Itafos Inc. (TSX-V: IFOS) (the “Company”) reported today its Q4 and

FY 2022 financial and operational highlights. The Company’s

financial statements and management’s discussion and analysis and

annual information form for the year ended December 31, 2022 are

available under the Company’s profile at www.sedar.com and on the

Company’s website at www.itafos.com. All figures are in thousands

of US Dollars except as otherwise noted.

CEO Commentary

“We are pleased to report record safety

performance and financial results for 2022. The 2022 reported

revenues of $593.3 million and adjusted EBITDA of $224.8 million

were supported by strong production performance at our Conda

facility and improved market fundamentals for the agricultural

sector.”

“Over the last 24 months we have successfully

executed on our stated business objectives and implemented

solutions which have strengthened the Company for the future.

Included among those accomplishments were deploying strong free

cash flow toward deleveraging, including two debt refinancings

which have significantly reduced the Company’s net debt at the end

of 2022 to $88.3 million, a $129.4 million reduction from the prior

year-end. We have positioned Itafos for the next phase of

sustainable growth with the planned extension of the Conda (H1/NDR)

mine-life through 2037. Following the publication of the

Final Environmental Impact Statement in November, we continue to

advance the H1/NDR mine-life extension approval process, working

collaboratively with the relevant regulatory agencies, and expect a

decision in the coming months with capital work commencing

soon thereafter.”

“As a result of the significant progress made

over the last two years, the Company announced on March 13, 2023

that the Board has formed a committee of independent directors to

explore and evaluate various strategic alternatives. The board

believes that this is an appropriate time to consider the full

range of potential alternatives to enhance value for all Itafos

shareholders,” said G. David Delaney, CEO of Itafos.

Q4 2022 Key Highlights

- revenues of $135.2 million

- adjusted EBITDA of $50.1

million(1)

- net income of $29.3 million

- basic earnings of C$0.21/share

- free cash flow of $38.6

million(1)

FY 2022 Key Highlights

- revenues of $593.3 million

- adjusted EBITDA of $224.8

million(1)

- net income of $114.7 million

- basic earnings of C$0.79/share

- free cash flow of $187.9

million(1)

December 31, 2022 Key

Highlights

- trailing 12 months adjusted EBITDA

of $224.8 million(1)

- net debt of $88.3 million(1)

- net leverage ratio of 0.4x (1)

FY 2023 Guidance

- adjusted EBITDA guidance of $140 to

$180 million(1)

- net income guidance of $35 to $65

million

- basic earnings guidance of C$0.25

to $0.45/share

- maintenance capex guidance of $15

to 25 million(1)

- growth capex guidance of $40 to 50

million(1)

- free cash flow guidance of $70 to

$100 million(1)

___________________________________1 Adjusted

EBITDA, trailing 12 months adjusted EBITDA, maintenance capex,

growth capex, net debt, net leverage ratio and free cash flow are

each a non-International Financial Reporting Standards (“IFRS”)

financial measure. For additional information on non-IFRS and other

financial measures, see “Non-IFRS financial measures” below.

Q4 and FY 2022 Market

Highlights

Diammonium phosphate (“DAP”) New Orleans

(“NOLA”) prices averaged $672/short ton (“st”) in Q4 2022 compared

to $715/st in Q4 2021, down 6% year-over-year. Although prices are

marginally below the comparative period last year, pricing remains

elevated relative to historical norms. DAP NOLA prices averaged

$772/st in FY 2022 compared to $602/st in FY 2021, up 28%

year-over-year.

Specific factors impacting DAP NOLA prices were

as follows:

- limited phosphate capacity

additions;

- multi-year low stocks-to-use ratios

for global coarse grains and oilseeds supporting fertilizer

relative affordability;

- historically high crop prices in

2022;

- the breakout of war in Ukraine;

and

- continued restrictions and controls

on exports of phosphate from China.

Q4 2022 Financial

Highlights

For Q4 2022, the Company’s financial highlights

were as follows:

- revenues of $135.2 million in Q4

2022 compared to $116.8 million in Q4 2021;

- adjusted EBITDA of $50.1 million in

Q4 2022 compared to $47.9 million in Q4 2021;

- net income of $29.3 million in Q4

2022 compared to $24.3 million in Q4 2021;

- basic earnings of C$0.21/share in

Q4 2022 compared to C$0.16/share in Q4 2021; and

- free cash flow of $38.6 million in

Q4 2022 compared to $28.8 million in Q4 2021.

The increase in the Company’s Q4 2022 financial

performance compared to Q4 2021 was primarily due to higher

realized MAP prices (priced on a three-month lag under the terms of

the MAP offtake agreement) and sales volumes at Conda, which were

partially offset by higher input costs. The increase in net income

was primarily due to lower finance and income tax expenses.

The Company’s total capex(2) spend in Q4 2022

was $9.9 million compared to $6.3 million in Q4 2021 with the

increase primarily due to timing of projects at Conda.

FY 2022 Financial

Highlights

For FY 2022, the Company’s financial highlights

were as follows:

- revenues of $593.3 million in FY

2022 compared to $413.2 million in FY 2021;

- adjusted EBITDA of $224.8 million

in FY 2022 compared to $143.4 million in FY 2021;

- net income of $114.7 million in FY

2022 compared to $51.4 million in FY 2021;

- basic earnings of C$0.79/share in

FY 2022 compared to C$0.35/share in FY 2021; and

- free cash flow of $187.9 million in

FY 2022 compared to $71.3 million in FY 2021.

The increase in the Company’s FY 2022 financial

performance compared to FY 2021 was primarily due to higher

realized prices and sales volumes at Conda, which were partially

offset by higher input costs.

The Company’s total capex spend in FY 2022 was

$39.9 million compared to $34.8 million in FY 2021 with the

increase primarily due to activities related to the initiative to

produce and sell HFSA at Conda and maintenance activities at

Arraias related to the restart of the sulfuric acid plant, which

were partially offset by a shorter turnaround at Conda in 2022

compared to 2021.

