U.S. CFPB Announces Settlement With TD Bank

21 August 2020 - 8:48AM

Dow Jones News

By Stephen Nakrosis

The U.S. Consumer Financial Protection Bureau said Thursday it

reached a settlement with TD Bank, NA, regarding the marketing and

sale of the bank's optional overdraft service, known as Debit Card

Advance.

The CFPB said it found "that TD Bank's overdraft enrollment

practices violated the Electronic Fund Transfer Act and Regulation

E by charging consumers overdraft fees for ATM and one-time debit

card transactions without obtaining their affirmative consent, and

that TD Bank engaged in deceptive and abusive acts or practices in

violation of the Consumer Financial Protection Act of 2010."

Under the terms of the consent order, the CFPB said, TD Bank

will pay about $97 million in restitution to some 1.42 million

consumers and will also pay a civil fine of $25 million.

TD Bank said the settlement "largely addresses certain

disclosure and enrollment processes for customers who enrolled in

the service at a TD store or offsite event between 2014 to 2018,"

and also said it "did not admit to any wrongdoing under the civil

settlement."

Greg Braca, TD Bank president and chief executive, said,

"Although we disagree with the CFPB's conclusions, we have

cooperated fully to resolve this matter and are moving forward with

a continued focus on meeting the needs of our customers."

"Throughout the period in question, TD had a clear process to

secure formal consent before providing this service to customers,

enabling them to make an informed and conscious choice," Mr. Braca

added.

--Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

August 20, 2020 18:33 ET (22:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

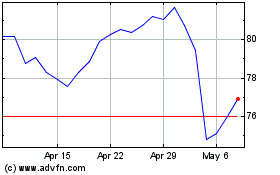

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Apr 2024 to May 2024

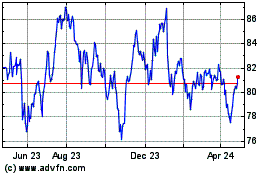

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From May 2023 to May 2024