Deveron Corp. (TSX-V: FARM) (“

Deveron” or the

“

Company”), a leading agriculture data company in

North America, is pleased to announce that the Company has entered

into a definitive agreement (the “

Purchase

Agreement”) dated May 2, 2022 with certain vendor

shareholders to acquire a 67% equity interest in A&L Canada

Laboratories East, Inc. (“

A&L”), with an

option to purchase the remaining 33% following the three-year

anniversary of closing. Total consideration payable to the vendor

shareholders includes $42.8 million in cash and $7.5 million in the

Company’s common shares (the “

Acquisition”). The

$7.5 million in the Company’s common shares will be distributed to

a company controlled by Greg Patterson, one of the vendor

shareholders who, upon closing of the Acquisition, is expected to

continue as President, CEO and director of A&L and be appointed

to Deveron’s Board of Directors (subject to regulatory approval).

A&L is the one of the largest soil and

tissue laboratories in Canada. Founded by Greg Patterson, and based

in London, Ontario, A&L operates a 54,500 square foot

laboratory with significant growth capacity and 106 employees,

including a large R&D group that has produced patented, crop

specific yield and disease solutions. A&L processes over

435,000 soil samples per year. Deveron and A&L have cooperated

in Canadian soil testing and analysis since 2019 and jointly own

and operate Wood’s End Laboratory in the United States. During the

12 month period ended December 31, 2021, A&L had unaudited

revenue of $26.7 million and EBITDA of $11.6 million.1 As at

December 31, 2021, A&L had total unaudited assets of

$19,835,475 and total unaudited liabilities of $6,747,983.

“This acquisition is transformational for

Deveron. Combining Deveron and A&L establishes one of the only

fully vertically integrated agriculture data companies in the

market. This also aligns with our vision to be North America’s

leader in lab and agronomist services,” stated David MacMillan,

Deveron’s President, and CEO. “I’m thrilled to welcome A&L to

the Deveron family. Greg Patterson, A&L’s Founder, President

and CEO, will continue to lead A&L and will join Deveron’s

Board of Directors to accelerate and guide the successful merger.

Over the last few years, we have built Deveron from the ground up,

creating digital, data-driven solutions to help our clients lower

costs and improve crop yields. A&L’s complementary services and

its successful track record provides the consolidated entity with a

strong customer base into which to expand our product offering. The

new consolidated company’s financial position will enable

investments in organic growth, Research & Development, and

capital to invest in new market opportunities.”

“A&L was founded under the principle that

farmers want the best information so that they can make the best

decisions on their farms,” stated A&L’s Founder, President and

CEO, Greg Patterson. “Over the last 35 years, we have built an

advice and analytical recommendation company that focuses on good

agricultural practices, backed by unbiased data, that promotes

sustainable and ecological farming. Combining our long-track record

of success in Canada and our three-year partnership with Deveron

into a more formal business combination will only continue to bring

more value to our customers, while also opening the door to

distributing our product offerings through Deveron’s growing US

customer base. Soil testing was an avant-garde idea when A&L

first opened its doors. We built world class recommendations for

our customers through deep research and field data, which we

believe will continue to accelerate as A&L and Deveron leverage

their respective expertise to deliver the best information in the

industry.”

Transaction Highlights

- Addition of 20,000 customers to

Deveron's customer base across key Canadian agriculture markets and

over 435,000 annual soil samples.

- Enterprise value of approximately

$73 million represents an estimated pre-synergies multiple of

approximately 6.3x A&L’s 2021 EBITDA.

- Deveron to initially acquire 67% of

A&L for $42.8 million in cash and $7.5 million in Deveron

common shares.

- Deveron will have an option to

purchase the remaining shares of A&L following the three-year

anniversary of closing, and is subject to an obligation to purchase

a portion of the remaining shares on the five year anniversary of

closing.

- A&L’s Founder, President and

CEO, Greg Patterson, to continue to lead A&L as President and

CEO with a 20% residual equity stake in A&L, and, on closing,

is expected to join Deveron’s Board of Directors (subject to

regulatory approval).

- Closing of the Acquisition is

subject to customary conditions for transactions of this nature,

including the receipt of necessary third-party consents and

regulatory approvals. Deveron currently expects the completion of

the Acquisition to occur in Q2/2022.