________________________________2 Total capex is

a non-IFRS financial measure. For additional information on

non-IFRS and other financial measures, see “Non-IFRS financial

measures” below.

Final Environmental Impact Statement for

Conda Mine Life Extension

On November 18, 2022, the Company announced the

publication of the Final Environmental Impact Statement (“Final

EIS”) for the Husky 1/North Dry Ridge (“H1/NDR”) mine development

project. This represents a significant milestone in the extension

of Conda’s mine life. The Company will continue to work through the

remaining regulatory approval process and expect to begin capital

work on the mine extension in the middle part of the year.

Strategic Alternative Review

Process

On March 13, 2023, the Company announced the

commencement of the process to explore and evaluate various

strategic alternatives in an effort to enhance shareholder

value.

Anthony Cina, Chairman of Itafos, commented:

“Itafos continues to successfully execute on its long-term plan.

Over the last year, Itafos has taken decisive actions to strengthen

the operational efficiency of the Company, including working to

extend the life of the Conda mine, extending the maturity and

reducing the cost of the Company’s debt, improving its capital

structure through significant deleveraging and strengthening the

Company’s management and Board. We expect significant shareholder

benefits from these initiatives and believe now is an opportune

time to consider the full range of potential strategic alternatives

to enhance value for all Itafos shareholders.”

CL Fertilizers Holding LLC, an entity owned by

funds managed by Castlelake L.P. and the Company’s largest

shareholder, supports the Company’s process to review strategic

alternatives.

December 31, 2022

Highlights

As at December 31, 2022, the Company had

trailing 12 -month adjusted EBITDA of $224.8 million compared to

$143.4 million at the end of 2021 with the increase primarily due

to higher realized prices and increased sales volumes at Conda

partially offset by higher input costs.

Also, as at December 31, 2022, the Company had

net debt of $88.3 million compared to $217.7 million at the end of

2021, with the reduction due to the repayment of principal debt

outstanding and higher cash and cash equivalents from free cash

flows generated during 2022. The Company also closed during FY

2022, a term loan and asset-based revolving credit facility, which

proceeds were used to refinance the 2021 secured term loan, the

Company’s unsecured and subordinated promissory note, Conda’s

secured working capital facility and the Canadian debentures. The

Company’s net debt as at December 31, 2022, was comprised of $42.8

million in cash and $131.1 million in debt (gross of deferred

financing costs). As at December 31, 2022, the Company’s net

leverage ratio was 0.4x compared to 1.5x at the end of 2021.

As at December 31, 2022, the Company had

liquidity(3) of $64.3 million comprised of $42.8 million in cash

and $21.5 million undrawn borrowing capacity under the ABL

Facility.

Q4 2022 Operational

Highlights

Environmental, Health and Safety (“EHS”)

- sustained EHS excellence, including

no reportable environmental releases and one recordable incident;

and

- continued corporate-wide risk

mitigation measures to address potential impacts to employees,

contractors and operations as a result of the COVID-19 pandemic,

which resulted in no material impact to operations.

Conda

- produced 89,226 tonnes P2O5 at

Conda in Q4 2022 compared to 84,808 tonnes P2O5 in Q4 2021 with the

increase primarily due to 2021 disruption in sulfuric acid

supply;

- generated revenues of $129.3

million at Conda in Q4 2022 compared to $116.8 million in Q4 2021

with the increase primarily due to higher realized MAP prices

(priced on a three-month lag under the terms of the MAP offtake

agreement) and increased sales volumes, which were partially offset

by lower realized SPA prices;

- generated adjusted EBITDA at Conda

of $54.8 million in Q4 2022 compared to $52.8 million in Q4 2021

with the increase primarily due to the same factors that resulted

in higher revenues, which were partially offset by higher input

costs;

- advanced activities related to the

extension of Conda's mine life through permitting and development

of H1/NDR, including a significant milestone on Conda’s mine life

extension with the publication of the Final EIS for H1/NDR on

November 18, 2022.

__________________________________3 Liquidity is a non-IFRS

financial measure. For additional information on non-IFRS and other

financial measures, see “Non-IFRS financial measures” below.

FY 2022 Operational

Highlights

EHS

- sustained EHS excellence, including

no reportable environmental releases and one recordable incident,

which resulted in a consolidated total recordable incident

frequency rate of 0.24, representing a new Company record;

- received national recognition

during the 87th North American Wildlife and Natural Resources

Conference as the Bureau of Land Management awarded the

Conservation Leadership Partner Award to the Southeast Idaho

Habitat Mitigation Fund, which was developed and funded by

Conda;

- continued corporate-wide risk

mitigation measures to address potential impacts to employees,

contractors and operations as a result of the COVID-19 pandemic,

which resulted in no material impact to operations; and

- received a notice of violation

(“NOV”) at Conda from the Idaho Department of Environmental Quality

(“DEQ”) related to a failed air stack emissions test in May 2021.

Conda investigated and corrected the issues during 2021. The NOV

was formally received from the DEQ in May 2022 and resolved in July

2022.

Conda

- completed a scheduled plant

turnaround at Conda and returned to full production capacity;

- produced 343,526 tonnes P2O5 at

Conda in FY 2022 compared to 331,219 tonnes P2O5 in FY 2021 with

the increase primarily due to a shorter plant turnaround in 2022

compared to 2021;

- generated revenues of $571.1

million at Conda in FY 2022 compared to $413.2 million in FY 2021

primarily due to higher realized prices and sales volumes;

- generated adjusted EBITDA at Conda

of $240.2 million in FY 2022 compared to $160.6 million in FY 2021

primarily due to the same factors that resulted in higher revenues,

which were partially offset by higher input costs;

- reached a settlement with insurers

on a business interruption claim related to the 2020 disruption in

sulfuric acid supply to Conda, which resulted in receipt of net

insurance proceeds of $8.7 million;

- reached a settlement agreement

related to shared environmental and asset retirement obligations at

Conda’s Lanes Creek mine;

- advanced activities related to the

extension of Conda’s mine life through permitting and development

of H1/NDR, including a significant milestone on Conda’s mine life

extension with the publication of the Final EIS for H1/NDR on

November 18, 2022; and

- advanced activities related to the

optimization of Conda's EBITDA generation, including beginning

production and sales of hydrofluorosilicic acid (“HFSA”).

