Trican Well Service Ltd. ("

Trican" or the

"Company") (TSX: TCW) is pleased to announce the

successful completion of its 2017-2018 normal course issuer bid

("

NCIB") that was announced on September 28, 2017.

Pursuant to the NCIB, Trican purchased and canceled the maximum

allowable number of common shares ("

Common

Shares") of the Company under the bid, totaling 34,274,375

Common Shares for total consideration of $119 million at a weighted

average price per share of $3.47 (before broker commissions).

Additionally, the Company announces that the

Toronto Stock Exchange (the "TSX") has accepted

its application to renew this program and make a NCIB to purchase,

from October 3, 2018 to October 2, 2019 (or until such earlier time

as the NCIB is completed or terminated at the option of Trican),

certain of its Common Shares. All purchases will be made through

the facilities of the TSX or Canadian alternative trading systems

at the prevailing market price at the time of such transaction.

As at September 21, 2018, there were 313,094,349

Common Shares issued and outstanding. The number of Common Shares

which may be purchased during the period of the NCIB will not

exceed 30,923,345 Common Shares, which is approximately 10% of the

public float for the Common Shares. The public float for the

Company's Common Shares as at September 21, 2018 was 309,233,454.

Except as permitted under the TSX rules, the Company will not

purchase on any given trading day under the NCIB more than 645,952

Common Shares, being 25% of the average daily trading volume of the

Common Shares on the TSX for the six calendar months ended August

31, 2018 of 2,583,808 Common Shares. All Common Shares purchased

through the NCIB will be returned to treasury for cancellation.

As the Company outlined in its Q2-2018

Management’s Discussion & Analysis (MD&A) and discussed

during its Q2-2018 quarterly earnings call, the NCIB has been put

in place because Trican believes, in the context of equity market

conditions, that purchasing Common Shares is a superior investment

for the Company. Management continually evaluates all alternatives

to maximize this investment. Previously, the Company had indicated

it would allocate $70 million towards share repurchases for the

period commencing August 3, 2018 to November 7, 2018, of which $30

million has been spent completing the 2017-2018 NCIB.

In the months following the release of the Q2-

2018 MD&A, the Company has seen highly competitive spot market

pricing and lower than previously anticipated industry well

completions activity. Trican expects the competitive pricing

environment to persist through the fourth quarter of 2018. Trican

remains disciplined on its job pricing, but this pricing discipline

is expected to result in reduced fourth quarter activity levels and

margins relative to the Company’s previous expectations and the

fourth quarter of 2017. Further, although interest in Trican’s

services for the first quarter of 2019 remains strong, we are still

waiting for confirmation of 2019 capital budgets from our clients

to support our 2019 activity assumptions for hydraulic fracturing

services. We expect to firm up our activity assumptions in the

coming months which is typical at the start of the fourth

quarter.

Given these factors, Trican will remain active

on its NCIB, but will now allocate $20 million for NCIB repurchases

by November 7, 2018. Under current equity market conditions, Trican

anticipates that this revised spend will still achieve 2018-2019

bid utilization levels of 25 to 30% by November 7, 2018, which are

consistent with the Company’s previous intentions.

Trican has consistently stated its commitment to

a financially prudent capital structure and that the NCIB would be

managed in accordance with this objective. As the Company’s

financial position dictates and Trican develops greater certainty

regarding market activity, pricing and availability of cash

resources resulting from optimization of idle and non-revenue

generating assets, the Company will evaluate and adjust the

investment level into the NCIB.

Trican has engaged BMO Nesbitt Burns Inc. as its

broker for the purpose of effecting purchases under the Bid and has

entered into an automatic purchase plan for the NCIB. All purchases

under the Bid will be at the discretion of Trican, subject to the

rules of the TSX.

FORWARD-LOOKING STATEMENTS

Certain statements and other information

contained in this press release constitute “forward-looking

information” and/or “statements” within the meaning of applicable

Canadian securities legislation (collectively "forward-looking

statements"). These statements relate to future events or our

future performance. All statements in this press release other than

those relating to historical facts or current conditions are

forward looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

"anticipate", "achieve", "estimate", "expect", "intend", "plan",

"planned", and other similar terms and phrases. These

forward-looking statements involve known and unknown risks,

uncertainties and other factors (many of which are beyond our

control) that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. We believe the expectations reflected in these

forward-looking statements are reasonable but no assurance can be

given that these expectations will prove to be correct. Therefore,

the forward-looking statements included in this press release

should not be unduly relied upon.

In particular, this press release contains

forward-looking statements pertaining to, but not limited to,

discussion of planned share repurchases under the NCIB and the

Company’s expected performance in Q4-2018.

Our actual results, performance or achievements

could differ materially from those anticipated in these forward

looking statements as a result of general economic, market and

business conditions, as well as the risk factors set forth in the

“Risk Factors” section of our most recent Annual Information Form

and annual MD&A. Readers are cautioned that the foregoing lists

of factors are not exhaustive. Forward-looking statements are based

on a number of factors and assumptions which have been used to

develop such statements and information but which may prove to be

incorrect. Although management of Trican believes that the

expectations reflected in such forward-looking statements or

information are reasonable, undue reliance should not be placed on

forward-looking statements because Trican can give no assurance

that such expectations will prove to be correct. In addition to

other factors and assumptions which may be identified in this

document, assumptions have been made regarding, among other things:

crude oil and natural gas prices; the impact of increasing

competition; the general stability of the economic and political

environment; the timely receipt of any required regulatory

approvals; Trican's ability to continue its operations for the

foreseeable future and to realize its assets and discharge its

liabilities and commitments in the normal course of business;

industry activity levels; Trican's policies with respect to

acquisitions; the ability of Trican to obtain qualified staff,

equipment and services in a timely and cost efficient manner; the

ability to operate our business in a safe, efficient and effective

manner; the ability of Trican to obtain capital resources and

adequate sources of liquidity; the performance and characteristics

of various business segments; the regulatory framework; the timing

and effect of pipeline, storage and facility construction and

expansion; and future commodity, currency, exchange and interest

rates.

The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Trican disclaims any intention or obligation to update or revise

any forward-looking statements in this press release as a result of

new information or future events, except as may be required under

applicable Canadian securities legislation.

Additional information regarding Trican

including Trican’s most recent Annual Information Form is available

under Trican’s profile on SEDAR (www.sedar.com).

ABOUT TRICAN

Headquartered in Calgary, Alberta, Trican

provides a comprehensive array of specialized products, equipment

and services that are used during the exploration and development

of oil and gas reserves.

Requests for further information should be

directed to:

Dale Dusterhoft Chief Executive Officer E-mail:

ddusterhoft@trican.ca

Michael Baldwin Senior Vice President,

Corporate DevelopmentE-mail: mbaldwin@trican.ca

Robert Skilnick Chief Financial Officer E-mail:

robert.skilnick@trican.ca

Phone: (403) 266-0202 Fax: (403) 237-7716 2900, 645 – 7th Avenue

S.W. Calgary, Alberta T2P 4G8

Please visit our website at

www.tricanwellservice.com

PDF

available: http://resource.globenewswire.com/Resource/Download/a5f1c018-5c64-44cf-9c6c-b47affb6f097

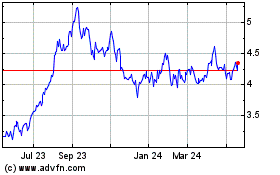

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Dec 2024 to Jan 2025

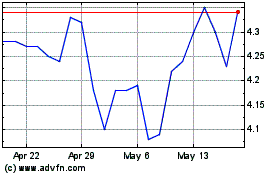

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Jan 2024 to Jan 2025