Revenue and Cost Synergies

Management of the Company expects to realize

numerous revenue and cost synergies, including approximately $7.0

million in annualized revenue synergies within 24 months following

the completion of the Acquisition from vertical integration

opportunities and approximately $1.0 million in annualized cost

synergies within six months following the completion of the

Acquisition resulting from reductions in software, engineering and

other sales as well as general and administrative costs. There can

be no assurance that such revenue and cost synergies will be

achieved. Management of the Company expects to monetize

approximately $20 million in product R&D, although there can be

no assurances that such R&D will be monetized. Furthermore,

Deveron expects the Acquisition to provide additional scale,

enabling the Company to vertically integrate a carbon service

platform and provide immediate growth to Deveron’s recently

acquired companies through the vertical integration.

Public Offering of Subscription

Receipts

In connection with the Acquisition, Deveron will

file a preliminary prospectus supplement in connection with a

marketed public offering (the “Offering”) of

subscription receipts (“Subscription Receipts”) to

be led by TD Securities Inc. (the “Bookrunner”)

for gross proceeds of approximately $20 million. The Offering will

be priced in the context of the market with the price and other

final terms to be determined at the time of entering into the

Underwriting Agreement (as defined below). It is expected that the

Bookrunner and a syndicate of underwriters (collectively the

“Underwriters”) will enter into a definitive

underwriting agreement (the “Underwriting

Agreement”) with the Company upon completion of marketing

of the Offering. Each Subscription Receipt represents the right to

receive one unit (“Unit”) consisting of one common

share (a “Common Share”) and one-half of one

common share purchase warrant of Deveron (each whole Common Share

purchase warrant, a “Warrant”). Each Warrant will

have an exercise price to be determined in the context of the

market and shall be exercisable for a period of 24 months from

closing of the Offering.

In connection with the Offering, the Company

will grant the Underwriters an option, exercisable for a period of

30 days from the date of the closing of the Offering, to purchase

up to an additional number of Subscription Receipts equal to 15% of

the number Subscription Receipts to be sold pursuant to the

Offering at the offering price to cover over-allotments, if any,

and for market stabilization purposes (the “Over-Allotment

Option”). If the Escrow Release Conditions (as defined

below) have been satisfied prior to the exercise of the

Over-Allotment Option, the Underwriters may elect to exercise the

Over-Allotment Option by purchasing additional Units, Common Shares

or Warrants or any combination thereof.

In consideration for their services, the

Underwriters will receive: (i) a cash commission equal to 6.0% of

the gross proceeds of the Offering (the "Underwriters'

Fee"); and (ii) such number of broker warrants (each, a

"Broker Warrant") as is equal to 6.0% of the

number of Subscription Receipts issued by the Company on the

closing date of the Offering. Each Broker Warrant shall be

exercisable, upon the satisfaction or waiver of the Escrow Release

Conditions, to acquire one Common Share at an exercise price equal

to the offering price for a period of 24 months following the

closing date of the Offering.

Closing of the Offering is subject to customary

closing conditions and approvals of applicable securities

regulatory authorities, including the TSX Venture Exchange.

The Subscription Receipts distributed pursuant

to the Offering will be offered in all provinces of Canada, except

Québec, pursuant to a prospectus supplement (the

“Prospectus Supplement”) to the short form base

shelf prospectus of Deveron dated November 30, 2021 (the

“Base Shelf Prospectus”).

The proceeds from the Offering less 50% of the

Underwriters' Fee payable on the closing date of the Offering will

be held in escrow pending satisfaction of certain escrow release

conditions, including, among other things, (i) completion of all

conditions precedent to the Acquisition, (ii) no material

amendments of the terms and conditions of the Purchase Agreement

and (iii) delivery of an escrow notice from the Company and the

Bookrunner to the subscription receipt agent (the “Escrow

Release Conditions”). Upon satisfaction of the Escrow

Release Conditions, the net proceeds will be released from escrow

to the Company and the Subscription Receipts will be exchanged on a

one-for-one basis for Units for no additional consideration or

further action on the part of the holder thereof.

If certain Termination Events (as defined in the

Prospectus Supplement) occur, the holders of the Subscription

Receipts will receive a cash payment equal to the offering price of

the Subscription Receipts plus their pro rata share of interest.

Please refer to the Prospectus Supplement for further details on

the Termination Events and payment.

Conditions to Completion of the

Acquisition

The Acquisition and the Offering have been

unanimously approved by the directors of Deveron entitled to vote

thereon, and remain subject to customary closing conditions,

including regulatory approvals (including the approval of the TSX

Venture Exchange) and financing conditions.