Q4 Other Highlights

- produced 35,895

tonnes of sulfuric acid at Arraias in Q4 2022 compared to zero

production in Q4 2021;

- generated adjusted EBITDA at

Arraias of $0 in Q4 2022 compared to a loss of $1.1 million in Q4

2021 with the reduced loss due to the restart of the sulfuric acid

plant; and

- continued evaluation of strategic

alternatives for non-North American assets.

FY 2022 Other Highlights

- produced 99,030 tonnes of sulfuric

acid at Arraias in 2022 compared to no production in 2021;

- generated adjusted EBITDA at

Arraias of $0 in 2022 compared to a $3.8 million loss in 2021 with

the reduced deficit due to the restart of the sulfuric acid

plant;

- continued evaluation of strategic

alternatives for non-North American assets;

- announced the appointment of

Stephen Shapiro and Isaiah Toback to the Company’s Board of

Directors (the “Board”). Mr. Toback replaced Rory O'Neill as a

nominee to the Board by its principal shareholder, CL Fertilizer

Holdings, LLC; and

- on August 11, 2022, announced the

appointment of Matthew O’Neill as Chief Financial Officer (“CFO”).

Mr. O’Neill succeeded George Burdette who served as CFO since April

2018.

Subsequent Events

- Subsequent to December 31, 2022,

the Company approved the grant of up to, in aggregate, 3,507,846

restricted share units (“RSUs”) under its RSU Plan. The grants were

made to directors, officers, management, employees, and contractors

of the Company.

Market Outlook

The Company expects the current strength in

global agriculture and phosphate fertilizer fundamentals to

continue, although 2023 prices are expected to moderate off the

historically high 2022 prices. Accordingly, the Company expects

continued stability in prices and volume fundamentals in the

phosphate fertilizer markets.

Specific factors the Company expects to support

the continued strength in the global phosphate fertilizer markets

through 2023 are as follows:

- no significant phosphate supply

capacity additions

- sustained crop price levels

- improved phosphate application

following historically high pricing; and

- ongoing phosphate export

restrictions from China.

The Company expects the sulfur and sulfuric acid

market to remain soft globally through 2023 due to increased

refinery activity and reduced demand from phosphate producers and

metals consumers.

Financial Outlook

The Company’s guidance for 2023 is as

follows:

|

(in millions of US Dollars |

|

| except

as otherwise noted) |

FY 2023 |

|

Adjusted EBITDA |

$140 to $180 |

| Net income |

$35 to $65 |

| Basic earnings (C$/share) |

$0.25 to $0.45 |

| Maintenance capex |

$15 to $25 |

| Growth capex |

$40 to $50 |

| Free

cash flow |

$70 to $100 |

Business Outlook

The Company continues to focus on the following

key objectives to drive long-term value and shareholder

returns:

- improving financial and operational

performance;

- deleveraging the balance

sheet;

- extending Conda’s current mine life

through permitting and development of H1/NDR; and

- conducting the strategic

alternatives review process (including evaluating potential

strategic alternatives for the company as outlined in the news

release dated 13 March, 2023).

About Itafos

The Company is a phosphate and specialty

fertilizer company. The Company’s businesses and projects are as

follows:

- Conda – a vertically integrated

phosphate fertilizer business located in Idaho, US with production

capacity as follows:

- approximately 550kt per year of

monoammonium phosphate (“MAP”), MAP with micronutrients (“MAP+”),

superphosphoric acid (“SPA”), merchant grade phosphoric acid

(“MGA”) and ammonium polyphosphate (“APP”); and

- approximately 27kt per year of

hydrofluorosilicic acid (“HFSA”);

- Arraias – a vertically integrated

phosphate fertilizer business located in Tocantins, Brazil with

production capacity as follows:

- approximately 500kt per year of

single superphosphate (“SSP”) and SSP with micronutrients (“SSP+”);

and

- approximately 40kt per year of

excess sulfuric acid (220kt per year gross sulfuric acid production

capacity);

- Farim – a high-grade phosphate mine

project located in Farim, Guinea-Bissau;

- Santana – a vertically integrated

high-grade phosphate mine and fertilizer plant project located in

Pará, Brazil; and

- Araxá – a vertically integrated

rare earth elements and niobium mine and extraction plant project

located in Minas Gerais, Brazil.

In addition to the businesses and projects

described above, the Company also owns Mantaro (Junin, Peru), a

phosphate mine project that is in the process of being wound

down.

The Company is a Delaware corporation that is

headquartered in Houston, TX. The Company’s shares trade on the TSX

Venture Exchange (“TSX-V”) under the ticker symbol “IFOS”. The

Company’s principal shareholder is CL Fertilizers Holding LLC

(“CLF”). CLF is an affiliate of Castlelake, L.P., a global private

investment firm.

For more information, or to join the Company’s

mailing list to receive notification of future news releases,

please visit the Company’s website at www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information, including

statements with respect to: the exploration and evaluation of

strategic alternatives; the timing for the extension of the life of

the Conda mine; and the continued strength in the global phosphate

fertilizer markets. All information other than information of

historical fact is forward-looking information. Statements that

address activities, events or developments that the Company

believes, expects or anticipates will or may occur in the future

include, but are not limited to, statements regarding estimates

and/or assumptions in respect of the Company’s financial and

business outlook are forward-looking information. The use of any of

the words “intend”, “anticipate”, “plan”, “continue”, “estimate”,

“expect”, “may”, “will”, “project”, “should”, “would”, “believe”,

“predict” and “potential” and similar expressions are intended to

identify forward-looking information. This information involves

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that this information will prove to be correct and such

forward-looking information included in this news release should

not be unduly relied upon.

