Crowflight Restructures $55 Million Debt Facility: Pays Off $42 Million of Debt and Adds $19.4 Million in Cash

28 October 2008 - 11:45PM

Marketwired

CROWFLIGHT MINERALS INC. (Crowflight, the Company) (TSX VENTURE:

CML) is pleased to announce that in conjunction with RMB Resources

Inc. acting as agent for Crowflight's lender, FirstRand Ireland

Plc, Crowflight has restructured the Cdn $55 million debt facility

entered into in February 2008 (see Press Release February 13,

2008).

Both Crowflight and RMB Resources have decided to close out most

of the nickel forward sales contract entered into in July 2008 (see

Press Release July 30, 2008). At that time, Crowflight hedged 20.5

million pounds of nickel at a price of US$8.49 per pound over a

four year period. Details of the debt restructuring are as

follows:

- The following amounts of nickel were closed out recently to

raise net proceeds of Cdn $63 million. A total of 18.2 million

pounds of nickel or 89% of the hedge has been monetized.

------------------------------

Calendar Year Million pounds

------------------------------

2008 0.4

------------------------------

2009 1.6

------------------------------

2010 5.7

------------------------------

2011 5.5

------------------------------

2012 4.9

------------------------------

- The proceeds of Cdn $63 million are being used to repay in its

entirety the Tranche 1 debt facility of Cdn $10.35 million

(including capitalized interest) and a minimum of Cdn $33.2 million

(including capitalized interest) of the Cdn$45 million Tranche 2

debt facility. As of October 27, 2008, Crowflight had only drawn

Cdn $50.2 million of the Cdn $55.0 million debt facility. As part

of the debt restructuring, Crowflight and the Lender have agreed to

cancel the 16.3 million warrants exercisable at Cdn $0.64 per share

associated with the Tranche 1 facility and the 1 million warrants

exercisable at Cdn $0.64 per share associated with the Tranche 2

facility.

- After monetization of the nickel hedge, Crowflight will still

have 2.27 million pounds of nickel hedged at US$8.49 per pound in

2009. In addition Crowflight will put in place a currency hedge

covering the Canadian dollar amount of the nickel hedge in

2009.

- Crowflight's new debt outstanding under the restructured

facility is Cdn $7.6 million, which is repayable to the Lender over

2010, 2011 and 2012 in equal quarterly installments. As a part of

the restructured facility Crowflight will make mandatory quarterly

prepayments to the Lender equal to 40% of after debt service

project cash flow during 2009, falling to 15% thereafter.

- The restructuring will provide Crowflight with Cdn $19.4

million in cash and the restructured facility calls for Cdn$10

million to be applied to the facility proceeds account for

completion of the Bucko Mine and project working capital, Cdn$3

million to the facility debt service reserve and the remainder to

Crowflight for working capital and general corporate purposes.

Under the restructured facility Crowflight has agreed to grant 20

million Crowflight warrants, the Restructuring Warrants, at 125% of

the 20 day VWAP (volume weighted average price) at closing to the

Lender, subject to regulatory approval. Any proceeds from the

warrants will be used to prepay or repay the restructured facility

debt outstanding.

- Crowflight in conjunction with RMB may also implement future

strategic currency and nickel hedges both to protect Crowflight

cash flow and meet Lender requirements.

Commented Mike Hoffman, President and CEO of Crowflight, "During

discussions with our lender during the week of October 14th, we

noticed that the value of our nickel hedge was far in excess of our

market capitalization due to a weakening Canadian dollar and weaker

nickel prices. We realized we had a very unique opportunity to

lower our lender's risk by repaying a large portion of the debt and

dramatically improve our financial situation with the debt

repayment while leaving us with sufficient cash to ramp up the

Bucko Mine to commercial production. It is a testament to our Board

and the flexibility of RMB Resources and FirstRand Ireland plc that

we could execute this opportunity during the window that was

available on a very timely basis. With our existing cash balances

and the additional funds provided by the restructured facility,

Crowflight is in a strong position as we bring on line Canada's

newest primary nickel mine."

Crowflight expects to initiate production of nickel concentrate

at the Bucko Mine by the end of October. Final testing and

commissioning of mill components continues to advance.

Crowflight Minerals - Canada's Next Nickel Producer

Crowflight Minerals Inc. (TSX VENTURE: CML) is a Canadian junior

mining company that is bringing the Bucko Lake Nickel Mine near

Wabowden, Manitoba into production. Full commercial production is

expected to be achieved at Bucko in early 2009. The Company is also

focused on nickel, copper and Platinum Group Mineral (PGM) projects

in the Thompson Nickel Belt and Sudbury Basin.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the

information in this press release constitutes "forward-looking

information" within the meaning of Canadian securities law. Such

forward-looking information may be identified by words such as

"plans", "proposes", "estimates", "intends", "expects", "believes",

"may", "will" and include without limitation, statements regarding

estimated capital and operating costs, expected production

timeline, benefits of updated development plans, foreign exchange

assumptions and regulatory approvals. There can be no assurance

that such statements will prove to be accurate; actual results and

future events could differ materially from such statements. Factors

that could cause actual results to differ materially include, among

others, metal prices, competition, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside

the control of the Company. Investors are cautioned not to put

undue reliance on forward-looking information. Except as otherwise

required by applicable securities statutes or regulation, the

Company expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new

information, future events or otherwise.

Total Shares Outstanding: 269.7MM

Fully Diluted: 307.9MM

52-Week Trading Range: C$0.13 - $0.93

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: Crowflight Minerals Inc. Mike Hoffman President and

CEO (416) 861-2964 Crowflight Minerals Inc. Heather Colpitts

Manager, Investor and Public Relations (416) 861-5803 Email:

info@crowflight.com Website: www.crowflight.com

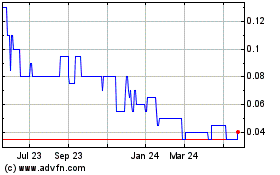

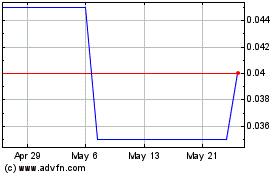

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Feb 2025 to Mar 2025

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Mar 2024 to Mar 2025