CloudMD Software & Services Inc. (TSXV: DOC, OTCQX: DOCRF,

Frankfurt: 6PH) (the “

Company” or

“

CloudMD”), an innovative health services company

transforming the delivery of care, is pleased to announce its

financial results for the second quarter ended June 30, 2023. All

financial information is presented in Canadian dollars unless

otherwise indicated.

Karen Adams, Chief Executive Officer of

CloudMD, commented, “Our performance during the second

quarter focused on driving profitable growth in the near term and

executing our strategic plan to reduce costs and divest

margin-dilutive businesses. With our core assets in place, we are

focused on expanding our pipeline. Importantly, after the quarter,

we secured a contract with a United States Hospital System customer

for remote patient monitoring. This provides us with a testimonial

to support new large pipeline growth opportunities in a $4.4

billion addressable market and paves the way for long term

sustainable growth. The second quarter results provide confidence

that we are delivering on expectations.”

Prakash Patel, Chief Financial Officer,

added, “The incremental progress that’s been achieved this

year sets the stage for a dynamic second half of 2023. Both Gross

Margin and Adjusted EBITDA have seen continuous improvement quarter

over quarter and our goal for Adjusted EBITDA breakeven in Q4 2023

is within reach. Aligning our processes and controls to build

operational efficiency while continuing to support our growth

becomes a greater priority now that our core assets are in

place.”

Second Quarter 2023 Financial

Highlights

- Q2 2023

revenue of $23.2 million, compared to $22.9 million in Q1 2023 and

$26.2 million in Q2 2022. Year over year organic growth in Health

and Wellness Services was 7%, normalizing for non-recurring

Covid-19 contracts in the prior year. The Company divested the

remaining Electronic Medical Records clinic billing business and

commenced a process to divest VisionPros.

- Q2 2023

Gross Profit Margin1 was 38.2% compared to 36.9% in Q1 2023 and

compared to 33.1% in Q2 2022. Gross Margin1 expansion was driven by

improved operating efficiency in the delivery of care.

- Q2 2023

Adjusted EBITDA1 of ($0.7) million, compared to Adjusted EBITDA1 of

($1.4) million in Q1 2023 and compared to ($3.2) million in Q2

2022. The improvement in Adjusted EBITDA1 from both Q1 2023 and the

prior year was driven by Gross Margin expansion and strong cost

control across the organization.

- Net loss

from continuing operations in Q2 2023 was $5.2 million compared to

a loss of $11.0 million in the prior year comparative period.

- Cash

balance in the second quarter was largely unchanged. Normalized

cash outflow1 for the second quarter was $3.1 million. As of June

30, 2023, the Company had $18.8 million of cash and cash

equivalents.

Second Quarter & Subsequent

Corporate Highlights

- On April 3,

2023, CloudMD announced the launch of its online prescription

renewal in the United States.

- On April 4,

2023, CloudMD announced its partnership with Mohawk Medbuy to offer

its full suite of services to hospitals across Canada.

- On April 10,

2023, CloudMD announced that Dhruv Chandra had joined the Company

as the new Chief Technology Officer.

- On April 12,

2023, CloudMD announced an expanded partnership with Benefits

Alliance to offer its full suite of Kii services to employee

benefits plans across Canada.

- On May 11, 2023,

CloudMD announced a partnership with XTM to bring Employee

Assistance Program and Telemedicine to service industry

workers.

- On June 7, 2023,

CloudMD announced the appointment of Prakash Patel as Chief

Financial Officer.

- On July 4, 2023,

CloudMD announces the divestment of non-core Electronic Medical

Records and Practice Management business.

- On July 6, 2023,

CloudMD announced the results of Ontario Therapist Assisted

Internet Delivered Cognitive Behavioural Therapy program.

- On August 23,

2023, CloudMD announced a contract for remote patient monitoring

program with major United States hospital system.

Outlook

2022 was a transition year as the Company

focused on operationalizing, aligning, and rationalizing historical

acquisitions. The Company has largely completed that goal and is

increasing its focus on cross-selling and winning new Health and

Wellness Services customers while expanding its Remote Patient

Monitoring in the United States to drive organic growth. The

Company sees significant opportunities to continue improving the

cost of delivery of care and efficiency across the organization to

improve margins.