Forward-looking information is subject to a

number of risks and other factors that could cause actual results

and events to vary materially from that anticipated by such

forward-looking information. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. Factors that may cause

actual results to differ materially from expected results described

in forward-looking statements include, but are not limited to,

uncertainties of estimates of capital and operating costs and

production estimates; the ability of the Company to meet its

financial obligations and minimum commitments, fund capital

expenditures and comply with covenants contained in the agreements

that govern indebtedness; fluctuations in foreign exchange or

interest rates and stock market volatility; the continued supply of

sulfuric acid to Conda from its primary supplier; the risk that the

strategic alternatives review process will not result in the

Company pursuing any transaction or that any alternative will be

available to the Company; and those risk factors set out in the

Company’s annual information form and other disclosure documents

available under the Company’s profile on SEDAR at www.sedar.com and

on the Company’s website at www.itafos.com. Readers are cautioned

that the foregoing list of risks, uncertainties and assumptions are

not exhaustive. The forward-looking information included in this

news release is expressly qualified by this cautionary statement

and is made as of the date of this news release. The Company

undertakes no obligation to publicly update or revise any

forward-looking information except as required by applicable

securities laws.

This news release contains future oriented

financial information and financial outlook information (together,

“FOFI”) about the Company’s prospective results of operations,

including statements regarding expected adjusted EBITDA, net

income, basic earnings per share, maintenance capex, growth capex

and free cash flow. FOFI is subject to the same assumptions, risk

factors, limitations and qualifications as set forth in the above

paragraph. The Company has included the FOFI to provide an outlook

of management’s expectations regarding anticipated activities and

results, and such information may not be appropriate for other

purposes. The Company and management believe that the FOFI has been

prepared on a reasonable basis, reflecting management’s reasonable

estimates and judgements; however, actual results of operations and

the resulting financial results may vary from the amounts set forth

herein. Any financial outlook information speaks only as of the

date on which it is made and the Company undertakes no obligation

to publicly update or revise any financial outlook information

except as required by applicable securities laws.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX-V)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please

contact:

Matthew O’NeillItafos Investor

Relationsinvestor@itafos.com713-242-8446

Non-IFRS Financial Measures

This press release contains both IFRS and

certain non-IFRS measures that management considers to evaluate the

Company’s operational and financial performance. Non-IFRS measures

are a numerical measure of a company’s performance, that either

include or exclude amounts that are not normally included or

excluded from the most directly comparable IFRS measures.

Management believes that the non-IFRS measures provide useful

supplemental information to investors, analysts, lenders and

others. In evaluating non-IFRS measures, investors, analysts,

lenders and others should consider that non-IFRS measures do not

have any standardized meaning under IFRS and that the methodology

applied by the Company in calculating such non-IFRS measures may

differ among companies and analysts. Non-IFRS measures should not

be considered as a substitute for, nor superior to, measures of

financial performance prepared in accordance with IFRS. Definitions

and reconciliations of non-IFRS measures to the most directly

comparable IFRS measures are included below.

DEFINITIONS

The Company defines its non-IFRS measures as

follows:

|

Non-IFRS Measure |

Definition |

Most Directly Comparable IFRS Measure |

|

EBITDA |

Earnings before interest, taxes, depreciation, depletion and

amortization |

Net income (loss) and operating income (loss) |

|

Adjusted EBITDA |

EBITDA adjusted for non-cash, extraordinary, non-recurring and

other items unrelated to the Company’s core operating

activities |

Net income (loss) and operating income (loss) |

|

Trailing 12 months adjusted EBITDA |

Adjusted EBITDA for the current and preceding three quarters |

Net income (loss) and operating income (loss) for the current and

preceding three quarters |

|

Total capex |

Additions to property, plant, and equipment and mineral properties

adjusted for additions to asset retirement obligations, additions

to right-of-use assets and capitalized interest |

Additions to property, plant and equipment and mineral

properties |

|

Maintenance capex |

Portion of total capex relating to the maintenance of ongoing

operations |

Additions to property, plant and equipment and mineral

properties |

|

Growth capex |

Portion of total capex relating to the development of growth

opportunities |

Additions to property, plant and equipment and mineral

properties |

|

Cash growth capex |

Growth capex less accrued growth capex |

Additions to property, plant and equipment and mineral

properties |

|

Net debt |

Debt less cash and cash equivalents plus deferred financing costs

(does not consider lease liabilities) |

Current debt, long-term debt and cash and cash equivalents |

|

Net leverage ratio |

Net debt divided by trailing 12 months adjusted EBITDA |

Current debt, long-term debt and cash and cash equivalents; net

income (loss) and operating income (loss) for the current and

preceding three quarters |

|

Liquidity |

Cash and cash equivalents plus undrawn committed borrowing

capacity |

Cash and cash equivalents |

|

Free cash flow |

Cash flows from operating activities, which excludes payment of

interest expense, plus cash flows from investing activities less

cash growth capex |

Cash flows from operating activities and cash flows from investing

activities |

|

|

|

|

EBITDA, ADJUSTED EBITDA AND TRAILING 12

MONTHS ADJUSTED EBITDA

EBITDA is a non-IFRS measure that excludes

interest, taxes, depreciation, depletion and amortization from

earnings. Management believes that EBITDA is a valuable indicator

of the Company’s ability to generate operating income.

Adjusted EBITDA is a non-IFRS measure that

excludes non-cash, extraordinary, non-recurring and other items

unrelated to the Company’s core operating activities from EBITDA

(non-IFRS measure). Management believes that adjusted EBITDA is a

valuable indicator of the Company’s ability to generate operating

income from its core operating activities normalized to remove the

impact of non-cash, extraordinary and non-recurring items. The

Company provides guidance on adjusted EBITDA as useful supplemental

information to investors, analysts, lenders and others.

Trailing 12 months adjusted EBITDA is a non-IFRS

measure that includes adjusted EBITDA (non-IFRS measure) for the

current and preceding three quarters.