Subject to the foregoing, closing of the

Offering is expected to occur on or about May 12, 2022 and closing

of the Acquisition is expected to occur during the second quarter

of 2022.

New Credit Facility

In connection with the Acquisition, the

Toronto-Dominion Bank has provided A&L with a commitment letter

pursuant to which, among other things, it has agreed to provide

A&L with: (a) a revolving credit facility in the principal

amount of up to $5 million available for working capital and

general corporate purposes including up to $1 million in letters of

credit (the “Revolving Credit Facility”); and (b)

a term loan in the principal amount of up to $24 million (the

“Term Loan” and together with the Revolving Credit

Facility, the “Credit Facilities”). A&L

expects to immediately loan the $24 million under the Term Facility

to Deveron and to ultimately use the proceeds available under the

Term Facility to partially fund the cash consideration and fees

relating to the completion of the Acquisition.

The Credit Facilities will be governed by a

credit agreement to be entered into between the lenders, A&L,

the material subsidiaries of A&L and the Toronto-Dominion Bank

as administrative agent, lead arranger and sole bookrunner (the

“Credit Agreement”). All current and future

wholly-owned material subsidiaries (direct and indirect) of A&L

shall provide an unlimited recourse guarantee of A&L’s

obligations. Additionally, each shareholder of A&L, including

the Company, shall provide a guarantee for A&L’s obligation

with recourse limited under such guarantee to a pledge of the

shares held by such shareholder in A&L. The Credit Agreement

will be secured with first priority security interest granted by

A&L, and a pledge of equity interest in the shares of A&L

pledged by the limited recourse guarantors. The Credit Facilities

will be secured against A&L.

Upon completion of the financing contemplated in

the Credit Agreement, A&L shall provide a loan in the amount of

up to $24 million to Deveron, which is to be used by Deveron to

partially fund the Acquisition.

Advisors

TD Securities Inc. is acting as financial

advisor to Deveron on the Acquisition and TD Securities Inc. is

acting as bookrunner on the Offering. Irwin Lowy LLP is acting as

legal advisor to Deveron on the Acquisition, Miller Thomson LLP is

acting as Deveron’s counsel on the Offering and the Credit

Facility, and Bennett Jones LLP is acting as Underwriters’ counsel

on the Offering.

Availability of Documents

Copies of related documents, such as the Base

Shelf Prospectus, Prospectus Supplement, Purchase Agreement and the

Underwriting Agreement will be available under the Company’s

profile on SEDAR (www.sedar.com) as part of the public filings of

Deveron.

About Deveron

Deveron is an agriculture technology company

that uses data and insights to help farmers and large agriculture

enterprises increase yields, reduce costs and improve farm

outcomes. The company employs a digital process that leverages data

collected on farms across North America to drive unbiased

interpretation of production decisions, ultimately recommending how

to optimize input use. Our team of agronomists and data scientists

build products that recommend ways to better manage fertilizer,

seed, fungicide, and other farm inputs. Additionally, we have a

national network of data technicians that are deployed to collect

various types of farm data, from soil to drone, that build a basis

of our best-in-class data layers. Our focus is the US and Canada

where 1 billion acres of farmland are actively farmed

annually.2

For more information and to join our community,

please visit www.deveron.com.

David MacMillanPresident & CEO, Deveron

Corp.dmacmillan@deveron.com

A&L Financial Statements and

Information

All A&L financial statements have been

prepared in accordance with Canadian GAAP principles applicable to

private enterprises, which are Canadian accounting standards for

private enterprises in Part II of the Chartered Professional

Accountants of Canada Handbook. The recognition, measurement and

disclosure requirements of Canadian GAAP applicable to private

enterprises differ from those of Canadian GAAP applicable to

publicly accountable enterprises, which are IFRS.

A&L’s EBITDA, as used herein, is defined by

A&L as net earnings (as per Canadian accounting standards for

private enterprises set out in Part II of the CPA Canada Handbook –

Accounting, as issued by the Accounting Standards Board in Canada)

less interest expense, depreciation and amortization, and income

taxes.

