GFM Signs Formal Option Agreement With Geologix For La Casita Property

25 August 2008 - 11:00PM

Marketwired Canada

GFM Resources Limited (NEX:GFM.H) ("GFM" or "the Company") is pleased to

announce that, further to a Letter of Intent announced in January of 2008, a

formal agreement to option its 1,472 hectare La Casita property - Los Arados

claim group to Geologix Explorations Inc. (TSX VENTURE:GIX) ("Geologix") has

been executed.

"The signing of this agreement is a major milestone for the Company", said Mr.

Roman Friedrich, GFM's President and CEO. "Bringing a partner such as Geologix

adds considerable value to the Company's strategy of acquiring properties in

Mexico which are worthy of advanced exploration spending and potential

development by either GFM or joint venture partners. We look forward to further

growth in our exploration portfolio through our continuing affiliation with our

major Mexican shareholder."

The Property

The property is located in central Durango State, 40 kilometres (km) north of

Geologix's San Agustin project and 5.5 km southwest of the town of Rodeo in

Durango, Mexico.

Information compiled by Geologix for La Casita shows gold mineralization in the

1 gram per ton (g/t) gold range occurs sporadically in an area roughly 2 km long

by 1.25 km wide within Tertiary felsic volcanic and subvolcanic units that

contain stockwork quartz veinlets and disseminated pyrite. The highest gold

values are associated with stockwork quartz veinlets in rhyolitic volcanics and

tuffs as well as in rhyolite dikes.

Based on Geologix's and GFM's sampling, numerous untested drill targets exist in

areas of shallow alluvium and post-mineral cover. These, and other prospective

targets, will be tested during an initial drilling program subsequent to

completion of geological mapping, sampling, and geophysics.

Geologix has advised that its rock-chip sampling on the claim group has returned

assays up to 1.84 g/t gold and 247 g/t silver in silicified stockwork and

breccia zones hosted in subvolcanic rhyolites found on the property. Colluvium

and post mineral volcanics commonly mantle the gold-bearing rhyolites at La

Casita-Los Arados, especially along the northeast flank of a prominent peak on

the property called Cerro Colorado. In that zone, scattered rhyolite outcrops

have returned assays of more than 1 g/t gold along a northwest trending corridor

for at least 950 metres. A similar corridor of gold mineralization occurs a

kilometre southeast of Cerro Colorado and trends east northeast along the south

flank of a rhyolite ridge called Cerra La Amarilla. That zone is at least 1000

metres long.

The Agreement

In order to acquire a 60% interest in La Casita, Geologix will:

1. Pay GFM the sum of US $650,000 in cash over a period of up to four years as

follows:

a. On signature of a definitive agreement US $50,000 (paid)

b. On or before the first anniversary thereof US $100,000

c. On or before the second anniversary thereof US $125,000

d. On or before the third anniversary thereof US $150,000

e. On or before the fourth anniversary thereof US $225,000

Total US $650,000

2. Fund 100% of an exploration program totalling US $1,875,000, as follows:

a. On or before the first anniversary US $125,000

b. On or before the second anniversary US $250,000

c. On or before the third anniversary US $500,000

d. On or before the fourth anniversary US $1,000,000

Total US $1,875,000

Geologix will maintain the mineral concessions in good standing over the term of

the option, and will have the right to accelerate the schedule of payments and

work expenditures to earn its 60% interest.

Once Geologix has earned its 60% interest in La Casita, a joint venture between

Geologix and GFM will be formed. The Operator will be Geologix. The Operator

over the following three years must propose a minimum annual US $625,000 joint

venture budget to remain as operator. The joint venture committee may decide to

spend less over the period. Both parties may elect to contribute to the proposed

budget or have their interest diluted.

A feasibility study may be proposed by the Operator, or by the other party if

the Operator fails to do so, within three months of the end of the three-year

joint venture period. If one of the parties elects not to participate in the

funding of the feasibility study, the other party will earn an additional 11%

interest in the joint venture by the completion of a positive feasibility study.

If the feasibility study recommends taking the property into production and one

of the parties does not elect to participate, the other party will earn a

further 9% interest.

About GFM

GFM Resources Limited is a Canadian public company engaged in the business of

mineral exploration in Mexico; its shares are listed on the NEX Board of the TSX

Venture Exchange under the symbol GFM.H. The Company's majority shareholder is

Compania Minera Autlan S.A.B. de C.V., a company listed on the Mexico City stock

exchange and active in manganese and ferroalloy operations in Mexico, in turn

controlled by Grupo Ferrominero, S.A. de C.V., a private Mexican holding company

that also controls other companies in domains such as electronics and investment

banking. For more information please visit www.gfm-resources.com.

About Geologix

Geologix Explorations Inc. is a mineral exploration company focused on

acquiring, exploring and developing gold properties in North and South America.

The Company has a wealth of experience in the mining industry taking early stage

exploration prospectus to final feasibility and ultimately to production.

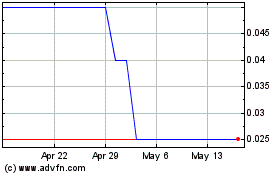

GFM Resources (TSXV:GFM.H)

Historical Stock Chart

From Nov 2024 to Dec 2024

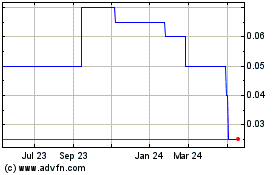

GFM Resources (TSXV:GFM.H)

Historical Stock Chart

From Dec 2023 to Dec 2024