For the three months ended December 31,

2022 and 2021

For the three months ended December 31, 2022,

the Company had EBITDA and adjusted EBITDA by segment as

follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

35,321 |

|

|

$ |

(116 |

) |

|

$ |

59 |

|

|

$ |

(5,942 |

) |

|

$ |

29,322 |

|

| Finance (income) expense,

net |

|

|

1,164 |

|

|

|

(122 |

) |

|

|

(2 |

) |

|

|

4,771 |

|

|

|

5,811 |

|

| Current and deferred income tax

expense (recovery) |

|

|

9,595 |

|

|

|

— |

|

|

|

— |

|

|

|

(3,660 |

) |

|

|

5,935 |

|

| Depreciation and depletion |

|

|

8,354 |

|

|

|

585 |

|

|

|

3 |

|

|

|

47 |

|

|

|

8,989 |

|

| EBITDA |

|

$ |

54,434 |

|

|

$ |

347 |

|

|

$ |

60 |

|

|

$ |

(4,784 |

) |

|

$ |

50,057 |

|

| Unrealized foreign exchange

(gain) loss |

|

|

400 |

|

|

|

(124 |

) |

|

|

(568 |

) |

|

|

578 |

|

|

|

286 |

|

| Share-based payment recovery |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(133 |

) |

|

|

(133 |

) |

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

15 |

|

|

|

214 |

|

|

|

229 |

|

| Gain on settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other income, net |

|

|

(11 |

) |

|

|

(223 |

) |

|

|

(74 |

) |

|

|

(1 |

) |

|

|

(309 |

) |

|

Adjusted EBITDA |

|

$ |

54,823 |

|

|

$ |

— |

|

|

$ |

(567 |

) |

|

$ |

(4,126 |

) |

|

$ |

50,130 |

|

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

46,558 |

|

|

$ |

(585 |

) |

|

$ |

(585 |

) |

|

$ |

(4,254 |

) |

|

$ |

41,134 |

|

| Depreciation and depletion |

|

|

8,354 |

|

|

|

585 |

|

|

|

3 |

|

|

|

47 |

|

|

|

8,989 |

|

| Foreign exchange loss -

realized |

|

|

(89 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(89 |

) |

| Share-based payment recovery |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(133 |

) |

|

|

(133 |

) |

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

15 |

|

|

|

214 |

|

|

|

229 |

|

| Gain on settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

54,823 |

|

|

$ |

|

|

|

$ |

(567 |

) |

|

$ |

(4,126 |

) |

|

$ |

50,130 |

|

For the three months ended December 31, 2021,

the Company had EBITDA and adjusted EBITDA by segment as

follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

34,914 |

|

|

$ |

(1,204 |

) |

|

$ |

(507 |

) |

|

$ |

(8,923 |

) |

|

$ |

24,280 |

|

| Finance expense, net |

|

|

848 |

|

|

|

64 |

|

|

|

2 |

|

|

|

7,375 |

|

|

|

8,289 |

|

| Current and deferred income tax

expense (recovery) |

|

|

10,160 |

|

|

|

— |

|

|

|

— |

|

|

|

(2,880 |

) |

|

|

7,280 |

|

| Depreciation and depletion |

|

|

6,943 |

|

|

|

64 |

|

|

|

4 |

|

|

|

46 |

|

|

|

7,057 |

|

| EBITDA |

|

$ |

52,865 |

|

|

$ |

(1,076 |

) |

|

$ |

(501 |

) |

|

$ |

(4,382 |

) |

|

|

46,906 |

|

| Unrealized foreign exchange

(gain) loss |

|

|

(15 |

) |

|

|

98 |

|

|

|

58 |

|

|

|

(145 |

) |

|

|

(4 |

) |

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

904 |

|

|

|

904 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

316 |

|

|

|

316 |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other income |

|

|

(1 |

) |

|

|

(138 |

) |

|

|

(44 |

) |

|

|

— |

|

|

|

(183 |

) |

|

Adjusted EBITDA |

|

$ |

52,849 |

|

|

$ |

(1,116 |

) |

|

$ |

(487 |

) |

|

$ |

(3,307 |

) |

|

$ |

47,939 |

|

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

45,755 |

|

|

$ |

(1,180 |

) |

|

$ |

(556 |

) |

|

$ |

(4,587 |

) |

|

$ |

39,432 |

|

| Depreciation and depletion |

|

|

6,943 |

|

|

|

64 |

|

|

|

4 |

|

|

|

46 |

|

|

|

7,057 |

|

| Foreign exchange gain -

realized |

|

|

151 |

|

|

|

— |

|

|

|

65 |

|

|

|

14 |

|

|

|

230 |

|

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

904 |

|

|

|

904 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

316 |

|

|

|

316 |

|

| Technical Studies |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

52,849 |

|

|

$ |

(1,116 |

) |

|

$ |

(487 |

) |

|

$ |

(3,307 |

) |

|

$ |

47,939 |

|

For the year ended December 31,

2022 and 2021

For the year ended December 31, 2022, the

Company had EBITDA and adjusted EBITDA by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

