEP provides coiled tubing and fracturing services in

the Permian Basin and Eagle Ford Shale Play in Texas along with

coiled tubing services in the Bakken Shale Play in North Dakota and

the Uinta-Piceance and Niobrara-DJ Basin in Utah and Colorado,

respectively. STEP delivers the expertise – the people, the

equipment, and the knowledge – required to improve operational

efficiencies and productivity in extended reach wellbore designs.

At the heart of STEP’s strategy is the company’s commitment to the

execution of safe projects, its dedication to its team of field

professionals and ultimately to providing oil and gas producers an

Exceptional Client Experience.

For more information please

contact:

|

Steve GlanvillePresident & Chief Operating Officer |

Klaas DeemterChief Financial Officer |

|

Telephone: 403-457-1772 |

Telephone: 403-457-1772 |

Email: investor_relations@step-es.comWeb:

www.stepenergyservices.com

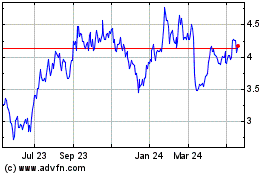

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Dec 2024 to Jan 2025

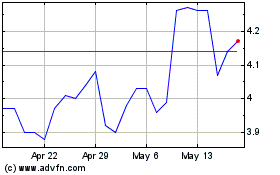

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Jan 2024 to Jan 2025