During Q2 2023, the Company saw positive trends

continue with improving Gross Margin1, Adjusted EBITDA1, and cash

usage.

The Company expects low double digit revenue

growth in 2023 based on the fourth quarter of 2023 forecast

compared to the fourth quarter of 2022. The Company sold $2.3

million in multi-year contracts in Q2 2023 and has a robust growing

pipeline that will continue to drive revenue growth in 2023. The

Company’s announcement subsequent to the second quarter of 2023, of

a contract to provide Remote Patient Monitoring for a major U.S.

Regional Hospital System’s Medicare patients, has the potential to

change the financial profile of the organization. The Company

believes that if the contract is scaled up over the initial two

quarters, it can deliver an average of $3.0-$4.0 million in revenue

per quarter and the opportunity to participate in the global Remote

Patient Monitoring market. This growth would be incremental to the

low double-digit growth target it has for its broader

portfolio.

During the first half of 2023, the Company

actively identified and actioned approximately $4.0 million in

annual cost reductions. These synergies come with severance costs,

or working notice, which will continue to impact cash flows in the

second half of 2023.

The cost savings achieved in the first and

second quarters of 2023 have led to improvements in the Company’s

Adjusted EBITDA1. The Company expects to generate positive Adjusted

EBITDA1 in the fourth quarter of 2023.

The Company believes its cash position of $18.8

million, will provide sufficient liquidity to fund its obligations

and organic growth. The Company will continue to prudently manage

expenditures and seek further efficiencies in its cost

structure.

Select Financial

Information

All results were prepared in accordance with

International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board.