162,107 |

|

|

$ |

(2,304 |

) |

|

$ |

(397 |

) |

|

$ |

(44,706 |

) |

|

$ |

114,700 |

|

| Finance (income) expense,

net |

|

|

5,020 |

|

|

|

(131 |

) |

|

|

4 |

|

|

|

41,031 |

|

|

|

45,924 |

|

| Current and deferred income tax

expense (recovery) |

|

|

50,895 |

|

|

|

— |

|

|

|

— |

|

|

|

(18,741 |

) |

|

|

32,154 |

|

| Depreciation and depletion |

|

|

31,453 |

|

|

|

2,048 |

|

|

|

14 |

|

|

|

190 |

|

|

|

33,705 |

|

| EBITDA |

|

$ |

249,475 |

|

|

$ |

(387 |

) |

|

$ |

(379 |

) |

|

$ |

(22,226 |

) |

|

$ |

226,483 |

|

| Unrealized foreign exchange

(gain) loss |

|

|

400 |

|

|

|

872 |

|

|

|

(900 |

) |

|

|

1,068 |

|

|

|

1,440 |

|

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,850 |

|

|

|

4,850 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

140 |

|

|

|

719 |

|

|

|

859 |

|

| Gain on settlement |

|

|

(1,352 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,352 |

) |

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,511 |

|

|

|

1,511 |

|

| Other income, net |

|

|

(8,354 |

) |

|

|

(551 |

) |

|

|

(94 |

) |

|

|

(34 |

) |

|

|

(9,033 |

) |

|

Adjusted EBITDA |

|

$ |

240,169 |

|

|

$ |

(66 |

) |

|

$ |

(1,233 |

) |

|

$ |

(14,112 |

) |

|

$ |

224,758 |

|

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

210,246 |

|

|

$ |

(2,114 |

) |

|

$ |

(1,387 |

) |

|

$ |

(21,361 |

) |

|

$ |

185,384 |

|

| Depreciation and depletion |

|

|

31,453 |

|

|

|

2,048 |

|

|

|

14 |

|

|

|

190 |

|

|

|

33,705 |

|

| Realized foreign exchange

loss |

|

|

(178 |

) |

|

|

— |

|

|

|

— |

|

|

|

(21 |

) |

|

|

(199 |

) |

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,850 |

|

|

|

4,850 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

140 |

|

|

|

719 |

|

|

|

859 |

|

| Gain on settlement |

|

|

(1,352 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,352 |

) |

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,511 |

|

|

|

1,511 |

|

|

Adjusted EBITDA |

|

$ |

240,169 |

|

|

$ |

(66 |

) |

|

$ |

(1,233 |

) |

|

$ |

(14,112 |

) |

|

$ |

224,758 |

|

For the year ended December 31, 2021, the

Company had EBITDA and adjusted EBITDA by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

102,794 |

|

|

$ |

(3,459 |

) |

|

$ |

(2,044 |

) |

|

$ |

(45,852 |

) |

|

$ |

51,439 |

|

| Finance expense, net |

|

|

3,073 |

|

|

|

123 |

|

|

|

7 |

|

|

|

34,041 |

|

|

|

37,244 |

|

| Current and deferred income tax

expense (recovery) |

|

|

28,913 |

|

|

|

— |

|

|

|

— |

|

|

|

(6,807 |

) |

|

|

22,106 |

|

| Depreciation and depletion |

|

|

25,213 |

|

|

|

405 |

|

|

|

49 |

|

|

|

177 |

|

|

|

25,844 |

|

| EBITDA |

|

$ |

159,993 |

|

|

$ |

(2,931 |

) |

|

$ |

(1,988 |

) |

|

$ |

(18,441 |

) |

|

|

136,633 |

|

| Unrealized foreign exchange

(gain) loss |

|

|

621 |

|

|

|

(599 |

) |

|

|

543 |

|

|

|

459 |

|

|

|

1,024 |

|

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,127 |

|

|

|

4,127 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,029 |

|

|

|

2,029 |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

35 |

|

|

|

21 |

|

|

|

56 |

|

| Other income |

|

|

(32 |

) |

|

|

(284 |

) |

|

|

(128 |

) |

|

|

— |

|

|

|

(444 |

) |

|

Adjusted EBITDA |

|

$ |

160,582 |

|

|

$ |

(3,814 |

) |

|

$ |

(1,538 |

) |

|

$ |

(11,805 |

) |

|

$ |

143,425 |

|

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

135,148 |

|

|

$ |

(4,219 |

) |

|

$ |

(1,777 |

) |

|

$ |

(18,173 |

) |

|

$ |

110,979 |

|

| Depreciation and depletion |

|

|

25,213 |

|

|

|

405 |

|

|

|

49 |

|

|

|

177 |

|

|

|

25,844 |

|

| Foreign exchange gain -

realized |

|

|

221 |

|

|

|

— |

|

|

|

155 |

|

|

|

14 |

|

|

|

390 |

|

| Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,127 |

|

|

|

4,127 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,029 |

|

|

|

2,029 |

|

| Technical Studies |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

35 |

|

|

|

21 |

|

|

|

56 |

|

|

Adjusted EBITDA |

|

$ |

160,582 |

|

|

$ |

(3,814 |

) |

|

$ |

(1,538 |

) |

|

$ |

(11,805 |

) |

|

$ |

143,425 |

|

As at December 31, 2022 and December 31,

2021

As at December 31, 2022, the Company had

trailing 12 months adjusted EBITDA as follows:

| (in

thousands of US Dollars) |

Total |

|

|

For the three months ended December 31, 2022 |

$ |

50,130 |

|

| For the three months ended

September 30, 2022 |

|

50,656 |

|

| For the three months ended

June 30, 2022 |

|

63,591 |

|

| For the three months ended March

31, 2022 |

|

60,381 |

|

|

Trailing 12 months adjusted EBITDA |

$ |

224,758 |

|

As at December 31, 2021, the Company had

trailing 12 months adjusted EBITDA as follows:

| (in

thousands of US Dollars) |

Total |

|

|

For the three months ended December 31, 2021 |

$ |

47,939 |

|

| For the three months ended

September 30, 2021 |

|

41,174 |

|

| For the three months ended June

30, 2021 |

|

33,696 |

|

| For the three months ended March

31, 2021 |

|

20,616 |

|

|

Trailing 12 months adjusted EBITDA |

$ |

143,425 |

|

TOTAL CAPEX

Total capex is a non-IFRS measure that includes

additions to property, plant, and equipment and mineral properties,

which are adjusted for additions to asset retirement obligations,

additions to right-of-use assets and capitalized interest.

Maintenance capex is a non-IFRS measure that

includes the portion of total capex (non-IFRS measure) relating to

the maintenance of ongoing operations. Management believes that

maintenance capex is a valuable indicator of the Company’s required

capital expenditures to sustain operations at existing levels.

Growth capex is a non-IFRS measure that includes

the portion of total capex (non-IFRS measure) relating to the

development of growth opportunities. Management believe that growth

capex is a valuable indicator of the Company’s capital expenditures

related to growth opportunities.

