Decklar Resources Inc. (TSX-V: DKL)

(OTCQX: DKLRF) (FSE: A1U1) (

the “Company” or

“Decklar”) announces the entering into of a non-binding

Letter of Intent to purchase all of the issued and outstanding

ordinary shares of Westfield Exploration and Production Limited

(“Westfield”), a Nigerian entity that has entered into a Risk

Finance and Technical Services Agreement (“RFTSA”) with Erebiina

Energy Resources Limited (“Erebiina”) to participate in the Emohua

Field in Nigeria, located in OML 22, which is 6 km west of Port

Harcourt.

The Emohua Field

The Emohua Field, which was recently awarded to

Erebiina (60%) and the balance (40%) to other local Nigerian

entities in the 2020/2021 Marginal Field Bid Round, is situated

onshore on dry land terrain in the southeastern section of OML 22

in the Eastern Niger Delta area. The Emohua Field is situated

approximately 6 km west of the city of Port Harcourt in Rivers

State and approximately 30 km west of the Oza Field, which Decklar

is currently developing. The Bonny Oil Export Terminal and Bonny

LNG plant are located approximately 50 km south of the Emohua

Field.

The Emohua Field was formerly operated by Shell

Petroleum Development Company of Nigeria Limited (“SPDC”). It was

awarded to Erebiina by the Federal Government of Nigeria in 2021 as

part of the Marginal Field Program.

One well (Emohua-1) was drilled by Shell

Production Development Company (“SPDC”) in 1979 to a depth of

11,050 ft and encountered oil and gas in several stacked

reservoirs. The well was suspended by SPDC as an oil and gas

discovery. Data available includes 3-D seismic acquired in

2000/2001 and wireline log data. Petrophysical analysis showed the

presence of nine hydrocarbon bearing zones ranging from 20 ft to 70

ft thick. Seismic interpretation also shows upside potential in the

deeper undrilled/untested zones where potential closures exist.

The next planned stages for development of the

Emohua Field include re-entering the existing Emohua-1 well,

drilling and completion of up to nine additional wells,

installation of production and export facilities, and construction

of flowlines. The Emohua Field can potentially be placed on

production in an expedited manner immediately after the re-entry of

the Emohua-1 well due to existing oil and gas export pipelines

being located within 5 km of the well.

The full field development plan will include the

expansion of the processing facilities to enable handling and

processing of up to 30,000 barrels of crude per day for the

expected peak production levels.

Letter of Intent between Westfield and

Decklar

Decklar and Westfield have signed a non-binding

letter of intent with respect to the proposed acquisition by

Decklar (the “Transaction”) of all of the issued and outstanding

ordinary shares of Westfield (the “Westfield Shares”). Westfield

has separately entered into an RFTSA with Erebiina in respect of

the 60% equity interest that was awarded to Erebiina for the Emohua

Field. Further, Decklar is aware that Westfield is seeking to enter

separate RFTSAs with one or more parties in relation to the

remaining 40% interest in the Emohua Field.

The Transaction terms include a cash payment of

US$7 million, which has already been paid as a deposit to be

credited against the final purchase price, and the issuance of up

to 6,000,000 common shares of Decklar (“Decklar Shares”) as

consideration for the acquisition of all the issued and outstanding

Westfield Shares. In the event Westfield enters into additional

RFTSAs in respect of the remaining 40% interest, up to an

additional 2,500,000 Decklar Shares will be issued to the

shareholders of Westfield. The specific terms of the Transaction

remain under negotiation, and the Transaction will be structured,

and definitive agreements entered into following the review and

consideration of applicable tax, securities, corporate law, and

other relevant considerations and shall be subject to the mutual

agreement of Decklar and Westfield, acting reasonably. The Letter

of Intent shall terminate with Decklar and Westfield having no

further obligations to each other under the agreement upon mutual

written agreement to terminate or by either party if definitive

agreements have not been entered into by November 30, 2021. The

Transaction will be subject to customary conditions precedents to

completion, including, if applicable, approval of the TSX Venture

Exchange.

Duncan Blount, CEO of Decklar Resources,

remarked “the Emohua Field has the potential to be a significant

addition to the Decklar portfolio. This field is located close to

the Nigerian oil industry service city of Port Harcourt.

Additionally, similar to our other fields, Emohua has a

considerable infrastructure advantage with existing oil and gas

export pipelines in close proximity. This will allow Decklar to use

an Early Production Facility (“EPF”) after the Emohua-1 re-entry

well as part of a fast-track development plan to realize near-term

cash flow. This field also has significant upside in terms of

reserves and production from the previously discovered nine

hydrocarbon-bearing zones. In addition to the Oza and Asaramatoru

Fields, the Emohua Field marks the third field that Decklar has

acquired an interest in – and by following a similar strategy, we

look forward to advancing all of these high quality proven

undeveloped fields.”

For further information:

Duncan T. BlountChief Executive

Officer Telephone:

+1 305 890 6516Email: dblount@decklarresources.com

David HalpinChief Financial Officer

Telephone: +1 403

816 3029Email: davidhalpin@decklarpetroleum.com

Investor Relations: info@decklarresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Language

Certain statements made and information

contained herein constitute "forward-looking information" (within

the meaning of applicable Canadian securities legislation),

including entering into definitive agreements in respect of the

Transaction and satisfaction of conditions precedent to completion

of the Transaction. All statements in this news release, other than

statements of historical facts, are forward-looking statements.

Such statements and information (together, "forward looking

statements") relate to future events or the Company's future

performance, business prospects or opportunities. There is no

certainty that definitive agreements in respect of the Transaction

will be entered into, or that any conditions precedent contained

therein will be satisfied on terms satisfactory to the parties or

at all.

All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect, "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions) are not statements of historical

fact and may be "forward-looking statements". Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. The Company believes that the expectations reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

The Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. These forward-looking statements involve risks and

uncertainties relating to, among other things, changes in oil

prices, results of exploration and development activities,

uninsured risks, regulatory changes, defects in title, availability

of materials and equipment, timeliness of government or other

regulatory approvals, actual performance of facilities,

availability of financing on reasonable terms, availability of

third party service providers, equipment and processes relative to

specifications and expectations and unanticipated environmental

impacts on operations. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

The Company provides no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not assume the obligation to revise or update these

forward-looking statements after the date of this document or to

revise them to reflect the occurrence of future unanticipated

events, except as may be required under applicable securities

laws.

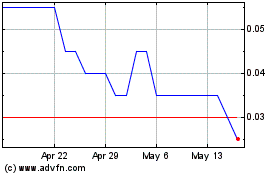

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Oct 2024 to Nov 2024

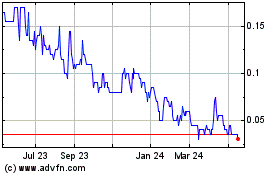

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Nov 2023 to Nov 2024