|

Selected Financial Information (unaudited) |

Three months endedJune 30 |

Six months endedJune 30 |

|

|

2023 |

2022(2) |

2023 |

2022(2) |

|

Revenue |

$ 23,191 |

$ 26,210 |

$ 46,086 |

$ 53,591 |

|

Cost of sales |

14,341 |

17,534 |

28,782 |

34,826 |

|

Gross profit

(1) |

$8,850 |

$ 8,676 |

$ 17,304 |

$ 18,765 |

|

Gross profit % |

38.2% |

33.1% |

37.5% |

35.0% |

|

Indirect Expenses |

|

|

|

|

|

Sales and marketing |

902 |

1,877 |

1,985 |

3,611 |

|

Research and development |

397 |

1,508 |

903 |

2,386 |

|

General and administrative |

8,329 |

9,102 |

16,765 |

18,409 |

|

Share-based compensation |

370 |

532 |

400 |

1,022 |

|

Depreciation and amortization |

3,616 |

4,163 |

6,885 |

6,616 |

|

Acquisition and divestiture-related, integration and restructuring

costs |

871 |

5,229 |

1,742 |

7,524 |

|

Operating loss |

$(5,635) |

$(13,735) |

$(11,376) |

$(20,803) |

|

Other income |

73 |

120 |

231 |

271 |

|

Change in fair value of contingent consideration |

- |

3,273 |

- |

6,050 |

|

Change in fair value of liability to non-controlling interest |

- |

(39) |

(549) |

(168) |

|

Change in contingent liability |

760 |

- |

760 |

- |

|

Finance costs |

(406) |

(601) |

(1,056) |

(1,026) |

|

Income tax recovery/(expense) |

58 |

32 |

313 |

(53) |

|

Net loss for the period from continuing

operations |

(5,150) |

(10,950) |

(11,677) |

(15,729) |

|

Net loss after tax from discontinuing

operations |

(1,727) |

(33,264) |

(2,341) |

(34,133) |

|

Net loss for the period |

$ (6,877) |

$ (44,214) |

$ (14,018) |

$ (49,862) |

|

Add: |

|

|

|

|

|

Depreciation and amortization |

3,616 |

4,163 |

6,885 |

6,616 |

|

Finance costs |

406 |

601 |

1,056 |

1,026 |

|

Income tax (recovery)/expense |

(58) |

(32) |

(313) |

53 |

|

EBITDA (1) |

$ (2,913) |

$ (39,482) |

$ (6,390) |

$ (42,167) |

|

Share-based compensation |

370 |

532 |

400 |

1,022 |

|

Acquisition and divestiture-related, integration and restructuring

costs |

871 |

5,229 |

1,742 |

7,524 |

|

Litigation costs |

- |

454 |

- |

454 |

|

Change in fair value of contingent consideration |

- |

(3,273) |

- |

(6,050) |

|

Change in fair value of liability to non-controlling interest |

- |

39 |

549 |

168 |

|

Change in contingent liability |

(760) |

- |

(760) |

- |

|

Net loss after tax from discontinuing operations |

1,727 |

33,264 |

2,341 |

34,133 |

|

Adjusted EBITDA (1) |

$ (705) |

$ (3,237) |

$ (2,118) |

$ (4,916) |

|

|

|

|

|

|

|

Loss per share, basic and diluted |

(0.02) |

(0.15) |

(0.05) |

(0.19) |

|

Loss per share from continuing operations, basic and diluted |

(0.02) |

(0.04) |

(0.04) |

(0.06) |

Summary of Results from Last Four

Quarters

The following tables provides a summary of the

Company’s financial results for the four most recently completed

quarters. Financial results exclude all divested or held for sale

assets.

|

|

|

Q2 2023 |

|

Q1 2023 |

|

Q4 2022 |

|

Q3 2022 |

|

Q2 2022 |

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Revenue |

$ |

23,191 |

$ |

22,895 |

$ |

22,134 |

$ |

23,544 |

$ |

26,210 |

| Gross

profit(1) |

$ |

8,850 |

$ |

8,454 |

$ |

7,709 |

$ |

7,996 |

$ |

8,676 |

| Gross

profit % (1) |

|

38.2% |

|

36.9% |

|

34.8% |

|

34.0% |

|

33.1% |

| Net

loss |

$ |

(6,877) |

$ |

(7,141) |

$ |

(9,586) |

$ |

(88,663) |

$ |

(44,214) |

| Adjusted

EBITDA (1) |

$ |

(705) |

$ |

(1,413) |

$ |

(2,186) |

$ |

(3,354) |

$ |

(3,237) |

| EPS,

basic and diluted |

$ |

(0.02) |

$ |

(0.03) |

$ |

(0.03) |

$ |

(0.30) |

$ |

(0.15) |

|

Cash and cash equivalents |

$ |

18,779 |

$ |

18,752 |

$ |

24,058 |

$ |

27,506 |

$ |

29,703 |

Second Quarter 2023 Conference Call and

Webinar Details:

Date and Time: Monday, August

28, 2023, at 9:30 am Eastern Time (6:30 am Pacific Time)

Webcast link:

https://edge.media-server.com/mmc/p/d2o59vic

Financial Statements and Management’s Discussion and

Analysis

This news release should be read in conjunction

with the Company’s unaudited condensed interim consolidated

financial statements and accompanying notes, and management’s

discussion and analysis (“MD&A”) for the three

months ended June 30, 2023, and 2022, copies of which can be found

under the Company’s profile at www.sedar.com.

Non-GAAP Financial Measures

In addition to the results reported in

accordance with IFRS, the Company uses various non-GAAP financial

measures which are not recognized under IFRS, as supplemental

indicators of the Company’s operating performance and financial

position. These non-GAAP financial measures are provided to enhance

the reader’s understanding of the Company’s historical and current

financial performance and its prospects for the future. Management

believes that these measures provide useful information in that

they exclude amounts that are not indicative of the Company’s core

operating results and ongoing operations and provide a more

consistent basis for comparison between quarters and years. Details

of such non-GAAP financial measures and ratios and how they are

derived are provided below as well as in the MD&A in

conjunction with the discussion of the financial information

reported.

Since non-GAAP financial measures do not have

any standardized meanings prescribed by IFRS, other companies may

calculate these non-IFRS measures differently, and our non-GAAP

financial measures may not be comparable to similar titled measures

of other companies. Accordingly, investors are cautioned not to

place undue reliance on them and are also urged to read all IFRS

accounting disclosures presented in the audited consolidated

financial statements and the related notes for the year ended

December 31, 2022, and 2021.