The Company provides guidance on both

maintenance capex and growth capex as useful supplemental

information to investors, analysts, lenders and others.

For the three months ended

December 31, 2022 and 2021

For the three months ended December 31,

2022, the Company had capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

(21,435 |

) |

|

$ |

(1,935 |

) |

|

$ |

22 |

|

|

$ |

— |

|

|

$ |

(23,348 |

) |

| Additions to mineral

properties |

|

|

2,297 |

|

|

|

— |

|

|

|

210 |

|

|

|

— |

|

|

|

2,507 |

|

| Additions to property, plant

and equipment related to asset retirement obligations |

|

|

32,660 |

|

|

|

2,202 |

|

|

|

— |

|

|

|

— |

|

|

|

34,862 |

|

| Additions to right of use

assets |

|

|

(4,010 |

) |

|

|

(83 |

) |

|

|

(23 |

) |

|

|

— |

|

|

|

(4,116 |

) |

|

Total capex |

|

$ |

9,512 |

|

|

$ |

184 |

|

|

$ |

209 |

|

|

$ |

— |

|

|

$ |

9,905 |

|

|

Maintenance capex |

|

|

3,689 |

|

|

|

70 |

|

|

|

— |

|

|

|

— |

|

|

|

3,759 |

|

| Growth

capex |

|

|

5,823 |

|

|

|

114 |

|

|

|

209 |

|

|

|

— |

|

|

|

6,146 |

|

For the three months ended December 31,

2021, the Company had capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

95,156 |

|

|

$ |

1,531 |

|

|

$ |

38 |

|

|

$ |

51 |

|

|

$ |

96,776 |

|

| Additions to mineral

properties |

|

|

(82 |

) |

|

|

— |

|

|

|

10 |

|

|

|

— |

|

|

|

(72 |

) |

| Additions to property, plant

and equipment related to asset retirement obligations |

|

|

(90,037 |

) |

|

|

(326 |

) |

|

|

— |

|

|

|

— |

|

|

|

(90,363 |

) |

| Additions to right of use

assets |

|

|

— |

|

|

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

Total capex |

|

$ |

5,037 |

|

|

$ |

1,208 |

|

|

$ |

48 |

|

|

$ |

51 |

|

|

$ |

6,344 |

|

|

Maintenance capex |

|

|

1,924 |

|

|

|

1,238 |

|

|

|

— |

|

|

|

31 |

|

|

|

3,193 |

|

| Growth

capex |

|

|

3,113 |

|

|

|

(30 |

) |

|

|

48 |

|

|

|

20 |

|

|

|

3,151 |

|

For the years ended December 31, 2022

and 2021

For the year ended December 31, 2022, the

Company had capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

2,524 |

|

|

$ |

484 |

|

|

$ |

22 |

|

|

$ |

19 |

|

|

$ |

3,049 |

|

| Additions to mineral

properties |

|

|

7,163 |

|

|

|

— |

|

|

|

1,485 |

|

|

|

— |

|

|

|

8,648 |

|

| Additions to asset retirement

obligations |

|

|

30,349 |

|

|

|

2,020 |

|

|

|

— |

|

|

|

— |

|

|

|

32,369 |

|

| Additions to Right of Use

assets |

|

|

(4,010 |

) |

|

|

(117 |

) |

|

|

(23 |

) |

|

|

— |

|

|

|

(4,150 |

) |

|

Total capex |

|

$ |

36,026 |

|

|

$ |

2,387 |

|

|

$ |

1,484 |

|

|

$ |

19 |

|

|

$ |

39,916 |

|

|

Maintenance capex |

|

|

19,386 |

|

|

|

1,497 |

|

|

|

— |

|

|

|

19 |

|

|

|

20,902 |

|

| Growth

capex |

|

|

16,640 |

|

|

|

890 |

|

|

|

1,484 |

|

|

|

— |

|

|

|

19,014 |

|

For the year ended December 31, 2021, the

Company had capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

122,317 |

|

|

$ |

1,532 |

|

|

$ |

54 |

|

|

$ |

464 |

|

|

$ |

124,367 |

|

| Additions to mineral

properties |

|

|

3,031 |

|

|

|

— |

|

|

|

604 |

|

|

|

— |

|

|

|

3,635 |

|

| Additions to asset retirement

obligations |

|

|

(93,038 |

) |

|

|

202 |

|

|

|

— |

|

|

|

— |

|

|

|

(92,836 |

) |

| Additions to Right of Use

assets |

|

|

— |

|

|

|

16 |

|

|

|

(13 |

) |

|

|

(367 |

) |

|

|

(364 |

) |

|

Total capex |

|

$ |

32,310 |

|

|

$ |

1,750 |

|

|

$ |

645 |

|

|

$ |

97 |

|

|

$ |

34,802 |

|

|

Maintenance capex |

|

|

21,986 |

|

|

|

1,238 |

|

|

|

— |

|

|

|

77 |

|

|

|

23,301 |

|

| Growth

capex |

|

|

10,324 |

|

|

|

512 |

|

|

|

645 |

|

|

|

20 |

|

|

|

11,501 |

|

CASH GROWTH CAPEX

Cash growth capex is a non-IFRS measures that

excludes accrued capex from growth capex (non-IFRS measure). The

Company uses cash growth capex in the calculation of free cash flow

(non-IFRS measure).