Presentation of Financial Information

The financial information of Deveron referred to

in this news release is reported in Canadian dollars and have been

prepared in accordance with IFRS. All financial information of

A&L referred to in this news release is reported in Canadian

dollars and has been derived from audited and unaudited historical

financial statements of A&L that were prepared in accordance

with Canadian accounting standards for private enterprises. The

recognition, measurement and disclosure requirements of Canadian

GAAP applicable to private enterprises differ from those of

Canadian GAAP applicable to publicly accountable enterprises, which

are IFRS.

The financial information for A&L in this

news release for the 12 months ended December 31, 2021 are

unaudited and were calculated by management by adding figures for

six months ended December 31, 2021 (unaudited) to figures for year

ended June 30, 2021 (audited) and subtracting figures for six

months ended December 31, 2020 (unaudited).

Forward-Looking Statements

This news release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking information”) within the meaning

of applicable securities laws. Forward-looking information may

relate to our future financial outlook and anticipated events or

results and may include information regarding our financial

position, business strategy, growth strategies, budgets,

operations, financial results, taxes, dividend policy, capital

structure, plans and objectives. Particularly, information

regarding our expectations of future results, performance,

achievements, prospects or opportunities or the markets in which we

operate is forward-looking information. In some cases,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”,

“budget”, “scheduled”, “estimates”, “outlook”, “forecasts”,

“projection”, “prospects”, “strategy”, “intends”, “anticipates”,

“does not anticipate”, “believes”, or variations of such words and

phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might”, “will”, “will be taken”, “occur”

or “be achieved”. In addition, any statements that refer to

expectations, intentions, projections or other characterizations of

future events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding future events or

circumstances.

This forward-looking information in this news

release includes, among other things, statements relating to:

expectations regarding the completion of the Acquisition; the

expected impact of the Acquisition on the Company’s operations,

prospects, opportunities, financial condition, cash flow and

overall strategy; completion of credit facilities; the strategic

rationale for the Acquisition; strength, complementarity and

compatibility of A&L with Deveron’s existing business and

teams; anticipated sources of financing of the purchase price of

the Acquisition; successful marketing of the Offering; the entering

into of the Underwriting Agreement and timing thereof; the closing

and terms of the Offering, the filing of the Prospectus Supplement

qualifying the distribution of the Subscription Receipts, the

listing of the Subscription Receipts and the underlying Common

Shares and Warrants; regulatory approval of the Acquisition and the

Offering; Greg Patterson’s appointment to Deveron’s board and

continued involvement with A&L following the Acquisition; the

expectations regarding industry trends, overall market growth rates

and our growth rates and growth strategies; projected milestones

and timelines, including the expected closing dates for the

Offering and the Acquisition; the ability to satisfy the escrow

release conditions of the Subscription Receipts; and the

anticipated benefits and impacts of the Offering and the

Acquisition.

This forward-looking information and other

forward-looking information are based on management’s opinions,

estimates and assumptions in light of our experience and perception

of historical trends, current conditions and expected future

developments, as well as other factors that we currently believe

are appropriate and reasonable in the circumstances. Despite a

careful process to prepare and review the forward-looking

information, there can be no assurance that the underlying

opinions, estimates and assumptions will prove to be correct.

Certain assumptions in respect of our ability to expand the

Company's network of partnerships in existing and new geographies

and verticals and our ability to expand our customer base

domestically and internationally; the viability and continuity of

our existing commercial partnerships; our ability to build market

share; our ability to develop and market additional products and to

increase sales from our existing customers through sales of our

more premium products; our ability to attract and retain key

management and personnel; our anticipated growth prospects; the

state of the agricultural industry and global economy; the expected

impact and adoption of digital tools by farmers; the impact of the

coronavirus disease (including any new strains and variants of

concern); the continued confidence in our products and services;

future foreign exchange and interest rates; the impact of

competition; changes to trends in the agricultural industry,

including verticals in the broader agricultural ecosystem or to

global economic factors; changes to laws, rules, regulations and

global standards; the satisfaction of all conditions of closing and

the successful completion of the Acquisition and within the

anticipated timeframe, including receipt of regulatory, stock

exchange and other required approvals, including without limitation

the approval of the TSX Venture Exchange, in regards to the

Offering and the Acquisition; the estimated purchase price of the

Acquisition; the receipt of required consent of third parties the

successful and timely integration of A&L in the anticipated

timeframe; the realization of the anticipated benefits, economies

of scale, operating efficiencies, costs savings and synergies of

the Acquisition in the timeframe anticipated, including impacts on

growth and accretion in various financial metrics; and the absence

of significant undisclosed costs or liabilities associated with the

Acquisition are material factors made in preparing forward-looking

information and management’s expectations.