EBITDA

EBITDA is a non-GAAP financial measure that does

not have a standard meaning and may not be comparable to a similar

measure disclosed by other issuers. EBITDA referenced herein

relates to earnings before interest, taxes, and depreciation and

amortization. This measure does not have a comparable IFRS measure

and is used by the Company to assess its capacity to generate

profit from operations before taking into account management’s

financing decisions and costs of consuming intangible and tangible

capital assets, which vary according to their vintage,

technological currency, and management’s estimate of their useful

life.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

that does not have a standard meaning and may not be comparable to

a similar measure disclosed by other issuers. Adjusted EBITDA

referenced herein relates to earnings before interest, taxes,

depreciation, amortization, share-based compensation, acquisition

and divestiture-related, integration and restructuring costs,

change in fair value of liability to non-controlling interest,

litigation costs, change in fair value of contingent consideration,

change in contingent liability, and net loss after tax from

discontinuing operations. This measure does not have a comparable

IFRS measure and is used by the Company to assess its capacity to

generate profit from operations before taking into account

management’s financing decisions and costs of consuming intangible

and tangible capital assets, which vary according to their vintage,

technological currency, and management’s estimate of their useful

life, adjusted for factors that are unusual in nature or factors

that are not indicative of the operating performance of the

Company.

The following table provides a reconciliation of

net loss for the periods to EBITDA and Adjusted EBITDA for the

three months ended June 30, 2023, and 2022.

|

|

Three months ended June 30, |

Variance |

Six months ended June 30, |

Variance |

|

|

2023 |

2022 |

$ |

% |

2023 |

2022 |

$ |

% |

|

Net loss |

$ (6,877) |

$ (44,214) |

37,337 |

(84%) |

$(14,018) |

$ (49,862) |

35,844 |

(72%) |

|

Add: |

|

|

|

|

|

|

|

|

|

Finance costs |

406 |

601 |

(195) |

(32%) |

1056 |

1,026 |

30 |

3% |

|

Income tax expense/(recovery) |

(58) |

(32) |

(26) |

81% |

(313) |

53 |

(366) |

(691%) |

|

Depreciation and amortization |

3,616 |

4,163 |

(547) |

(13%) |

6,885 |

6,616 |

269 |

4% |

|

EBITDA(1)

for the period |

$ (2,913) |

$ (39,482) |

36,569 |

(93%) |

$ (6,390) |

$ (42,167) |

35,777 |

(85%) |

|

Share-based compensation |

370 |

532 |

(162) |

(30%) |

400 |

1,022 |

(622) |

(61%) |

|

Acquisition and divestiture-related, integration and restructuring

costs |

871 |

5,229 |

(4,358) |

(83%) |

1,742 |

7,524 |

(5,782) |

(77%) |

|

Litigation costs |

- |

454 |

(454) |

(100%) |

- |

454 |

(454) |

(100%) |

|

Change in fair value of contingent consideration |

- |

(3,373) |

3,273 |

(100%) |

- |

(6,050) |

6,050 |

(100%) |

|

Change in fair value of liability to non-controlling interest |

- |

39 |

(39) |

(100%) |

549 |

168 |

381 |

227% |

|

Change in contingent liability |

(760) |

- |

(760) |

- |

(760) |

- |

(760) |

- |

|

Net loss from discontinuing operations |

1,727 |

33,264 |

(31,537) |

(95%) |

2,341 |

34,133 |

(31,792) |

(93%) |

|

Adjusted

EBITDA(1) for

the period |

$ (705) |

$(3,237) |

3,086 |

(78%) |

$ (2,118) |

$(4,916) |

2,798 |

(57%) |

(1) EBITDA,

Adjusted EBITDA, Gross Profit, Gross Profit Margin, Cash flow and

Normalized cash outflow are non-GAAP measures. Refer to the

Non-GAAP Financial Measures section of the MD&A for further

information.

Gross Profit

Gross Profit is a non-GAAP financial measure

that does not have a standard meaning and may not be comparable to

a similar measure disclosed by other issuers. Gross Profit

referenced herein is defined as revenues less cost of sales. This

measure does not have a comparable IFRS measure and is used by the

Company to manage and evaluate the operating performance of the

business.

Gross Margin

Gross Margin is a non-GAAP financial ratio that

has Gross Profit, which is a non-GAAP financial measure as a

component. Gross Margin referenced herein is defined as gross

profit as a percent of total revenue. This measure does not have a

comparable IFRS measure and is used by the Company to manage and

evaluate the operating performance of the business.