For the three months ended

December 31, 2022 and 2021

For the three months ended December 31,

2022, the Company had cash growth capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Growth capex |

|

$ |

5,823 |

|

|

$ |

114 |

|

|

$ |

209 |

|

|

$ |

— |

|

|

$ |

6,146 |

|

| Accrued growth capex |

|

|

386 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

386 |

|

|

Cash growth capex |

|

$ |

6,209 |

|

|

$ |

114 |

|

|

$ |

209 |

|

|

$ |

— |

|

|

$ |

6,532 |

|

For the three months ended December 31,

2021, the Company had cash growth capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Growth capex |

|

$ |

3,113 |

|

|

$ |

(30 |

) |

|

$ |

48 |

|

|

$ |

20 |

|

|

$ |

3,151 |

|

| Accrued growth capex |

|

|

(281 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(281 |

) |

|

Cash growth capex |

|

$ |

2,832 |

|

|

$ |

(30 |

) |

|

$ |

48 |

|

|

$ |

20 |

|

|

$ |

2,870 |

|

For the years ended December 31,

2022 and 2021

For the year ended December 31, 2022, the

Company had cash growth capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Growth capex |

|

$ |

16,640 |

|

|

$ |

890 |

|

|

$ |

1,484 |

|

|

$ |

— |

|

|

$ |

19,014 |

|

| Accrued growth capex |

|

|

(526 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(526 |

) |

|

Cash growth capex |

|

$ |

16,114 |

|

|

$ |

890 |

|

|

$ |

1,484 |

|

|

$ |

— |

|

|

$ |

18,488 |

|

For the year ended December 31, 2021, the

Company had cash growth capex by segment as follows:

| (in

thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Developmentandexploration |

|

|

Corporate |

|

|

Total |

|

|

Growth capex |

|

$ |

10,324 |

|

|

$ |

512 |

|

|

$ |

645 |

|

|

$ |

20 |

|

|

$ |

11,501 |

|

| Accrued growth capex |

|

|

(634 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(634 |

) |

|

Cash growth capex |

|

$ |

9,690 |

|

|

$ |

512 |

|

|

$ |

645 |

|

|

$ |

20 |

|

|

$ |

10,867 |

|

NET DEBT and NET LEVERAGE

RATIO

Net debt is a non-IFRS measure that includes

debt less cash and cash equivalents and excludes deferred financing

costs from debt. The Company’s net debt does not include lease

liabilities. Management believes that net debt is a valuable

indicator of the Company’s net debt position as it removes the

impact of deferring financing costs.

Net leverage ratio is a non-IFRS measure that

considers net debt (non-IFRS measure) divided by trailing 12 months

adjusted EBITDA (non-IFRS measure). Management believes that the

Company’s net leverage ratio is a valuable indicator of its ability

to service its debt from its core operating activities.

As at December 31, 2022 and December 31, 2021,

the Company had net debt as follows:

| |

|

December 31, |

|

|

December 31, |

|

| (in

thousands of US Dollars) |

|

2022 |

|

|

2021 |

|

|

Current debt |

|

$ |

29,217 |

|

|

$ |

52,838 |

|

| Long-term debt |

|

|

98,907 |

|

|

|

187,010 |

|

| Cash and cash equivalents |

|

|

(42,811 |

) |

|

|

(31,565 |

) |

| Deferred financing costs related

to the Credit Facilities |

|

|

3,006 |

|

|

|

— |

|

| Deferred financing costs related

to the Term Loan |

|

|

— |

|

|

|

9,423 |

|

|

Net debt |

|

$ |

88,319 |

|

|

$ |

217,706 |

|

As at December 31, 2022 and December 31,

2021, the Company’s net leverage ratio was as follows:

| (in thousands of US

Dollars |

|

December 31, |

|

|

December 31, |

|

| except

as otherwise noted) |

|

2022 |

|

|

2021 |

|

|

Net debt |

|

$ |

88,319 |

|

|

$ |

217,706 |

|

| Trailing 12 months adjusted

EBITDA |

|

|

224,758 |

|

|

|

143,425 |

|

|

Net leverage ratio |

|

0.4x |

|

|

1.5x |

|

LIQUIDITY

Liquidity is a non-IFRS measure that includes

cash and cash equivalents plus undrawn committed borrowing

capacity. Management believes that liquidity is a valuable

indicator of the Company’s liquidity.

As at December 31, 2022 and December 31, 2021,

the Company had liquidity as follows:

| |

|

December 31, |

|

|

December 31, |

|

| (in

thousands of US Dollars) |

|

2022 |

|

|

2021 |

|

|

Cash and cash equivalents |

|

$ |

42,811 |

|

|

$ |

31,565 |

|

| ABL Facility undrawn borrowing

capacity |

|

|

21,447 |

|

|

|

— |

|

| Conda ABL undrawn borrowing

capacity |

|

|

— |

|

|

|

5,870 |

|

|

Liquidity |

|

$ |

64,258 |

|

|

$ |

37,435 |

|

FREE CASH FLOW

Free cash flow is a non-IFRS measure that

includes cash flows from operating activities (which excludes

payment of interest expense) and cash flows from investing

activities less cash growth capex (non-IFRS measure). Management

believes that free cash flow is a valuable indicator of the

Company’s ability to generate cash flows from operations after

giving effect to required capital expenditures to sustain

operations at existing levels. Management further believes that

free cash flow is a valuable indicator of the Company’s cash flow

available for debt service or to fund growth opportunities. The

Company provides guidance on free cash flow as useful supplemental

information to investors, analysts, lenders and others.

For the three months and years ended December

31, 2022 and 2021, the Company had free cash flow as follows:

| |

|

For the three months ended December 31, |

|

|

For the year ended December 31, |

|

| (in

thousands of US Dollars) |

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

|

Cash flows from operating activities |

|

$ |

42,245 |

|

$ |

32,333 |

|

|

$ |

208,369 |

|

$ |

94,499 |

|

| Cash flows used by investing

activities |

|

|

(10,162 |

) |

|

(6,355 |

) |

|

|

(39,003 |

) |

|

(34,076 |

) |

| Less: Cash growth capex |

|

|

6,532 |

|

|

2,870 |

|

|

|

18,488 |

|

|

10,867 |

|

|

Free cash flow |

|

$ |

38,615 |

|

$ |

28,848 |

|

|

$ |

187,854 |

|

$ |

71,290 |

|

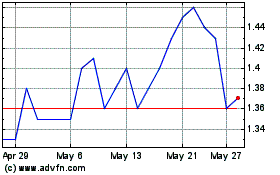

Itafos (TSXV:IFOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Itafos (TSXV:IFOS)

Historical Stock Chart

From Dec 2023 to Dec 2024