Forward-looking information is subject to known

and unknown risks, uncertainties, assumptions and other factors

that may cause the actual results, level of activity, performance

or achievements to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to the risk factors discussed or referred to in the

Company’s Management’s Discussion and Analysis dated March 30, 2022

for the year ended December 31, 2021 and under the heading “Risk

Factors” in the Base Shelf Prospectus (including in the documents

incorporated by reference therein): completion and use of net

proceeds of the Offering; failure to list the Subscription Receipts

and the underlying Common Shares and Warrants; failure to complete

the Acquisition in all material respects in accordance with the

purchase agreement; failure to obtain, in a timely manner or at

all, regulatory, stock exchange and other required approvals, or to

otherwise satisfy the conditions to the completion of, the

Acquisition; necessary borrowings, such as the aforementioned

credit facilities, may not be available to fund a portion of the

purchase price for the Acquisition; increased indebtedness after

completion of the Acquisition; failure to receive required consents

of third parties; failure to realize the anticipated benefits,

economies of scale, operating efficiencies, costs savings and

synergies of the Acquisition in the timeframe anticipated, or at

all; the materiality of post-closing adjustments; the A&L

business being adversely impacted during the pendency of the

Acquisition; potential unforeseen difficulties in integrating the

A&L business into the Company’s systems and operations;

dependence on key employees and the loss of certain key A&L

personnel; the discovery of significant undisclosed costs or

liabilities associated with the Acquisition; reliance on

information provided by A&L and the risk of inaccurate or

incomplete information, historical and/or stand-alone financial

information may not be representative of future performance, and

uncertainty as to expected financial condition and economic

performance following the completion of the Acquisition.

If any of these risks or uncertainties

materialize, or if the opinions, estimates or assumptions

underlying the forward-looking information prove incorrect, actual

results or future events might vary materially from those

anticipated in the forward-looking information. The pro forma

information set forth in this news release should not be considered

to be a prediction of what the actual financial position or other

results of operations of Deveron would have necessarily been had

the Acquisition or other recently completed or proposed

acquisitions been completed as, at, or for the periods stated.

Although we have attempted to identify important

risk factors that could cause actual results to differ materially

from those contained in forward-looking information, there may be

other risk factors not presently known to us or that we presently

believe are not material that could also cause actual results or

future events to differ materially from those expressed in such

forward-looking information. There can be no assurance that such

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. Accordingly, prospective investors should not place

undue reliance on forward-looking information, which speaks only as

of the date made. The forward-looking information contained in this

news release represents our expectations as of the date of this

news release and are subject to change after such date. However, we

disclaim any intention or obligation or undertaking to update or

revise any forward-looking information whether as a result of new

information, future events or otherwise, except as required under

applicable securities laws in Canada.

This forward-looking information is used to

assist readers in obtaining a better understanding of Deveron’s

business, current objectives, strategic priorities, expectations

and plans, including following the Acquisition, and may not be

appropriate for other purposes. Such forward-looking information

that is not historical fact, including statements based on

management’s belief and assumptions cannot be considered as

guarantees of future performance.

All of the forward-looking information contained

in this news release is expressly qualified by the foregoing

cautionary statements. The Company relies on litigation protection

for forward-looking statements.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

The securities offered have not been,

and will not be, registered under the U.S. Securities Act of 1933

(the “U.S. Securities Act”), as amended, and may not be offered or

sold in the United States, absent registration or an applicable

exemption from registration. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy

the securities. The offering or sale of the securities shall not be

made in any jurisdiction in which such offer, solicitation or sale

would be unlawful.

1 A&L figures for 12 months ended December

31, 2021 calculated by management by adding figures for six months

ended December 31, 2021 (unaudited) to figures for year ended June

30, 2021 (audited) and subtracting figures for six months ended

December 31, 2020 (unaudited).2 Based on data collected through the

United States Department of Agriculture, the National Agricultural

Statistics Service and Statistics Canada

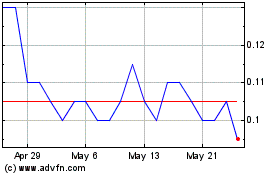

Deveron (TSXV:FARM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Deveron (TSXV:FARM)

Historical Stock Chart

From Dec 2023 to Dec 2024