Cash outflow and Normalized cash

outflow

Normalized cash outflow is a non-GAAP financial

measures that does not have a standard meaning and may not be

comparable to a similar measure disclosed by other issuers. Cash

outflow, utilized in the calculation of normalized cash outflow, is

defined as the decrease in cash and cash equivalents for the

applicable period. Normalized cash outflow, as referenced herein,

is defined as cash outflow, adjusted for expenditures that are not

expected be recurring, net of changes in non-cash working capital,

discontinuing operations, payment of contingent consideration, and

net proceeds from business divestitures. For the purpose of

calculating Normalized cash flow, expenditures that are not

expected to be recurring include cash related adjustments to

EBITDA. Management believes that normalized cash outflow, in

addition to other conventional financial measures prepared in

accordance with IFRS, provides information that is helpful to

understand the financial condition of the Company. The objective of

using normalized cash outflow is to present readers with a view of

the Company from management’s perspective by interpreting the

material trends and activities that affect the Company’s use of

cash. These measures do not have a comparable IFRS measure and are

used to ensure that we have sufficient liquidity to meet our

liabilities as they become due.

Annual Recurring Revenue

Annual recurring revenue is defined as average

annualized contract value for closed sales. This measure does not

have a comparable IFRS measure and is used by the Company to assess

the impact of closed sales on future period revenue

projections.

About CloudMD Software &

Services

CloudMD is an innovative North American

healthcare service provider focused on empowering healthier living

by combining leading edge technology with an exceptional national

network of healthcare professionals. Every day, our employees and

health care providers live our values of delivering excellence,

collaboration, connected communication and accountability to solve

complex health problems. CloudMD’ s industry leading workplace

health and wellbeing solution, Kii, supports members and their

families with a personalized and connected healthcare experience

across mental, physical and occupation health. Kii delivers

superior clinical health outcomes, consistent high engagement, and

measurable ROI for payers such as employers, educational

institutions, associations, government, and insurers. CloudMD is

also a market leader in workplace absence management through

data-driven prevention, intervention and return to work

programs.

In addition, the Company sells health and

productivity tools to hospitals, clinics, and other healthcare

service providers to empower them to deliver better care. Visit

www.cloudmd.ca to learn more about the Company’s comprehensive

healthcare offerings.

“Karen Adams”Chief Executive Officer

FOR ADDITIONAL INFORMATION, CONTACT:

Investor Relations

Investors@cloudmd.ca

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains “forward-looking

statements” and “forward-looking information” within the meaning of

Canadian securities laws, including statements about the Company’s

growth strategy and profitability. These statements are based upon

information currently available to CloudMD’s management. All

information that is not clearly historical in nature may constitute

forward‐looking statements. In some cases, forward‐looking

statements may be identified by the use of terms such as

“forecast,” “assumption” and other similar expressions or future or

conditional terms such as “anticipate”, “believe”, “could”,

“estimate”, “expect”, “intend”, “may”, “plan”, “predict”,

“project”, “will”, “would,” and “should”. Forward-looking

statements contained in this news release are based on certain

factors and assumptions made by management of CloudMD based on

their current expectations, estimates, projections, assumptions,

and beliefs regarding their business and CloudMD does not provide

any assurance that actual results will meet management’s

expectations. While management considers these assumptions to be

reasonable based on information currently available to them, they

may prove to be incorrect. Such forward‐looking statements are not

guarantees of future events or performance and by their nature

involve known and unknown risks, uncertainties and other factors,

including those risks described in the Company’s MD&A (which is

filed under the Company’s issuer profile on SEDAR and can be

accessed at www.sedar.com), that may cause the actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

such forward‐looking statements. Although CloudMD has attempted to

identify important factors that could cause actual actions, events,

or results to differ materially from those described in

forward‐looking statements, other factors may cause actions,

events, or results to be different than anticipated, estimated, or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could vary or

differ materially from those anticipated in such forward‐looking

statements. Accordingly, readers should not place undue reliance on

forward‐looking information. CloudMD does not undertake to update

any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws.

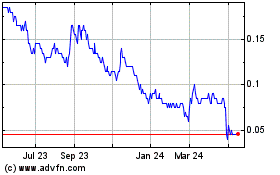

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Dec 2024 to Jan 2025

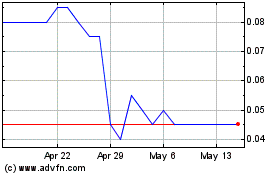

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Jan 2024 to Jan 2025